Mace(R) Security International, a Global Leader in Personal Self-Defense Sprays, Announces 2Q22 Financial Results And Extension

Mace Security International (MACE) announced its Q2 2022 financial results, revealing a 42% decline in net sales to $1.981 million, primarily due to reduced retail impulse purchases amid inflation. However, international sales surged by 170%, and B2B sales grew by 80%. The gross profit margin improved to 40% from 39% last year, supported by increased pricing and lower operating costs. Adjusted EBITDA showed a loss of $116,000, a notable shift from a profit of $234,000 in Q2 2021. The company is optimistic about new orders from major retailers and the launch of new products.

- International sales increased by 170%

- B2B sales grew by 80%

- Gross profit margin improved to 40%

- Adjusted EBITDA loss narrowed to $116,000 from a profit of $234,000 in Q2 2021

- Restructuring plan completed to reduce operating costs

- Anticipated orders could add $1.5 to $2 million in gross revenue

- Orders from mace.com increased by 27% YoY

- Net sales down 42% compared to Q2 2021

- Net loss of $452,000 versus a net income of $705,000 in Q2 2021

- Cash and cash equivalents decreased to $32,000

- Working capital declined by $830,000 since December 31, 2021

CLEVELAND, OH / ACCESSWIRE / August 1, 2022 / Mace Security International (OTCQX:MACE) today announced its second quarter and year-to-date 2022 financial results for the periods ended June 30, 2022.

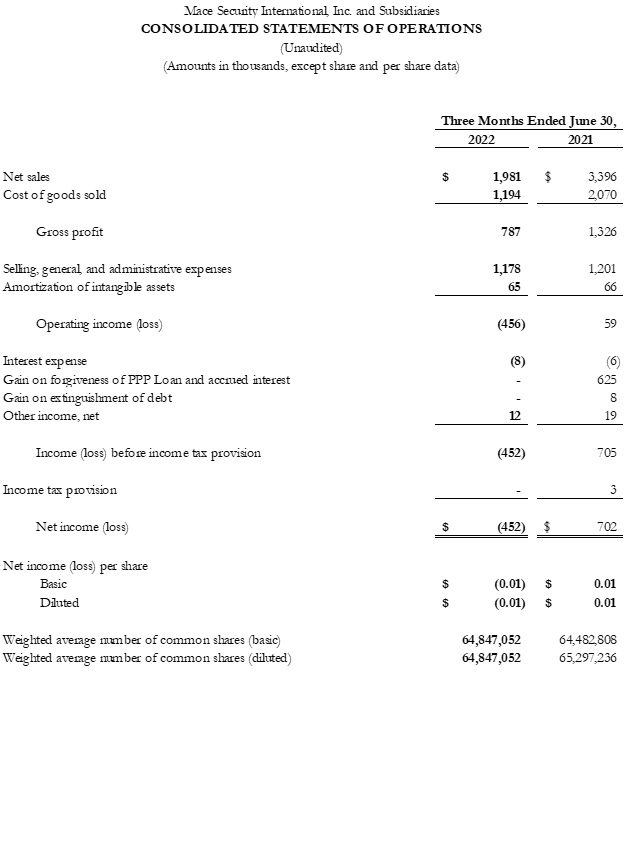

The Company's net sales for the second quarter were

Mace reported a gross profit rate for the quarter of

The company's credit facility, which was set to expire on November 30th, 2022 was extended to May 31st, 2023. The Credit Agreement provides for monthly interest payments at a floating rate per annum equal to the SOFR plus

Sanjay Singh, Chairman and CEO commented, "We recognize that this quarter was disappointing. The Company initiated a restructuring plan in Q2 2022 which is now complete and will reduce operating costs resulting in a lower break-even revenue level. On the revenue front, we are encouraged by the addition late in the second quarter of Mid States Distributing as a new customer and are anticipating orders in the third and fourth quarters from a major new retailer that could add incremental annual gross revenues of

Second Quarter 2022 Financial Highlights

- Net sales were

$1,981,000 , down (42% ) from the second quarter of 2021. The decline from prior year was due to the slowdown in retail sales in several of the Company's large retail customers as impulse sales were impacted by a slowing economy and the highest U.S. inflation rate experienced in decades. The Company also had a difficult quarter-over-quarter comparison against second quarter 2021 which was aided by backlogged orders from 2020. Mace did achieve significant growth of170% in its international shipments due primarily to the recovery from the impact of Covid-19 oversees and international freight issues impacting delivery of product in 2021. - Gross profit rate of

40% increased1% from the same period in 2021 even though the Company had a decrease in sales volume. The modifications implemented to its operational cost structure during the second half of 2021 led to a38% reduction in four-wall manufacturing costs on a quarter-over-quarter basis and a32% increase in direct labor efficiency. This bodes well for margin improvement as revenue recovers. Product margins improved over the second quarter of 2021 as price increases implemented in the first quarter 2022 helped offset rising costs of components and freight. - Gross profit for the second quarter decreased by

