Matthews Highlights Significant Shareholder Support and Underscores Board’s Commitment to Long-Term Value Creation

Matthews International (MATW) issued a letter to shareholders highlighting support from GAMCO Asset Management, a top 5 shareholder with 4.38% stake, for the company's director nominees ahead of the Annual Meeting. The letter addresses the proxy contest with Barington, emphasizing Matthews' 175-year evolution from a hand stamp business to a diversified company with memorialization products, industrial technologies, and brand solutions.

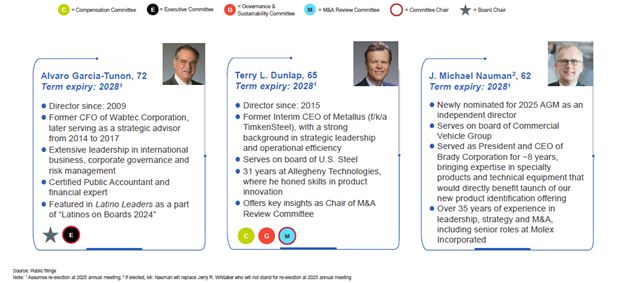

The Board urges shareholders to vote for their nominees - Terry L. Dunlap, Alvaro Garcia-Tunon, and J. Michael Nauman - on the WHITE proxy card. The company criticizes Barington's nominees for their lack of understanding of Matthews' businesses and questions their track record in other companies. Matthews defends its strategic evolution, particularly highlighting the development of its energy storage business and the value generated through strategic acquisitions like Saueressig in 2008 and Schawk in 2014.

Matthews International (MATW) ha inviato una lettera agli azionisti evidenziando il supporto di GAMCO Asset Management, uno dei principali azionisti con una partecipazione del 4,38%, per i candidati alla carica di direttore dell'azienda in vista dell'Assemblea Annuale. La lettera affronta il contenzioso per procura con Barington, sottolineando l'evoluzione di Matthews nel corso di 175 anni, da azienda di timbri a un'impresa diversificata con prodotti di commemorazione, tecnologie industriali e soluzioni per marchi.

Il Consiglio invita gli azionisti a votare per i propri candidati - Terry L. Dunlap, Alvaro Garcia-Tunon e J. Michael Nauman - sulla scheda bianca per il voto. L'azienda critica i candidati di Barington per la loro mancanza di comprensione delle attività di Matthews e mette in discussione il loro curriculum in altre aziende. Matthews difende la sua evoluzione strategica, evidenziando in particolare lo sviluppo del suo business di stoccaggio energetico e il valore generato attraverso acquisizioni strategiche come Saueressig nel 2008 e Schawk nel 2014.

Matthews International (MATW) emitió una carta a los accionistas destacando el apoyo de GAMCO Asset Management, uno de los cinco principales accionistas con una participación del 4.38%, para los nominados a directores de la empresa antes de la Junta Anual. La carta aborda la contienda de poder con Barington, enfatizando la evolución de Matthews en 175 años, desde un negocio de sellos a una empresa diversificada con productos de conmemoración, tecnologías industriales y soluciones de marca.

La Junta insta a los accionistas a votar por sus nominados - Terry L. Dunlap, Alvaro Garcia-Tunon y J. Michael Nauman - en la tarjeta de voto BLANCA. La empresa critica a los nominados de Barington por su falta de entendimiento de los negocios de Matthews y cuestiona su historial en otras empresas. Matthews defiende su evolución estratégica, destacando en particular el desarrollo de su negocio de almacenamiento de energía y el valor generado a través de adquisiciones estratégicas como Saueressig en 2008 y Schawk en 2014.

매튜스 인터내셔널 (MATW)는 연례 회의에 앞서 4.38%의 지분을 가진 주요 5대 주주인 GAMCO 자산 관리의 이사 후보 추천을 지지하는 내용을 담은 서신을 주주들에게 발송했습니다. 이 서신에서는 바링톤과의 대리 투표 분쟁을 언급하며, 매튜스가 175년에 걸쳐 손 도장 사업에서 기념 제품, 산업 기술, 브랜드 솔루션을 갖춘 다각화된 회사로 발전한 과정을 강조하고 있습니다.

