Kore Mining Announces Results from PEA - US$ 263M NPV5% with IRR of 40% Using US $1,600 Gold at Long Valley Gold Deposit

KORE Mining Ltd. (OTCQX: KOREF) announced a positive Preliminary Economic Assessment (PEA) for its 100% owned Long Valley Gold Deposit in California, revealing strong economic prospects. The PEA indicates an estimated US$ 263 million NPV5% post-tax, with a 40% IRR at a gold price of US$ 1,600 per ounce. It forecasts production of 100,000 ounces of gold annually over seven years at an all-in sustaining cost of US$ 732 per ounce. Additionally, the project has significant potential upside from unexplored targets and compliance with stringent California regulations.

- US$ 263 million NPV5% post-tax at US$ 1,600 per ounce gold.

- 40% IRR at US$ 1,600 per ounce gold price.

- Projected production of 100,000 ounces of gold annually over 7 years.

- Low AISC of US$ 732 per ounce.

- Significant upside potential from additional exploration targets.

- Compliance with California's stringent environmental and reclamation standards.

- The PEA is preliminary and based on inferred mineral resources considered speculative.

- There is no certainty that the PEA's projections will be realized, as economic viability is not demonstrated.

Shallow, Open Pit, Heap Leach Operation with Nearby Infrastructure Models as Low Cost ~100,000 per annum Gold Production

VANCOUVER, BC, Sept. 15, 2020 /PRNewswire/ - KORE Mining Ltd. (TSXV: KORE) (OTCQX: KOREF) ("KORE" or the "Company") is pleased to announce a positive Preliminary Economic Assessment ("PEA") for the Company's

LONG VALLEY PROJECT PEA HIGHLIGHTS:

- Robust economics: US

$ 263 million NPV5% post-tax with40% IRR at US$ 1,600 per ounce gold - 100,000 ounces gold per year over 7 years at AISC of US

$ 732 per ounce - Technically simple: shallow open pit, heap leach with nearby infrastructure

- Significant leverage to gold: US

$ 396 million NPV5% at recent spot US$ 1,900 per ounce gold - Unmodelled silver potential from metallurgical test-work

- Shallow oxide and sulphide feeder exploration potential to further enhance project

Watch a video (50 seconds) of Scott Trebilcock, KORE's CEO, summarizing the highlights of the Long Valley PEA – click here. Refer to the Long Valley PEA Summary infographic in Figure 1.

KORE's CEO Scott Trebilcock stated: "The Long Valley PEA generated an NPV

Mr. Trebilcock continued, " The Long Valley PEA is a key milestone towards KORE's becoming a significant North American producer envisioning production of 250,000 ounces of gold a year from our US projects."

KORE's COO Marc Leduc added: "The mine plan at Long Valley complies with California's stringent reclamation and environmental laws while delivering skilled jobs and long-term regional economic development. KORE's next step is to grow Long Valley by drilling oxide and sulphide targets while further defining silver potential."

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

PEA SUMMARY

The PEA was prepared in accordance with National Instrument 43-101 ("NI 43-101") by Global Resource Engineering (Denver) ("GRE") - Terre Lane, RMSME MMSAQP, Todd Harvey, PhD, RMSME in conjunction with a revised resource estimate prepared by Mine Development Associates and authored by Neil Prenn, PE. The team was led by Marc Leduc, P.Eng. the COO of KORE Mining. The Company plans to file the PEA on SEDAR at www.sedar.com within 45 days in accordance with NI 43-101.

This news release contains information from a preliminary economic assessment, which is a conceptual study, and other forward-looking information about potential future results and events. Please refer to the cautionary statements in the footnotes below and the Cautionary Statements located at the end of this news release, which include associated assumptions, risks, uncertainties and other factors.

Unless otherwise stated, all dollar figures are in United States dollars ("$") and masses are in short tons.

Economics | Pre-Tax | Post-Tax | |

Net present value (NPV | C$ millions | ||

Net present value (NPV | US$ millions | ||

Internal rate of return (IRR) | % | ||

Payback (undiscounted) | Years | 2.0 | 2.3 |

LOM avg. annual cash flow after tax & capital | US$ millions | ||

LOM cumulative cash flow (undiscounted) | US$ millions | ||

Gold price assumption | US$ per ounce | ||

Mine life | Years | 7 | |

Average annual mining rate | million tons/yr | 18.5 | |

Average annual gold production | thousand ounces/yr | 100 | |

Total LOM recovered gold | thousand ounces | 717 | |

Initial capital costs | US$ millions | ||

Life-of-mine ("LOM") calculation and "Mine Life" is defined as the duration of mining operations, 7 years. There are additional years of site work for residual leaching, washing, back-filling and reclamation modelled.

