Masimo Has the Right Leadership and Strategy to Drive Long-Term Value Creation

Highlights Risk to Continued Momentum and Innovation if Politan Gains Board Control

Urges Stockholders to Vote “FOR” Only Masimo’s Director Nominees, Joe Kiani and Christopher Chavez, on the Updated GOLD Proxy Card

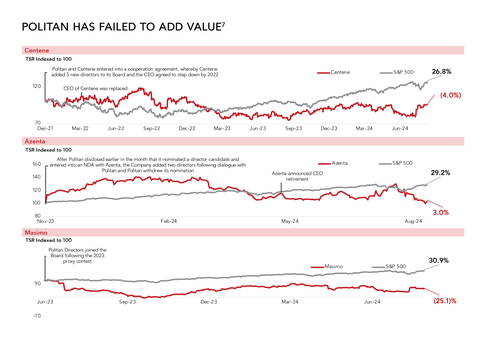

Politan Has Failed to Add Value (Graphic: Business Wire)

Masimo is urging stockholders to vote “FOR” the Company’s director nominees, Joe Kiani and Christopher Chavez, on the updated GOLD proxy card to protect the Company and the value of their investment. Stockholders of record as of the close of business on August 12, 2024 are entitled to vote at the Annual Meeting.

The full text of the letter follows:

Dear Fellow Masimo Stockholders,

The vote at Masimo’s upcoming Annual Meeting on September 19, 2024 is critically important. We recognize you have heard opposing views from us and from Politan Capital Management, who is seeking to gain control of your company. As we urge you to vote “FOR” Masimo’s director nominees – Joe Kiani and Christopher Chavez – on the updated GOLD proxy card today, we want to outline as clearly as possible why this vote matters so much and reiterate our commitment to continued stockholder value creation.

WHY THIS VOTE MATTERS: Preserving our leadership team and engineers is paramount to our continued success.

Over the past 35 years, Masimo has delivered outstanding innovations and established itself as a partner of choice for today’s leading healthcare providers. Our successes result from an unrelenting focus on our mission, consistent hard work across our highly skilled employee base, and the visionary leadership and significant expertise embodied by our CEO and management team. By way of example, Mr. Kiani has overseen more than 4,000 patent filings, 900 of which name him as an inventor.

As we build on Masimo’s strong second quarter and pursue opportunities to increase profitability and capitalize on strong product demand, diligent execution and oversight by our leadership team are more important than ever. Customer relationships with our senior management are key to maintaining our portfolio expansion strategy while increasing market share gains. By contrast, Politan has never invested in a medical technology company before and has no known relationships with Masimo customers.

Mr. Kiani has been clear about his intentions to depart the Company should Politan gain control of the Board – with independent industry experts acknowledging the significant risk this poses to Masimo stakeholders1:

- “Mr. Kiani is unbelievable in the number of achievements, innovations that he has created for Masimo. The damage to Masimo will be enormous if he leaves Masimo but the loss to humanity and our patients will be irreparable.”2

- “[Masimo] is a global company with a global influence on the health and well being of millions of users of its technology… As a recognised global leader with a track record in patient safety and medical policy leadership I cannot believe that a company with such an exemplary position that Masimo currently enjoys would even contemplate losing such a leader as Joe Kiani.”3

- “I am an anesthesiologist with a long career that has seen Mr. Kiani and Masimo make impactful contributions to perioperative medicine and patient safety… Over the years, Mr. Kiani has expanded the impact of Masimo on population health... And Masimo is well-poised to be a major force in an exciting future of healthcare regarding untethered, continuous monitoring of patients in the hospital and an emerging trend ‘the hospital at home’.”4

Similarly, Masimo’s COO, Bilal Muhsin, has declared his intent to resign if Politan gains control of the Board, and more than three hundred other employees, including senior executives, have expressed that they may follow suit. With its continuous mischaracterizations of Masimo’s business practices, Politan has sown mistrust across the Company’s workforce regarding its intentions.