이사회는 주주들에게 화이트 투표 카드에 있는 후보 - 테리 L. 던랩, 알바로 가르시아-투논, J. 마이클 노먼 - 에 투표할 것을 촉구합니다. 회사는 매튜스의 사업에 대한 이해 부족으로 바링톤의 후보를 비판하며 그들의 다른 회사에서의 실적에 의문을 제기합니다. 매튜스는 특히 2008년의 사우어리식과 2014년의 쇼크와 같은 전략적 인수를 통해 창출된 가치와 에너지 저장 사업의 발전을 강조하며 자신의 전략적 진화를 방어합니다.

Matthews International (MATW) a envoyé une lettre aux actionnaires mettant en avant le soutien de GAMCO Asset Management, un des cinq principaux actionnaires avec une participation de 4,38 %, pour les candidats à la direction de l'entreprise avant l'Assemblée Générale. La lettre aborde la contestation de procuration avec Barington, soulignant l'évolution de Matthews sur 175 ans, d'une entreprise de timbres à une société diversifiée proposant des produits de commémoration, des technologies industrielles et des solutions de marque.

Le Conseil invite les actionnaires à voter pour ses candidats - Terry L. Dunlap, Alvaro Garcia-Tunon et J. Michael Nauman - sur la carte de vote BLANCHE. L'entreprise critique les candidats de Barington pour leur manque de compréhension des affaires de Matthews et remet en question leur expérience dans d'autres entreprises. Matthews défend son évolution stratégique, en mettant particulièrement en avant le développement de son activité de stockage d'énergie et la valeur générée par des acquisitions stratégiques comme Saueressig en 2008 et Schawk en 2014.

Matthews International (MATW) hat einen Brief an die Aktionäre verschickt, in dem die Unterstützung von GAMCO Asset Management hervorgehoben wird, einem der fünf größten Aktionäre mit einem Anteil von 4,38%, für die Direktorenkandidaten des Unternehmens vor der Hauptversammlung. Der Brief behandelt den Streik um die Stimmrechtsvertretung mit Barington und betont die 175-jährige Entwicklung von Matthews, das sich von einem Stempelgeschäft zu einem diversifizierten Unternehmen mit Gedenkprodukten, industriellen Technologien und Markenlösungen gewandelt hat.

Der Vorstand fordert die Aktionäre auf, für ihre Kandidaten - Terry L. Dunlap, Alvaro Garcia-Tunon und J. Michael Nauman - auf der WEISSEN Stimmkarte zu stimmen. Das Unternehmen kritisiert die Kandidaten von Barington für ihr mangelndes Verständnis der Geschäfte von Matthews und stellt deren Leistung in anderen Unternehmen in Frage. Matthews verteidigt seine strategische Entwicklung und hebt insbesondere die Entwicklung seines Energiespeichergeschäfts und den durch strategische Übernahmen wie Saueressig im Jahr 2008 und Schawk im Jahr 2014 erzielten Wert hervor.

- Support from major shareholder GAMCO Asset Management (4.38% stake)

- Strong free cash flow from memorialization segment enabling dividends and share repurchases

- Strategic evolution into high-growth markets through acquisitions

- Ongoing proxy battle with activist investor Barington threatening board stability

- Criticism of current business strategy and management by significant shareholders

Insights

This proxy contest represents a critical juncture for Matthews International's corporate governance and strategic direction. The endorsement from GAMCO Asset Management, holding

The dispute centers on two contrasting visions: the board's long-term transformation strategy versus Barington's likely focus on immediate value realization. Matthews has demonstrated a methodical approach to business evolution, particularly noteworthy in their strategic pivot from traditional memorialization products to high-growth industrial technologies, especially in energy storage solutions.

Several key factors warrant investor attention:

- Strategic Continuity Risk: The current board's nominees possess direct industry experience and historical knowledge of Matthews' transformation. Disrupting this continuity could jeopardize ongoing initiatives, particularly in the emerging energy storage sector.

- Qualification Assessment: Matthews' nominees bring specific relevant expertise - Dunlap and Garcia-Tunon in manufacturing and Nauman with specialty products experience from Brady In contrast, Barington's nominees appear to lack direct industry expertise.

- Track Record Concerns: The board raises valid concerns about Barington nominees' previous board experiences, particularly citing the Avon Products case where public shareholders received underperforming stock while preferred shareholders received cash.

