Meridian Assays Multiple Stacked Layers of High-Grade Cu-Au-Ag Including CD-544: 38.2m @ 3.2g/t AuEq From 78.9m

Meridian Mining reports significant drilling results from its Cabaçal Cu-Au-Ag project in Mato Grosso, Brazil. The company identified multiple stacked zones of high-grade mineralization, highlighted by intersections including CD-544: 38.2m @ 3.2g/t AuEq or 2.1% CuEq, CD-595: 12.4m @ 3.3g/t AuEq or 2.2% CuEq, and CD-571: 22.2m @ 1.7 g/t AuEq.

The drilling program revealed 20+ intercepts exceeding 10-gram meters gold equivalent, with results showing both VMS Cu-Au-Ag horizons and gold overprint. The program has improved definition of high-grade trends and confirmed stacked zones of mineralization, particularly in areas where historical drilling was incomplete or partially sampled.

Meridian Mining riporta risultati di perforazione significativi dal suo progetto Cabaçal Cu-Au-Ag nel Mato Grosso, Brasile. L'azienda ha identificato molteplici zone sovrapposte di mineralizzazione ad alta legge, evidenziate da intersezioni tra cui CD-544: 38.2m @ 3.2g/t AuEq o 2.1% CuEq, CD-595: 12.4m @ 3.3g/t AuEq o 2.2% CuEq, e CD-571: 22.2m @ 1.7 g/t AuEq.

Il programma di perforazione ha rivelato oltre 20 intercettazioni che superano i 10 metri grammo di equivalente oro, con risultati che mostrano sia orizzonti VMS Cu-Au-Ag che sovrapposizione di oro. Il programma ha migliorato la definizione delle tendenze ad alta legge e ha confermato zone sovrapposte di mineralizzazione, in particolare nelle aree dove la perforazione storica era incompleta o parzialmente campionata.

Meridian Mining informa sobre resultados de perforación significativos de su proyecto Cabaçal Cu-Au-Ag en Mato Grosso, Brasil. La compañía identificó múltiples zonas apiladas de mineralización de alta ley, destacadas por intersecciones que incluyen CD-544: 38.2m @ 3.2g/t AuEq o 2.1% CuEq, CD-595: 12.4m @ 3.3g/t AuEq o 2.2% CuEq, y CD-571: 22.2m @ 1.7 g/t AuEq.

El programa de perforación reveló más de 20 interceptaciones que superan los 10 metros de gramos equivalentes de oro, con resultados que muestran tanto horizontes VMS Cu-Au-Ag como sobreimpresión de oro. El programa ha mejorado la definición de tendencias de alta ley y ha confirmado zonas apiladas de mineralización, particularmente en áreas donde la perforación histórica fue incompleta o muestreada parcialmente.

메리디안 마이닝은 브라질 마토 그로소에 위치한 카바살 Cu-Au-Ag 프로젝트에서 중요한 시추 결과를 보고합니다. 회사는 고등급 광물화의 다중 겹쳐진 구역을 확인했으며, 이는 CD-544: 38.2m @ 3.2g/t AuEq 또는 2.1% CuEq, CD-595: 12.4m @ 3.3g/t AuEq 또는 2.2% CuEq, CD-571: 22.2m @ 1.7 g/t AuEq와 같은 교차점으로 강조됩니다.

시추 프로그램은 10그램 미터 이상의 금 함량을 초과하는 20개 이상의 탐지 결과를 보여주었으며, VMS Cu-Au-Ag 지평선과 금의 오버프린트를 모두 포함하는 결과를 보여 줍니다. 이 프로그램은 고급 트렌드의 정의를 개선하고, 역사적인 시추가 불완전하거나 부분적으로 샘플링된 지역에서 특히 광물화의 겹친 구역을 확인했습니다.

Meridian Mining rapporte des résultats de forage significatifs de son projet Cabaçal Cu-Au-Ag dans le Mato Grosso, Brésil. L'entreprise a identifié plusieurs zones empilées de minéralisation de haute qualité, mises en avant par des intersections telles que CD-544 : 38,2 m @ 3,2 g/t AuEq ou 2,1 % CuEq, CD-595 : 12,4 m @ 3,3 g/t AuEq ou 2,2 % CuEq, et CD-571 : 22,2 m @ 1,7 g/t AuEq.

Le programme de forage a révélé plus de 20 intercepts dépassant 10 mètres-grammes d'équivalent or, avec des résultats montrant à la fois des horizons VMS Cu-Au-Ag et une superposition d'or. Le programme a amélioré la définition des tendances de haute qualité et confirmé des zones empilées de minéralisation, en particulier dans des zones où le forage historique était incomplet ou partiellement échantillonné.

