Lifezone Metals Upgrades High-Grade Nickel Copper and Cobalt Mineral Resources at its Kabanga Nickel Project

Multiple Exploration Opportunities Identified to Add High-Grade Mineralization

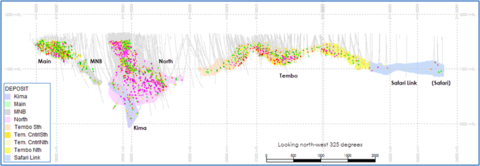

Figure 1: Schematic Projected Long-Section of the Kabanga Mineralized Zones (truncated UTM, looking north-west). (Graphic: Business Wire)

The Kabanga Nickel Project is

Highlights:

-

Attributable Measured and Indicated Resources total 46.8 million tonnes grading

2.09% nickel,0.29% copper and0.16% cobalt (2.62% nickel-equivalent – 1.2 million tonnes contained nickel-equivalent). -

Plus, attributable Inferred Resources totaling 11.3 million tonnes grading

2.08% nickel,0.28% copper and0.15% cobalt (2.59% nickel-equivalent – 0.3 million tonnes contained nickel-equivalent). -

3.3 million tonnes attributable to Lifezone with an average grade of

3.00% nickel (3.26% nickel-equivalent) for 98,000 tonnes attributable contained nickel have been added to the Measured and Indicated categories compared to the previous November 2023 Mineral Resource Update. -

81% of Kabanga’s Mineral Resource tonnes are now classified as the higher confidence Measured and Indicated categories relative to Inferred. Only Measured and Indicated Resources can support the conversion to Proven and Probable Reserves. -

The nickel-equivalent formula and cut-off grade calculation has been revised to reflect updated assumptions and technical parameters, increasing to

0.73% nickel-equivalent (NiEq24) for the massive sulfide domain and0.77% NiEq24 for ultramafic, compared to0.58% nickel-equivalent (NiEq23) previously. -

Kabanga’s largest mineralized zone, the North Zone, has had a

21% increase in contained nickel in Measured and Indicated. The North Zone represents more than50% of Kabanga’s total resources, with 24.7 million tonnes of attributable Measured and Indicated Resources grading3.19% nickel-equivalent. - Multiple opportunities identified to grow the current Kabanga resources, including at the Safari Link zone. High-priority regional targets include multiple identified geophysical anomalies, such as Rubona Hill.

Mr. Showalter commented: “Kabanga stands as one of the world’s largest and highest-grade undeveloped nickel sulfide deposits, and today’s update underscores its exceptional potential. With the addition of over 15,000 meters of new drilling data, we can refine the Definitive Feasibility Study mine plan to unlock maximum value from Kabanga’s rich mineralization. Upgrading high-grade nickel, copper and cobalt Mineral Resources into the Measured and Indicated categories is a pivotal step towards converting these into Proven and Probable Reserves.

With these upgrades to Kabanga’s Mineral Resources, we have identified opportunities for further enhancing the Definitive Feasibility Study. We will provide an update on the Definitive Feasibility Study timeline once we have completed these technical evaluations.

Facilitated by the Memorandum of Understanding with Japan Organization for Metals and Energy Security (JOGMEC), we are evaluating the potential for a strategic investment by a Japanese partner, alongside the sale of offtake through Lifezone’s marketing rights. These negotiations are progressing well and in close coordination with our project partners. We welcome the opportunity to bring on a strategically aligned Japanese partner to further advance the Kabanga Nickel Project. In parallel, we are working with our project partners to conclude the Joint Financial Model, which remains a crucial condition for BHP’s T2 investment.”

Table 1: Kabanga Nickel Project Mineral Resource Update shown on an attributable to Lifezone Metals basis (