The outcome of this proxy contest will likely have substantial implications for Matthews' strategic direction and shareholder value. The board's emphasis on long-term value creation through strategic evolution, backed by GAMCO's support, suggests their approach may better serve long-term investor interests compared to potential short-term focused alternatives.

GAMCO Asset Management Endorses Matthews’ Director Nominees

Urges Shareholders to Vote “FOR” All Three of Matthews’ Director Nominees on the WHITE Proxy Card and “WITHHOLD” on Barington’s Director Nominees

PITTSBURGH, Feb. 03, 2025 (GLOBE NEWSWIRE) -- Matthews International Corporation (NASDAQ GSM: MATW) (“Matthews” or the “Company”) today issued a letter to its shareholders highlighting significant shareholder support and reiterating the Board’s commitment to long-term shareholder value. The full text of the letter is pasted below:

February 3, 2025

Dear Matthews Shareholder:

Over Matthews’ rich 175-year history, we have evolved, through innovation and investment, complementary and market-leading businesses, encompassing memorialization products, industrial technologies, and brand solutions. Today, our experienced and skilled Board of Directors is actively overseeing these businesses and we are fully committed to generating long-term value for shareholders.

At this year’s Annual Meeting, you have a choice between our purpose-built strategy and team versus a slate of activist nominees who have shown no understanding of Matthews and have offered no ideas that would improve our business.

We believe that Barington’s nominees would destroy the value of your investment. That’s why we are asking shareholders to support Matthews’ director nominees – Terry L. Dunlap, Alvaro Garcia-Tunon and J. Michael Nauman – on the WHITE proxy card today.

A LONG-TERM, TOP 5 SHAREHOLDER HAS ALREADY ANNOUNCED ITS SUPPORT FOR MATTHEWS AND OUR BOARD

On January 31, 2025, GAMCO Asset Management, one of Matthews’ top 5 shareholders with an approximate

This is a clear message from a top shareholder that Matthews is taking the right actions and has the right team and Board in place to continue the execution of the current strategy. We ask that you seriously consider this endorsement and vote on the WHITE proxy card today.

BARINGTON DOES NOT UNDERSTAND OUR BUSINESSES AND HAS IGNORED THE BOARD’S ACTIONS TO UNLOCK VALUE

Barington’s claims about Matthews reveal the same poor understanding of our businesses that Barington principal and nominee James Mitarotonda evidenced as a consultant for Matthews over the last two years.

For instance, Barington has claimed that our “focus has shifted from SGK Brand Solutions to Product Identification and, most recently, to Energy Storage.” That is untrue. Our market-leading businesses reflect strategic evolution and innovation to complement one another.

Beginning as a hand stamp and engraving business in the Pittsburgh workshop of John Dixon Matthews in 1850, Matthews grew over its first 140 years by applying its manufacturing expertise to developing world class identification products, including bronze memorials, industrial marking products, and printing plates for packaging graphics. Following our IPO in 1994, we acquired businesses to expand our existing capabilities.

Through cost-effective acquisitions and superior operational capabilities, we have built the memorialization segment into an industry leader with predictable free cash flow and best-in-class offerings. The strong free cash flow from this business has enabled us to return significant value to shareholders through dividends and share repurchases and re-investment in our businesses, including in the high-growth businesses.

One of those long-term investments was our 2008 acquisition of Saueressig, which added roto-gravure and embossing cylinder expertise within our graphic imaging business. We further grew our graphics imaging business into a global brand solutions leader through the acquisition of Schawk in 2014 (the SGK Brand Solutions segment).

We scaled advanced precision rotor processing and calendaring equipment technologies acquired in the Saueressig transaction to develop the dry battery electrode solutions in our Industrial Technologies segment. Our energy storage business, which was retained by us in the sale of our SGK business, addresses end-markets with significant growth potential.

Barington has failed to understand how our high-growth energy storage and PID businesses have evolved and how they generate long-term value. Shareholders should be concerned that Barington’s simplistic view of our business will lead it and its nominees to destroy value if they are voted into the boardroom.

BARINGTON’S NOMINEES WOULD NOT ADD VALUE TO YOUR BOARD

It's unsurprising that Mr. Mitarotonda and his two nominees lack this basic, yet critical technical understanding of Matthews.