Meridian Mining berichtet über bedeutende Bohrergebnisse aus seinem Cabaçal Cu-Au-Ag-Projekt im Mato Grosso, Brasilien. Das Unternehmen hat mehrere übereinander liegende Zonen hoher Mineralisierung identifiziert, hervorgehoben durch Schnittpunkte wie CD-544: 38,2 m @ 3,2 g/t AuEq oder 2,1% CuEq, CD-595: 12,4 m @ 3,3 g/t AuEq oder 2,2% CuEq, und CD-571: 22,2 m @ 1,7 g/t AuEq.

Das Bohrprogramm offenbarte mehr als 20 Durchschläge, die 10 Grammmeter Goldäquivalent übersteigen, wobei die Ergebnisse sowohl VMS Cu-Au-Ag-Horizonte als auch Goldüberprägungen zeigen. Das Programm hat die Definition von hochgradigen Trends verbessert und übereinander liegende Zonen der Mineralisierung bestätigt, insbesondere in Bereichen, in denen historische Bohrungen unvollständig oder teilweise beprobt waren.

- Multiple high-grade intersections with significant Cu-Au-Ag mineralization

- Over 20 intercepts exceeding 10-gram meters gold equivalent

- CD-544 returned exceptional results: 38.2m @ 3.2g/t AuEq

- Discovery of previously unsampled mineralization in historical drilling areas

- Presence of mining voids in some drill holes affecting continuity

- Historical drilling data shows incomplete sampling, requiring additional verification

20+ intercepts of Cu-Au-Ag mineralization grading higher than 10 gram-meters AuEq

LONDON, UK / ACCESSWIRE / October 29, 2024 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to announce further strong results from its advanced Cabaçal Cu-Au-Ag project ("Cabaçal"), located in the state of Mato Grosso Brazil. Multiple wide zones of stacked Cu-Au-Ag mineralization overprinted by a later stage gold event, continue to be defined and extended, highlighted by CD-544 assaying: 38.2m @ 3.2g/t AuEq or

Highlights Reported Today

Meridian assays further strong copper, gold, and silver mineralization at Cabaçal;

Cabaçal PFS drill program assay multiple stacked zones of strong Cu-Au-Ag mineralization;

CD-544: 10.9m @ 2.6g/t AuEq /

1.7% CuEq from 78.9m;3.4m @ 11.0g/t AuEq /

7.4% CuEq from 92.6m;10.4m @ 3.1g/t AuEq /

2.1% CuEq from 114.1m;

CD-595: 11.7m @ 1.2g/t AuEq /

0.8% CuEq from 57.9m;10.6m @ 1.7g/t AuEq /

1.1% CuEq from 83.2m;12.4m @ 3.3g/t AuEq /

2.2% CuEq from 99.9m;5.4m @ 2.0g/t AuEq /

1.4% CuEq from 117.9m;

CD-576: 2.3m @ 5.1g/t AuEq /

3.4% CuEq from 38.5m;4.5m @ 3.6g/t AuEq /

2.4% CuEq from 51.9m;8.5m @ 1.3g/t AuEq /

0.8% CuEq from 68.0m;

CD-566: 20.0m @ 1.8g/t AuEq /

1.2% CuEq from 91.3m;14.8m @ 1.8g/t AuEq /

1.2% CuEq from 114.3m;15.0m @ 1.9g/t AuEq /

1.3% CuEq from 138.7m; and

Twenty-one intercepts returned where assays exceeded 10-gram meters gold equivalent.

*See technical note for true thickness estimate and separate AuEq and CuEq equations.

Mr. Gilbert Clark, CEO, comments: "We are strongly encouraged by these excellent results, even after more than 100,000 metres of drilling at Cabaçal, we are still improving the definition of the high grade trends and confirming stacked zones of high-grade Cu-Au-Ag mineralization. This continues to show the significance of this advanced VMS open pit deposit and its potential to become Brazil's next near-term producer. One of my general observations of open pit mining is that a viable project needs to have greater than 10-gram meters of gold mineralization within open pitable depths to be indicative of a workable deposit. This press release has over twenty such intervals alone and it represents only a small sample population of the Cabaçal drill hole database."

1See Cabaçal Gold-Copper Project NI 43-101 PEA March 30, 2023, https://meridianmining.co/cabacal/

