Morningstar Risk Ecosystem Launches Across 7 Million Portfolios to Help Advisors Put Investors' Best Interests at the Core of Investment Advice

Morningstar, Inc., a leader in independent investment research, has launched the Morningstar Portfolio Risk Score and Risk Comfort Range, part of its Morningstar Risk Ecosystem. This initiative aims to enhance risk assessment for financial advisors, providing a more personalized investment experience. The Portfolio Risk Score will be available soon on the Morningstar Advisor Workstation for advisors in Canada and the U.S., significantly impacting over 7.1 million client portfolios.

- Launch of Morningstar Portfolio Risk Score and Risk Comfort Range enhances risk measurement.

- New methodologies aim to improve client-advisor matching and investment planning.

- Tools made available across 7.1 million client portfolios, enabling better advisor-client engagement.

- Integration with PlanPlus Global enhances risk tolerance assessment confidence.

- None.

Morningstar Portfolio Risk Score and Risk Comfort Range, new components of the Morningstar Risk Ecosystem, debut as part of creating an investor-centric risk measurement approach for financial advisors seeking to provide more personalized investment advice, meet evolving regulatory standards, and build better businesses

CHICAGO, July 1, 2021 /PRNewswire/ -- Morningstar, Inc. (Nasdaq: MORN), a leading provider of independent investment research, today announced the launch of Morningstar Portfolio Risk Score and Risk Comfort Range, new risk measurement tools in the Morningstar Risk Ecosystem, an evidence-based, transparent and independent set of methodologies to provide a more rigorous and manageable client profiling and investment planning process for firms and their advisors.

The launch of the Morningstar Risk Ecosystem, including its new Morningstar Portfolio Risk Score and Risk Comfort Range, marks a new approach to risk measurement and analysis that aligns Morningstar methodologies for scoring portfolio risk and assessing a client's risk profile and tolerance. Morningstar Portfolio Risk Score will become available next week in Morningstar® Advisor WorkstationSM for advisors in Canada and the U.S. Morningstar Portfolio Risk Score and Risk Comfort Range are both available to third-party platforms now through Morningstar® Enterprise Components, and they will roll out across Morningstar's flagship platforms through the remainder of 2021.

In a white paper published today, "Measurement of Client Risk Tolerance: How Improving Methodology Could Offer Advisors a Significant Competitive Advantage," Morningstar Director of Financial Planning Methodology Shawn Brayman and Director of Product Management Jason Stipp explain the importance of matching clients to compatible portfolios. A 2015 paper by Browning and Finke found 57 percent of U.S. households actively reduced their stock holdings between 2006 and 2008 amid the housing and credit crisis. This effectively locked in losses for some investors and kept them from potential benefits of staying in the stock market for the subsequent rebound.

"Many investors lack access to sound financial planning services, and many advisors use tools that check the box for compliance but may not reliably assess an investor's risk tolerance and align it to appropriately risky portfolios," Brayman said. "The Morningstar Risk Ecosystem addresses this with robust, transparent methodologies and simple illustrations, ultimately helping them make more informed, long-term investment decisions."

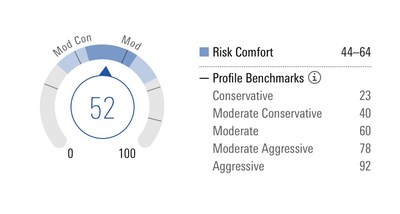

Morningstar Portfolio Risk Score measures a portfolio's level of risk compared with Morningstar's Target Allocation Index family and can be applied to client portfolios, model portfolios, proposed portfolios, or individual managed investments. In support of its existing subscriber clients, Morningstar has made the Morningstar Portfolio Risk Score available across 7.1 million client portfolios in Morningstar Advisor Workstation, enabling advisors to have deeper conversations with clients and build more targeted financial plans.

Morningstar's Risk Comfort Range is a methodology to align client expectations about the risk exposure of their portfolios based on their risk profile and investment objectives to an appropriate range of Morningstar Portfolio Risk Scores. This can help the advisor demonstrate compatibility between the investor's needs and risk tolerance and the recommended investment products or portfolio. Each subsequent enhancement to the Morningstar Risk Ecosystem through 2021 will build on Morningstar's objective to empower investors and enable advisors to easily document and show clients how their own risk tolerance and comfort measures up against mutual funds, ETFs, or their own portfolio.

"Traditional risk profiling is typically inadequate and does not meet the true needs of investors or advisors serving them. The industry has, for too long, focused on measuring only the risk of investments within a portfolio, resulting in a commoditization of investment advice," said Jeff Schwantz, head of client advisor experience for Morningstar. "We are putting the priority back on the investor and unlocking an advisor's ability to see both investor risk and investment risk in one clear view. The result of these integrations will be a new way to measure and understand investment risk, develop truly personalized portfolios and confidently address new and upcoming regulatory standards."

The methodologies introduced in the Morningstar Risk Ecosystem result from the integration of PlanPlus Global, which Morningstar acquired in 2020, with Morningstar's financial planning solutions. The foundation of the risk tolerance questionnaire is built on the world's most academically validated psychometric risk tolerance assessment to give advisors confidence in delivering defensible advice to clients. More than 1.5 million risk tolerance tests have been completed for over 10,000 advisors in 35 countries since 1998.

For more information on the Morningstar Risk Ecosystem, visit https://www.morningstar.com/products/risk.

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The Company offers an extensive line of products and services for individual investors, financial advisors, asset managers and owners, retirement plan providers and sponsors, and institutional investors in the debt and private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, debt securities, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with approximately

The sole purpose of the Morningstar Portfolio Risk Score and Risk Comfort Range is to assist investors in determining their general attitudes towards investment risk and to help assess a financial product's suitability given an investor's risk tolerance. These tools do not consider all factors necessary in making an investment decision and should not be used as the sole basis for investment decisions. In no way should these tools be viewed as investment advice or establishing any kind of advisory relationship with Morningstar. Morningstar does not endorse and/or recommend any specific financial product that may be used in conjunction with the Morningstar Risk Ecosystem.

MORN-P

CONTACT: Stephanie Lerdall, newsroom@morningstar.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/morningstar-risk-ecosystem-launches-across-7-million-portfolios-to-help-advisors-put-investors-best-interests-at-the-core-of-investment-advice-301324313.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/morningstar-risk-ecosystem-launches-across-7-million-portfolios-to-help-advisors-put-investors-best-interests-at-the-core-of-investment-advice-301324313.html

SOURCE Morningstar, Inc.

FAQ

What is the Morningstar Risk Ecosystem?

How does the Morningstar Portfolio Risk Score work?

When will the Morningstar Portfolio Risk Score be available?

What impact does the Risk Comfort Range have on advisors?