Montage Gold Enters into Strategic Partnership with African Gold to Advance the High-Grade Didievi Project in Côte d’ivoire

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) has announced a strategic partnership with African Gold (ASX:A1G), acquiring up to 19.9% ownership through the issuance of up to 2.19 million common shares valued at approximately C$6.3 million.

The partnership centers on African Gold's Didievi project in Côte d'Ivoire, which hosts an Inferred Resource of 4.93Mt at 2.9 g/t Au containing 452,000oz of gold. African Gold is currently executing a 10,000-meter drill programme at Didievi, reporting high-grade extension intercepts.

Key terms include:

- Montage becoming the operator of the Didievi project

- Appointment of Silvia Bottero as Non-Executive Director and Martino De Ciccio as Strategic Advisor to African Gold's Board

- African Gold raising C$1.66 million through a non-brokered private placement

- Technical Services Agreement until December 2026

- Right of First Refusal on the Didievi Project

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) ha annunciato una partnership strategica con African Gold (ASX:A1G), acquisendo fino al 19,9% di partecipazione attraverso l'emissione di fino a 2,19 milioni di azioni ordinarie del valore di circa 6,3 milioni di dollari canadesi.

La partnership si concentra sul progetto Didievi di African Gold in Costa d'Avorio, che ospita una Risorsa Indicata di 4,93 Mt a 2,9 g/t Au contenente 452.000 once d'oro. African Gold sta attualmente eseguendo un programma di perforazione di 10.000 metri a Didievi, riportando intercettazioni di estensioni ad alta legge.

I termini chiave includono:

- Montage che diventa l'operatore del progetto Didievi

- Nomina di Silvia Bottero come Direttore Non Esecutivo e Martino De Ciccio come Consulente Strategico nel Consiglio di African Gold

- African Gold che raccoglie 1,66 milioni di dollari canadesi attraverso un collocamento privato non mediato

- Accordo di Servizi Tecnici fino a dicembre 2026

- Diritti di Prelazione sul Progetto Didievi

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) ha anunciado una asociación estratégica con African Gold (ASX:A1G), adquiriendo hasta el 19,9% de propiedad mediante la emisión de hasta 2,19 millones de acciones comunes valoradas en aproximadamente 6,3 millones de dólares canadienses.

La asociación se centra en el proyecto Didievi de African Gold en Costa de Marfil, que alberga un Recurso Inferido de 4,93 Mt a 2,9 g/t Au que contiene 452,000 onzas de oro. African Gold está ejecutando actualmente un programa de perforación de 10,000 metros en Didievi, informando sobre interceptaciones de extensiones de alta ley.

Los términos clave incluyen:

- Montage convirtiéndose en el operador del proyecto Didievi

- Nombramiento de Silvia Bottero como Directora No Ejecutiva y Martino De Ciccio como Asesor Estratégico en la Junta de African Gold

- African Gold recaudando 1,66 millones de dólares canadienses a través de una colocación privada no mediada

- Acuerdo de Servicios Técnicos hasta diciembre de 2026

- Derecho de Tanteo sobre el Proyecto Didievi

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF)는 African Gold (ASX:A1G)와 전략적 파트너십을 발표하며, 최대 19.9%의 지분을 확보하기 위해 약 630만 캐나다 달러에 해당하는 219만 주의 보통주를 발행한다고 밝혔습니다.

이 파트너십은 코트디부아르에 위치한 African Gold의 Didievi 프로젝트에 초점을 맞추고 있으며, 이 프로젝트는 4.93Mt의 추정 자원과 2.9 g/t Au의 등급을 가지고 있어 452,000온스의 금을 포함하고 있습니다. African Gold는 현재 Didievi에서 10,000미터의 시추 프로그램을 진행 중이며, 고품질 확장 교차점에 대한 보고를 하고 있습니다.

