Lumen Technologies Completes TSA Transactions, Enabling Transformation Strategy

- None.

- None.

Insights

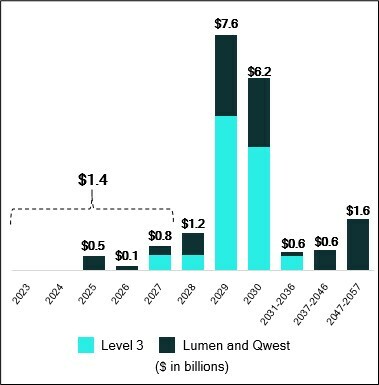

From a financial perspective, Lumen Technologies' restructuring of its debt through the TSA transactions indicates a proactive approach to managing its balance sheet. The high participation rates in the term loan transactions reflect a strong creditor endorsement, which often correlates with improved investor sentiment and could potentially lead to a more favorable credit rating. The reduction in near-term debt maturities from $2.1 billion to $600 million for 2025-2026 and from $9.5 billion to $800 million for 2027, considerably alleviates short-term liquidity pressures. This strategic move provides Lumen with a more manageable debt profile, allowing for operational flexibility and the opportunity to invest in growth initiatives.

However, the issuance of $1.325 billion in senior secured notes, while bolstering liquidity, adds to long-term obligations and could be a concern if the company's turnaround plan does not yield the expected results. The new revolving credit facility further enhances liquidity but must be monitored for its potential impact on the company's leverage ratios. Investors should consider the implications of these financial maneuvers on the company's future interest expenses and overall financial health.

The digital solutions sector is fiercely competitive and Lumen's pivot to a growth strategy is critical in maintaining its market position. Lumen's successful restructuring efforts may signal to competitors and customers alike that the company is stabilizing and preparing for aggressive market re-entry. The confidence expressed by creditors could serve as a positive signal to the market, potentially impacting Lumen's stock performance as investors react to the news of improved financial flexibility.

However, it is important to monitor the company's execution of its business transformation plans. The success of these plans is essential for long-term sustainability and will determine the effectiveness of the debt restructuring in the context of business growth. Market analysts should track Lumen's operational metrics and market share post-restructuring to gauge the true impact of these financial changes on the company's competitive stance.

The restructuring of debt by Lumen Technologies can be seen as a microcosmic reflection of broader economic trends, where companies are seeking to optimize their capital structures amid fluctuating interest rates and economic uncertainty. The reduction in near-term debt maturities can be economically advantageous, as it may reduce the risk of default during uncertain economic times and provide a buffer to withstand potential market downturns.

Furthermore, the shift in the company's debt maturity profile could indicate a strategic anticipation of future economic conditions, potentially allowing Lumen to capitalize on lower interest rates before any anticipated hikes. From an economic standpoint, the company's ability to secure such a substantial commitment from creditors suggests a level of confidence in the firm's fundamentals and the broader industry's growth prospects. Economists would be interested in evaluating the potential ripple effects of Lumen's strengthened liquidity position on its investment in innovation and employment within the tech sector.

Moves Forward as a Stronger Company with Increased Financial Flexibility

Primed to Execute on Business Transformation Plans

Lumen achieved participation in the TSA transactions of over

Following the closing of the TSA transactions, Lumen is in a strengthened liquidity position, including as a result of closing a new approximately

"This is a significant milestone that clears the runway for our transformation and signals confidence in our strategy and progress," said Kate Johnson, president and CEO of Lumen. "The transaction provides the time and capital to fuel our return to growth."

"This process over the last several months could not have been possible without the support of many stakeholders. We sincerely thank the Lumen team for their dedication and continued commitment to the Company during this process," said Chris Stansbury, Chief Financial Officer of Lumen. "We also thank our customers, vendors and partners for their unwavering trust in the business and our future."

Debt Maturity Profile Following Consummation of TSA Transactions

Lumen's near-term debt maturity profile has significantly improved, with the amount of maturities outstanding for 2025 to 2026 reduced from approximately

Additional information can be found in the Company's Current Report on Form 8-K, which will be filed with the SEC.

Guggenheim Securities, LLC served as financial advisor and Wachtell, Lipton, Rosen & Katz served as legal advisor to the Company.

About Lumen Technologies

Lumen connects the world. We are dedicated to furthering human progress through technology by connecting people, data, and applications – quickly, securely, and effortlessly. Everything we do at Lumen takes advantage of our network strength. From metro connectivity to long-haul data transport to our edge cloud, security, and managed service capabilities, we meet our customers' needs today and as they build for tomorrow.

