JANA Partners Sends Letter to Lamb Weston Board of Directors

JANA Partners, owning over 5% of Lamb Weston Holdings (NYSE: LW), sent a critical letter to the company's Board of Directors highlighting significant shareholder dissatisfaction. The letter follows LW's December 19, 2024 earnings report, which showed poor financial performance and resulted in a 20% stock drop.

The key issues raised include: repeated guidance cuts, questionable leadership changes (replacing CEO with a 17-year veteran COO), and poor operational execution. A perception study of 70% of top 70 LW shareholders revealed widespread frustration with management and board performance.

JANA threatens to present alternative director candidates at the 2025 Annual Meeting if the board remains resistant to change. The activist investor suggests either implementing significant board and leadership changes or pursuing a sale transaction, noting over $6 billion in value destruction.

JANA Partners, proprietaria di oltre il 5% di Lamb Weston Holdings (NYSE: LW), ha inviato una lettera critica al Consiglio di Amministrazione dell'azienda, evidenziando un significativo malcontento tra gli azionisti. La lettera segue il rapporto sugli utili del 19 dicembre 2024 di LW, che ha mostrato una scarsa performance finanziaria e ha portato a un calo del 20% del titolo.

I principali problemi sollevati includono: ripetuti tagli delle previsioni, cambiamenti di leadership controversi (sostituzione dell'amministratore delegato con un COO con 17 anni di esperienza), e una cattiva esecuzione operativa. Uno studio di percezione condotto su il 70% dei primi 70 azionisti di LW ha rivelato una diffusa frustrazione riguardo alla gestione e alle performance del consiglio.

JANA minaccia di presentare candidati alternativi per il consiglio durante l'Assemblea Annuale del 2025 se il consiglio rimarrà resistente al cambiamento. L'investitore attivista suggerisce di attuare cambiamenti significativi nel consiglio e nella leadership, oppure di perseguire una transazione di vendita, evidenziando oltre 6 miliardi di dollari di distruzione di valore.

JANA Partners, que posee más del 5% de Lamb Weston Holdings (NYSE: LW), envió una carta crítica a la Junta Directiva de la empresa señalando un significativo descontento de los accionistas. La carta sigue al informe de ganancias del 19 de diciembre de 2024 de LW, que mostró un bajo rendimiento financiero y resultó en una caída del 20% en el precio de las acciones.

Las principales cuestiones planteadas incluyen: recortes de guía repetidos, cambios de liderazgo cuestionables (reemplazar al CEO con un COO de 17 años de experiencia), y una mala ejecución operativa. Un estudio de percepción realizado sobre el 70% de los 70 principales accionistas de LW reveló una frustración generalizada con el desempeño de la dirección y de la junta.

JANA amenaza con presentar candidatos alternativos para la junta en la Junta Anual de 2025 si la junta sigue siendo resistente al cambio. El inversor activista sugiere implementar cambios significativos en la junta y en el liderazgo o buscar una transacción de venta, señalando más de 6 mil millones de dólares en destrucción de valor.

JANA Partners는 Lamb Weston Holdings (NYSE: LW)의 5% 이상을 소유하고 있으며, 회사의 이사회에 중요한 비판의 서신을 보냈습니다. 이 서신은 LW의 2024년 12월 19일 실적 보고서 이후 작성되었으며, 실적 부진으로 인해 주가가 20% 하락했습니다.

제기된 주요 문제는 반복적인 가이드라인 감축, 의문이 제기되는 리더십 변화(17년 경력의 COO로 CEO 교체), 그리고 불량한 운영 실행을 포함합니다. LW의 상위 70명 주주 중 70%를 대상으로 한 인식 조사 결과 경영진 및 이사회 성과에 대한 광범위한 불만이 드러났습니다.

JANA는 이사회가 변화에 저항할 경우 2025년 정기총회에서 대체 이사 후보를 제시하겠다고 위협합니다. 이 행동주의 투자자는 이사회 및 리더십에서 중요한 변화를 이행하거나 매각 거래를 추진할 것을 제안하며, 60억 달러 이상의 가치 파괴를 언급했습니다.

