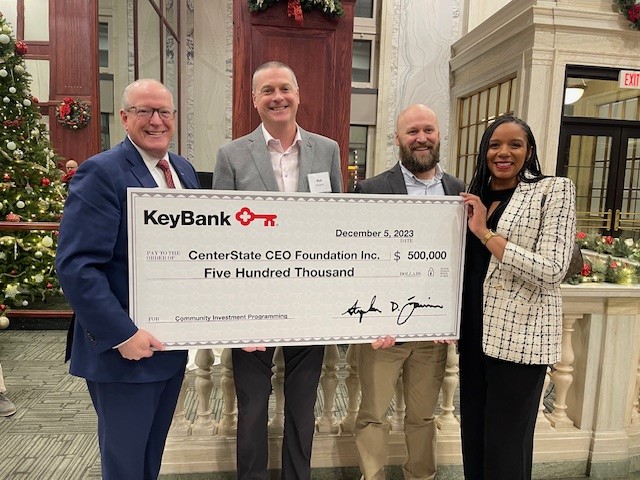

$500,000 Investment from KeyBank will Help CenterState CEO Expand Business Coaching and Technical Assistance Programs for BIPOC, Women and Veteran-owned Firms

- None.

- None.

Insights

The $500,000 investment by KeyBank into CenterState CEO's initiatives represents a strategic approach to fostering economic inclusivity and diversity within Central New York's business landscape. By addressing systemic barriers to financing and business support for underrepresented groups, this infusion of capital is likely to stimulate local economic activity and entrepreneurship. From an economic standpoint, the increased availability of resources for BIPOC, women and veteran-owned firms could lead to a more dynamic and resilient local economy, as diversity in business ownership has been linked to enhanced innovation and economic stability.

Furthermore, the direct lending and investment in undercapitalized firms through CenterState CEO's Growth + Equity Fund could have a multiplier effect. As these firms grow, they may create jobs, increase demand for local goods and services and contribute to the tax base. The long-term economic implications might include a reduction in wealth disparities and the fostering of generational wealth within communities that have historically been marginalized, potentially altering the socio-economic fabric of the region.

The commitment from KeyBank to invest in diversity, equity and inclusion efforts through CenterState CEO's programs aligns with a broader market trend where corporations are increasingly recognizing the importance of social responsibility in their business models. This trend is reflected in consumer and investor preferences, which are progressively favoring companies with strong corporate social responsibility (CSR) profiles. Consequently, KeyBank's investment could enhance its brand image and reputation, potentially impacting customer loyalty and investor interest.

From a market analysis perspective, the focus on underrepresented entrepreneurs could uncover untapped market segments and lead to the development of innovative products and services that meet the needs of diverse populations. The support for these entrepreneurs through training, coaching and technical assistance is likely to result in a more competitive and varied business environment, which could attract further investments and partnerships in the region.

KeyBank's strategic investment in CenterState CEO's programs can be viewed as an effort to generate social returns alongside potential financial returns. The direct lending aspect of the investment will likely have immediate financial implications for the selected firms, providing them with capital that is essential for growth and expansion. This could lead to an increase in the overall creditworthiness of the small business sector in the region, as successful loan repayments would improve financial metrics and credit histories for these firms.

From a financial analysis perspective, it is crucial to monitor the performance of the Growth + Equity Fund and the outcomes of the Up Start program. The success of these initiatives could serve as a model for similar investments in other regions, potentially influencing the strategies of other financial institutions. The emphasis on building generational wealth also suggests a long-term investment horizon, which may not yield immediate financial returns but could contribute to sustainable economic development and financial stability in the region over time.

Funding will support the launch and growth of underrepresented firms through training, coaching, and technical assistance and provide direct lending to and investment in undercapitalized firms

SYRACUSE, NY / ACCESSWIRE / February 6, 2024 / A

This funding will also play a significant role in helping CenterState CEO scale efforts to expand access to business financing for under-capitalized founders, for whom traditional business loans and investments are often challenging. It will support the launch and growth of underrepresented and BIPOC firms through training, coaching and technical assistance, through CenterState CEO's Up Start program and other small business development programming, including a real estate developer-in-residence pilot. It will also provide direct lending to and investment in undercapitalized firms via CenterState CEO's Growth + Equity Fund.

"This unique approach to equitable growth by CenterState CEO will help entrepreneurs from all backgrounds have access to assistance and financing they need that will help our region grow," said Stephen Fournier, KeyBank Central New York Market President. "We are proud to invest in their efforts that will make it possible for marginalized entrepreneurs to build successful futures and generational wealth."

"Systemic barriers have often left the talent of many entrepreneurs in our community untapped and their potential under supported," said Dominic Robinson, senior vice president of Inclusive Growth at CenterState CEO. "This investment from KeyBank will support important tools like the Growth + Equity Fund and Up Start that address these equity gaps and scale their economic impact on entrepreneurs from historically disinvested populations and neighborhoods."

Ultimately, as participants in these programs build successful businesses, they will achieve financial sustainability and begin to build generational wealth. As drivers of the local economy, they will gain stronger voices in local leadership, participate in the regeneration of the built environment, and drive economic growth and revitalization in these neighborhoods.

"Building generational wealth is key to building strong neighborhoods and strong economies," said Tamika Otis, corporate responsibility officer for KeyBank in Central New York. "This investment by Key will kelp CenterState CEO continue the important work they are doing to level the playing field and make our community more accessible, equitable and successful."

Since 2017, KeyBank has followed through on community commitments totaling more than

ABOUT KEYBANK

KeyBank's roots trace back nearly 200 years to Albany, New York. Headquartered in Cleveland, Ohio, KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately

Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank is Member FDIC.

ABOUT CENTERSTATE CEO & THE CENTERSTATE CEO FOUNDATION

CenterState CEO is Central New York's premier business leadership and economic development organization, committed to creating a region where business thrives, and all people prosper. Its vision is to be recognized as a visionary leader, effective advocate, exceptional employer and a force for positive outcomes for the community.

The mission of the CenterState CEO Foundation is to attract philanthropic support for CenterState CEO programs that remove barriers to economic prosperity for people and places. These programs help residents access quality jobs, inclusive workplaces and entrepreneurship opportunities, as well as build vibrant neighborhood business centers. Supported activities are designed in collaboration with community partners and focus on engaging historically marginalized populations including women, people of color, Indigenous people, veterans, New Americans and individuals with low-to-moderate incomes.

View additional multimedia and more ESG storytelling from KeyBank on 3blmedia.com.

Contact Info:

Spokesperson: KeyBank

Website: https://www.3blmedia.com/profiles/keybank

Email: info@3blmedia.com

SOURCE: KeyBank

View the original press release on accesswire.com

FAQ

What is the purpose of KeyBank's $500,000 investment in CenterState CEO?

How will the funding help marginalized entrepreneurs?

What are the specific programs that will benefit from the investment?