Moody’s Analytics Launches Climate Scores on its Commercial Real Estate Platform

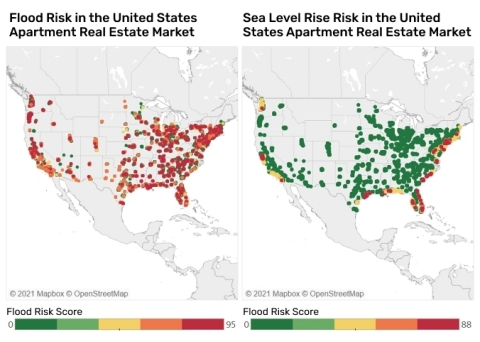

Moody’s Analytics has launched proprietary climate risk scores on its commercial real estate platform, REIS. This innovation aims to quantify the climate exposure of commercial properties, assisting investors and lenders with risk assessment. It highlights acute and chronic risks affecting the CRE sector, such as floods and sea-level rise, which can disrupt market dynamics. The scoring methodology employs peer-reviewed models for reliable risk evaluation.

- Launch of climate risk scores enhances REIS platform functionality.

- Provides a competitive advantage for CRE market participants in risk assessment.

- Utilization of best-in-class, peer-reviewed models for climate risk evaluation.

- CRE sector still faces significant climate risks, which may deter investment.

- Case study reveals developers are not currently integrating climate risks into assessments.

Insights

Analyzing...

Source: Moody's

“This integration marks an important step in the evolution of our property analytics platform into a full-service risk assessment proposition for the CRE industry,” said

The CRE sector faces some of the most direct and tangible risks from physical climate hazards. Acute physical risks, such as floods and wildfires, can cause immediate and substantial damage to real estate assets. Chronic physical risks, such as sea level rise or heat stress, can significantly disrupt CRE markets from both supply and demand perspectives.

Moreover, climate change exacerbates existing risks in several ways including increasing restoration and remediation costs and presenting uncertainty around the viability of a property or market. Understanding the likelihood and severity of these risks can help CRE market participants make better decisions over both near and longer-term time horizons.

New research from Moody’s Analytics examines how climate change is affecting real estate markets today and discusses implications for the future. A case study of the

Moody’s climate risk scoring methodology utilizes best-in-class, peer-reviewed models to measure both current and forward-looking climate risks, providing a transparent and consistent standard for monitoring the impacts of climate change on CRE performance fundamentals.

This launch follows expansion of data coverage of the physical risks posed by climate change with new sub-sovereign climate risk scores introduced by Moody’s ESG Solutions. It coincides with the ongoing “Moody’s on Climate” campaign that focuses on Moody’s leadership in addressing the shared challenge of climate change through our insights, solutions and corporate commitments.

About Moody’s Analytics

Moody’s Analytics provides financial intelligence and analytical tools to help business leaders make better, faster decisions. Our deep risk expertise, expansive information resources, and innovative application of technology help our clients confidently navigate an evolving marketplace. We are known for our industry-leading and award-winning solutions, made up of research, data, software, and professional services, assembled to deliver a seamless customer experience. We create confidence in thousands of organizations worldwide, with our commitment to excellence, open mindset approach, and focus on meeting customer needs. For more information about Moody’s Analytics, visit our website or connect with us on Twitter or LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211012005678/en/

KATERINA SOUMILOVA

Moody’s

+1.212.553.1177

Moody’s Analytics Media Relations

moodysanalytics.com

twitter.com/moodysanalytics

linkedin.com/company/moodysanalytics

Source: Moody’s Analytics