주요 조건은 다음과 같습니다:

- Montage가 Didievi 프로젝트의 운영자가 됨

- Silvia Bottero가 비상임 이사로, Martino De Ciccio가 African Gold 이사회의 전략 고문으로 임명됨

- African Gold가 비중개 사모 배정을 통해 166만 캐나다 달러를 모금함

- 2026년 12월까지 기술 서비스 계약

- Didievi 프로젝트에 대한 우선 매수권

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) a annoncé un partenariat stratégique avec African Gold (ASX:A1G), acquérant jusqu'à 19,9% de participation par l'émission de jusqu'à 2,19 millions d'actions ordinaires d'une valeur d'environ 6,3 millions de dollars canadiens.

Ce partenariat se concentre sur le projet Didievi d'African Gold en Côte d'Ivoire, qui abrite une Ressource Indiquée de 4,93 Mt à 2,9 g/t Au contenant 452 000 onces d'or. African Gold exécute actuellement un programme de forage de 10 000 mètres à Didievi, rapportant des intercepts d'extensions de haute qualité.

Les conditions clés incluent:

- Montage devenant l'opérateur du projet Didievi

- Nommer Silvia Bottero en tant que Directrice Non Exécutive et Martino De Ciccio en tant que Conseiller Stratégique au Conseil d'African Gold

- African Gold levant 1,66 million de dollars canadiens par le biais d'un placement privé non intermédié

- Contrat de Services Techniques jusqu'en décembre 2026

- Droit de Préemption sur le Projet Didievi

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) hat eine strategische Partnerschaft mit African Gold (ASX:A1G) angekündigt und erwirbt bis zu 19,9% Eigentum durch die Ausgabe von bis zu 2,19 Millionen Stammaktien im Wert von etwa 6,3 Millionen kanadischen Dollar.

Die Partnerschaft konzentriert sich auf das Didievi-Projekt von African Gold in der Côte d'Ivoire, das eine geschätzte Ressource von 4,93 Mt bei 2,9 g/t Au mit 452.000 Unzen Gold enthält. African Gold führt derzeit ein Bohrprogramm über 10.000 Meter im Didievi durch und berichtet über hochgradige Erweiterungsabschnitte.

Wichtige Bedingungen sind:

- Montage wird Betreiber des Didievi-Projekts

- Ernennung von Silvia Bottero zur nicht geschäftsführenden Direktorin und Martino De Ciccio zum strategischen Berater des Vorstands von African Gold

- African Gold erhebt 1,66 Millionen kanadische Dollar durch eine nicht vermittelte Privatplatzierung

- Technikdienstleistungsvertrag bis Dezember 2026

- Vorkaufsrecht für das Didievi-Projekt

- Strategic acquisition of 19.9% stake in African Gold provides exposure to high-grade gold resource

- Operational control of Didievi project leverages Montage's expertise in Côte d'Ivoire

- Current drilling program showing promising high-grade extension results

- Right of First Refusal on Didievi Project provides strategic advantage for future expansion

- Dilution of existing shareholders through issuance of 2.19 million new shares

- Resource is currently only in Inferred category, requiring additional work to upgrade

- Investment subject to shareholder approval and closing conditions

HIGHLIGHTS:

- Montage to obtain up to

19.9% ownership stake in African Gold (ASX:A1G), through the issuance of up to 2.19 million common shares for deemed aggregate consideration of up to circa C$6.3 million - African Gold to appoint Silvia Bottero, EVP Exploration of Montage, as Non-Executive Director and Martino De Ciccio, CEO of Montage, as Strategic Advisor to the Board of Directors

- African Gold owns several exploration properties in Côte d’Ivoire, including its flagship Didievi project which hosts an Inferred Resource of 4.93Mt at 2.9 g/t Au containing 452,000oz of gold, as published by African Gold

- Montage appointed operator of the Didievi project to take advantage of its presence and expertise in Côte d’Ivoire

- African Gold is currently undertaking a 10,000-meter drill programme at its Didievi project which continues to return high-grade extension intercepts

VANCOUVER, British Columbia, March 24, 2025 (GLOBE NEWSWIRE) -- Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU, OTCQX: MAUTF) is pleased to announce that it has entered into a strategic partnership with African Gold Limited (“African Gold”) (ASX:A1G), given its highly attractive exploration portfolio in Côte d’Ivoire, including its high-grade Didievi project, obtaining an up to

