K92 Mining Announces Strong Q1 Production Results – Production of 47,817 oz AuEq, Significantly Exceeding Budget and Record Monthly Development

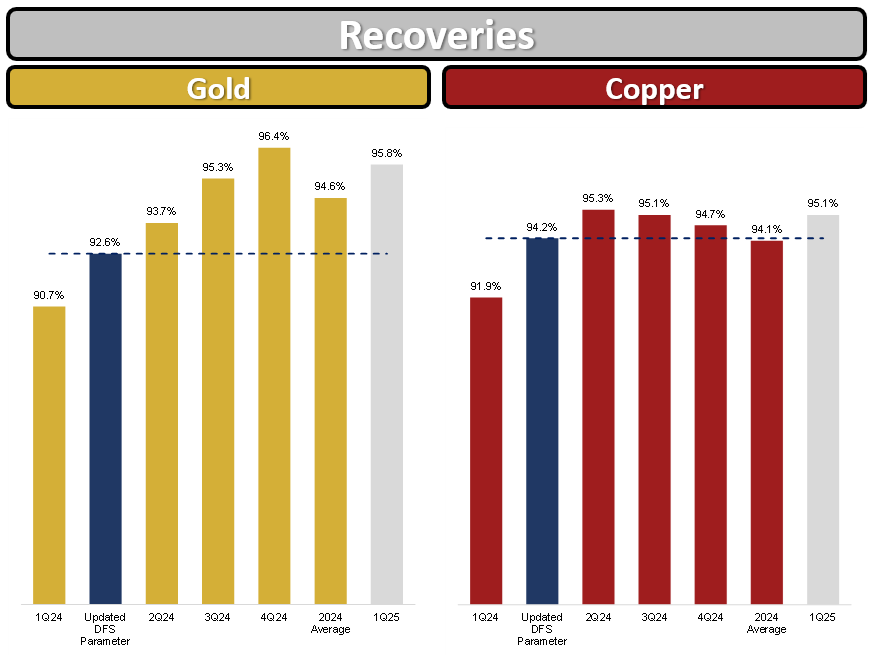

K92 Mining (KNTNF) reported strong Q1 2025 production results, achieving 47,817 ounces gold equivalent (AuEq), marking a 74% increase from Q1 2024. The company processed 103,449 tonnes of ore with impressive head grades of 14.9 g/t AuEq and achieved strong metallurgical recoveries of 95.8% for gold and 95.1% for copper.

The quarter saw total material movement of 315,182 tonnes and set a new monthly development advance record of 954 metres in March. The mine benefited from recently commissioned infrastructure upgrades, including an interim ventilation system that exceeded expectations with a 50% increase in mine airflow.

The Stage 3 Expansion is progressing well with 75% of capital spent or committed, and commissioning of the new 1.2 million tonnes per annum process plant is set to begin in Q2 2025. The company maintained strong financial performance, growing its net cash balance despite investing in expansion and making a US$12 million PNG Corporate Tax payment.

K92 Mining (KNTNF) ha riportato risultati di produzione solidi per il primo trimestre del 2025, raggiungendo 47.817 once equivalenti d'oro (AuEq), segnando un aumento del 74% rispetto al primo trimestre del 2024. L'azienda ha trattato 103.449 tonnellate di minerale con gradi medi impressionanti di 14,9 g/t AuEq e ha ottenuto recuperi metallurgici solidi del 95,8% per l'oro e del 95,1% per il rame.

Durante il trimestre si è registrato un movimento totale di materiale di 315.182 tonnellate e si è stabilito un nuovo record mensile di avanzamento dello sviluppo di 954 metri a marzo. La miniera ha beneficiato di recenti aggiornamenti infrastrutturali, inclusi un sistema di ventilazione temporaneo che ha superato le aspettative con un aumento del 50% nel flusso d'aria della miniera.