JANA Partners, qui possède plus de 5 % de Lamb Weston Holdings (NYSE: LW), a envoyé une lettre critique au conseil d'administration de l'entreprise, soulignant un mécontentement important des actionnaires. La lettre fait suite au rapport sur les bénéfices de LW du 19 décembre 2024, qui a montré de mauvaises performances financières et a entraîné une chute de 20 % de l'action.

Les principales questions soulevées comprennent : des baisses répétées des prévisions, des changements de direction douteux (remplaçant le PDG par un COO ayant 17 ans d'expérience), et une mauvaise exécution opérationnelle. Une étude de perception menée auprès de 70 % des 70 principaux actionnaires de LW a révélé une frustration généralisée à l'égard de la gestion et des performances du conseil.

JANA menace de présenter des candidats alternatifs pour le conseil lors de l'Assemblée Générale de 2025 si le conseil reste réticent au changement. L'investisseur activiste suggère soit de mettre en œuvre des changements significatifs au sein du conseil et de la direction, soit de poursuivre une transaction de vente, notant plus de 6 milliards de dollars de destruction de valeur.

JANA Partners, das über 5% von Lamb Weston Holdings (NYSE: LW) besitzt, hat einen kritischen Brief an den Vorstand des Unternehmens gesendet, in dem eine erhebliche Unzufriedenheit der Aktionäre hervorgehoben wird. Der Brief folgt auf den Ergebnisbericht von LW vom 19. Dezember 2024, der schwache finanzielle Ergebnisse zeigte und zu einem Rückgang der Aktie um 20% führte.

Die wichtigsten angesprochenen Themen umfassen: wiederholte Senkungen der Prognosen, fragwürdige Veränderungen in der Führung (Austausch des CEO durch einen COO mit 17 Jahren Erfahrung) und schlechte operative Ausführung. Eine Wahrnehmungsstudie unter 70% der 70 wichtigsten LW-Aktionäre ergab weit verbreitete Frustration über das Management und die Leistung des Vorstands.

JANA droht, alternative Kandidaten für den Vorstand bei der Hauptversammlung 2025 zu präsentieren, wenn der Vorstand weiterhin Veränderungen widersteht. Der aktivistische Investor schlägt vor, entweder bedeutende Veränderungen im Vorstand und in der Führung umzusetzen oder einen Verkaufsprozess zu verfolgen und weist auf einen Wertverlust von über 6 Milliarden Dollar hin.

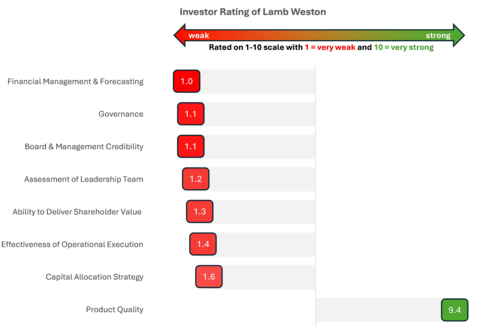

- High product quality ratings from shareholders (nearly 10/10)

- Company maintains leading market position in industry

- 20% stock price drop following December 2024 earnings report

- Four guidance cuts in five quarters

- $6 billion in shareholder value destruction

- Significant volume declines compared to North American peers

- Poor operational execution and capacity utilization

- Loss of customer relationships despite capacity expansion

- Stock trading near 52-week low

Highlights Overwhelming Investor Support for Significant Board and Leadership Change

Excerpt of Quantitative Feedback from Perception Study (Graphic: Business Wire)

The full text of the letter is below.