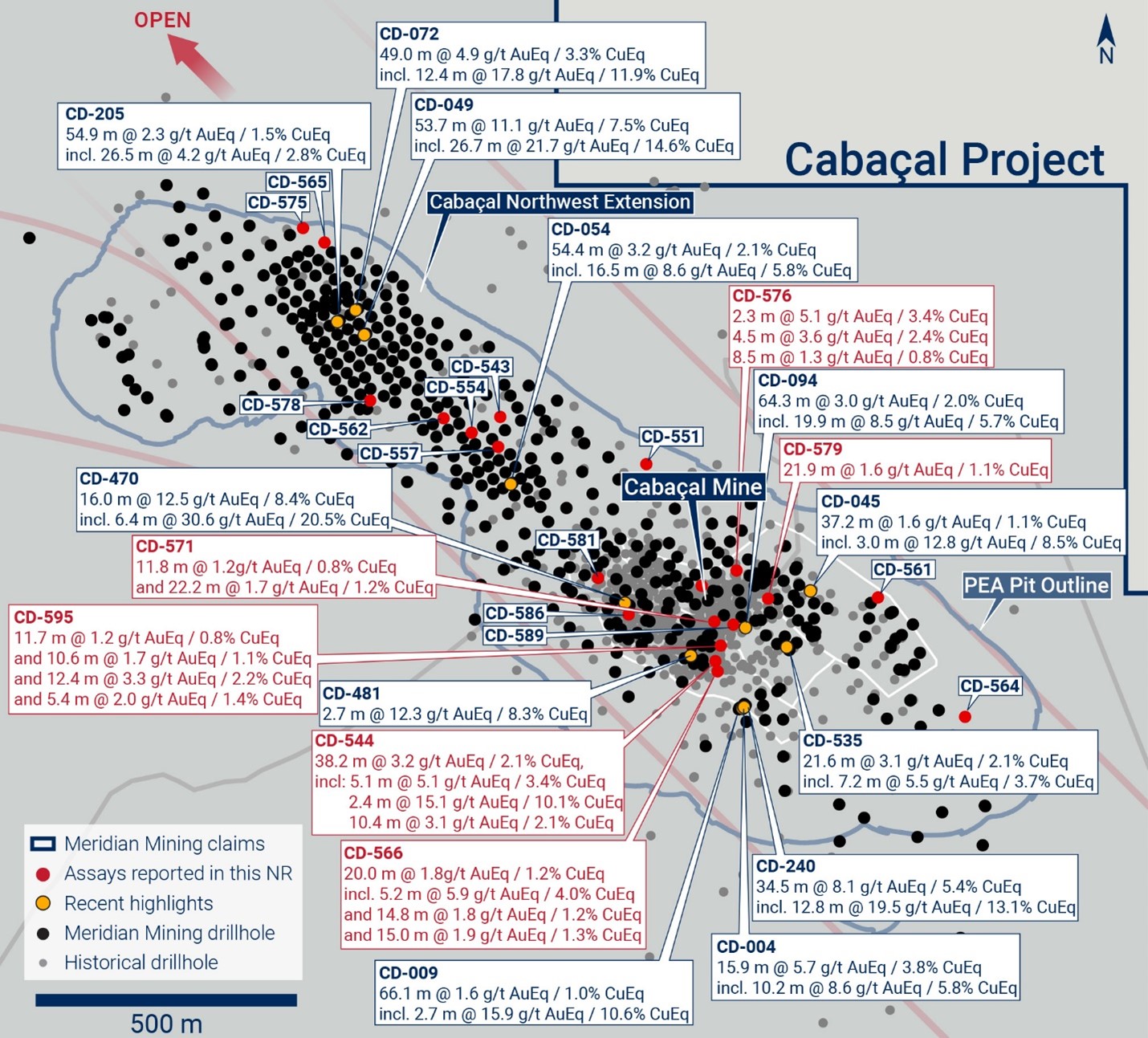

Figure 1: Cabaçal drill highlights

Cabaçal Drill Results

Results reported today from Cabaçal ("Table 1"), continue to define the multiple stacked horizons of Cu-Au-Ag VMS type mineralization that has been over printed by a later stage high-grade gold event. This recent drilling program has been focused more in the mine sphere, in areas where Meridian's angled drill program had not been completed, or where the historical drill programs only partially sampled the core resulting in an underestimation in the mineralization's grade and extent. Meridian's angled drilling defines both the VMS Cu-Au-Ag horizons and the gold over print, while its vertical drilling results "completes" the vertical profile of the VMS stacked layers correcting the partial under representation of the historical results ("Figure 2").

A selection of the results is highlighted below:

CD-544

38.2m @ 3.2g/t AuEq /

2.1% CuEq from 78.9m; Including5.1m @ 5.1g/t AuEq /

3.4% CuEq from 84.8m;2.4m @ 15.1g/t AuEq /

10.1% CuEq from 92.6m;10.4m @ 3.1g/t AuEq /

2.1% CuEq from 114.1m;

3.4m @ 11.0g/t AuEq /

7.4% CuEq from 92.6m;21.1m @ 2.6g/t AuEq /

1.8% CuEq from 103.5m; Including4.5m @ 3.7g/t AuEq /

2.5% CuEq from 106.9m;10.4m @ 3.1g/t AuEq /

2.1% CuEq from 114.1m;

CD-595

11.7m @ 1.2g/t AuEq /

0.8% CuEq from 57.9m;10.6m @ 1.7g/t AuEq /

1.1% CuEq from 83.2m;12.4m @ 3.3g/t AuEq /

2.2% CuEq from 99.9m; Including2.2m @ 13.1g/t AuEq /

8.8% CuEq from 110.1m;5.4m @ 2.0g/t AuEq /

1.4% CuEq from 117.9m;