$539,000 , or41% , from the second quarter of 2021, entirely due to the decline in sales volume and increased freight costs. - SG&A when adjusted for (a)

$110,000 in increased legal support primarily related to the Company's announcement in the second quarter 2022 to explore and evaluate potential strategic alternatives for the Company, (b)$45,000 related to transition payroll/temporary labor costs associated with the Company optimizing its headcount and (c) non-cash stock compensation expense of$50,000 was$973,000 in the second quarter of 2022, compared to SG&A when adjusted for$52,000 of non-cash stock compensation expense was$1,149 in the same period in 2021. SG&A in both periods contains expenditures in support of the Company's commitment to its growth plan and the related cost for digital advertising. - Net loss of (

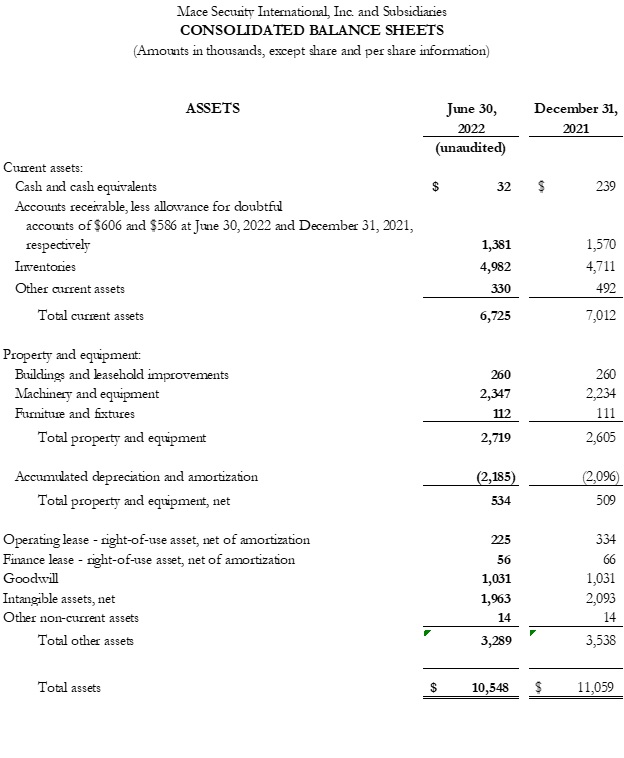

$452,000) in the second quarter of 2022, compared with net income of$705,000 in the same quarter in 2021 which benefited from a$625,000 gain from PPP Loan forgiveness. - Cash and cash equivalents decreased to

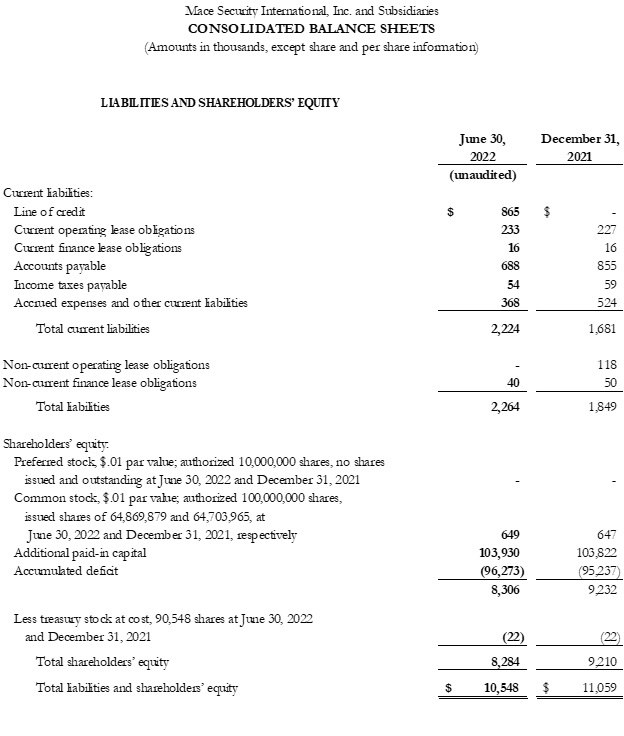

$32,000 as of June 30, 2022, a decline of$207,000 over the$239,000 on hand on December 31, 2021.$865,000 was drawn against the Company's$3.0 million bank line of credit at June 30, 2022. - Working capital decreased by

$830,000 compared to December 31, 2021, with an increase in debt of$865,000 and a$189,000 decrease in accounts receivable on lower sales. This was partially offset with a$271,000 net increase in Inventory, and a$167,000 decrease in accounts payable. Inventory converted to finished goods ready for shipping as sales volume picks up increased$521,000 compared with December 31, 2021. - Adjusted EBITDA for the second quarter 2022 was a loss of (

$116,000) and excludes severance pay, transition legal costs associated with the strategic alternative review process, transition payroll/temporary labor costs associated with the Company optimizing its headcount and non-cash stock compensation expense. Adjusted EBITDA for the second quarter 2021 was income of$234,000 and excludes the$625,000 gain from PPP Loan forgiveness, gain on extinguishment of debt and non-cash stock compensation expense.

