Chase’s 2021 Digital Banking Attitudes Study Finds Consumers Continue to Adopt Digital Banking Tools to Manage Their Finances

Mobile apps have become the most frequently used banking channel, with

(Photo: Business Wire)

“This year, digital banking played an even bigger role in how consumers manage and track their finances on a daily basis,” said

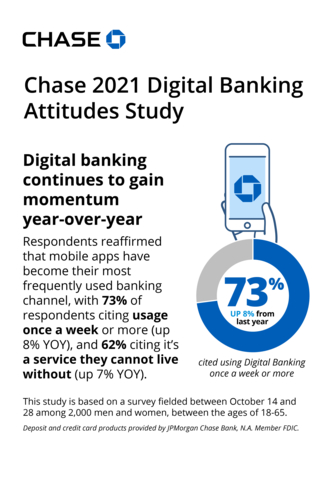

Digital banking continues to gain momentum year-over-year

Respondents reaffirmed that mobile apps have become their most frequently used banking channel, with

- Millennials, Gen X and Baby Boomers all said they use digital banking to manage finances more today than they did a year ago.

Consumers are paying digitally more than ever before, which will likely continue

Ninety-three percent of consumers have used one or more digital payment methods, such as Zelle®2, in the past year (up

-

Consumers’ top reasons for using digital payment methods were the same across all generations:

-

Convenient (

66% ) -

Easy (

57% ) -

Saves time (

46% )

-

Convenient (

- Approximately one in three consumers said they started using digital payment tools in the past six months.

- Seventy-nine percent of respondents said digital payment options make it easier to track and manage finances as well.

Gen Z uses credit monitoring services as learning tools

Sixty-nine percent of respondents said they use a service to monitor their credit, such as

- Seventy-six percent of respondents said they use credit services to check their credit scores.

- Forty-four percent of Gen Z respondents cited they are using credit monitoring services to learn how to improve credit scores.

Consumers increasingly use digital banking features to book travel

Consumers are using digital features to do more than check their balances or pay bills.

-

Thirteen percent of respondents said they have used their bank’s website or mobile app to book travel, yet when asked,

34% of those who had not used this feature said they would be willing to try booking with their bank next time. - Seventy-four percent of respondents who said they’ve booked travel with their bank are highly likely to do so again.

-

Just

18% of respondents cited that they’ve added offers to their credit cards through their bank online, but those who have are likely to repeat. If they haven’t tried it yet,45% say they are likely to add offers in the near future.

“Chase’s Product, Design, Data and Technology teams are driving innovation at scale, creating digital experiences that help millions of consumers to manage more aspects of their financial lives from their mobile device,” Amin added.

This study is based on a survey fielded

As of Q3 2021, Chase has over 44 million mobile active (+

For more information about Chase’s digital banking features, visit www.chase.com/digital/banking.

About Chase

Chase is the

1 Deposit and credit card products provided by

2 [2]Enrollment in Zelle® is required. Both parties need a

Zelle and the Zelle related marks are wholly owned by

View source version on businesswire.com: https://www.businesswire.com/news/home/20211216005062/en/

Media Contact

paul.lussier@chase.com

Source: