Nut Tree Capital Management and Caspian Capital Increase Offer to Purchase Martin Midstream Partners L.P. to $4.50 per Common Unit In Cash

Nut Tree Capital Management and Caspian Capital have increased their offer to purchase Martin Midstream Partners L.P. (MMLP) to $4.50 per common unit in cash. This enhanced offer represents a 48% premium over Martin Resource Management 's (MRMC) previous proposal of $3.05 per unit. The increased offer, up from their initial $4.00 per unit, is based on financial analysis of MMLP's public information, recent results, and current peer valuations.

Despite repeated requests, Martin Midstream GP 's Conflicts Committee has refused to meet directly with Nut Tree and Caspian. The investors believe their proposal is superior to MRMC's, which they claim significantly undervalues MMLP and its future prospects. They call on the Conflicts Committee to act in the best interests of all MMLP unitholders by meeting with them and requiring approval from the majority of unaffiliated unitholders for any transaction with MRMC.

Nut Tree Capital Management e Caspian Capital hanno aumentato la loro offerta per l'acquisto di Martin Midstream Partners L.P. (MMLP) a $4,50 per unità comune in contanti. Questa offerta potenziata rappresenta un premio del 48% rispetto alla proposta precedente di Martin Resource Management (MRMC) di $3,05 per unità. L'offerta aumentata, passata dai loro iniziali $4,00 per unità, si basa su un'analisi finanziaria delle informazioni pubbliche di MMLP, dei risultati recenti e delle valutazioni attuali dei concorrenti.

Nonostante ripetute richieste, il Comitato per i Conflitti di Martin Midstream GP ha rifiutato di incontrarsi direttamente con Nut Tree e Caspian. Gli investitori credono che la loro proposta sia superiore a quella di MRMC, che sostengono svaluti significativamente MMLP e le sue prospettive future. Chiedono al Comitato per i Conflitti di agire nel migliore interesse di tutti gli azionisti di MMLP incontrandoli e richiedendo l'approvazione della maggioranza degli azionisti non affiliati per qualsiasi transazione con MRMC.

Nut Tree Capital Management y Caspian Capital han incrementado su oferta para adquirir Martin Midstream Partners L.P. (MMLP) a $4,50 por unidad común en efectivo. Esta oferta mejorada representa un premio del 48% sobre la propuesta anterior de Martin Resource Management (MRMC) de $3,05 por unidad. La oferta incrementada, que pasó de sus iniciales $4,00 por unidad, se basa en un análisis financiero de la información pública de MMLP, los resultados recientes y las valoraciones actuales de sus pares.

A pesar de las repetidas solicitudes, el Comité de Conflictos de Martin Midstream GP ha rechazado reunirse directamente con Nut Tree y Caspian. Los inversores creen que su propuesta es superior a la de MRMC, que afirman subestima significativamente a MMLP y sus perspectivas futuras. Hacen un llamado al Comité de Conflictos para que actúe en el mejor interés de todos los accionistas de MMLP, reuniéndose con ellos y exigiendo la aprobación de la mayoría de los accionistas no afiliados para cualquier transacción con MRMC.

너트 트리 캐피탈 매니지먼트와 카스피안 캐피탈은 마틴 미드스트림 파트너스 L.P. (MMLP)의 매입 제안을 현금으로 보통주 당 $4.50로 인상했습니다.이 향상된 제안은 마틴 리소스 매니지먼트 (MRMC)의 이전 제안인 주당 $3.05보다 48% 프리미엄을 나타냅니다. 제안 증가는 처음 제안한 주당 $4.00에서 기반한 MMLP의 공적 정보, 최근 결과 및 현재 동종 기업의 평가에 대한 재무 분석에 기초합니다.

반복적인 요청에도 불구하고, 마틴 미드스트림 GP의 갈등 위원회는 너트 트리와 카스피안과 직접 만나는 것을 거부했습니다. 투자자들은 그들의 제안이 MRMC의 제안보다 우수하다고 믿고 있으며, MRMC가 MMLP와 그 미래 전망을 상당히 과소평가한다고 주장합니다. 그들은 갈등 위원회가 모든 MMLP 유닛 소유자의 최선의 이익을 위해 만나고 MRMC와의 어떤 거래에 대해서도 비연관 유닛 소유자의 다수 승인을 요구할 것을 촉구합니다.

Nut Tree Capital Management et Caspian Capital ont augmenté leur offre d'achat de Martin Midstream Partners L.P. (MMLP) à 4,50 $ par unité commune en espèces. Cette offre améliorée représente une prime de 48% par rapport à la proposition précédente de Martin Resource Management (MRMC) de 3,05 $ par unité. L'offre rehaussée, passant de leur offre initiale de 4,00 $ par unité, est basée sur une analyse financière des informations publiques de MMLP, des résultats récents et des évaluations des concurrents actuels.