Mr. Mitarotonda has no engineering or other relevant business experience, and his track record as a public company director is pushing companies into near-term sales with questionable benefits for long-term shareholders. During his consulting relationship with the Company, Mr. Mitarotonda failed to demonstrate even a basic understanding of our business and frequently cut routinely scheduled meetings short, as he was unprepared, and, many other times, cancelled them outright.

Mr. Galbato’s last professional experience in manufacturing was 20 years ago, and since he has worked in private equity operations and served on public company boards in which his employer was invested. As directors of Avon Products, Mr. Galbato and Mr. Mitarotonda oversaw a sale in which public shareholders received Natura shares that are down

Meanwhile, Ms. Amicarella’s experience is limited to the generation and distribution of energy, which is not relevant to our energy storage business that is focused on manufacturing equipment used for producing battery components. Like Mr. Mitarotonda and Mr. Galbato’s dubious M&A track records, Ms. Amicarella was a director at Forward Air when its acquisition of Omni Holdings was criticized by shareholders and proxy advisors for depriving shareholders of a vote on the transaction.

What’s more, neither Mr. Galbato nor Ms. Amicarella showed any knowledge of Matthews during their interviews with the Board, and they openly admitted as much.

OUR NOMINEES BRING ESSENTIAL SKILLS TO OUR PURPOSE-BUILT BOARD

In contrast to Barington’s nominees, Matthews’ Board nominees have extensive, relevant experience to our businesses. Mr. Garcia-Tunon and Mr. Dunlap both have manufacturing experience relevant to our businesses and oversaw our shift in focus to Industrial Technologies, the key to the Company’s next phase of growth. And our newly nominated candidate, Mr. Nauman, served as President and CEO of Brady Corporation for nearly eight years, bringing expertise in specialty products and technical equipment that would directly benefit the launch of our new PID offering.

YOUR VOTE IS CRITICAL TO ENSURE MATTHEWS’ POSITIVE MOMENTUM

Our Board nominees are best qualified to guide our strategy, with the experience and expertise necessary to successfully deliver Matthews’ vision and drive enhanced shareholder value. Do not allow Barington to derail Matthews’ positive trajectory by replacing critical members of your Board with people who don’t understand our business.

Protect the value of your investment and vote the WHITE proxy card today "FOR ALL" of Matthews’ highly qualified nominees TODAY.

Sincerely,

The Matthews Board of Directors

J.P. Morgan Securities LLC is serving as financial advisor to Matthews. Sidley Austin LLP is serving as legal counsel to Matthews.

About Matthews International

Matthews International Corporation is a global provider of memorialization products, industrial technologies, and brand solutions. The Memorialization segment is a leading provider of memorialization products, including memorials, caskets, cremation-related products, and cremation and incineration equipment, primarily to cemetery and funeral home customers that help families move from grief to remembrance. The Industrial Technologies segment includes the design, manufacturing, service and sales of high-tech custom energy storage solutions; product identification and warehouse automation technologies and solutions, including order fulfillment systems for identifying, tracking, picking and conveying consumer and industrial products; and coating and converting lines for the packaging, pharma, foil, décor and tissue industries. The SGK Brand Solutions segment is a leading provider of packaging solutions and brand experiences, helping companies simplify their marketing, amplify their brands and provide value. The Company has over 11,000 employees in more than 30 countries on six continents that are committed to delivering the highest quality products and services.

| YOUR VOTE IS IMPORTANT! Your vote is important, and we ask that you please vote “FOR” the election of our three nominees: Terry L. Dunlap, Alvaro Garcia-Tunon and J. Michael Nauman using the WHITE proxy card and “WITHHOLD” on Barington’s nominees. Simply follow the easy instructions on the enclosed WHITE proxy card to vote by internet or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided. If you received this letter by email, you may also vote by pressing the WHITE “VOTE NOW” button in the accompanying email. The Board of Directors urges you to disregard any such materials and does not endorse any of Barington’s nominees. If you have any questions or require any assistance with voting your shares, please call the Company’s proxy solicitor at: (888) 755-7097 or email MATWinfo@Georgeson.com |

Additional Information

In connection with the Company’s 2025 Annual Meeting, the Company has filed with the U.S. Securities and Exchange Commission (“SEC”) and commenced mailing to the shareholders of record entitled to vote at the 2025 Annual Meeting a definitive proxy statement and other documents, including a WHITE proxy card. SHAREHOLDERS ARE ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY THE COMPANY AND ALL OTHER RELEVANT DOCUMENTS WHEN FILED WITH THE SEC AND WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and other interested parties will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, or from the Company at its website: http://www.matw.com/investors/sec-filings. You may also obtain copies of the Company’s definitive proxy statement and other documents, free of charge, by contacting the Company’s Investor Relations Department at Matthews International Corporation, Two NorthShore Center, Pittsburgh, Pennsylvania 15212-5851, Attention: Investor Relations, telephone (412) 442-8200.

