Kingfisher Intersects 6.88 G/T Au, 13.60 G/T Ag, and 0.28% Cu Over 9 M in First-Ever Drill Program, Cloud Drifter Trend, Goldrange Project

Kingfisher Metals Corp. announces promising results from the first four drill holes of its 2021 program at the Goldrange Project, located in British Columbia. Notable findings include 6.88 g/t Au, 13.6 g/t Ag, and 0.28% Cu over 9 m in hole GR21-007. Additional results show 14.80 g/t Au over 1 m and significant broader intervals such as 0.90 g/t Au over 12 m. The initial data confirms the presence of a gold system, with ongoing drilling targeting extensive mineralization. CEO Dustin Perry expresses optimism about the project's potential for a high-grade gold camp.

- Discovery of high-grade mineralization including 6.88 g/t Au, 13.6 g/t Ag, and 0.28% Cu over 9 m in GR21-007.

- Vein-style mineralization yielding 14.80 g/t Au over 1 m and significant broader intervals.

- Initial drilling results confirm a gold system with significant intersections in multiple holes.

- Ongoing exploration is planned to further assess potential.

- Drill hole GR21-001 failed to reach the target depth due to difficult conditions.

- Poor recoveries were noted in the upper parts of some drill holes, potentially affecting data quality.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / November 16, 2021 / Kingfisher Metals Corp. (TSXV:KFR)(FSE:970)(OTCQB:KGFMF) ("Kingfisher" or the "Company") is pleased to announce results from the first four holes assayed from its 14-hole 4925.3 m 2021 program. Assay results for 10 remaining drill holes are pending. Goldrange is located approximately 25 km south of the town of Tatla Lake in the Chilcotin region of Southwest British Columbia.

Highlights

- Discovery of a high-grade sulfide-cement hydrothermal breccia with 6.88 g/t Au, 13.6 g/t Ag and

0.28% Cu over 9 m, in GR21-007 (Table 1) - Vein-style mineralization yielding 14.80 g/t Au over 1 m within 2.16 g/t Au over 8 m, also in GR21-007; and 5.30 g/t Au over 1 m in GR21-002

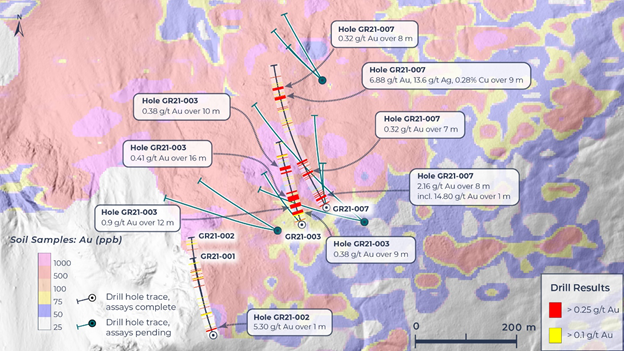

- Drilling to date has also revealed broad zones of near-surface mineralization over significant widths, such as 0.90 g/t Au over 12 m, 0.41 g/t Au over 16 m, 0.38 g/t Au over 9 m, and 0.38 g/t Au over 10 m in GR21-003; and 0.32 g/t Au over 7 m and 0.32 g/t over 8 m in GR21-007

- The initial results of drilling confirm the presence of a gold system with significant intersects in all holes other than GR21-001, which failed to reach target depth due to difficult drilling conditions in this shallow, slope-parallel hole; poor recoveries may have plagued the shallower parts of all drill holes in this release

