Kohl’s Sends Letter to Shareholders Highlighting Board Leadership and Robust Process

- Kohl’s Board has overseen a fundamental transformation to accelerate growth and profitability

- Kohl’s Board is running a robust and intentional process to evaluate interest from multiple parties

- Macellum’s slate lacks the right skills and experience - six of ten nominees have never served on a public company board

- Macellum presents hollow agenda and has offered no value-enhancing ideas

- Kohl’s urges shareholders to VOTE FOR ALL 13 of the Company’s highly qualified Directors on the BLUE Proxy Card today

- For more information, investors can visit www.KohlsMomentum.com

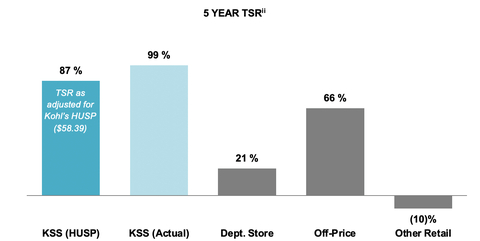

Kohl’s recent performance relative to peers can be objectively assessed using the hypothetical undisturbed share price (HUSP), which adjusts for stock price increases associated with media coverage of expressions of interest to buy the Company. This methodology assumes that from the unaffected date, Kohl’s stock price would have likely traded in-line with its direct department store peers. (Graphic: Business Wire)

The full text of the letter to shareholders follows.

***

PROTECT THE VALUE OF YOUR INVESTMENT IN KOHL’S – REJECT MACELLUM’S EMPTY AGENDA AND VOTE THE BLUE PROXY CARD TODAY FOR ALL OF KOHL’S HIGHLY QUALIFIED DIRECTOR NOMINEES

Dear Fellow Shareholder,

Your Board has the skills necessary to oversee Kohl’s strategy while exploring any potential value-maximizing opportunities. Comprised of 13 independent directors and our CEO,1 your Board has industry-leading experience in areas critical to our growth, including retail, e-commerce, and technology, as well as robust financial and M&A expertise. Your Board is fully engaged and will continue to take action to maximize value for all shareholders.

The Kohl’s Board is taking the right steps to maximize shareholder value.

Overseeing the Company’s value creation strategy: Your Board, working closely with Kohl’s management team, has acted decisively to put the Company on a new trajectory for improved growth and accelerated profitability. Since announcing our new strategy in

Running a robust and intentional process: We are committed to testing and measuring our strategy against alternatives. In January, the Board and its

Refreshing the Board with the right skills and experience: As Kohl’s strategy has evolved, the Board has proactively added the right capabilities and skill sets to accelerate Kohl’s transformation into the most trusted retailer of choice for the Active and Casual lifestyle. The Board has added six new independent directors in three years, including the three directors who joined Kohl’s Board last year as part of the Company’s settlement with Macellum, the hedge fund now seeking to take control of Kohl’s. Our directors bring highly relevant experience from top roles at leading retail companies such as lululemon, Walmart,

Macellum’s Campaign: An Empty Agenda

Macellum is attempting to take control of your Board with an inexperienced, unqualified slate. Six of ten nominees have never served on a public company board, and none have served on a retail company board of comparable size to Kohl’s. In addition, Macellum is promoting an ever-changing narrative, misinformed claims, and value-destructive proposals, all of which reveal a reckless and short-term approach that is not in the interest of driving long-term, sustainable value.

Macellum has offered virtually no new ideas; the few ideas they have presented are short-term focused and likely to destroy significant value: Macellum has presented no value-enhancing proposals. The sale leasebacks that they are demanding are an inefficient source of financing that would negatively impact margins by adding unnecessary rent expenses in perpetuity and risk Kohl’s investment-grade rating. While Kohl’s utilized sale leaseback transactions in

Macellum’s campaign is riddled with contradictions: Macellum has repeatedly contradicted itself in its public attacks on Kohl’s. Examples include:

-

Macellum criticized Kohl’s

Board for rejecting a$64 $100 - Macellum called Kohl’s shareholder rights plan an entrenchment mechanism while publicly acknowledging it is a “stop, look, and listen device.”

- Macellum praised the omnichannel approach as the future of the industry only months before calling on Kohl’s to spin-off its e-commerce business.

Macellum appears to be advocating for a quick sale of Kohl’s at any price: Macellum’s push for a hasty sale at any price reveals a short-term approach that is not in the best interest of Kohl’s shareholders. Macellum has repeatedly criticized Kohl’s for rejecting an offer to acquire the Company at

Macellum continues to make false and disruptive statements about the Board’s engagement with bidders: Macellum’s reckless and baseless commentary on your Board’s M&A process is particularly concerning. Macellum is not a party to the process, yet they continue to make false statements that have the potential to distract bidders.

Macellum’s criticisms of Kohl’s are ill-informed: Macellum has called 2021 a “lost year” for Kohl’s, despite the Company achieving record EPS. Additionally, Macellum seeks to mislead investors by focusing on Kohl’s stock performance on the day of its recent investor day that corresponded with a global market decline driven by heightened concerns of war in

Macellum “day traded” Kohl’s options, netting tens of millions in profits: As the graph below shows, Macellum bought call options representing 2.5 million shares of Kohl’s common stock in the two weeks before Acacia's unsolicited expression of interest was publicly reported. In the following trading days, Macellum sold most of these options, all while stating that Kohl’s was worth “at least

Several of Macellum’s nominees are not truly independent given their close ties to the hedge fund’s founding partner, who is also on the slate: Four of Macellum’s nine nominees have close professional ties to Macellum’s Founding Partner

The choice is clear: Re-elect the Kohl’s Board, which has the right skills and expertise to drive our strategy forward while evaluating any value-creating opportunities, or elect

Your Board is committed to protecting shareholders’ interests and taking proactive measures to maximize long-term value. Macellum’s contradictory and misinformed claims, short-term proposals, and unqualified director slate with close ties to the hedge fund, by contrast, make clear the stakes in this director election.

VOTE THE BLUE PROXY CARD TODAY FOR ALL OF KOHL’S HIGHLY QUALIFIED DIRECTOR NOMINEES

VISIT WWW.KOHLSMOMENTUM.COM FOR MORE INFORMATION

YOUR VOTE IS IMPORTANT!

Please refer to the enclosed BLUE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the BLUE proxy card and return it in the postage-paid envelope provided.

If you have any questions, or need assistance in voting your shares, please call our proxy solicitor:

INNISFREE M&A INCORPORATED TOLL-FREE, at 1-877-687-1874 BANKS AND BROKERS MAY CALL COLLECT, at 1-212-750-5833

|

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the

About Kohl's

Kohl’s (NYSE: KSS) is a leading omnichannel retailer. With more than 1,100 stores in 49 states and the online convenience of Kohls.com and the Kohl's App, Kohl's offers amazing national and exclusive brands at incredible savings for families nationwide. Kohl’s is uniquely positioned to deliver against its strategy and its vision to be the most trusted retailer of choice for the active and casual lifestyle. Kohl’s is committed to progress in its diversity and inclusion pledges, and the company's environmental, social and corporate governance (ESG) stewardship. For a list of store locations or to shop online, visit Kohls.com. For more information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com or follow @KohlsNews on Twitter.

1 |

13 directors are standing for reelection |

2 |

Thomson Eikon estimates as of |

3 |

CapitalIQ & IBES Estimates as of |

4 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20220331005422/en/

Investor Relations:

Media:

Source: Kohl's