January 27, 2025

Board of Directors,

JANA Partners (“JANA,” “we” or “us”), together with our strategic and operating partners, beneficially owns more than

Lamb Weston’s earnings report on December 19, 2024 further underscored the urgent need for change at the Company:

-

First, Lamb Weston again reported extremely poor financial metrics that were well below expectations. The Company made a significant cut to fiscal 2025 guidance – the latest in a series of recent cuts – resulting in the stock plummeting

20% in one day and now trading near its 52-week low;1 - Second, the Board’s response to shareholder pressure was to make a long overdue CEO change. But by replacing the CEO with his ‘right hand’ COO, a 17-year veteran and long-time senior Lamb Weston executive, the Board demonstrated its continued failure to recognize the magnitude of changes required at the Company;

- Third, the Board once again opted to shirk accountability for the self-inflicted missteps that have led to substantial share losses, which we believe to be the primary driver of Lamb Weston’s significant volume declines and large performance gap to North American peers (who we believe are operating at higher capacity utilization). After previously trying to blame its self-induced volume losses on restaurant traffic, on the December call the departing CEO once again strained credulity – citing potential future competitor capacity additions to normalize current and ongoing underperformance. After spending billions in shareholder capital to expand capacity and acquire its European joint venture – while at the same time voluntarily walking away from customers – the Company now claims ignorance regarding potential competitor capacity additions, despite their multi-year lead time and evidence to the contrary. The Board’s approval of this disingenuous presentation of the facts – presumably in a bid to save itself from blame – only adds to the damage;

- The market reaction to these events was so overwhelmingly negative that it prompted one long-tenured analyst to write, “Having missed and lowered guidance 4 times in the past 5 quarters, we too have lost confidence in mgmt's oversight”2 while another seasoned analyst titled his report, “Strategic Change Increasingly Likely.”3

Our discussions with investors and other stakeholders have revealed a staggering level of frustration and loss of confidence in Lamb Weston’s Board and leadership. We summarize below the feedback from roughly

The extensive qualitative feedback provided by Lamb Weston shareholders participating in the study paints a similar picture:

- “It's among the worst managed companies in 2024… They've not been proactive, and so maybe it is time to go for the management team and start fresh and try to right the ship.”

- “So, yeah, there's not much for me to say on the board other than I think we need a whole new board to really drive value creation.”

- “They've gone nowhere fast and oftentimes a wholesale change at the top can be the difference maker.”

- “The board seems to be non-existent… Many of the investors see the C-suite as the biggest hindrance as well as the board. If they're gone, they will have a chance to regroup and then go towards improving their lot and then moving forward. Because right now they seem to be completely floundering.”

- “I think they are probably on the medal platform for worst run company of 2024. That is not a distinction I think you want, but it is one that they have earned, and by a wide margin from our perspective."

Put simply, after more than

JANA has a multi-decade reputation of working constructively with boards to drive change and improve performance, and our offer to work constructively with Lamb Weston continues to stand. We and our team of highly regarded industry executives remain prepared to immediately join the Board and help rehabilitate the Company and drive long-term value. If, however, the Board remains unwilling to adopt the significant changes needed to repair the Company, Lamb Weston should pursue a sale transaction.

Sincerely,

Scott Ostfeld

Managing Partner & Portfolio Manager

About JANA Partners

JANA Partners was founded in 2001 by Barry Rosenstein. JANA invests in undervalued public companies and engages with management teams and boards to unlock value for shareholders.

Disclaimer

JANA has not sought or obtained consent from any third party to use any statements or information indicated herein. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. JANA does not necessarily endorse third-party estimates or research, which are used in this letter solely for illustrative purposes.

_________________

1 “Lamb reported another in a series of truly bad prints (typically we might say “soft” or “underwhelming,” but euphemisms don’t suffice today).” (JP Morgan, 12/19/24); “[I]t’s difficult to have much confidence in guidance (management is in the midst of a miss-and-lower run, and LW has produced some of the worst day-of-print stock performances in the group’s history).” (JP Morgan, 1/7/25).

2 TD Cowen, 12/20/24.

3 Barclays, 12/20/24.

4 Based on the change in market cap from market close as of 12/29/23 to market close as of 1/24/25 per Bloomberg.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250127978504/en/

Media

Jonathan Gasthalter/Nathaniel Garnick

JANA@gasthalter.com

Investors

IR@janapartners.com

Source: JANA Partners