As you consider your vote, please remember that handing control to Politan risks driving a mass exodus of critical leadership and talent5, creating disruption at a pivotal time for the business, derailing our sustainable growth trajectory and destroying future value.

MASIMO’S COMMITMENT TO CONTINUED VALUE CREATION: We are driving strong results and pursuing portfolio changes our stockholders have expressed they want, including the separation of our consumer business.

Masimo today is advancing a clear value creation strategy as we continue to gain market share, reduce costs, secure FDA approvals and innovate across both new and existing products. As demonstrated by our recent financial results, Masimo is experiencing historic growth and has strong forward momentum.

In 2Q24, Masimo, among other things:

-

Achieved

22% growth in healthcare revenue year-over-year, and9% in the first half of 2024; - Won record-breaking levels of new hospital contracts;

-

Made significant progress towards a

30% operating margin; and -

Materially raised the full-year GAAP consolidated EPS guidance range to

$1.74 $1.89 $3.80 -$4.00 $8

The core business is performing extremely well at this time, and it would be unfortunate to see this progress halted. Meanwhile, while Politan claims to have experience overseeing companies to the benefit of stockholders, the facts show that Politan actually has a very poor track record in this regard. Centene and Azenta, two other Politan targets, have failed to realize an increase in stockholder value since Politan’s intervention. As for Masimo, our team has continued to forge ahead despite the ongoing distractions that Politan continues to create for the leadership team.

To bolster our growth prospects and in response to what we have heard directly from stockholders, we are working with our financial advisor, Morgan Stanley, to actively evaluate the optimal structure for a potential separation of our consumer business. We had initially been pursuing a joint venture opportunity and we continue to discuss this option, but now that the related exclusivity period has concluded, we are now also engaged in parallel discussions with other parties who have reached out and expressed interest in the consumer audio business. While we cannot predict the exact timing for an outcome with respect to these discussions, we are committed to maximizing stockholder value while also protecting the Company’s valuable intellectual property. Masimo’s intellectual property will not be licensed to another party without the unanimous approval of the Board.

Despite Masimo’s strong momentum and track record of success under current management, Politan is waging a proxy campaign that threatens to derail the important work underway. Politan has shown no appetite for compromise and instead continues to put its own desire for control of the Company above the best interests of its stockholders.

We urge you to vote “FOR” Masimo’s director nominees, Joe Kiani and Christopher Chavez, on the updated GOLD proxy card to protect Masimo’s future and your investment. We look forward to your support and do not take it for granted.

Sincerely,

Craig Reynolds

Bob Chapek

Joe Kiani

For more information on how to protect the value of your investment at Masimo, visit www.ProtectMasimosFuture.com.

|

Your Vote Is Important, Please Use The Updated GOLD Proxy Card Today! |

|

Simply follow the easy instructions on the enclosed updated GOLD proxy card to vote by internet or by signing, dating, and returning the updated GOLD proxy card in the postage-paid envelope provided. If you received this letter by email, you may also vote by pressing the “VOTE NOW” button in the accompanying email. |

|

If you have previously voted on the GOLD proxy card or voting instruction form for the annual meeting previously scheduled on July 25, 2024, your vote is no longer valid. To enable your votes to be validly counted for the 2024 Annual Meeting, you must resubmit your vote on the updated GOLD proxy card or voting instruction form attached to the revised proxy statement for the 2024 Annual Meeting now scheduled to be held on September 19, 2024. |

|

If you have questions about how to vote your shares, please call the firm assisting us with the solicitation of proxies, |

Innisfree M&A Incorporated |

1 (877) 456-3463 (toll-free from the |

or |

+1 (412) 232-3651 (from other locations) |

|

If you hold your shares in more than one account, you will receive separate notifications. Please be sure to vote ALL your accounts using the updated GOLD proxy card relating to each account. |

