60 Percent Cite Access to Fewer Resources as Reason to Spend Less Overall

More Than One-Third of Consumers Plan to Use Savings to Cover Holiday Spending

Nearly One-Third of Consumers Intend to Use One or More Credit Options to Finance Purchases

SAN FRANCISCO, Nov. 20, 2023 /PRNewswire/ -- LendingClub Corporation (NYSE: LC), the parent company of LendingClub Bank, America's leading digital marketplace bank, today released key findings from the 28th edition of the Reality Check: Paycheck-To-Paycheck research series, conducted in partnership with PYMNTS Intelligence. The Holiday Shopping Deep Dive Edition examines the financial lifestyles and spending choices of U.S. consumers going into the 2023 holiday shopping season. This edition draws on insights from a survey of 3,640 U.S. consumers conducted from Oct. 3 to Oct. 19 and an analysis of other economic data.

The Paycheck-to-Paycheck Landscape

As of October 2023, 60% of consumers lived paycheck to paycheck, unchanged from a year prior. Among income brackets, 76% of consumers earning less than $50,000 annually lived paycheck to paycheck as of October 2023, as did 65% of those earning between $50,000 and $100,000 and 42% of consumers earning more than $100,000.

While the share of consumers living paycheck to paycheck has remained relatively stable in 2023, gloomy perceptions about the economy continue to impact consumer sentiment, with many believing they are worse off now than they were in 2022. Overall, 38% of consumers consider themselves in poorer financial health relative to 2022, and 62% are very or extremely concerned about the economic outlook. Furthermore, a solid majority of Americans (58%) are still seeing inflation exceed growth in their paychecks.

Consumer Spend During the 2023 Holiday Season

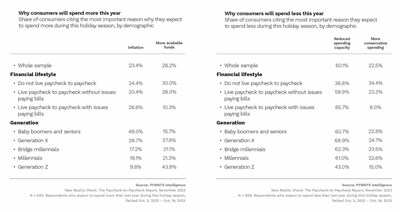

Even though consumers believe their financial health is worse than a year ago, 77% expect to shop during the 2023 holiday season, only slightly less than the 78% seen a year ago. As was the case in 2022, bridge millennials and millennials are the most likely to plan to shop this year, at 81% and 80% respectively, and more likely than the average shopper to say they will spend more this year than last year, at 27% and 31% respectively. In fact, 1 in 5 shoppers expect their holiday spending will increase, primarily because of higher prices. That said, many consumers expect to spend less overall during the holiday season for a variety of reasons, citing decreased spending capacity (60%) and more conservative spending (23%) as the chief deterrents.

Consumers Will Use Various Financing Options

The share of potential shoppers planning to use credit and the share of purchases expected to be financed are down across all demographics. While the research indicates that only 13% of holiday purchases are expected to be financed through a credit product, 32% of consumers expect to use one or more credit options. Credit cards take the lead among credit options for holiday shopping, at 27%, followed by buy now, pay later (BNPL), at 20%. Among generations, bridge millennials saw the biggest drop in both credit usage as well as the share of purchases they expect to finance — implying that, despite having access to financing, these consumers either intend to cut back on holiday spending or use other means to cover their holiday spending (like tapping into savings or borrowing from friends and family). Additionally, younger generations are almost twice as likely to cite BNPL usage than Generation X consumers or baby boomers and seniors.

Consumers are also more likely to use a combination of savings and credit rather than one or the other. More than one-third (37%) of consumers will tap into savings to finance holiday spending, with 21% expected to use less than half of their available funds and 16% prepared to use half or more of their savings to help with purchases. The share of consumers planning to use savings jumps to 53% among Generation Z consumers. Moreover, 43% of consumers expect to spend above their typical budgets in November and 60% expect to exceed their budgets in December.

"While consumers have found a way to manage through inflation, it's concerning that many plan to tap into savings, and even exceed their budgets, to finance their holiday purchases, which may leave them vulnerable to an unexpected emergency," said Alia Dudum, LendingClub's Money Expert. "Don't let the allure of instant gratification lead you deeper into credit card debt. Make a conscious choice to spend wisely, prioritize essentials, and create a budget that shields you from January's financial hangover, especially in a high interest rate environment."

To view the full report, visit: https://www.pymnts.com/study/reality-check-paycheck-to-paycheck-holiday-shopping-credit-financing/

Methodology

New Reality Check: The Paycheck-to-Paycheck Report, a PYMNTS Intelligence and LendingClub collaboration is based on a census-balanced survey of 3,640 U.S. consumers conducted from Oct. 3 to Oct. 19 as well as an analysis of other economic data. The data in this report is not intended to be a representation of LendingClub's core member base. The Paycheck-to-Paycheck series expands on existing data published by government agencies, such as the Federal Reserve and the Bureau of Labor Statistics, to provide a deep look into the core elements of American consumers' financial wellness: income, savings, debt and spending choices. Our sample was balanced to match the U.S. adult population in a set of key demographic variables: 51% of respondents identified as female, 33% were college-educated and 39% declared incomes of more than $100,000 per year.

About LendingClub

LendingClub Corporation (NYSE: LC) is the parent company of LendingClub Bank, National Association, Member FDIC. LendingClub Bank is the leading digital marketplace bank in the U.S., where members can access a broad range of financial products and services designed to help them pay less when borrowing and earn more when saving. Based on more than 150 billion cells of data and over $90 billion in loans, our advanced credit decisioning and machine-learning models are used across the customer lifecycle to expand seamless access to credit for our members, while generating compelling risk-adjusted returns for our loan investors. Since 2007, more than 4.7 million members have joined the Club to help reach their financial goals. For more information about LendingClub, visit https://www.lendingclub.com.

CONTACT:

For Investors: IR@lendingclub.com

Media Contact: Press@lendingclub.com

PYMNTS Contact: information@PYMNTS.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/77-percent-of-consumers-plan-to-participate-in-the-2023-holiday-shopping-season-301993013.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/77-percent-of-consumers-plan-to-participate-in-the-2023-holiday-shopping-season-301993013.html

SOURCE LendingClub Corporation

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/77-percent-of-consumers-plan-to-participate-in-the-2023-holiday-shopping-season-301993013.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/77-percent-of-consumers-plan-to-participate-in-the-2023-holiday-shopping-season-301993013.html