Il progetto di espansione Fase 3 sta procedendo bene con il 75% del capitale speso o impegnato, e il commissioning del nuovo impianto di processo da 1,2 milioni di tonnellate all'anno inizierà nel secondo trimestre del 2025. L'azienda ha mantenuto una forte performance finanziaria, aumentando il suo saldo di cassa netto nonostante gli investimenti nell'espansione e il pagamento di 12 milioni di dollari statunitensi per le tasse aziendali in PNG.

K92 Mining (KNTNF) reportó sólidos resultados de producción para el primer trimestre de 2025, logrando 47,817 onzas equivalentes de oro (AuEq), lo que representa un aumento del 74% en comparación con el primer trimestre de 2024. La compañía procesó 103,449 toneladas de mineral con impresionantes leyes promedio de 14.9 g/t AuEq y logró fuertes recuperaciones metalúrgicas del 95.8% para el oro y del 95.1% para el cobre.

Durante el trimestre, se registró un movimiento total de material de 315,182 toneladas y se estableció un nuevo récord mensual de avance en el desarrollo de 954 metros en marzo. La mina se benefició de las recientes mejoras en la infraestructura, incluyendo un sistema de ventilación temporal que superó las expectativas con un aumento del 50% en el flujo de aire de la mina.

La Expansión de Fase 3 avanza bien con el 75% del capital gastado o comprometido, y la puesta en marcha de la nueva planta de procesamiento de 1.2 millones de toneladas por año comenzará en el segundo trimestre de 2025. La compañía mantuvo un sólido desempeño financiero, aumentando su saldo de efectivo neto a pesar de invertir en expansión y realizar un pago de impuestos corporativos en PNG de 12 millones de dólares estadounidenses.

K92 Mining (KNTNF)는 2025년 1분기 생산 결과가 강력하다고 보고하며, 47,817 온스의 금 등가물(AuEq)을 달성하여 2024년 1분기 대비 74% 증가했다고 발표했습니다. 이 회사는 14.9 g/t AuEq의 인상적인 평균 품위를 가진 103,449톤의 광석을 처리했으며, 금에 대해 95.8%, 구리에 대해 95.1%의 높은 금속 회수율을 달성했습니다.

이번 분기에는 총 315,182톤의 자재 이동이 있었고, 3월에는 954미터의 새로운 월별 개발 진전을 기록했습니다. 이 광산은 최근에 시행된 인프라 업그레이드의 혜택을 받았으며, 기대를 초과한 50%의 광산 공기 흐름 증가를 보인 임시 환기 시스템이 포함되어 있습니다.

3단계 확장은 75%의 자본이 지출되거나 약정되며 순조롭게 진행되고 있으며, 연간 120만 톤 처리할 수 있는 새로운 공장의 가동이 2025년 2분기에 시작될 예정입니다. 이 회사는 확장에 투자하면서도 순 현금 잔고를 증가시키며 강력한 재무 성과를 유지했습니다. 또한 1,200만 달러의 PNG 법인세를 납부했습니다.

K92 Mining (KNTNF) a annoncé de solides résultats de production pour le premier trimestre 2025, atteignant 47 817 onces équivalentes en or (AuEq), marquant une augmentation de 74 % par rapport au premier trimestre 2024. L'entreprise a traité 103 449 tonnes de minerai avec des teneurs moyennes impressionnantes de 14,9 g/t AuEq et a obtenu de forts taux de récupération métallurgique de 95,8 % pour l'or et de 95,1 % pour le cuivre.

Au cours du trimestre, un mouvement total de matériel de 315 182 tonnes a été enregistré et un nouveau record mensuel d'avancement du développement de 954 mètres a été établi en mars. La mine a bénéficié de récentes améliorations d'infrastructure, y compris un système de ventilation temporaire qui a dépassé les attentes avec une augmentation de 50 % du flux d'air dans la mine.

L'expansion de la phase 3 progresse bien avec 75 % du capital dépensé ou engagé, et la mise en service de la nouvelle usine de traitement de 1,2 million de tonnes par an doit commencer au deuxième trimestre 2025. L'entreprise a maintenu une solide performance financière, augmentant son solde de trésorerie nette malgré les investissements dans l'expansion et le paiement d'un impôt sur les sociétés de 12 millions de dollars américains en PNG.