Forward-Looking Statements

Except for historical and factual information, the matters set forth in this release and other of our oral or written statements identified by words such as "estimates," "expects," "anticipates," "believes," "plans," "intends," "will," and similar expressions are forward-looking statements as defined by the federal securities laws, and are subject to the "safe harbor" protections thereunder. These forward-looking statements are not guarantees of future results and are based on current expectations only, are inherently speculative, and are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Actual events and results may differ materially from those anticipated, estimated, projected or implied by us in those statements if one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect. Factors that could affect actual results include but are not limited to: our ability to achieve the expected benefits from the TSA; the effects of intense competition from a wide variety of competitive providers, including decreased demand for our more mature service offerings and increased pricing pressures; the effects of new, emerging or competing technologies, including those that could make our products less desirable or obsolete; our ability to successfully and timely attain our key operating imperatives, including simplifying and consolidating our network, simplifying and automating our service support systems, attaining our Quantum Fiber buildout goals, strengthening our relationships with customers and attaining projected cost savings; our ability to safeguard our network, and to avoid the adverse impact of cyber-attacks, security breaches, service outages, system failures, or similar events impacting our network or the availability and quality of our services; the effects of ongoing changes in the regulation of the communications industry, including the outcome of legislative, regulatory or judicial proceedings relating to content liability standards, intercarrier compensation, universal service, service standards, broadband deployment, data protection, privacy and net neutrality; our ability to generate cash flows sufficient to fund our financial commitments and objectives, including our capital expenditures, operating costs, debt repayments, taxes, pension contributions and other benefits payments; our ability to effectively retain and hire key personnel and to successfully negotiate collective bargaining agreements on reasonable terms without work stoppages; our ability to successfully adjust to changes in customer demand for our products and services, including increased demand for high-speed data transmission services; our ability to successfully maintain the quality and profitability of our existing product and service offerings, to introduce profitable new offerings on a timely and cost-effective basis and to transition customers from our legacy products to our newer offerings; our ability to successfully and timely implement our corporate strategies, including our deleveraging and buildout strategies; our ability to successfully and timely realize the anticipated benefits from the divestiture of our European, Middle Eastern and African business and our divestitures completed in 2022, and to successfully operate and transform our remaining business; changes in our operating plans, corporate strategies, or capital allocation plans, whether based upon changes in our cash flows, cash requirements, financial performance, financial position, market or regulatory conditions, or otherwise; the impact of any future material acquisitions or divestitures that we may transact; the negative impact of increases in the costs of our pension, healthcare, post-employment or other benefits, including those caused by changes in markets, interest rates, mortality rates, demographics or regulations; the potential negative impact of customer complaints, government investigations, security breaches or service outages impacting us or our industry; adverse changes in our access to credit markets on favorable terms, whether caused by changes in our financial position, lower credit ratings, unstable markets, debt covenant restrictions or otherwise; our ability to meet the terms and conditions of our debt obligations and covenants, including our ability to make transfers of cash in compliance therewith; the impact of any purported notice of default or notice of acceleration arising from alleged breach of covenants under our credit documents; our ability to maintain favorable relations with our security holders, key business partners, suppliers, vendors, landlords and financial institutions; our ability to timely obtain necessary hardware, software, equipment, services, governmental permits and other items on favorable terms; our ability to meet evolving environmental, social and governance ("ESG") expectations and benchmarks, and effectively communicate and implement our ESG strategies; the potential adverse effects arising out of allegations regarding the release of hazardous materials into the environment from network assets owned or operated by us or our predecessors, including any resulting governmental actions, removal costs, litigation, compliance costs or penalties; our ability to collect our receivables from, or continue to do business with, financially-troubled customers; our ability to continue to use or renew intellectual property used to conduct our operations; any adverse developments in legal or regulatory proceedings involving us; changes in tax, pension, healthcare or other laws or regulations, in governmental support programs, or in general government funding levels, including those arising from governmental programs promoting broadband development; our ability to use our net operating loss carryforwards in the amounts projected; the effects of changes in accounting policies, practices or assumptions, including changes that could potentially require additional future impairment charges; continuing uncertainties regarding the impact that COVID-19 and its aftermath could have on our business, operations, cash flows and corporate initiatives; the effects of adverse weather, terrorism, epidemics, pandemics, rioting, vandalism, societal unrest, or other natural or man-made disasters or disturbances; the potential adverse effects if our internal controls over financial reporting have weaknesses or deficiencies, or otherwise fail to operate as intended; the effects of changes in interest rates or inflation; the effects of more general factors such as changes in exchange rates, in operating costs, in public policy, in the views of financial analysts, or in general market, labor, economic or geopolitical conditions; and other risks referenced from time to time in our filings with the

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lumen-technologies-completes-tsa-transactions-enabling-transformation-strategy-302097110.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lumen-technologies-completes-tsa-transactions-enabling-transformation-strategy-302097110.html

SOURCE Lumen Technologies