Mineral Resource

|

Attributable Tonnage

|

Grades |

Recovery |

||||||

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

Nickel

|

Copper

|

Cobalt

|

|||

OVERALL MINERAL RESOURCE – All Mineralization Types |

|||||||||

Measured |

15.9 |

2.48 |

1.95 |

0.26 |

0.16 |

82.7 |

92.0 |

85.4 |

|

Indicated |

31.0 |

2.69 |

2.16 |

0.30 |

0.16 |

82.9 |

92.6 |

85.3 |

|

Measured + Indicated |

46.8 |

2.62 |

2.09 |

0.29 |

0.16 |

82.8 |

92.4 |

85.3 |

|

Inferred |

11.3 |

2.59 |

2.08 |

0.28 |

0.15 |

83.7 |

93.7 |

86.5 |

|

|

|

|

|

||||||

Mineral Resource

|

Attributable Tonnage

|

Grades |

Attributable Contained Metals |

||||||

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

||

OVERALL MINERAL RESOURCE – All Mineralization Types |

|||||||||

Measured |

15.9 |

2.48 |

1.95 |

0.26 |

0.16 |

394 |

311 |

42 |

25 |

Indicated |

31.0 |

2.69 |

2.16 |

0.30 |

0.16 |

833 |

668 |

93 |

49 |

Measured + Indicated |

46.8 |

2.62 |

2.09 |

0.29 |

0.16 |

1,227 |

979 |

134 |

74 |

Inferred |

11.3 |

2.59 |

2.08 |

0.28 |

0.15 |

293 |

235 |

32 |

17 |

- This table reports the Mineral Resources for the combined massive sulfide and ultramafic mineralization types.

- Mineral Resources are reported exclusive of Mineral Reserves. There are no Mineral Reserves to report.

-

Mineral Resources are reported showing only the LZM attributable tonnage portion, which is

69.713% of the total. -

Cut-off applies to NiEq24, which is derived using a nickel price of

$9.50 $4.50 $23.00 - NiEq24 formulae are: MSSX NiEq24 = Ni + (Cu x 0.454) + (Co x 2.497) and UMAF NiEq24 = Ni + (Cu x 0.547) + (Co x 2.480).

- The point of reference for Mineral Resources is the point of feed into a concentrator.

-

All Mineral Resources in the 2024MRU were assessed for reasonable prospects for eventual economic extraction by reporting only material above cut off grades of: MSSX NiEq24>

0.73% and UMAF NiEq24>0.77% . - Totals may vary due to rounding.

The Kabanga December 2024 Mineral Resource Update was independently prepared by Sharron Sylvester, Technical Director – Geology at OreWin Pty Ltd and in accordance with Regulation S-K subpart 1300 promulgated by the

The December 2024 Mineral Resource Update reflects the results of a comprehensive review of the geology and mineralogy data, resulting in a tightening of the interpretations and higher confidence in the revised interpretations. It also includes assay results from 15,265 meters of drilling which were received after the September 2023 cut-off date applied to the previous November 2023 Mineral Resource Update.

Kabanga currently comprises six identified distinct mineralized zones, namely (from south-west to north-east) the Main, MNB, Kima, North, Tembo and Safari zones, which occur over a strike length exceeding 7.5 kilometers. The five mineralized zones that contribute to the Mineral Resource Update are: Main, MNB, Kima, North and Tembo, which extend over a total strike length of 6.0 kilometers and to a depth of up to 1.7 kilometers below surface.

The North Zone is the largest mineralized zone, representing more than

At the North Zone,

Table 2: North Zone ONLY Mineral Resource Update shown on an attributable to Lifezone Metals basis (

Mineral Resource

|

Attributable

|

Grades |

Recovery |

||||||

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

Nickel

|

Copper

|

Cobalt

|

|||

NORTH ZONE ONLY – All Mineralization Types |

|||||||||

Measured |

7.9 |

2.66 |

2.12 |

0.28 |

0.16 |

83.3 |

92.9 |

86.1 |

|

Indicated |

16.8 |

3.44 |

2.80 |

0.37 |

0.19 |

85.1 |

94.8 |

88.0 |

|

Measured + Indicated |

24.7 |

3.19 |

2.58 |

0.34 |

0.18 |

84.6 |

94.3 |

87.5 |

|

Inferred |

5.8 |

3.25 |

2.62 |

0.35 |

0.19 |

85.8 |

95.2 |

88.7 |

|

|

|

|

|

||||||

Mineral Resource

|

Attributable

|

Grades |

Attributable Contained

|

||||||

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

||

NORTH ZONE ONLY – All Mineralization Types |

|||||||||

Measured |

7.9 |

2.66 |

2.12 |

0.28 |

0.16 |

211 |

168 |

22 |

13 |

Indicated |

16.8 |

3.44 |

2.80 |

0.37 |

0.19 |

579 |

470 |

63 |

32 |

Measured + Indicated |

24.7 |

3.19 |

2.58 |

0.34 |

0.18 |

790 |

638 |

85 |

45 |

Inferred |

5.8 |

3.25 |

2.62 |

0.35 |

0.19 |

183 |

152 |

20 |

11 |

Note: refer to the metals’ prices, recoveries and other assumptions as shown in Table 1 and the provided notes. |

|||||||||

The Mineral Resource cut-off grade calculation has been revised to reflect updated assumptions and technical parameters, increasing to

Safari Link Area and High-Priority Regional Geophysical Anomalies Provide Opportunities for Additional Upside

The Safari Link area spans a 1.4 kilometers strike length north-east of the Tembo Zone, incorporating the Safari Zone (refer to Figure 1 above and Lifezone’s January 28, 2024 news release).The Safari Link area is considered to be a possible strike-extension (continuation) of the Tembo mineralization, as indicated by a Tembo-style high conductance electromagnetic (EM) geophysical anomaly that exists to the north-east of the Tembo Zone. Lifezone completed 13 drill holes in 2022–23, and there is currently approximately 850 meters of strike length that remains untested.

