Mace(R) Security International, a Global Leader in Personal Self-Defense Sprays, Announces 4Q23 Financial Results

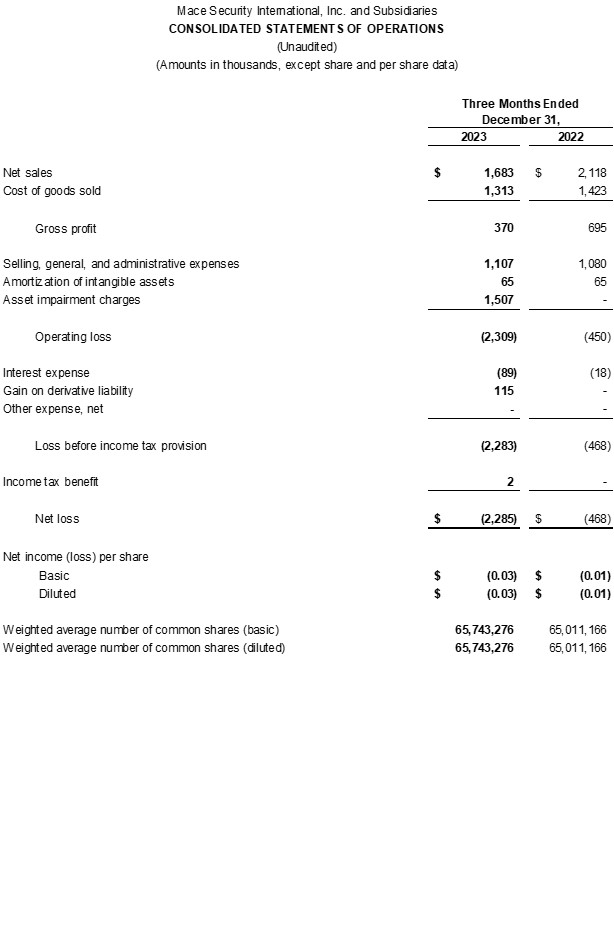

- Fourth quarter 2023 net sales of $1,683,000 decreased by 21% compared to the prior year due to a slowdown in retail impulse purchases.

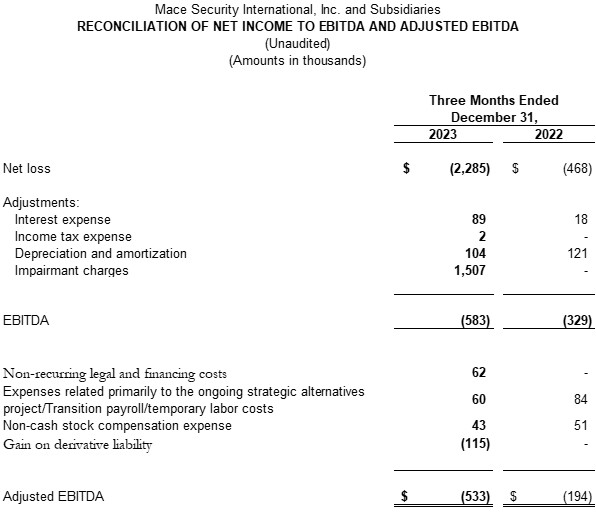

- Gross profit rate for the quarter was 22%, resulting in a loss of ($533,000) in adjusted EBITDA.

- The company raised $300,000 in Q1, 2024 to support new sales initiatives amid challenging market conditions.

