Mace Security International Reports Record 4Q 2020 Financial Results

Mace Security International (OTCQX:MACE) reported strong financial results for 4Q 2020, with net sales of $4,411,000, an 86% increase from the previous year, primarily due to retail growth and new product sales. The company achieved a net income of $446,000, reversing a loss from 2019. EBITDA improved significantly, reaching $592,000. For the full year, net sales rose 47% to $15,308,000, while net income was $1,701,000. Mace plans to enhance its direct-to-consumer market and further leverage its product line.

- 4Q 2020 net sales increased by $2,034,000, or 86%, driven by retail and e-commerce growth.

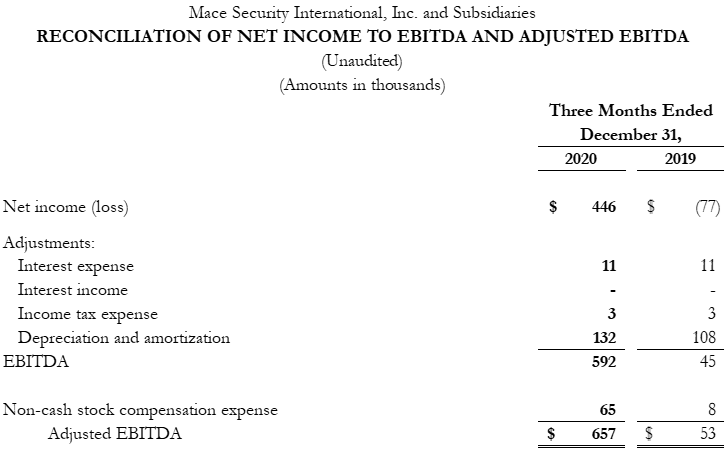

- Net income for 4Q 2020 was $446,000, compared to a loss of ($77,000) in 2019.

- EBITDA for 4Q 2020 was $592,000, up from $45,000 in the same quarter last year.

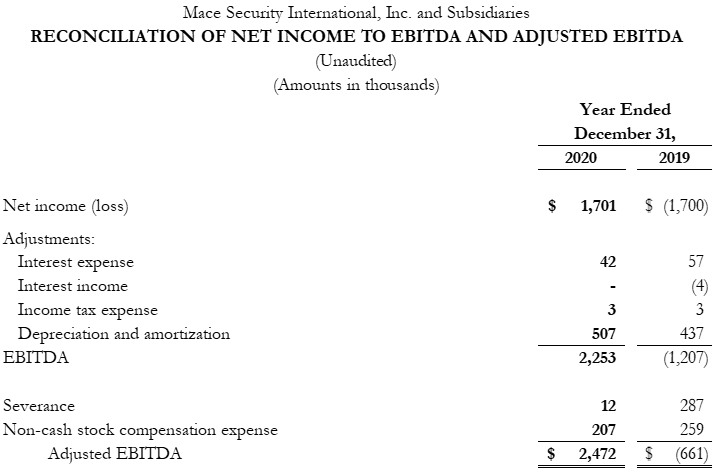

- Full year 2020 EBITDA was $2,253,000, a significant improvement over ($1,207,000) in 2019.

- Lower international sales due to ongoing COVID-related lockdowns.

Insights

Analyzing...