Previous programs of geophysical surveying have identified multiple anomalies on the Kabanga Special Mining Licence area, which include the Rubona Hill anomaly – a high-priority for future regional exploration.

Qualified Persons

The Kabanga December 2024 Mineral Resource Update Technical Report Summary (2024MRU) with an effective date of December 4, 2024, has been prepared in accordance with the

The 2024MRU scientific and technical information in this news release has been prepared and approved by Sharron Sylvester, BSc (Geol), RPGeo AIG (10125), Technical Director – Geology at OreWin Pty Ltd and Bernard Peters, BEng (Mining), FAusIMM (201743), Technical Director – Mining at OreWin Pty Ltd. Both individuals are Qualified Persons in accordance with S-K 1300 and are considered independent of Lifezone Metals.

Appendix : Kabanga Nickel Project Mineral Resource Update by zone on an attributable to Lifezone Metals basis (

Mineral Resource

|

Attributable

|

Grades |

Recovery |

|||||

NiEq24 |

Nickel |

Copper |

Cobalt |

Nickel |

Copper |

Cobalt |

||

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

||

MAIN ZONE - Massive Sulfide plus Ultramafic |

||||||||

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

Indicated |

8.7 |

1.53 |

1.18 |

0.19 |

0.10 |

73.4 |

85.9 |

75.6 |

Measured + Indicated |

8.7 |

1.53 |

1.18 |

0.19 |

0.10 |

73.4 |

85.9 |

75.6 |

Inferred |

- |

- |

- |

- |

- |

- |

- |

- |

MNB ZONE - Massive Sulfide plus Ultramafic |

||||||||

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

Measured + Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

Inferred |

1.8 |

1.59 |

1.25 |

0.18 |

0.10 |

75.3 |

88.9 |

78.6 |

KIMA ZONE - Massive Sulfide plus Ultramafic |

||||||||

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

Measured + Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

Inferred |

3.4 |

2.01 |

1.60 |

0.24 |

0.12 |

81.4 |

92.3 |

84.2 |

NORTH ZONE - Massive Sulfide plus Ultramafic |

||||||||

Measured |

7.9 |

2.66 |

2.12 |

0.28 |

0.16 |

83.3 |

92.9 |

86.1 |

Indicated |

16.8 |

3.44 |

2.80 |

0.37 |

0.19 |

85.1 |

94.8 |

88.0 |

Measured + Indicated |

24.7 |

3.19 |

2.58 |

0.34 |

0.18 |

84.6 |

94.3 |

87.5 |

Inferred |

5.8 |

3.25 |

2.62 |

0.35 |

0.19 |

85.8 |

95.2 |

88.7 |

TEMBO ZONE - Massive Sulfide plus Ultramafic |

||||||||

Measured |

8.0 |

2.30 |

1.79 |

0.25 |

0.15 |

81.9 |

91.1 |

84.5 |

Indicated |

5.5 |

2.22 |

1.75 |

0.24 |

0.14 |

82.0 |

90.5 |

84.9 |

Measured + Indicated |

13.5 |

2.27 |

1.78 |

0.24 |

0.15 |

82.0 |

90.9 |

84.7 |

Inferred |

0.3 |

2.49 |

2.01 |

0.23 |

0.15 |

84.2 |

90.3 |

87.0 |

OVERALL MINERAL RESOURCE – Massive Sulfide plus Ultramafic |

||||||||

Measured |

15.9 |

2.48 |

1.95 |

0.26 |

0.16 |

82.7 |

92.0 |

85.4 |

Indicated |

31.0 |

2.71 |

2.16 |

0.30 |

0.16 |

82.9 |

92.6 |

85.3 |

Measured + Indicated |

46.8 |

2.63 |

2.09 |

0.29 |

0.16 |

82.8 |

92.4 |

85.3 |

Inferred |

11.3 |

2.60 |

2.08 |

0.28 |

0.15 |

83.7 |

93.7 |

86.5 |

Note: refer to the metals’ prices, recoveries and other assumptions as shown in Table 1 and the provided notes. |

||||||||

Appendix: Kabanga Nickel Project Mineral Resource Update by zone on an attributable to Lifezone Metals basis (