Malgré des demandes répétées, le Comité des Conflits de Martin Midstream GP a refusé de se rencontrer directement avec Nut Tree et Caspian. Les investisseurs estiment que leur proposition est supérieure à celle de MRMC, qu'ils jugent considérablement sous-évaluée par rapport à MMLP et à ses perspectives futures. Ils appellent le Comité des Conflits à agir dans le meilleur intérêt de tous les détenteurs d'unités MMLP en se rencontrant avec eux et en exigeant l'approbation de la majorité des détenteurs d'unités non affiliés pour toute transaction avec MRMC.

Nut Tree Capital Management und Caspian Capital haben ihr Angebot zum Kauf von Martin Midstream Partners L.P. (MMLP) auf 4,50 $ pro Stammaktie in bar erhöht. Dieses verbesserte Angebot stellt einen Aufschlag von 48% im Vergleich zu dem vorhergehenden Vorschlag von Martin Resource Management (MRMC) von 3,05 $ pro Aktie dar. Das erhöhte Angebot, das von den anfänglichen 4,00 $ pro Aktie kommt, basiert auf einer finanziellen Analyse der öffentlichen Informationen von MMLP, den jüngsten Ergebnissen und den aktuellen Bewertungen der Wettbewerber.

Obwohl mehrfach darum gebeten wurde, hat der Konflikt Ausschuss von Martin Midstream GP sich geweigert, direkt zu treffen mit Nut Tree und Caspian. Die Investoren glauben, dass ihr Vorschlag dem von MRMC überlegen ist, den sie als signifikant unterbewertend für MMLP und dessen zukünftige Perspektiven betrachten. Sie fordern den Konfliktausschuss auf, im besten Interesse aller MMLP-Einheitseigner zu handeln, indem sie sich mit ihnen treffen und die Zustimmung der Mehrheit der nicht angeschlossenen Anteilseigner für eine Transaktion mit MRMC einfordern.

- Increased offer of $4.50 per common unit represents a 48% premium over MRMC's proposal

- Potential for additional value subject to due diligence findings

- Offer is fully financed with no financing condition in definitive agreements

- Investors claim MMLP has potential for distributable cash flow above $1.00/common unit annually

- MMLP's DSM Semichem joint venture expected to contribute over $6 million annually to profitability

- Potential for accretive debt refinancing opportunity in August 2025, potentially saving $10 million per year

- Conflicts Committee's refusal to meet directly with Nut Tree and Caspian may hinder the acquisition process

- Current MMLP leverage ratio of 3.9x is above the target of 3.75x, potentially affecting distribution capabilities

Insights

This enhanced offer from Nut Tree and Caspian represents a significant development in the potential acquisition of Martin Midstream Partners L.P. (MMLP). The increased bid of

Key financial aspects to note:

- The new offer values MMLP at approximately 8.5x to 9.0x expected 2024 EBITDA, aligning more closely with industry peers.

- MMLP's projected distributable cash flow of

$29 million ($0.74 /unit) for 2024 suggests potential for future distributions. - The DSM Semichem joint venture is expected to contribute

$6 million annually to profitability ($0.16 /unit). - A potential debt refinancing opportunity in 2025 could save

$5 million annually ($0.12 /unit).

The offerors' analysis suggests MMLP could potentially distribute

However, it's important to note that these projections are based on the bidders' analysis and may not fully account for all risks or potential downside scenarios. The Conflicts Committee's reluctance to engage directly with Nut Tree and Caspian raises questions about the process transparency and potential conflicts of interest.

The situation at MMLP presents several significant corporate governance concerns:

- Conflict of Interest: MRMC's initial offer and its relationship with MMLP's General Partner create a clear conflict of interest. The Conflicts Committee's role is important in ensuring fair treatment of unaffiliated unitholders.

- Transparency: The Conflicts Committee's refusal to meet directly with Nut Tree and Caspian, despite their higher offer, raises questions about the transparency and fairness of the process.

- Unaffiliated Unitholder Protection: The absence of a commitment to require approval from a majority of unaffiliated unitholders for any transaction with MRMC is concerning. This safeguard is often implemented in similar situations to protect minority interests.

- Information Disclosure: The removal of relative valuation slides from MMLP's Investor Relations website, as mentioned by the bidders, could be seen as an attempt to limit information available to unitholders and potential bidders.

These issues highlight the importance of robust corporate governance practices in M&A situations, especially those involving related parties. The Conflicts Committee bears a significant responsibility to ensure that all unitholders' interests are protected and that the process is fair and transparent.