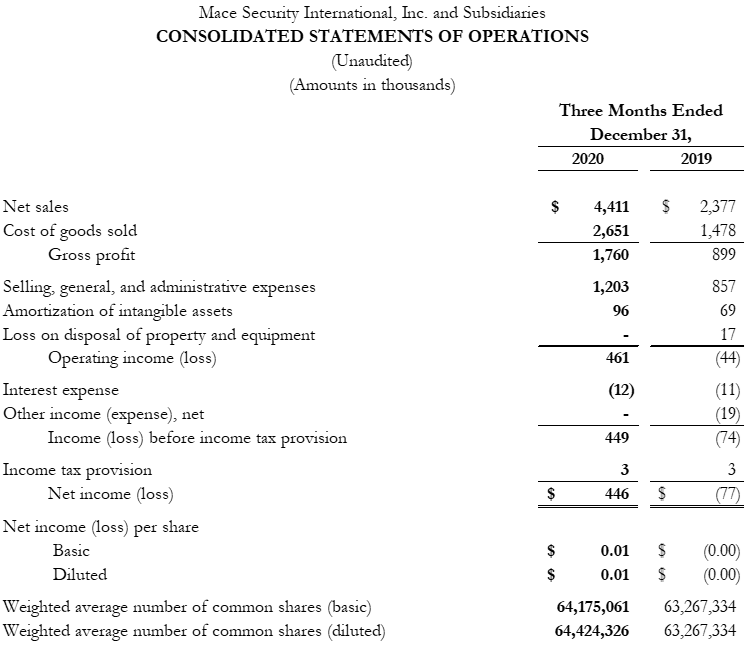

- 4Q 2020 net sales totaled

$4,411,000 , up$2,034,000 or86% versus prior year, primarily driven by organic retail growth, new direct-to-consumer sales and new product line extensions fueled by an increased demand for personal safety products - Net income for the quarter was

$446,000 or10% of net sales, an increase of$523,000 , compared to a net loss of ($77,000) in the same period of 2019 - EBITDA for the quarter was

$592,000 or13% of net sales, an increase of$547,000 versus$45,000 EBIDTA in the fourth quarter of 2019 - Full year EBITDA was

$2,253,000 or15% of net sales versus ($1,207,000) for full year 2019

CLEVELAND, OH / ACCESSWIRE / March 30, 2021 / Mace Security International (OTCQX:MACE) today announced its fourth quarter and full year 2020 financial results for the periods ended December 31, 2020.

The Company's net sales for the fourth quarter were

The Company reported a gross margin rate for the quarter of

President and CEO Gary Medved commented, "Our strong focus on the Mace® Brand product lineup, our continued push into retail, and aggressive campaigns on our digital platform combined to produce another strong quarter. Our new product look and lineup continues to be a big hit with our retail partners, while digital sales experienced its third consecutive quarter of triple digit percentage increase."

Sanjay Singh, Executive Chairman, commented, "My heartiest congratulations to the team for delivering an outstanding quarter and year. We reversed the trend in losses in years past to a meaningful net income number for the year. The focus in the coming quarters will be on increasing our market share in the direct-to-consumer segment and retailers in North America where our refreshed products are differentiators."

"The team is committed to making meaningful improvements in gross margins by removing wasteful processes from the entire order-to-ship process. We expect to fund further investments in marketing and branding campaigns from the continuous improvements in operations. There is a lot of work to be done in 2021, and we are excited to take on the challenge."

Fourth Quarter 2020 Financial Highlights

- Net sales were

$4,411,000 , up86% versus the same period in the prior year, primarily driven by organic retail growth, new direct-to-consumer sales and new product line extensions at retailers. - Gross profit rate improved to

40% in the fourth quarter of 2020 compared to39% for the same quarter in 2019 resulting from improved leverage of fixed manufacturing costs partially offset by lower product margin due to sales mix. - Gross profit for the fourth quarter increased by

$861,000 , or96% , over the fourth quarter of 2019, driven primarily by increased sales volume, labor efficiencies, and higher margin digital sales. - SG&A expenses increased by

$346,000 t o$1,203,000 for the quarter, or27% of net sales, driven primarily by higher variable sales commissions and performance-related incentives. - Net income increased by