K92 Mining (KNTNF) berichtete über starke Produktionszahlen im ersten Quartal 2025 und erreichte 47.817 Unzen Goldäquivalent (AuEq), was einem Anstieg von 74% im Vergleich zum ersten Quartal 2024 entspricht. Das Unternehmen verarbeitete 103.449 Tonnen Erz mit beeindruckenden Gehalten von 14,9 g/t AuEq und erzielte hohe metallurgische Rückgewinnungsraten von 95,8% für Gold und 95,1% für Kupfer.

Im Quartal wurde eine Gesamtbewegung von 315.182 Tonnen Material verzeichnet und ein neuer monatlicher Entwicklungsfortschritt von 954 Metern im März aufgestellt. Die Mine profitierte von kürzlich in Betrieb genommenen Infrastrukturverbesserungen, einschließlich eines vorübergehenden Belüftungssystems, das die Erwartungen mit einer 50%igen Steigerung des Luftstroms in der Mine übertraf.

Die Erweiterung der Phase 3 schreitet gut voran, wobei 75% des Kapitals ausgegeben oder verpflichtet sind, und die Inbetriebnahme der neuen Verarbeitungsanlage mit einer Kapazität von 1,2 Millionen Tonnen pro Jahr soll im zweiten Quartal 2025 beginnen. Das Unternehmen hielt eine starke finanzielle Leistung aufrecht und steigerte seinen Nettokassenbestand, obwohl es in die Expansion investierte und eine Unternehmenssteuerzahlung von 12 Millionen US-Dollar in PNG leistete.

- 74% increase in gold equivalent production year-over-year to 47,817 ounces

- Record-high metallurgical recoveries: 95.8% for gold and 95.1% for copper

- New monthly development advance record of 954 metres in March

- Ventilation upgrade outperformed expectations with 50% airflow increase

- Net cash balance growth despite expansion investments and tax payment

- 75% of Stage 3 Expansion capital already spent or committed

- Planned power disruptions impacted development rates in first half of Q1

- Throughput was reduced to optimize recoveries

- Strong quarterly production of 47,817 ounces gold equivalent (“AuEq”)(1) or 45,735 oz gold, 1,141,379 lbs copper and 34,085 oz silver, second highest on record, exceeding budget and representing a

74% increase from Q1 2024. Quarterly sales of 45,886 oz gold, 1,051,167 lbs copper and 32,439 oz silver. - Quarterly ore processed of 103,449 tonnes with a head grade of 14.9 grams per tonne (“g/t”) AuEq, or 14.3 g/t gold,

0.50% copper and 11.1 g/t silver. The AuEq head grade was significantly above budget, driven by higher-grade stopes from both Kora and Judd, and a positive gold grade reconciliation relative to the latest independent mineral resource estimate (effective September 12, 2023). Throughput was optimally reduced to maximize recoveries at the elevated feed grade. - Strong metallurgical recoveries in Q1 of

95.8% for gold and95.1% for copper, both marking the second-highest quarterly recoveries on record. Recoveries compare favorably to the recovery parameters from the Updated Definitive Feasibility Study (“Updated DFS”), of92.6% and94.2% , respectively (January 1, 2024 effective date). - Ore mined of 104,052 tonnes and total material movements (ore plus waste) totaling 315,182 tonnes, the second highest on record. Long hole open stoping performed to design.