CD-592

20.1m @ 1.2g/t AuEq /

0.8% CuEq from 44.8m; Including4.3m @ 2.6g/t AuEq /

1.8% CuEq from 44.8m;

CD-586

4.2m @ 3.4g/t AuEq /

2.3% CuEq from 62.1m;7.2m @ 1.1g/t AuEq /

0.8% CuEq from 68.7m;

CD-581

14.9m @ 1.3g/t AuEq /

0.9% CuEq from 61.8m;

CD-579

21.9m @ 1.6g/t AuEq /

1.1% CuEq from 58.6m; Including7.6m @ 2.7g/t AuEq /

1.8% CuEq from 59.8m;

CD-576

2.3m @ 5.1g/t AuEq /

3.4% CuEq from 38.5m;4.5m @ 3.6g/t AuEq /

2.4% CuEq from 51.9m;8.5m @ 1.3g/t AuEq /

0.8% CuEq from 68.0m;

CD-571

11.8m @ 1.2g/t AuEq /

0.8% CuEq from 24.9m;22.2m @ 1.7g/t AuEq /

1.2% CuEq from 65.1m; Including:4.6m @ 5.2g/t AuEq /

3.5% CuEq from 69.5m;

CD-566

20.0m @ 1.8g/t AuEq /

1.2% CuEq from 91.3m; Including2.9m @ 8.6g/t AuEq /

5.8% CuEq from 91.8m;

14.8m @ 1.8g/t AuEq /

1.2% CuEq from 114.3m; Including4.1m @ 3.6g/t AuEq /

2.4% CuEq from 114.3m; and

15.0m @ 1.9g/t AuEq /

1.3% CuEq from 138.7m; Including:7.6m @ 2.8g/t AuEq /

1.9% CuEq from 140.7m.

Good results have been delivered in drilling across the Southern, Central and Eastern Copper Zones of the Cabaçal deposit. Notable results included the Southern Copper Zone's ("SCZ") hole CD-544, which traversed three mining voids, but with very strong Cu-Au results above below and between the historical mining levels. The main mineralized zone returned 38.2m @ 3.2g/t AuEq /

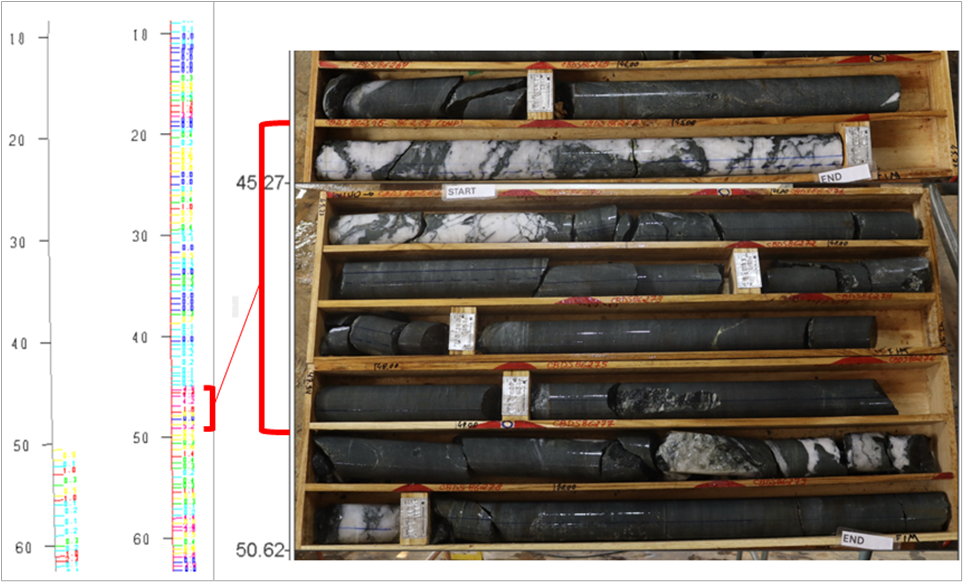

In the Central Copper Zone ("CCZ"), CD-592 illustrates the limitations of some of the historical sampling based on past visual protocols. This hole twinned an historical position (JUSPD278), in which sampling started at an initial depth of 50.55m. CD-592 intersected shallow levels of disseminated copper-dominant mineralization: 14.6m @ 0.6g/t AuEq /

Figure 2: Left drill traces JUSPD278 (unsampled from surface to -50m), and CD-592 (to the right), which locally assays 4.3m @ 2.6g/t AuEq /

In the more copper-dominant Eastern Copper Zone ("ECZ"), CD-579 provided another example of the benefits from the infill program. Historically unsampled but shallow disseminated mineralization of the deposit went unsampled in the historical drill hole JUSPD179. In this previously unsampled area, CD-579 assayed 8.5m @ 0.8g/t AuEq /

The ongoing program continues to cover areas where historical core was only partially sampled, leaving gaps in the historical assay sequence, and in other areas to continue to confirm the void model in more sparsely drilled areas.