Second Quarter 2022 Operational Highlights

- The modifications implemented to its operational cost structure during the second half of 2021 resulted in the Company realizing an improved gross margin of

41% in the first half of 2022, compared with39% in the first half of 2021, despite significantly lower sales. The Company will continue to invest in manufacturing process improvements and new product development as these are instrumental components of management's strategic vision for growth. - On July 29, 2022, the Company's

$3,000,000 line of credit with a bank was to extend the maturity date from November 30, 2022 to May 30, 2023. This amendment provides for the increase in the interest rate effective December 1, 2022 to SOFR plus2.5% , with a floor of2.5% . Under this amendment, the Company is subject to a minimum EBITDA level measured quarterly and certain customary reporting requirements.

Year-to-Date June 2022 Financial Highlights

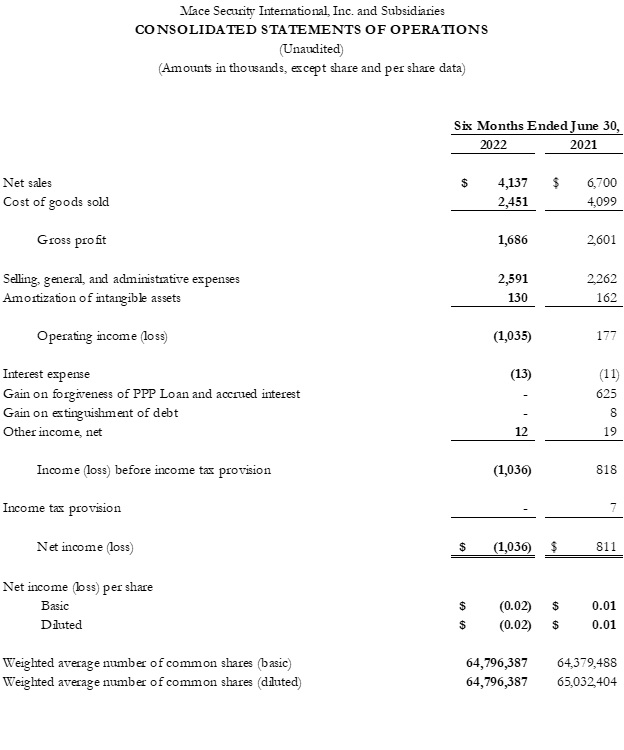

- Net Sales of

$4,137,000 decreased by$2,563,000 , or38% , versus the first half of 2021 net sales of$6,700,000 due to the slowdown in retail sales in several of the Company's large retail customers as impulse sales were impacted by a slowing economy and the highest U.S. inflation rate experienced in decades. - Gross profit rate improved to

41% for 2021 compared to39% for the same period in 2021. Price increases, lower manufacturing overhead and higher labor efficiencies led to the increase in gross margin despite lower sales volume and increasing components costs. - SG&A when adjusted for (a)

$220,000 in personnel related expenses for the transition in Mace's CEO role, (b)$110,000 in increased legal support primarily related to the Company's announcement in the second quarter 2022 to explore and evaluate potential strategic alternatives for the Company, (c)$45,000 related to transition payroll/temporary labor costs associated with the Company optimizing its headcount and (d) non-cash stock compensation expense of$110,000 was$693,000 in the first half of 2022, compared to SG&A when adjusted for$95,000 of non-cash stock compensation expense was$1,106,000 in the same period in 2021. SG&A in both periods contains expenditures in support of the Company's commitment to its growth plan and the related cost for digital advertising. - Net loss was

$1,036,000 , a decrease of$1,847,000 over net income of$811,000 in the first half of 2021. The 2021 net income was enhanced by a$625,000 gain from PPP Loan forgiveness. - Adjusted EBITDA for the first six months of 2022 was a loss of (

$306,000) and excludes severance pay, transition legal costs associated with the strategic alternative review process, transition payroll/temporary labor costs associated with the Company optimizing its headcount and non-cash stock compensation expense. Adjusted EBITDA for the first half 2021 was income of$559,000 and excludes the$625,000 gain from PPP Loan forgiveness, gain on extinguishment of debt, severance and non-cash stock compensation expense.