GOLD PRICE SENSITIVITIES

The following table demonstrates the post-tax sensitivities of NPV and IRR to gold price per ounce. The base case, highlighted in the table below, assumes US

Economic Sensitivities to Gold Prices (post-tax) | ||

Per ounce of gold | (NPV | IRR% |

US | US | |

US | US | |

US | US | |

US | US | |

US | US | |

US | US | |

OPPORTUNITIES

The PEA outlined a number of initiatives that may enhance the Project including:

- Assaying silver in all future drill programs to add silver into the resources;

- Conducting metallurgical tests to establish optimal crush size and cement addition;

- Performing test work on very low-grade samples to determine viability of run-of-mine leaching;

- Reviewing contract mining to reduce initial capital; and

- Drilling for more oxide resources and deep sulfides to look for high-grade feeder zones.

NEXT STEPS

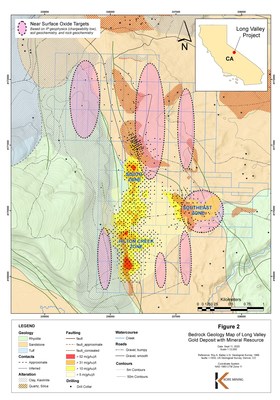

This PEA demonstrates the robust nature of the current Long Valley mineralization. However, there is a clear opportunity to grow shallow oxide mineralization as the mineralization remains open in all directions and on a separate parallel structure. Additional mineralization could extend mine life, reduce capital intensity and generate higher project economic returns. A summary of oxide expansion targets is included in Figure 2.

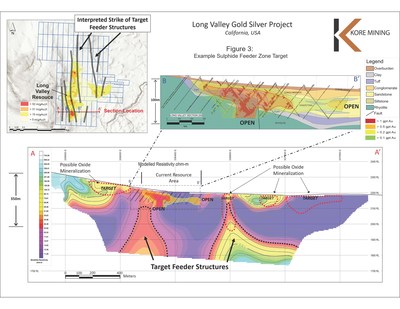

Additionally, as a fully intact epithermal deposit with a large at surface footprint, Long Valley has the potential for high-grade sulphides in the underlying feeder structures. Discovering high-grade sulphides would open up additional development pathways for the Project, such as underground mining and milling of mineralization. A summary of sulphide expansion targets is included in Figure 3.

KORE plans to drill-test the highest priority oxide and sulphide targets. KORE is currently permitting drill pads with our regulator the US Forest Service ("USFS"). Drilling is planned for H1 2021, subject to USFS permitting timelines.

Details of the Long Valley exploration targets are in KORE news releases dated January 30, 2020 and March 24, 2020.

LONG VALLEY PEA DETAILS

GRE notes that the Long Valley Project has an abundance of drill data as a result of the exploration completed in the 1980s and 1990s. The Project also has metallurgical sampling and testing from previous owners, reviewed by GRE, to support the initial engineering design. This data will act as an important background and aid in the design of future work on the project.

MINING & PROCESSING

The PEA presents an open-pit, heap leach scenario where oxide, transition and sulphide ore is stacked on the leach pads by conveyors after two stages of crushing and agglomeration. The conveyor system is also used at the end of the mine life to backfill the final pits and reclaim the site to California's stringent standards. In the design process, the engineering team also looked at several other scenarios:

- Silver production; a Merrill- Crowe precious metal recovery circuit is included in the project design to recover both gold and silver. Silver is NOT quantified in the resource or PEA as it was not assayed regularly in historic drilling but was seen in all of the previous metallurgical test work.

- Smaller, oxide only mine plan that had lower stripping ratio, lower capital and operating costs but yielded less ounces. KORE ultimately selected the mine plan with the most ounces recovered as those ounces would likely be mined at current metal prices.

Mining Plan and Processing Summary | ||

Mine life | years | 7 |

Mining rate | average tons per day | 50,600 |

Strip ratio | waste: mineralization | 1.4 |

Total tonnage mined | million tons | 130.7 |

Total mineralized material mined | million tons | 54.2 |

Heap leach stacking rate | average tons per day | 21,100 |

Average LOM grade | gram per metric tonne | 0.671 |

Average LOM recovery | % | |

A detailed mine plan by year is included in Table 1 at the end of this news release.

OPERATING COSTS

Mining costs for owner operated mining, processing and other costs were developed from a mix of first-principle engineering and benchmarked to the many ROM heap leach operations in California and nearby Nevada. The Long Valley Project is located near a large skilled labour pool and has local access to road and power infrastructure. The Project has several options for water locally with potential surface and ground water sources.