Mineral Resource Classification |

Attributable

Tonnage

|

Grades |

Attributable Contained Metals |

||||||

NiEq24 |

Nickel |

Copper |

Cobalt |

NiEq24 |

Nickel |

Copper |

Cobalt |

||

(%) |

(%) |

(%) |

(%) |

(kt) |

(kt) |

(kt) |

(kt) |

||

MAIN ZONE – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Indicated |

8.7 |

1.53 |

1.18 |

0.19 |

0.10 |

133 |

102 |

17 |

9 |

Measured + Indicated |

8.7 |

1.53 |

1.18 |

0.19 |

0.10 |

133 |

102 |

17 |

9 |

Inferred |

- |

- |

- |

- |

- |

- |

- |

- |

- |

MNB ZONE – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Measured + Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Inferred |

1.8 |

1.59 |

1.25 |

0.18 |

0.10 |

28 |

22 |

3 |

2 |

KIMA ZONE – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Measured + Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Inferred |

3.4 |

2.01 |

1.60 |

0.24 |

0.12 |

69 |

55 |

8 |

4 |

NORTH ZONE – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

7.9 |

2.66 |

2.12 |

0.28 |

0.16 |

211 |

168 |

22 |

13 |

Indicated |

16.8 |

3.44 |

2.80 |

0.37 |

0.19 |

579 |

470 |

63 |

32 |

Measured + Indicated |

24.7 |

3.19 |

2.58 |

0.34 |

0.18 |

790 |

638 |

84 |

45 |

Inferred |

5.8 |

3.25 |

2.62 |

0.35 |

0.19 |

183 |

152 |

20 |

11 |

TEMBO ZONE – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

8.0 |

2.30 |

1.79 |

0.25 |

0.15 |

184 |

143 |

20 |

12 |

Indicated |

5.5 |

2.22 |

1.75 |

0.24 |

0.14 |

122 |

96 |

13 |

8 |

Measured + Indicated |

13.5 |

2.27 |

1.78 |

0.24 |

0.15 |

305 |

239 |

33 |

20 |

Inferred |

0.3 |

2.49 |

2.01 |

0.23 |

0.15 |

6 | 6 |

1 |

0 |

OVERALL MINERAL RESOURCE – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

15.9 |

2.48 |

1.95 |

0.26 |

0.16 |

394 |

311 |

42 |

25 |

Indicated |

31.0 |

2.69 |

2.16 |

0.30 |

0.16 |

833 |

668 |

93 |

49 |

Measured + Indicated |

46.8 |

2.62 |

2.09 |

0.29 |

0.16 |

1,227 |

979 |

134 |

74 |

Inferred |

11.3 |

2.59 |

2.08 |

0.28 |

0.15 |

293 |

235 |

32 |

17 |

Note: refer to the metals’ prices, recoveries and other assumptions as shown in Table 1 and the provided notes. |

|||||||||

Appendix: December 2024 Mineral Resource Update compared to the November 2023 Mineral Resource Update, shown on an attributable to Lifezone Metals basis (

Mineral Resource

|

Attributable Tonnage

|

Grades |

Attributable Contained

|

||||||

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

NiEq24

|

Nickel

|

Copper

|

Cobalt

|

||

December 2024 – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

15.9 |

2.48 |

1.95 |

0.26 |

0.16 |

394 |

311 |

42 |

25 |

Indicated |

31.0 |

2.69 |

2.16 |

0.30 |

0.16 |

833 |

668 |

93 |

49 |

Measured + Indicated |

46.8 |

2.62 |

2.09 |

0.29 |

0.16 |

1,227 |

979 |

134 |

74 |

Inferred |

11.3 |

2.59 |

2.08 |

0.28 |

0.15 |

293 |

235 |

32 |

17 |

November 2023 – Massive Sulfide plus Ultramafic |

|||||||||

Measured |

14.1 |

2.61 |

2.03 |

0.28 |

0.17 |

368 |

286 |

39 |

24 |

Indicated |

29.5 |

2.55 |

2.02 |

0.28 |

0.15 |

753 |

595 |

83 |

45 |

Measured + Indicated |

43.6 |

2.57 |

2.02 |

0.28 |

0.16 |

1,121 |

881 |

122 |

69 |

Inferred |

17.5 |

2.79 |

2.23 |

0.31 |

0.16 |

489 |

391 |

54 |

27 |

Percentage Change (December 2024 vs. November 2023) |

|||||||||

Measured |

|

- |

- |

- |

- |

|

|

|

|

Indicated |

|

|

|

|

|

|

|

|

|

Measured + Indicated |

|

|

|

|

|

|

|

|

|

Inferred |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Note: refer to the metals’ prices, recoveries and other assumptions as shown in Table 1 and the provided notes. |

|||||||||

If you would like to sign up for Lifezone Metals news alerts, please register here.