- New monthly development advance record set in March, of 954 metres,

6% greater than the previous monthly record set in Q4 2024, and nearing the Stage 3 Expansion run-rate requirement of 1,000 metres per month. Development in March benefitted from the installation of the interim ventilation upgrade (commissioned in early January) which has significantly outperformed design (+50% increase in mine airflow vs +30% planned) and the Stage 2 Interim Water Upgrade (commissioned in late January). During installation of these upgrades, planned power disruptions resulted in lower development rates during the first half of Q1, with the second half of the quarter performing strongly. Overall development in Q1 2025 was 2,494 metres. Development rates are well positioned to continue to increase as the year progresses, driven by: i) the completion of multiple infrastructure upgrades over the first half of 2025, ii) a major increase in available headings from the opening of two new mining fronts, iii) the progressive introduction of additional equipment already on site as available headings increase, and, iv) the implementation of an enhanced maintenance program.

Note (1): Gold equivalent production for Q1 2025 is calculated based on: gold

John Lewins, K92 Chief Executive Officer and Director, stated, “We are very pleased with the strong start to 2025, delivering our strongest Q1 to date, recording quarterly production of 47,817 oz AuEq in a record gold price environment. This has resulted in yet another consecutive quarter where our net cash balance has grown, even after investing considerable capital into the Stage 3 Expansion and making a PNG Corporate Tax payment of US

We are also very encouraged with the progress in increasing our lateral advance rates, achieving a new monthly record in March, of 954 metres, nearing the required 1 km per month for the Stage 3 Expansions. In the second half of the quarter, lateral advance benefitted from the interim ventilation and interim Stage 2 Water Management upgrades completed earlier in the quarter. We look to continue to ramp up our lateral advance rates as various key enablers come together.

In addition, exploration is rapidly advancing with surface drilling at Arakompa, and underground drilling at Kora and Judd underway, with plans to drill Maniape and potentially interpreted veins sub-parallel and proximal to Kora/Judd later in the year. Our new VP Exploration Robert Smillie was recently on site visiting these targets and is very encouraged by what he has seen to date – we look forward to providing progress updates in due course.”

VANCOUVER, British Columbia, April 08, 2025 (GLOBE NEWSWIRE) -- K92 Mining Inc. (“K92” or the “Company”) (TSX: KNT; OTCQX: KNTNF) is pleased to announce production results for the first quarter (“Q1”) of 2025 at its Kainantu Gold Mine in Papua New Guinea, of 47,817 ounces AuEq or 45,735 oz gold, 1,141,379 lbs copper and 34,085 oz silver, a

During Q1, the process plant delivered tonnes processed of 103,449 tonnes, with a head grade averaging 14.9 g/t AuEq, or 14.3 g/t gold,

For the quarter, the process plant delivered strong metallurgical recoveries of

During the quarter, the mine delivered 104,052 tonnes of ore mined, with mining activity across 12 levels, including the 1090, 1110, 1305, 1345, and 1365 levels at Kora, and the 840, 970, 1170, 1185, 1285, 1325, 1365 and 1385 levels at Judd. Total material movement, including ore and waste, reached 315,182 tonnes, the second highest on record. Long hole open stoping met design parameters, supporting strong operational performance.

In March, a new monthly development advance record of 954 metres was achieved, surpassing the previous record set in Q4 2024 by