Operating Costs (LOM average) (1) | ||

Mining costs (per ton mined) | US$/st mined | |

Mining costs | US$/st processed | |

Processing costs | US$/st processed | |

G&A costs | US$/st processed | |

Total site operating costs | US$/st processed | |

Cash Costs* | ||

Cash costs (LOM)* | US$/oz | |

(1) Not including post-production reclamation and backfilling. See LOM description above. |

The assumed truck diesel fuel price in the PEA is US

INITIAL PRE-PRODUCTION AND SUSTAINING CAPITAL COSTS

Initial capital costs in the PEA are US

Pre-Production and Sustaining Capital Costs (US$ millions) | |

Mining and mine infrastructure | |

Heap leach pads and plant | |

Infrastructure and G&A | |

Working capital | |

Contingency ( | |

Pre-production mining | |

Total Pre-Production Cost | |

LOM sustaining capital | |

Closure incl. backfill (1) | |

(1) Closure cost includes final backfilling of the open pit and site reclamation to California's stringent standards. The cost includes US |

ALL-IN-SUSTAINING-COST*

All-in-sustaining costs ("AISC")* are competitive with peer projects and in the second quartile when compared to the World Gold Council AISC cost metric. Long Valley's AISC* is built up as follows:

AISC* per ounce (US$ millions) | |

Operating cost (1) | |

Royalties (2) | |

Sustaining capital | |

Closure | |

Total AISC* | |

(1) Operating costs includes US |

(2) Royalties consist of: (a) |

UPDATED MINERAL RESOURCE ESTIMATE

Long Valley is well drilled with a total of 896 holes, the majority being completed by reverse circulation with lesser core, rotary and air track from 1988-1996. The mineral resource model, as presented within KORE's December 18, 2019 Technical Report, has been updated using a more detailed geologic model which has allowed for the assigning of lithology-specific density values. In addition, the reported resource estimate has been updated using revised optimization parameters for the constraining pit shell. The updated estimate, effective September 15, 2020, was prepared by Mine Development Associates and the resource block model derived by Mine Development Associates was used in the development of this PEA. The current Mineral Resources are shown in Imperial and Metric units in the tables below. The revised pit-shell parameters, including the use of a higher gold price, US

Long Valley Mineral Resource Estimate – Imperial Units (as at September 15, 2020)

Classification | Cut-Off (oz / ton) | Quantity ('000 tons) | Grade Gold (oz / ton) | Contained |

Indicated | ||||

Oxide | 0.005 | 35,276 | 0.018 | 635 |

Transition | 0.006 | 4,026 | 0.014 | 56 |

Sulphide | 0.006 | 30,914 | 0.017 | 526 |

Total Indicated | 70,216 | 0.017 | 1,217 | |

Inferred | ||||

Oxide | 0.005 | 8,997 | 0.020 | 180 |

Transition | 0.006 | 1,277 | 0.016 | 20 |

Sulphide | 0.006 | 14,033 | 0.018 | 253 |

Total Inferred | 24,307 | 0.019 | 456 | |

Long Valley Mineral Resource Estimate – Metric Units (as at September 15, 2020)

Classification | Cut-Off (g / tonne) | Quantity ('000 tonnes) | Grade Gold (g / tonne) | Contained |

Indicated | ||||

Oxide | 0.17 | 32,002 | 0.62 | 635 |

Transition | 0.21 | 3,653 | 0.48 | 56 |

Sulphide | 0.21 | 28,045 | 0.58 | 526 |

Total Indicated | 63,699 | 0.58 | 1,217 | |

Inferred | ||||

Oxide | 0.17 | 8,162 | 0.69 | 180 |

Transition | 0.21 | 1,159 | 0.55 | 20 |

Sulphide | 0.21 | 12,731 | 0.62 | 253 |

Total Inferred | 22,052 | 0.65 | 456 | |

- Numbers may not add or multiply accurately due to rounding.

- Mineral Resources do not have demonstrated economic viability.

- CIM Definition and Standards were followed for the Mineral Resource estimates.

- The Mineral Resource estimate was prepared by Neil Prenn P.E., who is an independent consultant and Qualified Person for the purpose of NI 43-101.

- Mineral Resources are reported at a 0.005oz Au/ton cut-off grade for oxide material to be processed using heap leach methods and 0.006oz Au/ton cut-off grade for transition and sulfide material to be processed by milling methods.