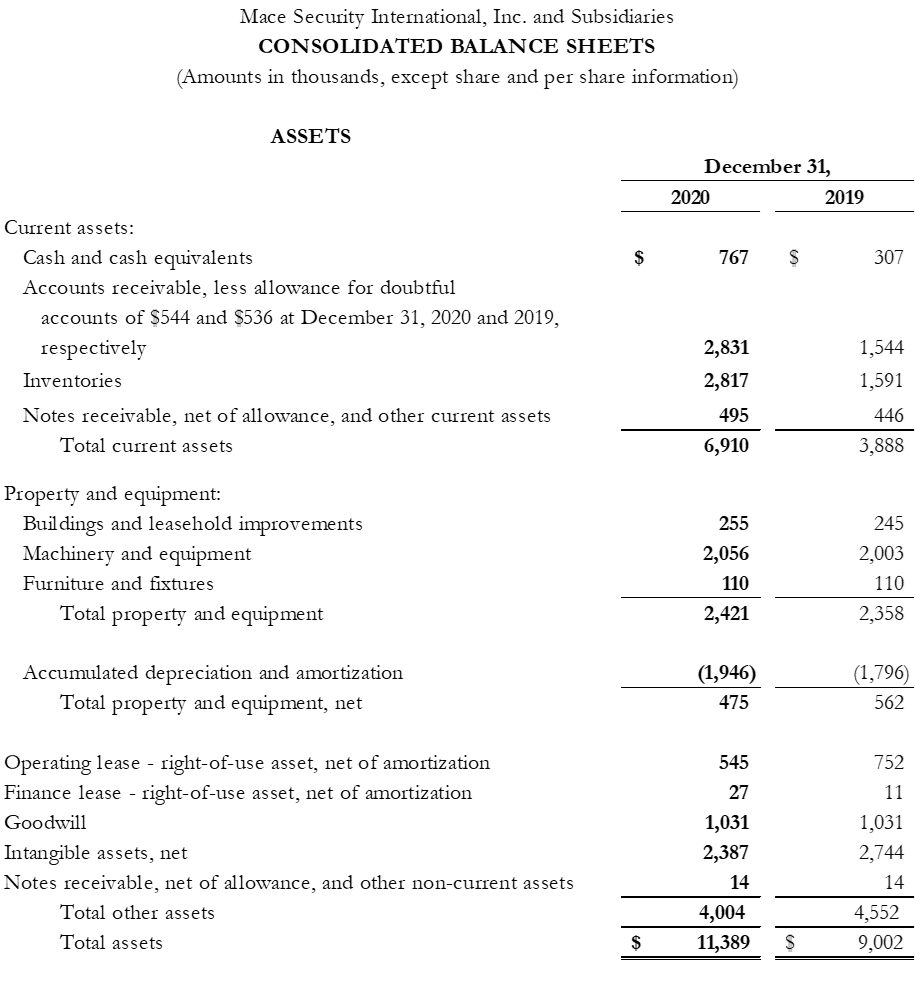

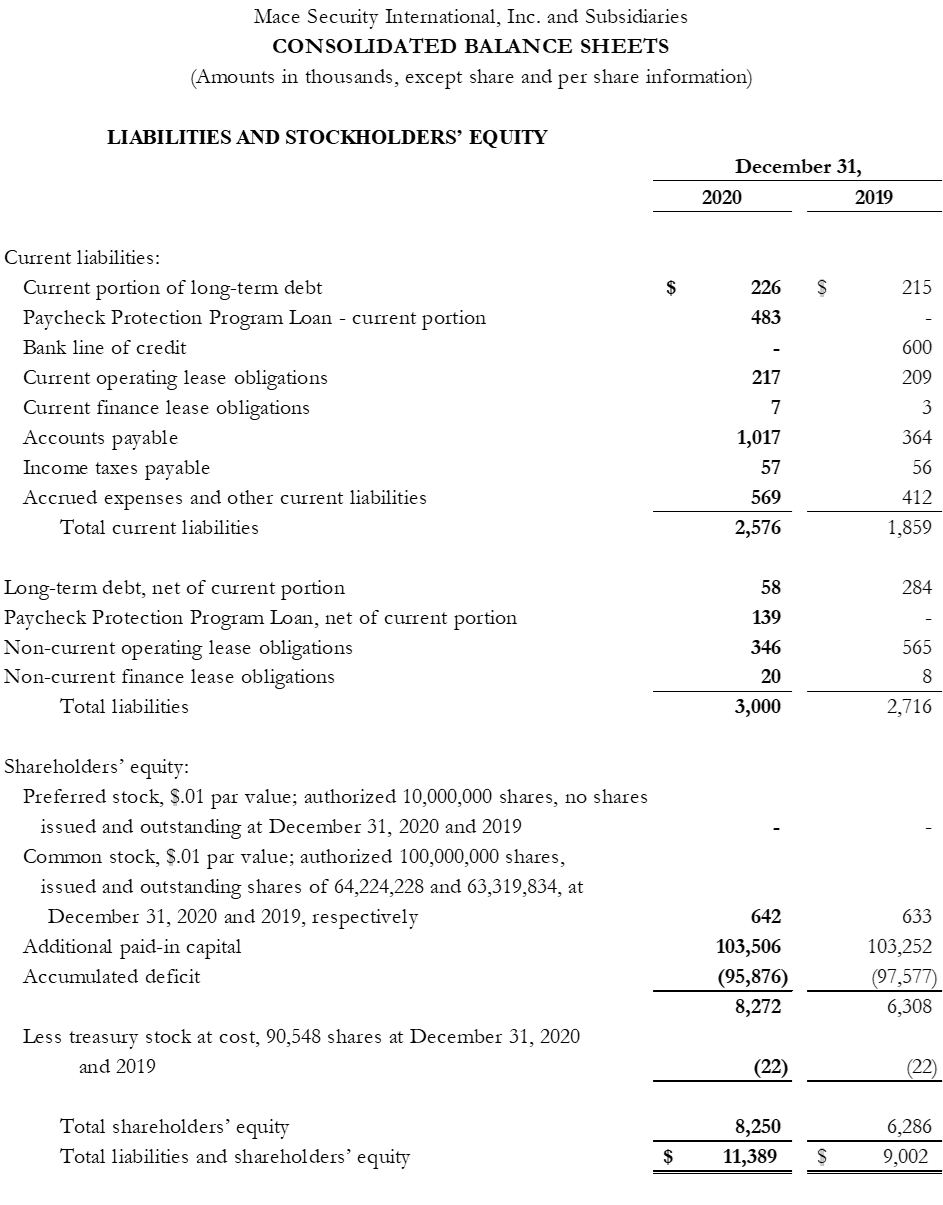

$523,000. - Cash and cash equivalents increased to

$767,000 as of December 31, 2020, an increase of$460,000 over the$307,000 on hand on December 31, 2019. - Working capital increased by

$2,305,000 compared to December 31, 2019 with comparable increases in accounts receivable, from increased fourth quarter sales, and inventory, for anticipated sales growth in 2021. The company paid off its bank line of credit in the amount of$600,000 in the third quarter of 2020. - Adjusted EBITDA for the quarter was

$657,000 (1 cent per share on an undiluted basis for the quarter).

Fourth Quarter 2020 Operational Highlights

- The Company maintained full manufacturing and distribution activities throughout the quarter and continued to experience some supply chain disruptions due to the COVID-19 emergency and delays due to overcrowded receiving ports in the United States. Labor efficiencies have improved over the same period last year but were partially offset by a physical inventory adjustment.