About Meridian

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

The initial resource definition at the second high-grade VMS asset at Santa Helena as first stage of Hub and Spoke development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Hub and Spoke strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold,

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Phone: +1 778 715-6410 (BST)

Twitter: https://twitter.com/MeridianMining

Stay up to date by subscribing for news alerts here: https://meridianmining.co/subscribe/

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with

Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Assay results reported in this release.

Hole-id | Dip | Azi | EOH | Zone |

| Int | AuEq | CuEq | Au | Cu | Ag | From |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

(m) |

| (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (m) | ||||

CD-595 | -51 | 089 | 123.3 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11.7 | 1.2 | 0.8 | 0.2 | 0.7 | 0.9 | 57.9 |

|

|

|

| Including |

| 3.0 | 3.1 | 2.1 | 0.8 | 1.7 | 1.8 | 64.8 |

|

|

|

|

|

| 1.4 | 0.4 | 0.3 | 0.1 | 0.2 | 0.8 | 75.3 |

|

|

|

|

|

| 0.4 | 3.7 | 2.5 | 3.7 | 0.1 | 0.1 | 79.0 |

|

|

|

|

|

| 10.6 | 1.7 | 1.1 | 0.9 | 0.6 | 0.8 | 83.2 |

|

|

|

| Including |

| 4.4 | 3.6 | 2.4 | 2.0 | 1.2 | 1.5 | 84.9 |

|

|

|

|

|

| 12.4 | 3.3 | 2.2 | 3.1 | 0.2 | 0.5 | 99.9 |

|

|

|

| Including |

| 2.2 | 13.1 | 8.8 | 11.6 | 1.1 | 1.9 | 110.1 |

|

|

|

|

|

| 5.4 | 2.0 | 1.4 | 1.0 | 0.8 | 1.4 | 117.9 |

CD-592 | -90 | 000 | 97.9 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 14.6 | 0.6 | 0.4 | 0.1 | 0.4 | 0.7 | 14.8 |

|

|

|

|

|

| 3.3 | 0.3 | 0.2 | 0.2 | 0.1 | 0.4 | 31.7 |

|

|

|

|

|

| 20.1 | 1.2 | 0.8 | 0.9 | 0.3 | 0.9 | 44.8 |

|

|

|

| Including |

| 4.3 | 2.6 | 1.8 | 2.4 | 0.2 | 0.4 | 44.8 |

|

|

|

| Including |

| 5.0 | 1.5 | 1.0 | 0.9 | 0.4 | 2.9 | 57.7 |

|

|

|

|

|

| 0.4 | 5.9 | 4.0 | 0.6 | 3.7 | 12.1 | 67.8 |

|

|

|

|

|

| 2.8 | 1.2 | 0.8 | 0.3 | 0.6 | 3.2 | 70.2 |

|

|

|

|

|

| 0.7 | 0.6 | 0.4 | 0.2 | 0.3 | 1.6 | 75.2 |

|

|

|

|

|

| 0.7 | 0.7 | 0.4 | 0.2 | 0.4 | 1.5 | 86.0 |

CD-589 | -89 | 000 | 79.8 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.1 | 0.4 | 0.3 | 0.1 | 0.3 | 1.0 | 16.0 |

|

|

|

|

|

| 9.9 | 0.4 | 0.2 | 0.0 | 0.2 | 0.6 | 24.8 |

|

|

|

|

|

| 0.7 | 2.4 | 1.6 | 2.5 | 0.0 | 0.0 | 38.3 |

|

|

|

|

|

| 7.7 | 0.7 | 0.4 | 0.3 | 0.3 | 0.3 | 47.3 |

|

|

|

|

|

| 4.9 | 1.0 | 0.7 | 0.6 | 0.4 | 0.5 | 60.5 |

|

|

|

|

|

| 2.7 | 3.2 | 2.1 | 2.0 | 0.9 | 1.4 | 68.6 |

CD-586 | -85 | 152 | 105.5 | SCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2.0 | 0.4 | 0.3 | 0.0 | 0.3 | 0.5 | 35.0 |

|

|

|

|

|

| 4.8 | 0.9 | 0.6 | 0.8 | 0.1 | 1.3 | 51.6 |

|

|

|

|

|

| 4.2 | 3.4 | 2.3 | 3.1 | 0.3 | 0.7 | 62.1 |

|

|

|

| Including |

| 1.4 | 9.7 | 6.5 | 9.0 | 0.5 | 1.7 | 63.0 |

|

|

|

|

|

| 7.2 | 1.1 | 0.8 | 0.2 | 0.7 | 1.6 | 68.7 |

|

|

|

|

|

| 1.9 | 0.2 | 0.1 | 0.1 | 0.1 | 0.2 | 78.4 |

|

|

|

|

|

| 1.0 | 1.1 | 0.7 | 0.4 | 0.6 | 1.4 | 86.6 |

CD-581 | -89 | 000 | 95.7 | SCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.6 | 0.9 | 0.6 | 0.1 | 0.6 | 1.1 | 31.5 |