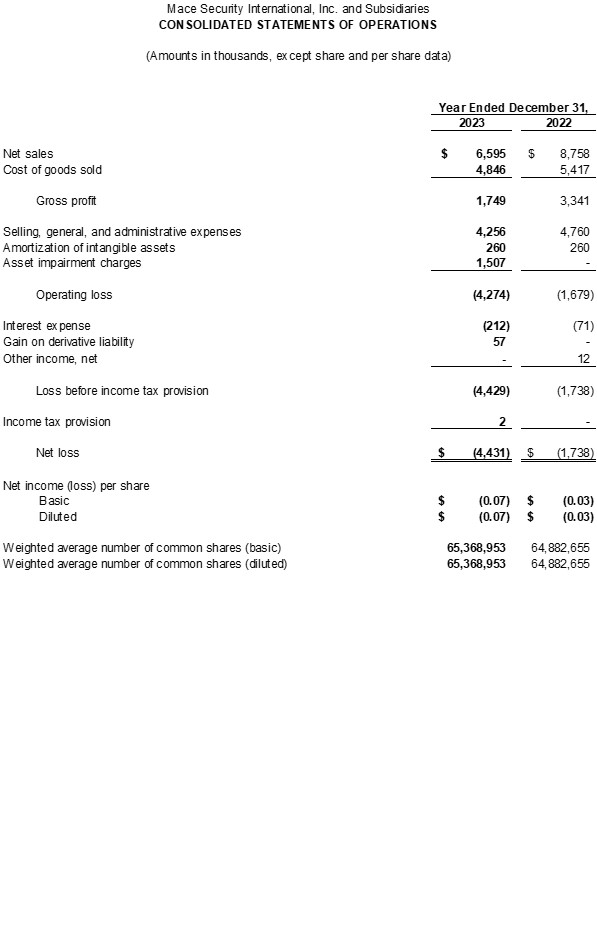

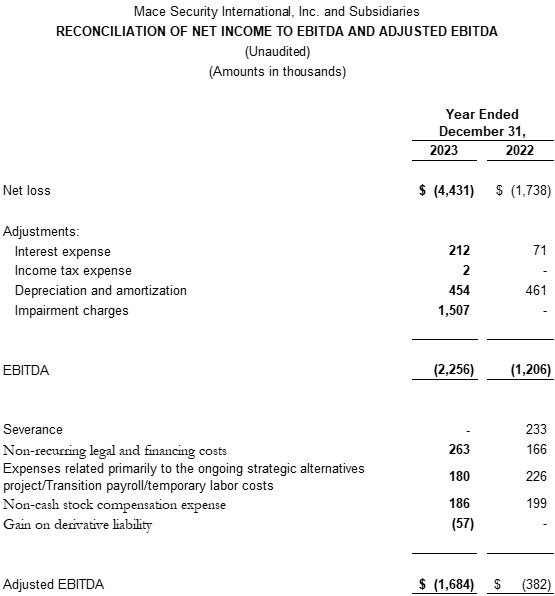

- Year-to-date 2023 net sales of $6,595,000 decreased by 25% compared to 2022, with a net loss of $4,431,000.

- Mace Security International will host a virtual Investor Day to present its business overview, growth strategy, and financial outlook.

- Net sales decline of 21% in the fourth quarter and 25% year-to-date compared to the previous year.

- Gross profit rate decreased to 22% in Q4, 2023, resulting in a loss of ($533,000) in adjusted EBITDA.

- Significant asset impairments totaling $1,507,000 in the fourth quarter of 2023.

- Net loss of $4,431,000 in 2023, a significant increase from the previous year.

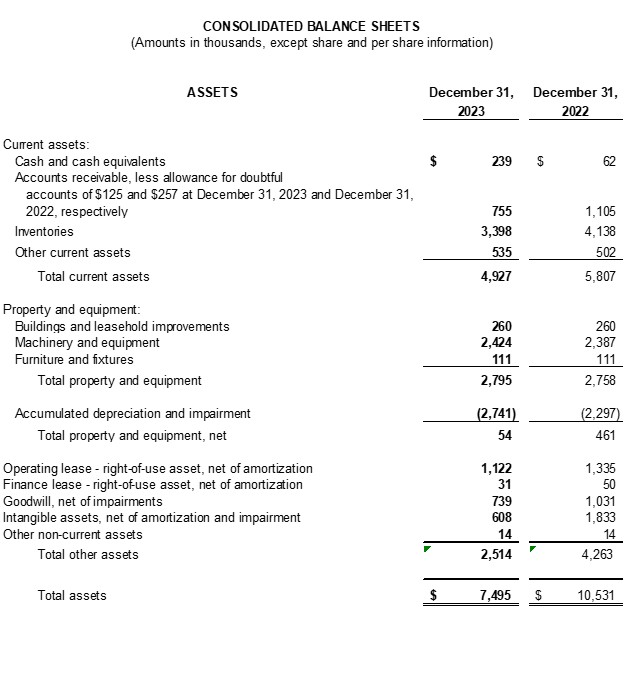

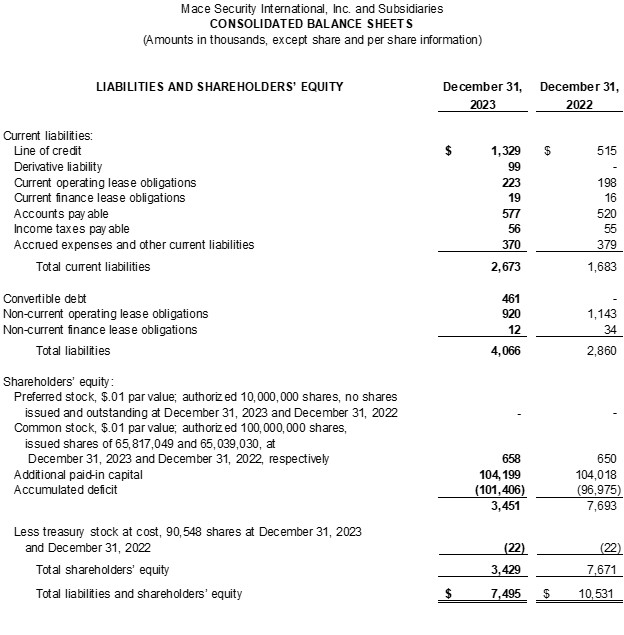

- Working capital decreased by $1,870,000 compared to December 31, 2022, with an increase in debt and a decrease in accounts receivable.