Participants in the Solicitation

The participants in the solicitation of proxies in connection with the 2025 Annual Meeting are the Company, Alvaro Garcia-Tunon, Gregory S. Babe, Joseph C. Bartolacci, Katherine E. Dietze, Terry L. Dunlap, Lillian D. Etzkorn, Morgan K. O’Brien, J. Michael Nauman, Aleta W. Richards, David A. Schawk, Jerry R. Whitaker, Francis S. Wlodarczyk, Steven F. Nicola and Brian D. Walters.

Certain information about the compensation of the Company’s named executive officers and non-employee directors and the participants’ holdings of the Company’s Common Stock is set forth in the sections entitled “Compensation of Directors” (on page 36 and available here), “Stock Ownership of Certain Beneficial Owners and Management” (on page 64 and available here), “Executive Compensation and Retirement Benefits” (on page 66 and available here), and “Appendix A” (on page A-1 and available here), respectively, in the Company’s definitive proxy statement, dated January 7, 2025, for its 2025 Annual Meeting as filed with the SEC on Schedule 14A, available here. Additional information regarding the interests of these participants in the solicitation of proxies in respect of the 2025 Annual Meeting and other relevant materials will be filed with the SEC when they become available. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.

Forward-Looking Statements

Any forward-looking statements contained in this release are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions or strategies of the Company regarding the future, including statements regarding the anticipated timing and benefits of the proposed joint venture transaction, and may be identified by the use of words such as “expects,” “believes,” “intends,” “projects,” “anticipates,” “estimates,” “plans,” “seeks,” “forecasts,” “predicts,” “objective,” “targets,” “potential,” “outlook,” “may,” “will,” “could” or the negative of these terms, other comparable terminology and variations thereof. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations, and no assurance can be given that such expectations will prove correct. Factors that could cause the Company’s results to differ materially from the results discussed in such forward-looking statements principally include our ability to satisfy the conditions precedent to the consummation of the proposed joint venture transaction on the expected timeline or at all, our ability achieve the anticipated benefits of the proposed joint venture transaction, uncertainties regarding future actions that may be taken by Barington in furtherance of its intention to nominate director candidates for election at the Company’s 2025 Annual Meeting, potential operational disruption caused by Barington’s actions that may make it more difficult to maintain relationships with customers, employees or partners, changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in interest rates, changes in the cost of materials used in the manufacture of the Company’s products, any impairment of goodwill or intangible assets, environmental liability and limitations on the Company’s operations due to environmental laws and regulations, disruptions to certain services, such as telecommunications, network server maintenance, cloud computing or transaction processing services, provided to the Company by third-parties, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company’s acquisitions and divestitures, cybersecurity concerns and costs arising with management of cybersecurity threats, effectiveness of the Company’s internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company’s control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, the outcome of the Company’s dispute with Tesla, Inc. (“Tesla”), the Company’s plans and expectations with respect to its exploration, and contemplated execution, of various strategies with respect to its portfolio of businesses, the Company’s plans and expectations with respect to its Board, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission.

Matthews International Corporation

Corporate Office

Two NorthShore Center

Pittsburgh, PA 15212-5851

Phone: (412) 442-8200

Contacts

Matthews International Co.

Steven F. Nicola

Chief Financial Officer and Secretary

(412) 442-8262

Sodali & Co.

Michael Verrechia/Bill Dooley

(800) 662-5200

MATW@investor.sodali.com

Georgeson LLC

Bill Fiske / David Farkas

MATWinfo@Georgeson.com

Collected Strategies

Dan Moore / Scott Bisang / Clayton Erwin

MATW-CS@collectedstrategies.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e9847825-51cc-44c3-8847-0a09d26aba65