|

|

|

|

|

| 1.4 | 1.6 | 1.1 | 1.6 | 0.1 | 0.4 | 53.5 |

|

|

|

|

|

| 1.9 | 1.0 | 0.7 | 0.7 | 0.3 | 0.3 | 56.7 |

|

|

|

|

|

| 14.9 | 1.3 | 0.9 | 0.7 | 0.5 | 1.4 | 61.8 |

|

|

|

| Including |

| 5.6 | 2.5 | 1.7 | 1.5 | 0.7 | 1.8 | 61.8 |

|

|

|

|

|

| 1.0 | 3.2 | 2.1 | 0.4 | 1.9 | 9.7 | 80.1 |

CD-579 | -89 | 000 | 106.6 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8.5 | 0.8 | 0.5 | 0.1 | 0.5 | 1.3 | 10.0 |

|

|

|

|

|

| 2.9 | 0.3 | 0.2 | 0.0 | 0.2 | 0.6 | 22.0 |

|

|

|

|

|

| 7.6 | 0.4 | 0.3 | 0.0 | 0.3 | 0.7 | 30.0 |

|

|

|

|

|

| 9.4 | 0.7 | 0.4 | 0.1 | 0.4 | 0.8 | 44.0 |

|

|

|

|

|

| 21.9 | 1.6 | 1.1 | 0.4 | 0.8 | 4.3 | 58.6 |

|

|

|

| Including |

| 7.6 | 2.7 | 1.8 | 0.7 | 1.4 | 7.3 | 59.8 |

|

|

|

|

|

| 2.8 | 2.2 | 1.5 | 0.4 | 1.3 | 2.6 | 82.7 |

CD-578 | -50 | 058 | 129.8 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.5 | 0.4 | 0.3 | 0.1 | 0.3 | 0.3 | 34.5 |

|

|

|

|

|

| 2.7 | 0.2 | 0.2 | 0.2 | 0.0 | 0.1 | 52.0 |

|

|

|

|

|

| 2.0 | 1.9 | 1.3 | 1.9 | 0.0 | 0.1 | 60.0 |

|

|

|

|

|

| 10.9 | 0.6 | 0.4 | 0.2 | 0.3 | 1.0 | 77.4 |

|

|

|

|

|

| 1.3 | 0.6 | 0.4 | 0.1 | 0.3 | 1.7 | 90.3 |

CD-576 | -60 | 042 | 85.5 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7.9 | 0.4 | 0.2 | 0.0 | 0.2 | 0.6 | 4.8 |

|

|

|

|

|

| 2.3 | 5.1 | 3.4 | 1.0 | 2.7 | 18.6 | 38.5 |

|

|

|

|

|

| 4.5 | 3.6 | 2.4 | 1.3 | 1.5 | 9.0 | 51.9 |

|

|

|

| Including |

| 3.0 | 5.1 | 3.4 | 1.9 | 2.1 | 12.7 | 52.2 |

|

|

|

|

|

| 4.8 | 0.8 | 0.5 | 0.2 | 0.4 | 3.1 | 59.2 |

|

|

|

|

|

| 8.5 | 1.3 | 0.8 | 0.6 | 0.5 | 2.0 | 68.0 |

CD-575 | -50 | 058 | 40.0 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.4 | 0.3 | 0.2 | 0.1 | 0.2 | 2.2 | 12.7 |

CD-571 | -89 | 000 | 118.9 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11.8 | 1.2 | 0.8 | 0.3 | 0.7 | 1.2 | 24.9 |

