Lithium Argentina Announces Ganfeng Lithium Agrees to Acquire Interest in Pastos Grandes for $70M

- Ganfeng Lithium agrees to acquire $70 million in newly issued shares of PGCo, representing a 15% interest.

- Preparation of a regional development plan for the Pastos Grandes Basin and PPG is ongoing, expected to be finalized by the end of 2024.

- Technical collaboration with Ganfeng Lithium for direct lithium extraction technology at Pastos Grandes.

- Proceeds from the transaction will support development and operating activities in Argentina.

- Exploration of new customers and financing options to accelerate global lithium chemical supply chain development.

- Transaction expected to close in Q2 2024, subject to regulatory approvals.

- Fairness opinion from Cormark Securities Inc. deems the transaction fair to Lithium Argentina.

- Shareholders' Agreement with Ganfeng Lithium includes standstill provisions, consent rights, and potential future acquisition terms.

- None.

Insights

The acquisition of a 15% interest in Proyecto Pastos Grandes S.A. by Ganfeng Lithium for $70 million marks a significant investment in the lithium sector, particularly within the context of the growing global demand for electric vehicles and energy storage solutions. From a market research perspective, this deal has the potential to influence lithium supply dynamics. Given the strategic location of the Pastos Grandes project in Salta, Argentina, adjacent to other significant lithium projects, it may bolster regional lithium production capabilities. The collaboration on a regional development plan and the exploration of direct lithium extraction technology could position the Pastos Grandes Basin as a significant hub for lithium production, potentially impacting lithium prices and availability.

Furthermore, the transaction's impact on Lithium Americas' balance sheet is noteworthy. The infusion of capital is expected to strengthen the company's financial position, allowing for the advancement of its lithium projects. This could also enhance investor confidence in Lithium Americas' growth trajectory, possibly influencing its stock performance positively. However, the actual impact on the market will depend on the successful integration of the investment and the effectiveness of the technological collaboration between the companies.

From a financial analysis standpoint, the transaction between Lithium Americas and Ganfeng Lithium is significant due to its potential effect on Lithium Americas' capital structure and future cash flows. The $70 million investment not only bolsters the company's balance sheet but also provides necessary funds for the development and operational activities in Argentina. The transaction details, including the potential additional 1.6% interest based on an independent resource estimation, indicate a well-structured deal that aligns with industry norms of resource-based valuations.

The fairness opinion provided by Cormark Securities Inc. adds an additional layer of assurance regarding the transaction's financial prudence for Lithium Americas. Investors and stakeholders should note that the deal's completion is contingent upon regulatory approvals, which introduces an element of uncertainty. Nevertheless, if the transaction proceeds as planned, it could lead to a revaluation of Lithium Americas' assets and future earnings potential, which is an essential consideration for shareholders and potential investors.

The legal intricacies of the transaction between Lithium Americas and Ganfeng Lithium, specifically the Shareholders' Agreement, highlight several critical points for consideration. The standstill agreement until the end of 2024 prevents the sale of an interest in Pastos Grandes, thereby ensuring stability and a period for strategic planning and development. The enhanced consent rights and right of first refusal clauses in 2025 provide Ganfeng Lithium with significant influence over operational matters and potential transactions, reflecting a strategic partnership rather than a mere financial investment.

The right for Ganfeng Lithium to acquire up to a 50% interest in Pastos Grandes upon a change of control of the Company for an additional $330 million underscores the strategic value Ganfeng Lithium places on the project. This clause could deter potential takeover attempts of Lithium Americas or, conversely, make Ganfeng Lithium a gatekeeper for any future corporate control changes. The completion of the transaction is subject to regulatory approvals, which is a standard procedure in international deals of this nature, but it also serves as a reminder of the regulatory risks and timelines associated with such cross-border investments.

VANCOUVER, British Columbia, March 05, 2024 (GLOBE NEWSWIRE) -- Lithium Americas (Argentina) Corp. (TSX/NYSE: LAAC) (“Lithium Argentina” or the “Company”) is pleased to announce it and certain of its subsidiaries have executed a definitive agreement (the “Transaction”) with a subsidiary of Ganfeng Lithium Co. Ltd. (“Ganfeng Lithium”,) whereby Ganfeng Lithium agrees to acquire