CLEVELAND, OH / ACCESSWIRE / April 1, 2024 / Mace Security International (OTCQB:MACE) today announced its fourth quarter and year-to-date 2023 financial results for the periods ended December 31, 2023.

The Company's net sales for the fourth quarter were

Mace reported a gross profit rate for the quarter of

Sanjay Singh, Chairman and CEO commented, "The fourth quarter was a tough quarter for the Company. The decline in revenues in the quarter was due primarily to two customers that accounted for most of the decrease. E-commerce revenues continue to increase and is very much the Company's white horse now. Although sales are lower quarter over quarter, retail sales are stabilizing. There are six new ventures that are expected to bring in new revenues in 2024. Gross profit margins were lower than our usual

Fourth Quarter 2023 Financial Highlights

- Net sales were

$1,683,000 , down (21% ) from the fourth quarter of 2022 net sales of$2,118,000. T he decline from prior year was due to the continuing slowdown in retail sales in several of the Company's large retail customers as impulse sales were impacted by a slowing economy and the highest U.S. inflation rate experienced in decades. Mace achieved significant growth of52% in e-commerce platform sales in the fourth quarter of 2023 compared with the fourth quarter of 2022. - Gross profit rate of

22% decreased11% from the same period in 2022 on decreased sales volume and higher freight and component costs. The modifications implemented to its operational cost structure during Q4, 2023 led to a19% reduction in four-wall manufacturing costs on a quarter-over-quarter basis. This bodes well for margin improvement as revenue recovers. Product margins decreased over the fourth quarter of 2022 due to increasing component prices and lower manufacturing efficiency. - Gross profit for the fourth quarter of 2023 decreased by

$325,000 , or46% , from the fourth quarter of 2022, due primarily to the decline in sales volume and lower operating efficiencies. - SG&A when adjusted for (a) non-recurring legal and financing costs of

$62,000 , (b)$60,000 related to the ongoing strategic alternatives project and (c) non-cash stock compensation expense of$43,000 was$942,000 in the fourth quarter of 2023, compared to SG&A when adjusted for$84,000 of expenses related primarily to transition payroll/temporary labor costs associated with the Company optimizing its headcount, and$51,000 of non-cash stock compensation expense was$945,000 in the same period in 2022. SG&A in both periods contains expenditures in support of the Company's commitment to its growth plan and the related cost for digital advertising. - Based on the Company's annual valuation of goodwill using a discounted cash flow analysis at December 31, 2023, the Company concluded that the carrying amount for goodwill and long-lived assets was impaired. The Company determined the fair value of its property and equipment to be

$54,000 , resulting in a$250,000 impairment of property and equipment. Intangible assets were impaired$965,000 , and goodwill was impaired$292,000 , for a total asset impairment charge of$1,507,000 in the fourth quarter of 2023. - Net loss of (

$2,285,000) in the fourth quarter of 2023, compared with net loss of ($468,000) in the same quarter in 2022. - Cash and cash equivalents increased to

$239,000 as of December 31, 2023, an increase of$177,000 over the$62,000 on hand on December 31, 2022.$1,329,000 was drawn against the Company's$2,000,000 line of credit at December 31, 2023. - Working capital decreased by

$1,870,000 compared to December 31, 2022, with an increase in debt of$1,374,000 and a$350,000 decrease in accounts receivable on lower sales. Inventories decreased$740,000 , and accounts payable increased$57,000. Inventory converted to finished goods ready for shipping as sales volume picks up increased$226,000 , while raw material inventory declined$966,000 , compared with December 31, 2022. - Adjusted EBITDA for the fourth quarter 2023 was a loss of (

$533,000) and excludes nonrecurring legal and financing costs, of expenses related primarily to the ongoing strategic alternatives project, non-cash stock compensation expense, and gain on derivative liability. Adjusted EBITDA for the fourth quarter 2022 was a loss of ($194,000) .

Fourth Quarter 2023 Operational Highlights

- The modifications implemented to its operational cost structure during the second half of 2021 partially offset the decrease in Q4 2023 gross margin driven by higher freight and component cost and lower sales and efficiencies, compared with Q4 2022. The Company will continue to invest in manufacturing process improvements and new product development as these are instrumental components of management's strategic vision for growth. This gross margin improvement was offset by inflationary increases in freight and component costs.