Social Media

About Lifezone Metals

Lifezone Metals (NYSE: LZM) is committed to delivering cleaner and more responsible metals production and recycling. Through the application of our Hydromet Technology, we offer the potential for lower energy consumption, lower emissions and lower cost metals production compared to traditional smelting.

Our Kabanga Nickel Project in

Through our US-based recycling partnership, we are working to demonstrate that our Hydromet Technology can process and recover platinum, palladium and rhodium from responsibly sourced spent automotive catalytic converters. Our process is expected to be cleaner and more efficient than conventional smelting and refining methods, enabling the circular economy for precious metals.

Forward-Looking Statements

Certain statements made herein are not historical facts but may be considered “forward-looking statements” within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended and the “safe harbor” provisions under the Private Securities Litigation Reform Act of 1995 regarding, amongst other things, the plans, strategies, intentions and prospects, both business and financial, of Lifezone Metals Limited and its subsidiaries.

Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” or the negatives of these terms or variations of them or similar terminology or expressions that predict or indicate future events or trends or that are not statements of historical matters; provided that the absence of these does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding future events, the estimated or anticipated future results of Lifezone Metals, future opportunities for Lifezone Metals, including the efficacy of Lifezone Metals’ hydrometallurgical technology (Hydromet Technology) and the development of, and processing of mineral resources at, the Kabanga Project, and other statements that are not historical facts.

These statements are based on the current expectations of Lifezone Metals’ management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lifezone Metals and its subsidiaries. These statements are subject to a number of risks and uncertainties regarding Lifezone Metals’ business, and actual results may differ materially. These risks and uncertainties include, but are not limited to: general economic, political and business conditions, including but not limited to the economic and operational disruptions; global inflation and cost increases for materials and services; reliability of sampling; success of any pilot work; capital and operating costs varying significantly from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; changes in government regulations, legislation and rates of taxation; inflation; changes in exchange rates and the availability of foreign exchange; fluctuations in commodity prices; delays in the development of projects and other factors; the outcome of any legal proceedings that may be instituted against the Lifezone Metals; our ability to obtain additional capital, including use of the debt market, future capital requirements and sources and uses of cash; the risks related to the rollout of Lifezone Metals’ business, the efficacy of the Hydromet Technology, and the timing of expected business milestones; the acquisition of, maintenance of and protection of intellectual property; Lifezone’s ability to achieve projections and anticipate uncertainties (including economic or geopolitical uncertainties) relating to our business, operations and financial performance, including: expectations with respect to financial and business performance, financial projections and business metrics and any underlying assumptions; expectations regarding product and technology development and pipeline and market size; expectations regarding product and technology development and pipeline; the effects of competition on Lifezone Metals’ business; the ability of Lifezone Metals to execute its growth strategy, manage growth profitably and retain its key employees; the ability of Lifezone Metals to reach and maintain profitability; enhancing future operating and financial results; complying with laws and regulations applicable to Lifezone Metals’ business; Lifezone Metals’ ability to continue to comply with applicable listing standards of the NYSE; the ability of Lifezone Metals to maintain the listing of its securities on a

The foregoing list of risk factors is not exhaustive. There may be additional risks that Lifezone Metals presently does not know or that Lifezone Metals currently believes are immaterial that could also cause actual results to differ from those contained in forward-looking statements. In addition, forward-looking statements provide Lifezone Metals’ expectations, plans or forecasts of future events and views as of the date of this communication. Lifezone Metals anticipates that subsequent events and developments will cause Lifezone Metals’ assessments to change.

These forward-looking statements should not be relied upon as representing Lifezone Metals’ assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements. Nothing herein should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results in such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this communication, which are based upon information available to us as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. In all cases where historical performance is presented, please note that past performance is not a credible indicator of future results.

Except as otherwise required by applicable law, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data, or methods, future events, or other changes after the date of this communication.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241205354407/en/

Investor Relations –

Evan Young

SVP: Investor Relations & Capital Markets

evan.young@lifezonemetals.com

Investor Relations –

Ingo Hofmaier

Chief Financial Officer

ingo.hofmaier@lifezonemetals.com

Source: Lifezone Metals