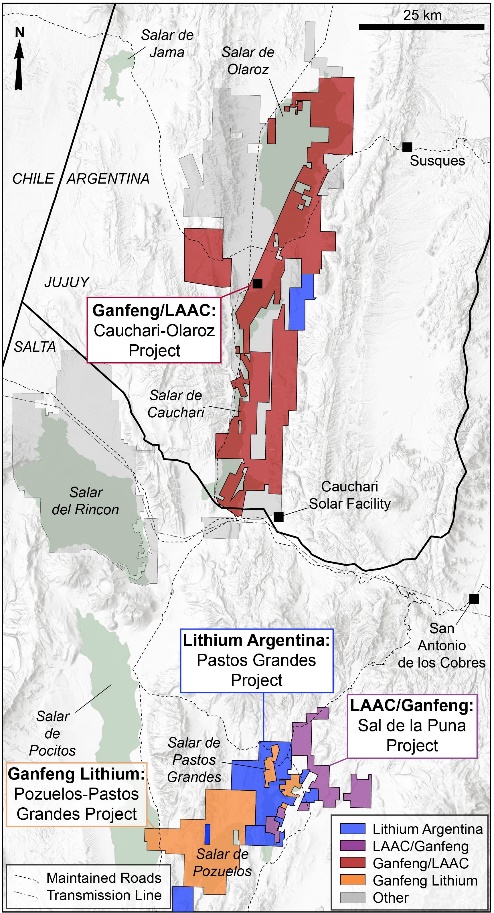

Pastos Grandes is an advanced stage lithium brine project acquired by the Company in early 2022 with the acquisition of Millennial Lithium Inc. The Project is in the same basin as the Sal de la Puna project (together, the “Pastos Grandes Basin”), adjacent to Ganfeng Lithium’s Pozuelos-Pastos Grandes project (“PPG”) and 100 km from the operating Caucharí-Olaroz project (“Caucharí-Olaroz”) jointly owned and operated by Lithium Argentina and Ganfeng Lithium.

HIGHLIGHTS

- Ganfeng Lithium agrees to acquire

$70M in newly issued shares of PGCo, which is expected to represent an approximate15% interest of PGCo - Ganfeng Lithium, with support of Lithium Argentina, to undertake preparation of a regional development plan for the Pastos Grandes Basin and PPG, expected to be finalized by the end of 2024

- Technical collaboration ongoing to explore benefits of Ganfeng Lithium’s direct lithium extraction (“DLE”) technology to complement the existing conventional solar evaporation process at Pastos Grandes

- Proceeds to strengthen the Company’s balance sheet and support development and operating activities in Argentina

- Offtake rights for PGCo remain uncommitted; Company is exploring opportunities to bring in new customers and financing to accelerate and support development of a global lithium chemical supply chain

- The Transaction is expected to close in Q2 2024

“The Transaction with Ganfeng Lithium demonstrates our long-term commitment to Salta and the sustainable development of Argentina’s lithium industry,” commented John Kanellitsas Executive Chairman, interim CEO and President. “While we continue to prioritize the ramp up at Caucharí-Olaroz, already among the largest lithium brine operations in Argentina, the Transaction further strengthens our balance sheet and enhances our growth plans by leveraging our existing teams and nearby operations.”

TRANSACTION DETAILS

Pursuant to the Transaction, a wholly-owned subsidiary of Ganfeng Lithium will subscribe for share capital of PGCo in consideration for an aggregate cash subscription price of no more than

In connection with the subscription, Lithium Argentina and Ganfeng Lithium will execute a shareholders agreement (the “Shareholders’ Agreement”) that, among other terms, provides for limited term rights and obligations as between the parties, including the following: (i) from the closing date until December 31, 2024, a standstill on the sale of an interest in Pastos Grandes; (ii) during the course of 2025, enhanced consent rights in favour of Ganfeng Lithium in respect of operational matters, as well as a right of first refusal in favour of Ganfeng Lithium over a sale of an interest in PGCo at the same valuation as that applicable to the Transaction (with the Company having a right of first refusal over a sale by Ganfeng Lithium of its interest); and (iii) from closing through to December 31, 2025, a right in favour of Ganfeng Lithium to acquire an aggregate

Completion of the Transaction is expected in Q2 2024 subject to satisfaction of certain conditions, including regulatory approvals of the People’s Republic of China and settlement of applicable transaction agreements.

PASTOS GRANDES PROJECT – REGIONAL MAP

FAIRNESS OPINION

Cormark Securities Inc. has provided a fairness opinion to the Board of Directors that, as of the date of such opinion and subject to the assumptions, limitations and qualifications set out in such opinion, and such other matters as Cormark Securities Inc. considered relevant, the Transaction is fair, from a financial point of view, to Lithium Argentina.

ABOUT LITHIUM ARGENTINA

Lithium Argentina is an emerging producer of lithium carbonate for use primarily in lithium-ion batteries and electric vehicles. The Company, in partnership with Ganfeng Lithium Co, Ltd., is ramping up production of the Caucharí-Olaroz lithium brine operation in Argentina and advancing development of additional lithium resources in the region.