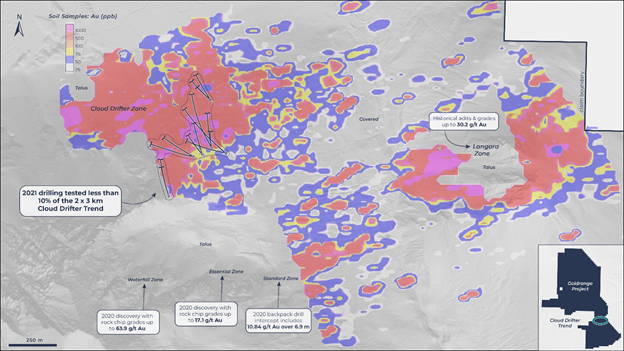

The 2021 drill program targeted a small part (350 m) of the western end of the gold-in-soil geochemical anomaly that defines the ~3 by 2 km Cloud Drifter Trend (Figure 1), in an area of extensive forest cover and limited outcrop. Significant intercepts from the drill holes are highlighted in Table 1 and Figure 2, more detailed drill hole summaries are given below, and the results presented in this news release are discussed by Kingfisher CEO Dustin Perry and Exploration Vice President Gayle Febbo in a video as well as during a webinar at 11:00 am EST.

Hole | From (m) | To (m) | Interval (m) | Au g/t | Ag g/t | Cu % |

GR21-001 | - | - | - | no significant values | ||

GR21-002 | 26 | 27 | 1 | 5.30 | - | - |

GR21-003 | 35 | 44 | 9 | 0.38 | - | - |

and | 56 | 68 | 12 | 0.90 | - | - |

and | 78 | 94 | 16 | 0.41 | - | - |

and | 179 | 189 | 10 | 0.38 | - | - |

GR21-007 | 35 | 43 | 8 | 2.16 | - | - |

Incl. | 41 | 42 | 1 | 14.80 | - | - |

and | 136 | 143 | 7 | 0.32 | - | - |

and | 418 | 427 | 9 | 6.88 | 13.6 | 0.28 |

and | 451 | 459 | 8 | 0.32 | - | - |

*True widths are not known at this time. All widths reported are drilled widths. Values less than 10 g/t Ag and <

Table 1: Highlight drill intercepts from oriented core diamond drilling at the Goldrange project

Figure 1: Cloud Drifter Trend

Dustin Perry, CEO of Kingfisher, states "I am thrilled that we were able to intersect high-grade mineralization on the initial drill holes of the first ever diamond drill program at the Goldrange Project. This initial drill program at Goldrange covered less than

Charlie Greig, Technical Advisor to Kingfisher, stated "The results from the first Cloud Drifter holes are exciting. To get broad ore grade intercepts in the initial holes bodes very well for the exploration potential of the Trend. The polyphase nature of the mineralization and its association with elevated bismuth, tellurium and antimony, elements which may be valuable in their own right and which are very commonly associated with high-grade gold deposits worldwide is significant. It is very early days for the Goldrange Project and its numerous mineral occurrences, which are just now beginning to be tested with modern exploration methods."

Geology and Mineralization of the Cloud Drifter Trend

The Cloud Drifter Trend (Figure 1) is a ~3 by 2 km zone of highly anomalous Au-Ag-Sb-Cu-As-Bi-Te geochemistry that is coincident with quartz-sulfide and sulfosalt veins, sulfide-cement breccias, and quartz-sulfide replacement zones. In 2020, Kingfishers' work along the Trend included prospecting that yielded 312 rock geochemical samples yielding an average grade of 6.26 g/t Au and soil sampling which produced an extensive soil geochemical anomaly with 50 samples over 1 g/t Au.

Mineralization within the Trend and throughout the 367 km2 Goldrange Project is closely associated with and largely hosted by a complex of Late Cretaceous quartz-diorite and diorite intrusions emplaced into Triassic to Cretaceous sedimentary and volcanic rocks.