Montage will be participating alongside a broader non-brokered private placement (the “Offering”) whereby an additional 26.3 million ordinary shares in African Gold will be issued to subscribers. Through the Offering, African Gold will obtain aggregate gross proceeds of approximately C

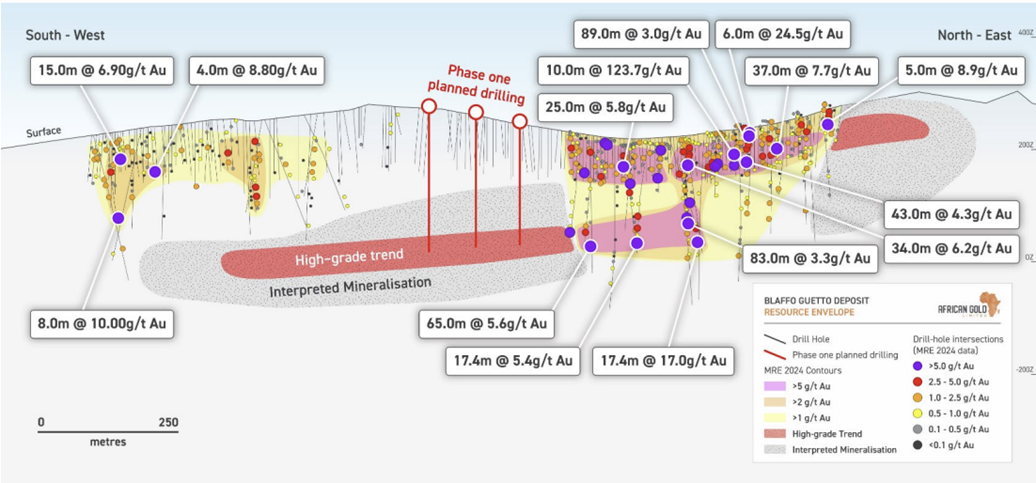

African Gold’s flagship Didievi project in Côte d’Ivoire is located close to established gold mining operations including Allied Gold’s Bonikro and Agbaou mines, as well as Perseus’ Yaoure mine. African Gold is currently undertaking a 10,000-meter drill programme at its Didievi project which continues to return high-grade extension intercepts on its main target, known as the Blaffo Guetto trend. The Didievi project hosts an Inferred Resource of 4.93Mt at 2.9 g/t Au containing 452,000 ounces of gold, as published by African Gold1.

Through the strategic partnership, Silvia Bottero, EVP Exploration of Montage, will be appointed as Non-Executive Director to the Board of Directors of African Gold and Montage will become the operator of the Didievi project to take advantage of the significant synergies and expertise Montage can leverage in Côte d’Ivoire.

Martino De Ciccio, CEO of Montage, commented: “We are very pleased to form a strategic partnership with African Gold and work alongside them to rapidly unlock exploration value across their highly attractive portfolio in Côte d’Ivoire, including the high-grade Didievi project, by leveraging our presence and expertise in the country. Our strategic investment in African Gold follows a thorough review of potential partnerships in Côte d’Ivoire, based on a value-driven approach that considers risk-adjusted geological potential and is supported by technical due diligence.

We continue to be pleased with the strong momentum generated across our business and look forward to unlocking significant exploration value at our flagship Koné project, while its build progresses on time and on budget. Additionally, we remain focused on sourcing future growth through greenfield exploration success. In line with this objective, and as part of our evaluation of strategic partnerships, we are continuing to make considerable progress in staking highly prospective exploration grounds in Côte d’Ivoire, to reinforce our presence in the country and leverage the expertise of our well-established exploration team.”

Adam Oehlman, CEO of African Gold commented: “We are excited to partner with Montage Gold given their extensive exploration track record and strong presence in Côte d’Ivoire. This collaboration offers an exciting opportunity to unlock exploration value at notably our flagship Didievi project. Furthermore, Montage’s robust technical due diligence process strengthens our belief that the Didievi project is highly prospective.

We are very pleased with the ongoing 10,000-meter drill programme at our Didievi project, which continues to return high-grade extension intercepts, and look forward to further drilling the property this year given our strengthened financial position.”