|

|

|

| Including |

| 2.4 | 2.4 | 1.6 | 0.2 | 1.5 | 2.3 | 27.4 |

|

|

|

|

|

| 4.5 | 1.6 | 1.1 | 1.1 | 0.4 | 0.5 | 41.6 |

|

|

|

| Including |

| 1.7 | 3.6 | 2.4 | 2.5 | 0.9 | 1.3 | 44.4 |

|

|

|

|

|

| 4.2 | 1.4 | 0.9 | 1.0 | 0.3 | 0.5 | 48.8 |

|

|

|

| Including |

| 0.8 | 5.4 | 3.6 | 4.2 | 0.9 | 1.1 | 52.2 |

|

|

|

|

|

| 3.7 | 0.7 | 0.5 | 0.2 | 0.4 | 0.8 | 59.4 |

|

|

|

|

|

| 22.2 | 1.7 | 1.2 | 0.8 | 0.7 | 2.6 | 65.1 |

|

|

|

| Including |

| 4.6 | 5.2 | 3.5 | 2.3 | 2.0 | 7.7 | 69.5 |

|

|

|

| Including |

| 8.5 | 3.3 | 2.2 | 1.4 | 1.3 | 5.4 | 69.5 |

|

|

|

| Including |

| 13.3 | 2.6 | 1.7 | 1.2 | 1.0 | 4.0 | 69.5 |

|

|

|

|

|

| 1.6 | 0.8 | 0.5 | 0.2 | 0.5 | 1.8 | 90.9 |

|

|

|

|

|

| 2.8 | 2.7 | 1.8 | 1.3 | 0.9 | 2.4 | 100.2 |

|

|

|

|

|

| 2.6 | 0.6 | 0.4 | 0.3 | 0.2 | 0.7 | 107.5 |

CD-566 | -66 | 090 | 166.7 | SCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.6 | 0.6 | 0.4 | 0.1 | 0.4 | 3.1 | 36.8 |

|

|

|

|

|

| 2.4 | 0.5 | 0.3 | 0.0 | 0.3 | 1.4 | 45.0 |

|

|

|

|

|

| 1.9 | 0.8 | 0.5 | 0.1 | 0.5 | 1.3 | 57.6 |

|

|

|

|

|

| 2.3 | 1.1 | 0.7 | 0.3 | 0.5 | 1.8 | 62.3 |

|

|

|

|

|

| 20.0 | 1.8 | 1.2 | 1.6 | 0.2 | 1.2 | 91.3 |

|

|

|

| Including |

| 2.9 | 8.6 | 5.8 | 7.7 | 0.7 | 6.8 | 91.8 |

|

|

|

| Including |

| 5.2 | 5.9 | 4.0 | 5.3 | 0.4 | 3.9 | 91.8 |

|

|

|

|

|

| 14.8 | 1.8 | 1.2 | 0.3 | 1.0 | 3.0 | 114.3 |

|

|

|

| Including |

| 4.1 | 3.6 | 2.4 | 0.5 | 2.1 | 6.7 | 114.3 |

|

|

|

|

|

| 3.5 | 1.1 | 0.7 | 0.1 | 0.7 | 1.5 | 132.0 |

|

|

|

|

|

| 15.0 | 1.9 | 1.3 | 0.6 | 0.9 | 2.8 | 138.7 |

|

|

|

| Including |

| 7.6 | 2.8 | 1.9 | 0.9 | 1.3 | 3.9 | 140.7 |

CD-565 | -49 | 059 | 53.2 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.4 | 0.3 | 0.2 | 0.1 | 0.2 | 1.1 | 23.6 |

CD-564 | -75 | 222 | 88.2 | CSTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.0 | 0.5 | 0.3 | 0.0 | 0.3 | 1.5 | 52.2 |

|

|

|

|

|

| 11.5 | 0.9 | 0.6 | 0.2 | 0.5 | 4.2 | 59.2 |

|

|

|

|

|

| 1.0 | 0.8 | 0.5 | 0.1 | 0.5 | 4.2 | 73.8 |

CD-562 | -49 | 059 | 144.6 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 0.9 | 0.6 | 0.4 | 0.1 | 0.4 | 0.3 | 23.0 |

|

|

|

|

|

| 2.5 | 0.6 | 0.4 | 0.1 | 0.3 | 0.3 | 30.1 |

|

|

|

|

|

| 13.3 | 0.8 | 0.5 | 0.3 | 0.3 | 0.9 | 38.3 |

|

|

|

| Including |

| 6.9 | 1.1 | 0.7 | 0.5 | 0.5 | 1.2 | 38.3 |

|

|

|

|

|

| 7.2 | 0.8 | 0.5 | 0.4 | 0.3 | 0.8 | 54.4 |

|

|

|

|

|

| 5.4 | 0.3 | 0.2 | 0.2 | 0.1 | 0.2 | 65.0 |

|

|

|

|

|

| 1.3 | 1.5 | 1.0 | 1.5 | 0.1 | 0.1 | 80.4 |

|

|

|

|

|

| 10.1 | 0.3 | 0.2 | 0.3 | 0.1 | 0.1 | 104.7 |

|

|

|

|

|

| 2.6 | 0.5 | 0.4 | 0.5 | 0.1 | 0.2 | 117.3 |

|

|

|

|

|

| 7.4 | 1.2 | 0.8 | 0.3 | 0.7 | 1.1 | 123.7 |

|

|

|

| Including |

| 1.5 | 3.0 | 2.0 | 0.5 | 1.8 | 2.0 | 125.3 |

CD-561 | -49 | 059 | 40.0 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4.2 | 2.1 | 1.4 | 0.3 | 1.2 | 6.3 | 19.4 |

|

|

|

| Including |

| 2.2 | 3.7 | 2.5 | 0.6 | 2.1 | 10.9 | 21.4 |

CD-557 | -49 | 059 | 140.4 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4.3 | 0.7 | 0.5 | 0.1 | 0.5 | 1.0 | 25.7 |