Regulators and unitholders alike may scrutinize this process closely, particularly if the Conflicts Committee continues to resist engagement with alternative bidders offering a substantial premium. The committee's actions in the coming days will be important in determining whether they are fulfilling their fiduciary duties to all unitholders.

This situation presents an intriguing M&A scenario with several strategic implications:

- Competitive Bidding: Nut Tree and Caspian's increased offer has effectively initiated a bidding war, potentially driving up the acquisition price for MMLP. This could benefit unitholders but may strain the financial capacity of potential acquirers.

- Strategic vs. Financial Buyers: MRMC, as a strategic buyer, may have synergies that allow it to justify a higher price. However, Nut Tree and Caspian, as financial buyers, seem to see untapped value in MMLP that could be realized through financial engineering and operational improvements.

- Due Diligence: The bidders' request for due diligence access is standard in M&A processes. Their suggestion that the offer could increase post-diligence is intriguing but also carries the risk of a reduced offer if they uncover unfavorable information.

- Transaction Structure: The mention of potential "alternative transaction structures" suggests that Nut Tree and Caspian may be open to creative deal structures that could unlock additional value for unitholders.

- Hidden Asset Value: The reference to MMLP's undeveloped land in Beaumont, TX as a "hidden asset" indicates potential for value creation that may not be reflected in current market valuations or MRMC's offer.

The Conflicts Committee's strategy in managing this process will be crucial. Their reluctance to engage with Nut Tree and Caspian could be seen as a defensive tactic, possibly to maintain negotiating leverage with MRMC or to explore other options. However, this approach risks alienating unitholders if a significantly higher offer is not seriously considered.

As this situation unfolds, we may see further developments such as revised offers, legal challenges, or activist investor involvement. The outcome will likely hinge on the Conflicts Committee's ability to navigate these complex dynamics while fulfilling their fiduciary duties to all unitholders.

Enhanced Offer Represents a

Despite Repeated Requests and Superior Value Being Offered to MMLP Unitholders, Martin Midstream GP LLC's Conflicts Committee Refuses to Meet with Nut Tree and Caspian Directly

Nut Tree and Caspian Call on Conflicts Committee to Act in Best Interests of All MMLP Unitholders by Meeting with Nut Tree and

Nut Tree and

The full text of the letter is below:

July 29, 2024

Martin Midstream GP LLC

4200 Stone Road

Attention: Byron Kelley, Chair of Conflicts Committee

Dear Members of the Conflicts Committee:

Nut Tree Capital Management L.P. ("Nut Tree") and Caspian Capital L.P. ("

Our decision to increase our offer is based on our own financial analysis of publicly available information regarding MMLP, its recent results, and current peer valuations. We further note that we may even be able to provide additional value for the Partnership's unitholders, subject to the findings of customary due diligence on the Partnership, should we be permitted to do so. In any event, we are confident that our improved proposal is vastly superior to MRMC's proposal, and that the Partnership's unitholders who are unaffiliated with MRMC will find our proposal more compelling, while we also provide equal or greater transaction certainty.

We are disappointed that despite our repeated requests, the Conflicts Committee has refused to meet with us directly, offering up only a meeting with its financial advisor, nor has the Conflicts Committee committed to requiring that any transaction with MRMC be subject to the approval of a majority of the unaffiliated common unitholders (that is, a vote that excludes the units held by MRMC, the General Partner, Ruben Martin, III, and any of their affiliates). We believe these steps are necessary to mitigate the conflicts of interest presented by MRMC's pending offer and to provide common unitholders with assurances regarding the integrity of the process being run by the Conflicts Committee. Nevertheless, we remain committed to constructive engagement with the Conflicts Committee to obtain its support, and ultimately to reach a negotiated, definitive agreement to acquire MMLP.

We have dedicated considerable time and effort to conduct our financial analysis of MMLP and ascertain an appropriate valuation, which supports our superior offer. We believe that MRMC significantly undervalues MMLP and its future prospects. In making these determinations, we considered the following:

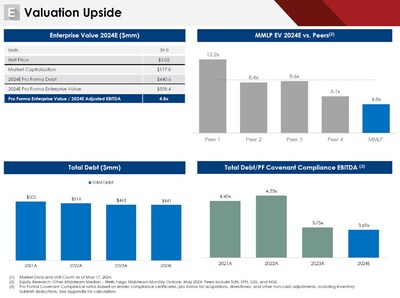

- Comparable master limited partnerships, as described in MMLP's own publicly available investor presentation from May 2024, traded at approximately 8.5x expected 2024 EBITDA, whereas MRMC's offer represents an Enterprise Value of only 4.8x management's expected 2024 EBITDA. Furthermore, when referencing the same peers and the most recent equity research, that multiple has improved to 9.0x. At a 9.0x multiple, MMLP's common units would be valued

500% of what MRMC has offered.1

- Curiously, the slides that discuss these relative valuations were recently removed from MMLP's publicly available Investor Relations website. Fortunately, we saved a copy of those slides and have pasted them below.