About Masimo

Masimo (NASDAQ: MASI) is a global medical technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, patient monitors, and automation and connectivity solutions. In addition, Masimo Consumer Audio is home to eight legendary audio brands, including Bowers & Wilkins, Denon, Marantz, and Polk Audio. Our mission is to improve life, improve patient outcomes, and reduce the cost of care. Masimo SET® Measure-through Motion and Low Perfusion™ pulse oximetry, introduced in 1995, has been shown in over 100 independent and objective studies to outperform other pulse oximetry technologies.1 Masimo SET® has also been shown to help clinicians reduce severe retinopathy of prematurity in neonates,2 improve CCHD screening in newborns3 and, when used for continuous monitoring with Masimo Patient SafetyNet™ in post-surgical wards, reduce rapid response team activations, ICU transfers, and costs.4-7 Masimo SET® is estimated to be used on more than 200 million patients in leading hospitals and other healthcare settings around the world,8 and is the primary pulse oximetry at 9 of the top 10 hospitals as ranked in the 2022-23

References

1. Published clinical studies on pulse oximetry and the benefits of Masimo SET® can be found on our website at http://www.masimo.com . Comparative studies include independent and objective studies which are comprised of abstracts presented at scientific meetings and peer-reviewed journal articles.

2. Castillo A et al. Prevention of Retinopathy of Prematurity in Preterm Infants through Changes in Clinical Practice and SpO2 Technology. Acta Paediatr. 2011 Feb;100(2):188-92.

3. de-Wahl Granelli A et al. Impact of pulse oximetry screening on the detection of duct dependent congenital heart disease: a Swedish prospective screening study in 39,821 newborns. BMJ. 2009;Jan 8;338.

4. Taenzer A et al. Impact of pulse oximetry surveillance on rescue events and intensive care unit transfers: a before-and-after concurrence study. Anesthesiology. 2010:112(2):282-287.

5. Taenzer A et al. Postoperative Monitoring – The Dartmouth Experience. Anesthesia Patient Safety Foundation Newsletter. Spring-Summer 2012.

6. McGrath S et al. Surveillance Monitoring Management for General Care Units: Strategy, Design, and Implementation. The Joint Commission Journal on Quality and Patient Safety. 2016 Jul;42(7):293-302.

7. McGrath S et al. Inpatient Respiratory Arrest Associated With Sedative and Analgesic Medications: Impact of Continuous Monitoring on Patient Mortality and Severe Morbidity. J Patient Saf. 2020 14 Mar. DOI: 10.1097/PTS.0000000000000696.

8. Estimate: Masimo data on file.

9. http://health.usnews.com/health-care/best-hospitals/articles/best-hospitals-honor-roll-and-overview.

Forward-Looking Statements

This press release includes forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in connection with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Masimo and the potential stockholder approval of the Board’s nominees; Masimo’s earnings per share estimates and targets; Masimo’s expectations to double earnings within five years; Masimo’s operating margin targets and potential growth; the proposed separation of Masimo’s consumer business, including any potential joint venture or any other potential separation of Masimo’s consumer business, the status of ongoing discussions between Masimo and other potential joint venture partners or acquirors of its consumer business, and the potential timing and structure of any separation and the expectation that the proposed separation will maximize stockholder value or be the best path for success. These forward-looking statements are based on current expectations about future events affecting Masimo and are subject to risks and uncertainties, all of which are difficult to predict and many of which are beyond Masimo’s control and could cause its actual results to differ materially and adversely from those expressed in its forward-looking statements as a result of various risk factors, including, but not limited to (i) uncertainties regarding future actions that may be taken by Politan in furtherance of its nomination of director candidates for election at the 2024 Annual Meeting, (ii) the potential cost and management distraction attendant to Politan’s nomination of director nominees at the 2024 Annual Meeting and (iii) factors discussed in the “Risk Factors” section of Masimo’s most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), which may be obtained for free at the SEC’s website at www.sec.gov. Although Masimo believes that the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations will prove correct. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of today’s date. Masimo does not undertake any obligation to update, amend or clarify these statements or the “Risk Factors” contained in the Company’s most recent reports filed with the SEC, whether as a result of new information, future events or otherwise, except as may be required under the applicable securities laws.