- Mineral Resources are contained within a US

$1,800 per ounce optimized pit. Other pit optimization parameters are: - Pit Slope: 45 degrees

- Mining: US

$1.80 / ton mined - Crushing: US

$1.40 / ton processed - Heap Leach: US

$1.80 / ton processed - Sulfide Mill: US

$10.0 / ton processed - G&A: US

$0.70 / ton processed - Refining: US

$5 / oz Au produced - Recovery (Oxide):

80% heap recovery - Recovery (Transition):

90% mill recovery

QUALIFIED PERSONS/QUALITY ASSURANCE

The Preliminary Economic Assessment was prepared by GRE with Terre Lane, PE being the Qualified Person in charge of its preparation and who is independent of KORE. The mineral resource portion of the PEA was prepared by Neil Prenn, P.E. of Mine Development Associates and who is independent of KORE. With regards to technical matters in this press release Marc Leduc, P.Eng. is the Qualified Person within the meaning of NI 43-101 and has reviewed and validated that the information in this press release is consistent with that provided by the Qualified Persons responsible for the PEA.

Further information about the PEA referenced in this news release, including information in respect of data verification, key assumptions, parameters, risks and other factors, can be found in the NI 43-101 technical report for the Long Valley Gold Deposit that the Company intends to file on SEDAR (www.sedar.com) under KORE's profile and on the Company's website (www.koremining.com) within the next 45 days from the date of this news release.

ALTERNATIVE PERFORMANCE MEASURES (NON-IFRS MEASURES)

Items marked with a * in this news release are alternative performance measures. Alternative performance measures are furnished to provide additional information. These non-IFRS performance measures are included in this news release because the Company believes these statistics are key performance measures that provide investors, analysts and other stakeholders with additional information to understand the costs associated with the Project. These performance measures do not have a standard meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

"Cash Costs " and "Cash Costs (LOM)" are a non-IFRS measure reported by KORE on an ounces of gold sold basis. Cash costs include mining, processing, refining, general and administration costs and royalties but excludes depreciation, reclamation, income taxes, capital and exploration costs for the life of the mine, defined above as 7 years.

"All-In-Sustaining-Costs" ("ASIC") is a non-IFRS measure reported by KORE on a per ounce of gold sold basis that includes all cash costs noted above (mining, processing refining, general and administration and royalties), as well as sustaining capital and closure costs, but excludes depreciation, capital costs and income taxes.

ABOUT LONG VALLEY GOLD DEPOSIT

Long Valley is

The Long Valley deposit is an intact low sulphidation epithermal gold/silver deposit, hosted within a melange of fine to coarse volcanogenic sedimentary lithologies. Mineralization at Long Valley has developed due to a combination of deep-rooted fault structures and a resurgence of rhyolite within an active caldera. The Hilton Creek Fault structure transects and served as a fluid conduit for interaction with the underlying hydrothermal system, while the rhyolite resurgence caused brittle fracturing of sediments and created voids or traps for mineralization and gold deposition. The combination of these factors yields strongly altered kaolin and quartz-hematite zones that are the primary host for gold mineralization.

The Hilton Creek Fault remains underexplored on-strike north and south and several parallel structures have been defined using geophysics, the eastern one hosting some of the current mineral resource and the western one being unexplored. Long Valley is therefore open to new oxide discoveries in all directions. More details on the deposit geology and exploration potential can be found in KORE's January 30, 2020 and March 24, 2020 news releases.

ABOUT KORE

KORE is

Further information on the Long Valley project and KORE can be found on the Company's website at www.koremining.com or by contacting us as info@koremining.com or by telephone at (888) 407-5450.

On behalf of KORE Mining Ltd

"Scott Trebilcock"

Chief Executive Officer

(888) 407-5450

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking statements relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects", "intends", "indicates" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the future plans and objectives of the Company are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to: the results of the PEA, including future Project opportunities, future operating and capital costs, closure costs, AISC, the projected NPV, IRR, timelines, permit timelines, and the ability to obtain the requisite permits, economics and associated returns of the Long Valley Project, the technical viability of the Long Valley Project, the market and future price of and demand for gold, the environmental impact of the Long Valley Project, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government. Such forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information.