The Company currently trades on the TSX and on the NYSE, under the ticker symbol “LAAC.”

For further information contact:

Investor Relations

Telephone: +54-11-52630616

Email: ir@lithium-argentina.com

Website: www.lithium-argentina.com

CURRENCY

All amounts are expressed in US dollars unless otherwise noted.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively referred to herein as “forward-looking information”). These statements relate to future events or the Company’s future performance. All statements, other than statements of historical fact, may be forward-looking information. Forward-looking information generally can be identified by the use of words such as “seek,” “anticipate,” “plan,” “continue,” “estimate,” “expect,” “may,” “will,” “project,” “predict,” “propose,” “potential,” “targeting,” “intend,” “could,” “might,” “should,” “believe” and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information.

In particular, this news release contains forward-looking information, including, without limitation, with respect to the following matters or the Company’s expectations relating to such matters: the Transaction; the expected completion the Transaction; the anticipated use of proceeds from the Transaction; the expected ownership interest by Ganfeng Lithium in PGCo as a result of the Transaction; the anticipated benefits of the Transaction; the rights to be provided to Ganfeng Lithium and the Company pursuant to the Transaction and the Shareholders’ Agreement; the ability to obtain regulatory approval for the Transaction; the ability of Ganfeng Lithium and the Company to meet the other closing conditions of the Transaction; and the preparation and completion of a regional development plan for the Pastos Grandes Basin and PPG.

Forward-looking information does not take into account the effect of transactions or other items announced or occurring after the statements are made. Forward-looking information is based upon a number of expectations and assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. With respect to forward-looking information listed above, the Company has made assumptions regarding, among other things: the ability of the Company and Ganfeng Lithium to obtain all regulatory approvals of the Transaction; the ability of the Company and Ganfeng Lithium to meet all conditions precedent to complete of the Transaction; the ability the Company and Ganfeng Lithium to prepare and complete the regional development plan for the Pastos Grandes Basin and PPG; the Company’s ability to operate in a safe and effective manner; uncertainties relating to receiving and maintaining mining, exploration, environmental and other permits or approvals in Argentina; demand for lithium, including that such demand is supported by growth in the electric vehicle market; the impact of increasing competition in the lithium business, and the Company’s competitive position in the industry; general economic conditions; the stable and supportive legislative, regulatory and community environment in the jurisdictions where the Company operates; stability and inflation of the Argentine peso, including any foreign exchange or capital controls which may be enacted in respect thereof, and the effect of current or any additional regulations on the Company’s operations; the impact of unknown financial contingencies, including litigation costs, on the Company’s operations; gains or losses, in each case, if any, from short-term investments in Argentine bonds and equities; estimates of and unpredictable changes to the market prices for lithium products; development and construction costs for the Company’s projects, and costs for any additional exploration work at the projects; uncertainties inherent to estimates of Mineral Resources and Mineral Reserves, including whether Mineral Resources not included in Mineral Reserves will be further developed into Mineral Reserves; reliability of technical data; anticipated timing and results of exploration, development and construction activities; the Company’s ability to obtain additional financing on satisfactory terms or at all; the ability to develop and achieve production at any of the Company’s mineral exploration and development properties; the impact of inflationary and other conditions on the Company’s business and global mark; and accuracy of development budget and construction estimates.

Although the Company believes that the assumptions and expectations reflected in such forward-looking information are reasonable, the Company can give no assurance that these assumptions and expectations will prove to be correct. Since forward-looking information inherently involves risks and uncertainties, undue reliance should not be placed on such information. The Company’s actual results could differ materially from those anticipated in any forward-looking information as a result of risk factors, including, without limitation, the risk that the Transaction will not be completed as contemplated, or at all; risk that the proceeds of the Transaction will not be used as contemplated; risk that the benefits of the Transaction will not be realized as anticipated, or at all; risk that the Company and Ganfeng Lithium will not be able to prepare and complete a regional development plan for the Pastos Grandes Basin and PPG as contemplated, or at all; and other risks factors contained in the Company’s latest annual information form (“AIF”), management information circular, management’s discussion and analysis and other continuous disclosure documents (collectively, “Company Disclosure Documents”), all of which are available on SEDAR+.

All forward-looking information contained in this news release is expressly qualified by the risk factors set out in the Company Disclosure Documents. Such risk factors are not exhaustive. The Company does not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law. All forward-looking information contained in this news release is expressly qualified in its entirety by this cautionary statement. Additional information about the above-noted assumptions, risks and uncertainties is contained in the Company Disclosure Documents, all of which are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e83dde6a-f15c-4c2b-89b0-192fc52e5941

https://www.globenewswire.com/NewsRoom/AttachmentNg/26ff505e-7b4c-4b5c-acee-307340f57b7c