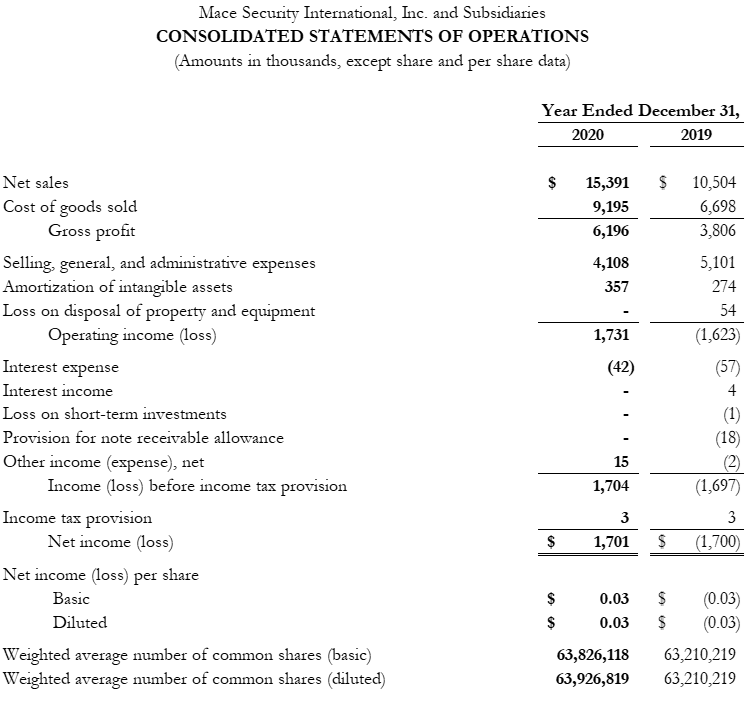

Full Year 2020 Financial Highlights

- Net Sales increased by

$4,887,000 , or47% , versus full year 2019 driven by organic growth, product line extensions introduced during the year and sales to new customers. - Gross profit rate improved to

40% for 2020 compared to36% for 2019. - Gross Profit increased by

$2,390,000 , or63% , when compared to 2019 results mostly due to the increased sales volume along with improved labor efficiencies and the impact of one-time costs that occurred in 2019. - SG&A decreased by

$993,000 , or19% , mostly from one-time costs that occurred last year, and lower wages net of performance-related incentives recorded in 2020. - Net Income was

$1,701,000 , or11% of net sales, an improvement of$3,404 1,000 over the loss of$1,700,000 in 2019. - Adjusted EBITDA for the year was

$2,472,000 (4 cents per share on an undiluted basis for the full year).

Conference Call

Mace® will conduct a conference call on Tuesday, April 6, 2021 at 11 AM EDT, 8 AM PDT to discuss its financial and operational performance for the fourth quarter and full year 2020.

A digital recording of the conference call will be available for replay after the call's completion. The date ranges that the recording will be available are listed below. To access the recording, use the dial in numbers listed below and the conference ID 7277818.

Participant Toll-Free Dial-In Number: (833) 360-0862; Conference ID 7277818.

A full set of the consolidated financial statements and accompanying slide presentation are available on www.mace.com. A digital recording of the conference call will be available for replay two hours after the call's completion. The date ranges the recording will be available are listed below. To access the recording, use the dial-in number listed below and the conference ID 7277818.

Encore dial-in number: 855-859-2056 (or internationally on 404-537-3406)

Encore dates: Will be available 2 hours after the call and will expire midnight on June 6, 2021.

Additionally, Mace is participating in the LD Micro Virtual Conference, tomorrow, March 31, 2021 at 11:00 AM EDT, 8AM PST to provide a business update. You can sign up for the conference using this link:

https://us02web.zoom.us/webinar/register/WN_ldQmcn--TgaL84Zzkz8bmg

About Mace Security International, Inc.

Mace Security International Inc. is a globally recognized leader in personal safety products. Based in Cleveland, Ohio, the Company has spent more than 30 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of pepper spray products. The Company's other leading brands include Tornado® Brand stun devices and pepper spray, and Vigilant® Brand personal alarms. The Company also offers aerosol defense sprays for law enforcement and security professionals worldwide through its Take Down® Brand.

Mace Security International distributes and supports its products and services through mass-market retailers, wholesale distributors, independent dealers, e-commerce channels and through its website, www.Mace.com. For more information, please visit www.mace.com.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used in this press release, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks, known and unknown, and uncertainties, including but not limited to economic conditions, dependence on management, our ability to compete with competitors, dilution to shareholders, and limited capital resources.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedules.

Contacts:

Mike Weisbarth

Chief Financial Officer

mweisbarth@mace.com

SOURCE: Mace Security International

View source version on accesswire.com:

https://www.accesswire.com/638069/Mace-Security-International-Reports-Record-4Q-2020-Financial-Results