Non-GAAP Financial Measure

This press release discusses the Company’s non-GAAP consolidated EPS for the year ending December 28, 2024, which is a supplement to the corresponding measure prepared in accordance with GAAP. Management believes non-GAAP consolidated EPS is an important measure in the evaluation of the Company’s performance and uses this measure to better understand and evaluate its business. Non-GAAP consolidated EPS reflects adjustment for certain items that are described in the Company’s earnings press release for the quarter ended June 29, 2024, which was furnished on a Current Report on Form 8-K filed by the Company on August 6, 2024, and is available here: https://www.sec.gov/Archives/edgar/data/937556/000093755624000062/masi-20240806xex991.htm (the “Q2 Earnings Release”). Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on-going operating performance. This non-GAAP financial measure has certain limitations in that it does not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measure presented by the Company may be different from the non-GAAP financial measures used by other companies.

Additional Information Regarding the 2024 Annual Meeting of Stockholders and Where to Find It

On August 15, 2024, the Company filed a revised version of its 2024 proxy statement (the “Revised Proxy Statement”) and has mailed the Revised Proxy Statement to its stockholders of record as of the new August 12, 2024 record date for the 2024 Annual Meeting. Any votes submitted by Masimo stockholders in connection with the 2024 Annual Meeting on the prior to the filing of the Revised Proxy Statement will not be counted and previous proxies submitted will be disregarded, and therefore, all stockholders will need to resubmit their votes, even if they have previously voted. The Company filed a revised version of the Revised Proxy Statement with the SEC on August 22, 2024, which amended, superseded and replaced in its entirety the Revised Proxy Statement (the “Amended Revised Proxy Statement”). THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE AMENDED REVISED PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING UPDATED GOLD PROXY CARD AS THEY CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the Amended Revised Proxy Statement and any amendments or supplements thereto and other documents as and when filed by the Company with the SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company, its directors and certain of its executive officers and employees may be deemed to be participants in connection with the solicitation of proxies from the Company’s stockholders in connection with the matters to be considered at the 2024 Annual Meeting. Information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company is included in the Amended Revised Proxy Statement, which can be found through the SEC’s website at is https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000121390024071554/ea0206756-07.htm, and any changes thereto may be found in any amendments or supplements to the Amended Revised Proxy Statement and other documents as and when filed by the Company with the SEC, which can be found through the SEC’s website at www.sec.gov.

Disclaimer

The Company has neither sought nor obtained the consent from any third party to use any statements or information contained in this press release that have been obtained or derived from statements made or published by such third parties. Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein.

1 Permission to use quotations was neither sought nor obtained. Refer to the information under the heading “Disclaimer” below for additional considerations.

2 Michael Ramsay MD. FRCA, Chair Emeritus, Department of Anesthesiology and Pain Management at Baylor University Medical Center. July 22, 2024.

3 Professor Mike Durkin; OBE MBBS FRCA FRCP DSc; Senior Advisor, Patient Safety Policy and Leadership; Academic Director, WHO Global Patient Safety Collaborative; Chair, Patient Safety Movement Foundation; Chair, NIHR Patient Safety Research Collaborative Network; Institute of Global Health Innovation; Imperial College London. July 21, 2024.

4 Daniel J. Cole, MD. President, Anesthesia Patient Safety Foundation. July 22, 2024.

5 Bilal Mushin Conditional Resignation. June 26, 2024; Letters from Masimo Senior Management 1 & 2. June 24, 2024; Letter from Masimo Healthcare Engineering; https://protectmasimosfuture.com/.

6 Represents a non-GAAP financial measure. Refer to the heading “Non-GAAP Financial Measure” below for additional detail.

7 TSR reflects dividend-adjusted total return percentage as of 8/23/2024.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240826479438/en/

Investor Contact: Eli Kammerman

(949) 297-7077

ekammerman@masimo.com

Media Contact: Evan Lamb

(949) 396-3376

elamb@masimo.com

Source: Masimo Corporation