Key terms of the Strategic Partnership

Montage has entered into a binding term sheet in respect of a transaction (the “Share Exchange Transaction”) whereby Montage and African Gold will enter into an Investment Agreement, Investor Rights Agreement and Technical Services Agreement to give effect to the Share Exchange Transaction. The rights of Montage under the Investor Rights Agreement will persist so long as Montage holds at least

- Equity Swap: Montage will obtain an up to

19.9% ownership in African Gold, through a Share Exchange Transaction which results in the issuance of up to 104,749,216 African Gold ordinary shares to Montage, and the issuance of up to 2,189,340 common shares of Montage (“Montage Shares”) to African Gold equating to an up to0.6% ownership in Montage, for a total implied transaction consideration of up to C$6.3 million . Montage insiders intend to participate in the Offering for up to 12,371,429 shares in African Gold, which would reduce the size of the Share Exchange Transaction commensurately and reduce the share issuance of Montage Shares to African Gold. The Share Exchange Transaction is based on a Montage share price of C$2.87 and an African Gold share price of A$0.07 . Montage Shares will be issued to African Gold under an exemption from the prospectus requirements of applicable Canadian securities laws and will be subject to a hold period of four months and one day from the date of issuance to African Gold. Any African Gold sale of Montage shares will be subject to certain notice rights to enable Montage Gold to designate a suitable purchaser(s), subject to the Investor Rights Agreement Threshold. - Technical Services Agreement: Montage and African Gold will enter into an agreement whereby Montage will be appointed operator of the Didievi project to direct exploration activities and its administration until December 31, 2026. Montage may terminate its operator service by providing a 3-months written notice, and may also elect to continue to be the operator after December 31, 2026 by providing written notice to African Gold. The budget and expenditures related to exploration, general management, studies, and all associated activities for the Didievi project will be approved by the Board of Directors of African Gold and paid by African Gold. Montage will be reimbursed for any out-of-pocket expenditures linked to the management of the project.

- Assignment of pre-emptive rights: African Gold will assign to Montage its pre-emptive rights to acquire a

20% project level shareholding in the Didievi project (and other permits) owned by minority shareholders. - Participation Rights: Requirement for African Gold to provide Montage with reasonable opportunity to participate in future equity issuances to maintain Montage’s ownership percentage in African Gold, payable in Montage common shares, cash, or a combination of either.

- Board Nominee: Appointment of a Montage nominee to the Board of Directors of African Gold. As such, on closing of the Share Exchange Transaction, Silvia Bottero, EVP Exploration of Montage, will be appointed as Non-Executive Director to the Board of Directors of African Gold. Martino De Ciccio, CEO of Montage, will be appointed as Strategic Advisor to the Board of Directors of African Gold.

- Joint-Technical-Committee: Appointment of Silvia Bottero, EVP Exploration at Montage, to a newly formed joint-technical-committee with African Gold on all properties of African Gold.

- Right of First Refusal (“ROFR”): Granted in favour of Montage on the Didievi Project and with respect to African Gold's rights to acquire the Angoda Permit (PR-585) located adjacent to the Didievi Project.

The Share Exchange Transaction and the Offering are expected to close in Q2-2025 and are subject to conditions including (a) approval of the shareholders of African Gold; and (b) entry into definitive transaction documents, among other customary conditions.

ABOUT AFRICAN GOLD

African Gold owns a highly prospective portfolio of exploration properties in Côte d’Ivoire, led by their flagship Didievi project, which has multi-million ounce potential. Strategically located close to established gold mining operations including Allied Gold’s Bonikro and Agbaou mines, as well as Perseus’ Yaoure project.