Such factors include, among others: risks related to exploration and development activities at the Company's projects, and factors relating to whether or not mineralization extraction will be commercially viable; risks related to mining operations and the hazards and risks normally encountered in the exploration, development and production of minerals, such as unusual and unexpected geological formations, rock falls, seismic activity, flooding and other conditions involved in the extraction and removal of materials; uncertainties regarding regulatory matters, including obtaining permits and complying with laws and regulations governing exploration, development, production, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, site safety and other matters, and the potential for existing laws and regulations to be amended or more stringently implemented by the relevant authorities; uncertainties regarding estimating mineral resources, which estimates may require revision (either up or down) based on actual production experience; risks relating to fluctuating metals prices and the ability to operate the Company's projects at a profit in the event of declining metals prices and the need to reassess feasibility of a particular project that estimated resources will be recovered or that they will be recovered at the rates estimated; risks related to title to the Company's properties, including the risk that the Company's title may be challenged or impugned by third parties; the ability of the Company to access necessary resources, including mining equipment and crews, on a timely basis and at reasonable cost; competition within the mining industry for the discovery and acquisition of properties from other mining companies, many of which have greater financial, technical and other resources than the Company, for, among other things, the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel; access to suitable infrastructure, such as roads, energy and water supplies in the vicinity of the Company's properties; and risks related to the stage of the Company's development, including risks relating to limited financial resources, limited availability of additional financing and potential dilution to existing shareholders; reliance on its management and key personnel; inability to obtain adequate or any insurance; exposure to litigation or similar claims; currently unprofitable operations; risks regarding the ability of the Company and its management to manage growth; and potential conflicts of interest.

In addition to the above summary, additional risks and uncertainties are described in the "Risks" section of the Company's management discussion and analysis for the year ended December 31, 2019 prepared as of April 27, 2020 available under the Company's issuer profile on www.sedar.com.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

There is no certainty that all or any part of the mineral resource will be converted into mineral reserve. It is uncertain if further exploration will allow improving the classification of the Indicated or Inferred mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Cautionary Note Regarding Mineral Resource Estimates: Information regarding mineral resource estimates has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States Securities and Exchange Commission ("SEC") Industry Guide 7. In October 2018, the SEC approved final rules requiring comprehensive and detailed disclosure requirements for issuers with material mining operations. The provisions in Industry Guide 7 and Item 102 of Regulation S-K, have been replaced with a new subpart 1300 of Regulation S-K under the United States Securities Act and will become mandatory for SEC registrants after January 1, 2021. The changes adopted are intended to align the SEC's disclosure requirements more closely with global standards as embodied by the Committee for Mineral Reserves International Reporting Standards (CRIRSCO), including Canada's NI 43-101 and CIM Definition Standards. Under the new SEC rules, SEC registrants will be permitted to disclose "mineral resources" even though they reflect a lower level of certainty than mineral reserves. Additionally, under the New Rules, mineral resources must be classified as "measured", "indicated", or "inferred", terms which are defined in and required to be disclosed by NI 43-101 for Canadian issuers and are not recognized under SEC Industry Guide 7. An "Inferred Mineral Resource" has a lower level of confidence than that applying to an "Indicated Mineral Resource" and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of "Inferred Mineral Resources" could be upgraded to "Indicated Mineral Resources" with continued exploration. Accordingly, the mineral resource estimates and related information may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal laws and the rules and regulations thereunder, including SEC Industry Guide 7.

TABLE 1 – DETAILED LONG VALLEY PEA MINE PLAN

Years | |||||||||||

LOM Total | -1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |||

Ore (ton) | 54,155,978 | 118,479 | 6,380,750 | 8,030,000 | 8,042,969 | 8,030,000 | 8,028,378 | 8,108,024 | 7,417,377 | ||

Waste Tons (ton) | 76,500,818 | 1,168,143 | 11,596,382 | 5,561,176 | 11,838,715 | 7,236,130 | 14,762,720 | 14,052,046 | 10,285,506 | ||

Stripping Ratio | 1.4 | - | 1.8 | 0.7 | 1.5 | 0.9 | 1.8 | 1.7 | 1.4 | ||

Mined Ore Grade (g/t) | 0.671 | 0.60 | 0.66 | 0.67 | 0.67 | 0.66 | 0.71 | 0.81 | 0.50 | ||

Contained Gold (troy oz) | 1,059,850 | 2,070 | 122,226 | 156,679 | 157,822 | 154,993 | 167,045 | 191,328 | 107,688 | ||

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/kore-mining-announces-results-from-pea---us-263m-npv5-with-irr-of-40-using-us-1-600-gold-at-long-valley-gold-deposit-301130756.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/kore-mining-announces-results-from-pea---us-263m-npv5-with-irr-of-40-using-us-1-600-gold-at-long-valley-gold-deposit-301130756.html

SOURCE Kore Mining

FAQ

What are the key findings of KORE Mining's Long Valley Gold Deposit PEA?

What is the projected cost of production for the Long Valley project?

What are the future plans for KORE Mining following the PEA?

What environmental standards does KORE Mining comply with?