- In prior discussions we have had with members of management, we have been told repeatedly that management believes the Partnership's common units are undervalued and should trade more in line with EBITDA valuation multiples of similar companies.

- Based on the Partnership's own public disclosures, we are convinced that a number of positive developments for the Partnership are likely to come to fruition in the near and medium term, which will not only result in distributable cash flow above

$1.00

- We use management's 2024 distributable cash flow projection made in May of

$29 million $0.74 $3.3 million $2.0 million $6 million

- MMLP has funded all but

$3 million $27 million $6 million $0.16 the United States .2

- MMLP has funded all but

- MMLP has an accretive debt refinancing opportunity coming soon, when

$400 million 11.5% bonds become callable beginning August 15, 2025. The bonds currently trade at a yield below8.0% , and we expect can be refinanced at9.0% . This would save an incremental$10 million $0.26 $5 million $0.12

- MMLP has an accretive debt refinancing opportunity coming soon, when

- Even with MMLP's current debt it is likely to be able to pay distributions to unitholders in the near term. MMLP reached its target leverage ratio of 3.75x at the end of 2023 and ended 2Q24 at 3.9x. Below 3.75x, a level we believe the company will reach sustainably in the near term, the current debt allows for distributions to unitholders.

- Equity research indicates that most midstream companies pay distributions of 45

-70% of distributable cash flow, implying possible annual distributions of$0.45 -0.7073% of MMLP's 2024E EBITDA coming from Service and Fixed Fee contracts. As a result, we expect MMLP could pay out on the higher end of distribution rates.3

- Equity research indicates that most midstream companies pay distributions of 45

- Furthermore, the same equity research shows Midstream MLP distribution yields average

6.7% , which would imply a value of approximately$6.50 -10.50

- Furthermore, the same equity research shows Midstream MLP distribution yields average

- Additionally, management has previously discussed with investors MMLP's "hidden asset value" in the form of 98 acres of owned and undeveloped land in and around

Beaumont, TX that could support another specialty industrial site. In addition to the land being in close proximity to three different rail facilities, it also provides access to at least one deepwater dock large enough to accommodate a natural gas carrier. We do not believe MRMC's offer attributes any value to this land.

As previously communicated, we stand ready to enter into an appropriate confidentiality agreement and commence our due diligence immediately and on an expedited basis following genuine and direct engagement with the Conflicts Committee regarding our offer. Depending on the outcome of that diligence, we may be able to increase our proposed purchase price or determine alternative transaction structures that could lead to even greater value for the Partnership's unitholders.

We continue to have committed and available capital to support this increased offer and can confirm that the definitive agreements would not include a financing condition.

We look forward to receiving a prompt response from the Conflicts Committee and directly discussing our offer further.

Sincerely,

Nut Tree Capital Management, LP Jed Nussbaum Chief Investment Officer Scott Silver Principal | Caspian Capital LP

Partner Meagan Bennett Managing Director |

Latham & Watkins LLP and Olshan Frome Wolosky LLP are serving as legal counsel to Nut Tree and

About Caspian Capital LP

Caspian Capital LP, founded in 1997, is focused on performing, stressed, distressed corporate credit, and value equities.

About Nut Tree Capital Management LP

Nut Tree Capital, founded in 2015, implements a fundamentals-based strategy focused on distressed credit, stressed/event-driven credit and value equities. Nut Tree currently oversees

Media Contacts:

Jonathan Gasthalter/Nathaniel Garnick

Gasthalter & Co.

(212) 257-4170

1 See Wells Fargo Midstream Energy Update July 12, 2024, pg. 7. Permission to use the Wells Fargo Midstream Energy Update was neither sought nor obtained.

2 See MMLP's Quarterly Report on Form 10-Q for the Quarter ended June 30, 2024 and May 2024 Investor Presentation

3 See Wells Fargo Midstream Monthly Outlook July 3, 2024, pg. 89. Permission to use the Wells Fargo Midstream Monthly Outlook was neither sought nor obtained.

4 See Wells Fargo Midstream Monthly Outlook July 3, 2024, pg. 9. Permission to use the Wells Fargo Midstream Monthly Outlook was neither sought nor obtained.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/nut-tree-capital-management-and-caspian-capital-increase-offer-to-purchase-martin-midstream-partners-lp-to-4-50-per-common-unit-in-cash-302208901.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/nut-tree-capital-management-and-caspian-capital-increase-offer-to-purchase-martin-midstream-partners-lp-to-4-50-per-common-unit-in-cash-302208901.html

SOURCE Nut Tree Capital Management and Caspian Capital