|

|

|

|

|

| 2.7 | 0.7 | 0.5 | 0.1 | 0.5 | 0.5 | 36.3 |

|

|

|

|

|

| 0.9 | 1.1 | 0.7 | 0.1 | 0.7 | 0.7 | 43.9 |

|

|

|

|

|

| 1.8 | 0.6 | 0.4 | 0.7 | 0.0 | 0.1 | 53.0 |

|

|

|

|

|

| 2.2 | 0.7 | 0.5 | 0.8 | 0.0 | 0.0 | 58.0 |

|

|

|

|

|

| 2.3 | 0.9 | 0.6 | 0.3 | 0.5 | 1.5 | 83.4 |

|

|

|

|

|

| 1.7 | 0.7 | 0.5 | 0.6 | 0.1 | 0.4 | 92.5 |

|

|

|

|

|

| 1.7 | 0.4 | 0.2 | 0.1 | 0.2 | 0.1 | 100.1 |

|

|

|

|

|

| 12.7 | 0.8 | 0.5 | 0.2 | 0.4 | 1.1 | 107.8 |

|

|

|

| Including |

| 1.5 | 2.6 | 1.8 | 0.3 | 1.6 | 2.6 | 113.2 |

CD-554 | -50 | 058 | 144.9 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6.6 | 0.4 | 0.3 | 0.1 | 0.2 | 0.1 | 99.1 |

|

|

|

|

|

| 4.5 | 0.3 | 0.2 | 0.1 | 0.1 | 0.2 | 111.3 |

|

|

|

|

|

| 7.5 | 1.0 | 0.7 | 0.1 | 0.6 | 1.0 | 121.3 |

|

|

|

| Including |

| 2.2 | 2.1 | 1.4 | 0.2 | 1.4 | 1.7 | 122.9 |

CD-551 | -49 | 058 | 41.9 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8.6 | 0.4 | 0.3 | 0.3 | 0.1 | 0.9 | 7.0 |

|

|

|

|

|

| 8.1 | 0.5 | 0.4 | 0.2 | 0.2 | 0.6 | 17.0 |

CD-544 | -68 | 040 | 157.7 | SCZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12.4 | 0.7 | 0.4 | 0.1 | 0.4 | 1.2 | 47.0 |

|

|

|

|

|

| 3.0 | 0.6 | 0.4 | 0.1 | 0.3 | 0.9 | 63.2 |

|

|

|

|

|

| 1.9 | 1.1 | 0.7 | 0.2 | 0.6 | 1.1 | 74.7 |

|

|

|

|

|

| 38.2 | 3.2 | 2.1 | 2.2 | 0.7 | 2.1 | 78.9 |

|

|

|

| Including |

| 5.1 | 5.1 | 3.4 | 4.7 | 0.3 | 1.2 | 84.8 |

|

|

|

| Including |

| 2.4 | 15.1 | 10.1 | 14.9 | 0.2 | 1.2 | 92.6 |

|

|

|

| Including |

| 10.4 | 3.1 | 2.1 | 1.7 | 1.0 | 2.7 | 114.1 |

|

|

|

| Including |

| 4.6 | 0.6 | 0.4 | 0.2 | 0.3 | 0.6 | 129.4 |

CD-543 | -50 | 059 | 108.4 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.8 | 0.3 | 0.2 | 0.1 | 0.2 | 0.1 | 63.1 |

|

|

|

|

|

| 1.8 | 1.5 | 1.0 | 0.2 | 0.9 | 1.0 | 83.4 |

|

|

|

|

|

| 3.7 | 1.6 | 1.1 | 0.2 | 0.9 | 2.3 | 87.6 |

CD-540 | -48 | 061 | 130.1 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 9.3 | 0.7 | 0.5 | 0.1 | 0.5 | 0.6 | 24.9 |

|

|

|

|

|

| 1.2 | 1.4 | 0.9 | 0.2 | 0.9 | 1.5 | 42.3 |

|

|

|

|

|

| 2.3 | 0.3 | 0.2 | 0.0 | 0.2 | 0.3 | 73.5 |

|

|

|

|

|

| 9.1 | 0.5 | 0.3 | 0.1 | 0.3 | 0.2 | 83.7 |

|

|

|

|

|

| 1.4 | 0.7 | 0.4 | 0.2 | 0.4 | 0.1 | 95.6 |

|

|

|

|

|

| 3.5 | 0.8 | 0.5 | 0.5 | 0.2 | 0.3 | 104.7 |

|

|

|

|

|

| 6.7 | 1.2 | 0.8 | 0.2 | 0.7 | 1.3 | 110.4 |

|

|

|

| Including |

| 2.9 | 2.1 | 1.4 | 0.3 | 1.2 | 2.1 | 111.7 |

SOURCE: Meridian Mining UK S

View the original press release on accesswire.com

FAQ

What are the latest drilling results from Meridian Mining's Cabaçal project (MRRDF)?

Where is Meridian Mining's Cabaçal project (MRRDF) located?