Year-to-Date December 2023 Financial Highlights

- Net sales of

$6,595,000 decreased by$2,163,000 , or25% , versus same period 2022 net sales of$8,758,000 due to the slowdown in retail sales in several of the Company's large retail customers as impulse sales were impacted by a slowing economy and the highest U.S. inflation rate experienced in decades. - Gross profit rate decreased to

27% for 2023, compared to38% for the same period in 2022. Price increases and lower manufacturing overhead were offset by the impact of lower sales volume and increasing component and freight costs. - SG&A when adjusted for (a)

$263,000 of non-recurring legal and financing costs (b)$180,000 of expenses related primarily to the ongoing strategic alternatives project, and (c) non-cash stock compensation expense of$186,000 was$3,627,000 in 2023, compared to SG&A when adjusted for (a)$220,000 in personnel related expenses primarily for the transition in Mace's CEO role, (b)$166,000 in increased legal support primarily related to the Company's announcement in the second quarter 2022 to explore and evaluate potential strategic alternatives for the Company and certain EPA compliance expenses, (c)$226,000 related to transition payroll/temporary labor costs associated with the Company optimizing its headcount and (d) non-cash stock compensation expense of$199,000 was$3,949,000 in 2022. SG&A in both periods contains expenditures in support of the Company's commitment to its growth plan and the related cost for digital advertising. - Net loss in 2023 was

$4,431,000 , a decrease of$2,693,000 over a net loss of$1,738,000 in 2022 and includes a$1,507,000 asset impairment charge in 2023. - Adjusted EBITDA for 2023 was a loss of (

$1,684,000) and excludes non-recurring legal and financing costs, of expenses related primarily to the ongoing strategic alternatives project, non-cash stock compensation expense, and gain on derivative liability. Adjusted EBITDA for 2022 was a loss of ($382,000) and excludes severance, increased legal support primarily related to the Company's announcement in the second quarter 2022 to explore and evaluate potential strategic alternatives for the Company and certain EPA compliance expenses, transition payroll/temporary labor costs associated with the Company optimizing its headcount, and non-cash stock compensation expense.

Virtual Investor Day

The Company will not be conducting a fourth quarter 2023 earnings conference call. Instead, the Company will be conducting a virtual Investor Day to be held later this month, the Company's first one since July 2, 2020. The presentations will provide an in-depth overview of Mace Security International's business, growth strategy, and financial outlook. Sanjay Singh, Chairman and CEO, Kunal Mehta, Head of Digital Strategy, will present a comprehensive overview of strategic initiatives and financial growth drivers. More details and registration information will be announced shortly. There will be an opportunity for Q&A after the Investor Day presentations. The Company has posted a letter from the Chairman and CEO to the Company's shareholders in lieu of an earnings conference call. The letter includes a review of the financial performance of the Company. Please go to www.corp.mace.com/Financial Reports and Filings to read the letter.

About Mace Security International, Inc.

Mace® Security International, Inc. (MACE) is a globally recognized leader in personal safety and security. Based in Cleveland, Ohio, the Company has spent more than 40 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of defense spray products. The Company also offers aerosol defense sprays and tactical products for law enforcement and security professionals worldwide through its Mace® Take Down® brand, KUROS!® Brand personal safety products, Vigilant® Brand alarms, and Tornado® Brand pepper spray and stun guns. MACE® distributes and supports Mace® Brand products through mass market retailers, wholesale distributors, independent dealers, Amazon.com, Mace.com, and other channels. For more information, visit www.mace.com.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to several known and unknown risks and uncertainties that may cause our actual results, trends, performance or achievements, or industry trends and results, to differ materially from the future results, trends, performance, or achievements expressed or implied by such forward-looking statements. Those risks and uncertainties may include, but are not limited to, (a) general economic and business conditions, including the impact of the COVID-19 pandemic and other possible pandemics and similar outbreaks; (b) competition; (c) potential changes in customer spending; (d) acceptance of our product offerings and designs; (e) the variability of consumer spending resulting from changes in domestic economic activity; (f) a highly promotional retail environment; (g) any significant variations between actual amounts and the amounts estimated for those matters identified as our critical accounting estimates, as well as other significant accounting estimates made in the preparation of our financial statements; (h) the impact of current and potential hostilities in various parts of the world, including but not limited to the war which resulted from Russia's invasion of Ukraine, as well as other geopolitical or public health concerns; (i) the impact of international supply chain disruptions and delays; (j) the impact on the Company of changes in U.S. Federal and State income tax regulations; and (k) the impact of inflation and the ability of the Company to pass on rising prices to its customers. You are urged to consider all such factors. Because of the uncertainty inherent in such forward-looking statements, you should not consider their inclusion to be a representation that such forward-looking matters will be achieved. Mace Security International, Inc. assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedule.

Contact:

Investor Relations

InvestorRelations@mace.com

SOURCE: MACE SECURITY INTERNATIONAL INC

View the original press release on accesswire.com