Figure 2: Cloud Drifter Zone - 2021 Drilling

Drill Hole Descriptions

Drill Hole GR21-007:

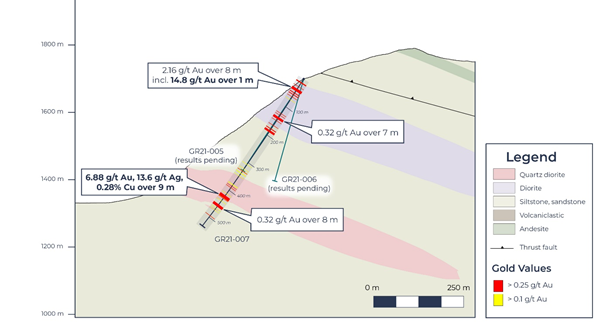

GR21-007 was drilled uphill of a soil geochemical anomaly near the projected trend of the plutonic contact. Assay results for this hole were prioritized in the interests of drill hole targeting once it was recognized that the lower quartz diorite was mineralized. However, given the delays common to all analytical laboratories this season, the original drill plan remained unchanged.

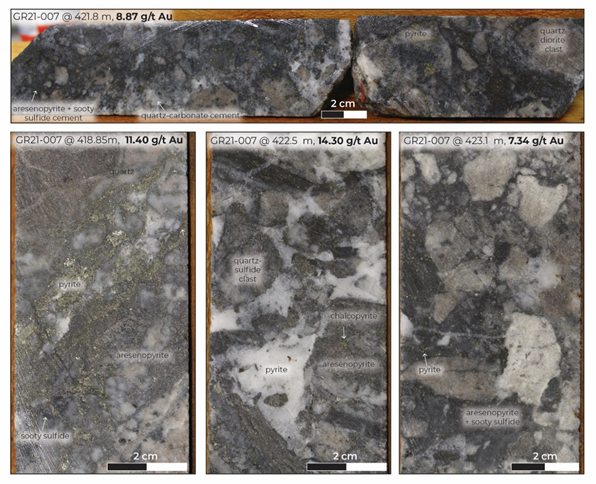

The excellent intercept in this hole (6.88 g/t Au, 13.60 g/t Ag, and

Figure 3: Drill core photos and gold grades over 1 m sample widths from the breccia body intersected in GR21-007

Figure 4: Cross-section of GR21-007, view east

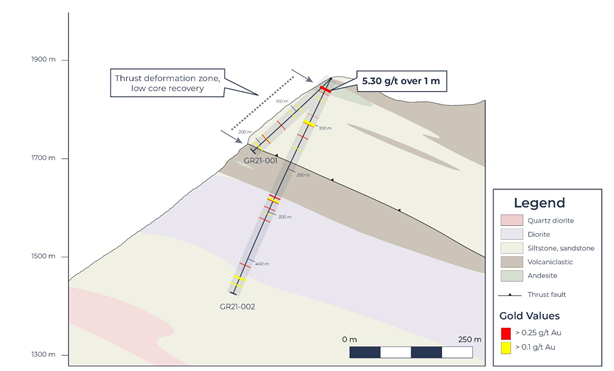

Holes GR21-001 and -002:

The initial drill setup for the 2021 program (Figure 5) targeted mineralization at surface that occurs within the hanging wall of a thrust fault that is part of the Late Cretaceous Waddington thrust belt developed along the eastern margin of the Coast Belt. High density veins on surface measure 2-20 cm wide and are highly fractured and disproportionately oxidized relative to the host rocks. Recovery within the deformation zone was poor, with recoveries from the uppermost parts of GR21-001 and GR21-002 being

Figure 5: Cross-section of GR21-001 and GR21-002, view east

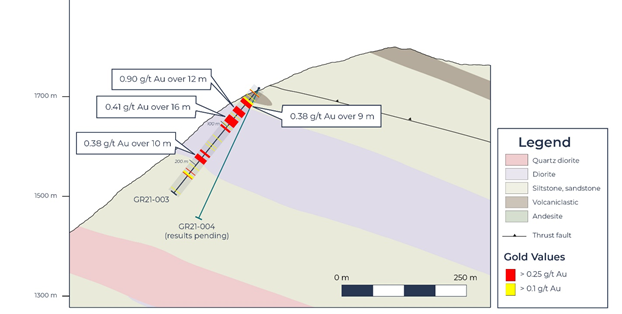

Holes GR21-003 and -004:

The setup for these holes (Figure 7) was collared upslope of a soil geochemical anomaly coincident with trenches yielding high-grade results from numerous quartz-sulfide veins that range in thickness between 2 and 30 cm (Figure 6). The veins are most abundant near the contacts of what is known as the upper diorite, but mineralized veins occur both within the diorite and in association with both upper and lower contacts. As a consequence, at surface the Cloud Drifter mineralized zone occurs over a relatively broad (~100 m) interval and area (Figures 2 and 5). Vein styles in drill core include both open space textures in dilation veins and laminated textures in shear veins.

Further geological descriptions of drill core and drill collar locations can be found in news releases dated September 2, 2021 and October 6, 2021.

Figure 6: Drill core photo of quartz-sulfide vein from hole GR21-003

Figure 7: Cross-section of GR21-003, view east

Future Work

Results for the remaining 10 drill holes in the 2021 program are pending. As the results are released to the Company, the Company will be focusing on interpretation and 3D modeling of the oriented drill core data, with the aims of improving our understanding of the controls on mineralization and on targeting for 2022 drilling. At the Cloud Drifter Zone, much of the focus for the targeting work will be on the sulfide-cement breccia intersected in drill hole GR21-007, which bears similarities with high-grade breccias that outcrop on surface at the Langara, Standard, Day Trip, and Lost Fiddle Zones. In addition, the results of its extensive property-scale soil and rock geochemical sampling programs are also pending. Following the compilation, interpretation and release of those results, Kingfisher will develop a path toward drill targeting the most prospective anomalies.

QAQC and Core Sampling Protocols

All drillholes at the Goldrange property were NQ sized (47.6 mm diameter). A continuous series of one-metre-long half-split core samples was taken down the entire length of each drill hole. Sample lengths were reduced to a minimum of half a meter to avoid crossing lithologic contacts or other features deemed important by Kingfisher geologists.

Unlabelled certified reference materials (CRM) were inserted systematically throughout the sample sequence along with blanks and duplicate samples. The total number of blanks, duplicates and CRM samples equals approximately

Core samples were shipped to Acme Labs, a division of Bureau Veritas, located in Vancouver, British Columbia, for preparation and analysis. Bureau Veritas is an ISO 9000 accredited analytical laboratory and is independent of Kingfisher Metals an its Qualified Person. Samples were prepped using the PRP7-250, PUL85 and SPTPL packages and analysed for 45 major and trace elements using ICP-ES/MS (method code MA200). A 30 g split from each sample was analyzed for Au using a lead collection fire assay fusion that was digested and analyzed using AAS (method code FA430). A 30g split from samples that assayed >10 ppm Au and/or >200 ppm Ag was analyzed using a lead collection fire assay fusion with a gravimetric finish (method code FA530).

Qualified Person

Dustin Perry, P.Geo., Kingfisher's CEO, is the Company's Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

About Kingfisher Metals Corp.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia. Kingfisher has three

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 236 358 0054

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property. This news release contains forward-looking statements, which relate to future events or future performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: formulation of plans for drill testing; and the success related to any future exploration or development programs.

These forward-looking statements and information reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include; success of the Company's projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour- related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks related to the COVID-19 pandemic; fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar); operational risks and hazards inherent with the business of mineral exploration; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mineral exploration; increased competition in the mining industry for equipment and qualified personnel; the availability of additional capital; title matters and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances.

SOURCE: Kingfisher Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/672782/Kingfisher-Intersects-688-GT-Au-1360-GT-Ag-and-028-Cu-Over-9-M-in-First-Ever-Drill-Program-Cloud-Drifter-Trend-Goldrange-Project