Conference Call

Mace® will conduct a conference call on Tuesday, August 2, 2022 at 11:00 AM EDT, 8:00 AM PDT to discuss its financial and operational performance for the second quarter and first half of 2022. The call can be made using the following link Connect Me or by telephone within the US at (800) 207-0148. Please use the conference identification number 798676.

A digital recording of the conference call will be available for replay after the call's completion. It will be available two hours after the call and will expire on August 16, 2022, at 2:00 PM. To access the encore recording, call 888-203-1112 and enter the conference ID 1185716.

The full set of financial statements and an accompanying slide presentation is available on Mace's website www.corp.mace.com under the subheading "Newsroom."

About Mace Security International, Inc.

Mace® Security International, Inc. (MACE) is a globally recognized leader in personal safety and security. Based in Cleveland, Ohio, the Company has spent more than 40 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of defense spray products. The Company also offers aerosol defense sprays and tactical products for law enforcement and security professionals worldwide through its Mace® Take Down® brand, KUROS!® Brand personal safety products, Vigilant® Brand alarms, and Tornado® Brand pepper spray and stun guns. MACE® distributes and supports Mace® Brand products through mass market retailers, wholesale distributors, independent dealers, Amazon.com, Mace.com, and other channels. For more information, visit www.mace.com.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to several known and unknown risks and uncertainties that may cause our actual results, trends, performance or achievements, or industry trends and results, to differ materially from the future results, trends, performance, or achievements expressed or implied by such forward-looking statements. Those risks and uncertainties may include, but are not limited to, (a) general economic and business conditions, including the impact of the COVID-19 pandemic and other possible pandemics and similar outbreaks; (b) competition; (c) potential changes in customer spending; (d) acceptance of our product offerings and designs; (e) the variability of consumer spending resulting from changes in domestic economic activity; (f) a highly promotional retail environment; (g) any significant variations between actual amounts and the amounts estimated for those matters identified as our critical accounting estimates, as well as other significant accounting estimates made in the preparation of our financial statements; (h) the impact of current and potential hostilities in various parts of the world, including but not limited to the war which resulted from Russia's invasion of Ukraine, as well as other geopolitical or public health concerns; (i) the impact of international supply chain disruptions and delays; (j) the impact on the Company of changes in U.S. Federal and State income tax regulations; and (k) the impact of inflation and the ability of the Company to pass on rising prices to its customers. You are urged to consider all such factors. Because of the uncertainty inherent in such forward-looking statements, you should not consider their inclusion to be a representation that such forward-looking matters will be achieved. Mace Security International, Inc. assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

Mace Security International, Inc. and Subsidiaries

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA

(Unaudited)

(Amounts in thousands)

| Three Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

Net income (loss) | $ | (452 | ) | $ | 702 | |||

Adjustments: | ||||||||

Interest expense | 8 | 6 | ||||||

Income tax expense | - | 3 | ||||||

Depreciation and amortization | 110 | 104 | ||||||

EBITDA | (334 | ) | 815 | |||||

Gain on forgiveness of PPP Loan and accrued interest | - | (625 | ) | |||||

Gain on extinguishment of debt | - | (8 | ) | |||||

Severance | 13 | - | ||||||

Strategic alternative review related legal costs | 110 | - | ||||||

Transition payroll/temporary labor costs | 45 | - | ||||||

Non-cash stock compensation expense | 50 | 52 | ||||||

Adjusted EBITDA | $ | (116 | ) | $ | 234 | |||

Mace Security International, Inc. and Subsidiaries

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA

(Unaudited)

(Amounts in thousands)

| Six Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

Net income (loss) | $ | (1,036 | ) | $ | 811 | |||

Adjustments: | ||||||||

Interest expense | 13 | 11 | ||||||

Income tax expense | - | 7 | ||||||

Depreciation and amortization | 219 | 238 | ||||||

EBITDA | (804 | ) | 1,067 | |||||

Gain on forgiveness of PPP Loan and accrued interest | - | (625 | ) | |||||

Gain on extinguishment of debt | - | (8 | ) | |||||

Severance | 233 | 30 | ||||||

Strategic alternative review related legal costs | 110 | - | ||||||

Transition payroll/temporary labor costs | 45 | - | ||||||

Non-cash stock compensation expense | 110 | 95 | ||||||

Adjusted EBITDA | $ | (306 | ) | $ | 559 | |||

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedule.

Contacts:

Mark O'Conner

Corporate Controller

moconner@mace.com

SOURCE: MACE SECURITY INTERNATIONAL INC

View source version on accesswire.com:

https://www.accesswire.com/710477/MaceR-Security-International-a-Global-Leader-in-Personal-Self-Defense-Sprays-Announces-2Q22-Financial-Results-And-Extension

FAQ

What were Mace's Q2 2022 net sales?

How did Mace's international sales perform in Q2 2022?

What was Mace's adjusted EBITDA for Q2 2022?

What is Mace's outlook for the second half of 2022?