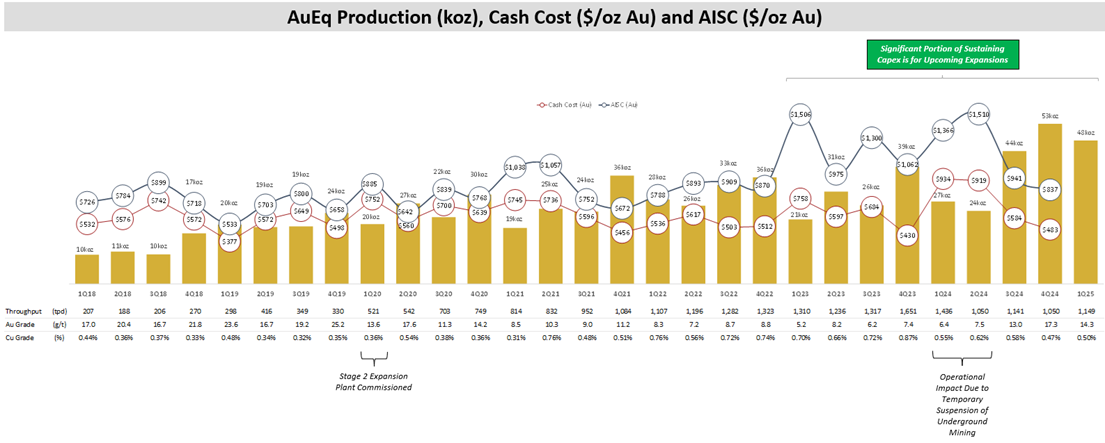

See Figure 1: Quarterly Production, Cash Cost and AISC Chart

See Figure 2: Gold and Copper Recoveries Chart

Table 1 – 2025 & 2024 Annual Production Data

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | 2024 | Q1 2025 | ||||||||

| Tonnes Processed | T | 130,632 | 95,582 | 104,992 | 96,614 | 427,821 | 103,449 | ||||||

| Feed Grade Au | g/t | 6.4 | 7.5 | 13.0 | 17.3 | 10.7 | 14.3 | ||||||

| Feed Grade Cu | % | 0.55% | |||||||||||

| Recovery (%) Au | % | 94.6% | |||||||||||

| Recovery (%) Cu | % | 94.1% | |||||||||||

| Metal in Conc & Doré Prod Au | oz | 24,389 | 21,661 | 41,702 | 51,371 | 139,123 | 45,735 | ||||||

| Metal in Conc Prod Cu | T | 655 | 565 | 580 | 435 | 2,235 | 518 | ||||||

| Metal in Conc Prod Ag | oz | 35,650 | 26,754 | 37,613 | 41,992 | 142,063 | 34,085 | ||||||

| Gold Equivalent Production | oz | 27,462 | 24,347 | 44,304 | 53,401 | 149,515 | 47,817 | ||||||

Notes – Gold equivalent for Q1 2025 is calculated based on:

gold

Gold equivalent for Q4 2024 is calculated based on:

gold

Gold equivalent for Q3 2024 is calculated based on:

gold

Gold equivalent for Q2 2024 is calculated based on:

gold

Gold equivalent for Q1 2024 is calculated based on:

gold

Qualified Person

K92 Mine Chief Geologist, Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Kohler includes significant time onsite reviewing drill core, face sampling, underground workings, and discussing work programs and results with geology and mining personnel.

Technical Report

The Updated DFS and mineral resource estimate for the Kainantu Gold Mine Project in Papua New Guinea is presented in a technical report, titled, “Independent Technical Report, Kainantu Gold Mine, Updated Definitive Feasibility Study, Kainantu Project, Papua New Guinea” dated March 21, 2025, with an effective date of January 1, 2024.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018, is in a strong financial position, and is working to become a Tier 1 mid-tier producer through ongoing plant expansions. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA, President and Chief Operating Officer at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Such forward-looking statements include, without limitation: (i) the results of the Kainantu Mine Definitive Feasibility Study, including the Stage 3 Expansion, a new standalone 1.2 million tonnes per annum process plant and supporting infrastructure; (ii) statements regarding the expansion of the mine and development of any of the deposits; (iii) the Kainantu Stage 4 Expansion, operating two standalone process plants, larger surface infrastructure and mining throughputs; and (iv) the potential extended life of the Kainantu Mine.

All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the epidemic or pandemic viruses; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company’s operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company’s ability to carry on current and future operations, including development and exploration activities at the Arakompa, Kora, Judd and other projects; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; failures of information systems or information security threats; political, economic and other risks associated with the Company’s foreign operations; geopolitical events and other uncertainties, such as the conflicts in Ukraine, Israel and Palestine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company’s Annual Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1: Quarterly Production, Cash Cost and AISC Chart

Figure 2: Gold and Copper Recoveries Chart

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca357631-2fc0-4584-b07d-90c70e287738

https://www.globenewswire.com/NewsRoom/AttachmentNg/d6248f1c-e8fe-4cca-b55e-6588e40d4ecb