The Didievi project hosts an Inferred Resource of 4.93Mt at 2.9 g/t gold, representing 452,000oz of gold2, for its main target, known as the Blaffo Guetto trend. On October 15, 2024, African Gold reported drilling results from the Didievi Project, including2:

- 65.0m at 5.6 g/t Au from 177m

- 155.0m at 1.1 g/t Au with a notable interval of 52m at 2.9 g/t Au from 178m

Previous drilling on Blaffo Guetto returned shallow intercepts on the Blaffo Guetto, including2:

- 65.0m at 5.6 g/t Au from 177m including 22m at 10.9 g/t Au

- 155m at 1.1 g/t Au from 105m including 52m at 2.9 g/t Au from 178m

- 31.4m at 3.5 g/t Au from 250m including 18m at 5.6 g/t Au from 252m

- 10.0m at 123.7 g/t Au from 66m including 2m at 613.1 g/t Au

- 83.3m at 3.3 g/t Au from 166.9m including 18m at 12 g/t Au

- 17.4m at 17.0 g/t Au from 244m including 1m at 216.0 g/t Au

- 89.0m at 3.0 g/t Au from 0m including 23m at 9.5 g/t Au

- 43.0m at 4.3 g/t Au from 57 m including 17m at 9.5 g/t Au

- 69.0m at 2.9 g/t Au from 31m including 37m at 4.9 g/t Au

- 37.0m at 7.7 g/t Au from 42m including 24m at 11.0 g/t Au

African Gold is currently undertaking a 10,000-meter drill programme at its Didievi project, the largest in the company’s history, as shown in Figure 1 below, which continues to return high-grade extension intercepts and is expected to be completed in April 2025, marking a significant milestone in African Gold’s growth strategy.

Figure 1: Blaffo Guetto long section with planned phase one drilling2

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ABOUT MONTAGE GOLD

Montage Gold Corp. (TSXV: MAU) is a Canadian-listed company focused on becoming a premier multi-asset African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Updated Feasibility Study published in 2024 (the “UFS”), the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years and is expected to enter production in Q2-2027.

TECHNICAL DISCLOSURE

Mineral Resource and Reserve Estimates

The Koné and Gbongogo Main Mineral Resource Estimates were carried out by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Western Australia, who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43–101.

The Mineral Reserve Estimate was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd., who is considered to be independent of Montage Gold. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under NI 43–101.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release relating to Montage Gold have been verified and approved by Silvia Bottero, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mrs. Bottero, EVP Exploration of Montage, is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (SACNASP), a member of the Geological Society of South Africa and a Member of AusIMM.

CONTACT INFORMATION

| For Investor Relations Inquiries: Jake Cain Strategy & Investor Relations Manager jcain@montagegold.com +44-7788-687-567 | For Media Inquiries: John Vincic Oakstrom Advisors john@oakstrom.com +1-647-402-6375 | For Regulatory Inquiries: Kathy Love Corporate Secretary klove@montagegold.com +1-604-512-2959 |

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the entering into definitive agreements relating to the Share Exchange Transaction, the terms of the Strategic Partnership, in issue of the Montage common shares and the African Gold ordinary shares, closing of the Share Exchange Transaction, the appointments to the Board of African Gold, the results of the African Gold drill program, future growth of Montage, shareholder approval of the Share Exchange Transaction, and timing of the completion of the subject matter.

Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There is no assurance that Share Exchange Transaction will be completed or on terms disclosed in this press release. There can be no assurance that any Forward-looking Statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the negotiation of the definitive agreements relating to the Share Exchange Transaction, shareholder and regulatory approval, as well as other risk factors including those set forth in the Company’s Annual Information form available at www.sedarplus.ca, under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

1Source: African Gold ASX announcement dated December 6, 2024, available on the ASX and on African Gold’s website. Montage Gold understands that the resource statement was prepared under JORC in July 2024. Montage Gold has not independently verified or validated the resource statement or other technical information relating to African Gold in this press release and takes no responsibility for such disclosure. Montage Gold has not done sufficient work to classify this historic resource as a current mineral resource and as such is not treating this resource as current under National Instrument 43-101.

2 Source: African Gold ASX announcement dated December 6, 2024, available on the ASX and on African Gold’s website. Montage Gold understands that the resource statement was prepared under JORC in July 2024. Montage Gold has not independently verified or validated the resource statement or other technical information relating to African Gold in this press release and takes no responsibility for such disclosure. Montage Gold has not done sufficient work to classify this historic resource as a current mineral resource and as such is not treating this resource as current under National Instrument 43-101.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a3edc527-cb4d-44e4-8c38-12dd5a5678e9