MAKO MINING ANNOUNCES OPERATIONAL UPDATE ON RECOVERIES

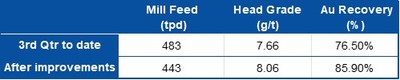

Mako Mining Corp. reported operational updates on October 3, 2022, revealing Q2 2022 recoveries at 74.5%, lower than the 86% from 2019 tests. Post improvements initiated on August 10, recoveries averaged 85.9%. Key upgrades included reducing preg-robbing materials and optimizing mill throughput and cyanide levels. Despite lower recoveries, Mako generated $7.5 million in Mine Operating Cash Flow for Q2 2022, allowing $2.7 million for growth exploration. Future improvements include resuming pre-leach thickener operations to enhance efficiency.

- Achieved average recoveries of 85.9% post improvements.

- Generated $7.5 million in Mine Operating Cash Flow for Q2 2022.

- Invested $2.7 million in growth exploration.

- Q2 2022 recoveries were below expectations at 74.5%.

Insights

Analyzing...

VANCOUVER B.C, Oct. 3, 2022 /PRNewswire/ - Mako Mining Corp. (TSXV: MKO) (OTCQX: MAKOF) ("Mako" or the "Company") is pleased to provide the following operational and corporate updates:

On July 20, 2022 the Company announced Q2 2022 production results showing recoveries of

*Preliminary results based on information obtained through September 30th, 2022 |

The improvements implemented are listed below:

- Through selective mining procedures and blending protocols, the amount of preg-robbing material going through the mill was significantly reduced. The hanging wall and foot wall appears to have a much higher preg-robbing potential than the vein and weathered lithologies and our selective mining procedures were able to separate this material effectively

- The mill throughput was reduced from 544 tpd in July to 449 tpd in September in order to increase the leach retention time

- The lower mill throughput also resulted in a grind size improvement from

77.2% passing 75 microns to79.1% passing 75 microns - The measured free cyanide in the grinding circuit fell from 14.1 ppm to 2.1 ppm through improved operational procedures. The lower cyanide levels in the grinding circuit contributed to reduced losses through preg-robbing

- The inventory of carbon in the CIL circuit was increased from 25 to 34 tonnes

Further improvements anticipated in the coming months include:

- Resuming operation of the pre-leach thickener which will allow for a higher slurry density in the CIL, allowing for an increased throughput rate without sacrificing leach retention time

- Replacement of worn-out carbon retention screens to improve carbon loading efficiencies

Akiba Leisman, CEO of Mako states that "the transition to carbonaceous fresh material from the oxide zone that we were mining in 2021 was a significant challenge for us to overcome. Nonetheless, our team's quick and diligent response through a series of testing and improvements allowed us to get back to

The Company has included reference to Q2 2022 Mine Operating Cash Flow which is a non-GAAP financial measure. This non-GAAP measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, this is a commonly used performance measure, but does not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

Mine Operating Cash Flow represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expenses.

John Rust, a metallurgical engineer, and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

CEO

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

Statements contained herein that are not historical fact are considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information is based on management's current expectations, beliefs and assumptions, and includes, without limitation: expected results from mill improvements implemented to-date and those to be further implemented; and that the Company will meet its object of operating San Albino profitably while continuing to fund exploration of prospective targets. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, that the mill improvements being implemented will not have the anticipated impacts; risks and uncertainties relating to political risks involving the Company's exploration and development of mineral properties interests; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations, the inability or failure to obtain adequate financing on a timely basis and other risks and uncertainties disclosed in the Company's public filings at www.sedar.com. Forward-looking information contained herein is based on management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company's plans and expectations in connection with its business and operations, share and loan capital, and may not be appropriate for other purposes.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mako-mining-announces-operational-update-on-recoveries-301638764.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mako-mining-announces-operational-update-on-recoveries-301638764.html

SOURCE Mako Mining Corp.