JLL Reports Financial Results for Second-Quarter 2024

JLL reported strong Q2 2024 financial results, with revenue up 12% to $5.6 billion. Diluted earnings per share rose to $1.75 from $0.05 last year, while adjusted diluted EPS increased to $2.55 from $2.12. Resilient business lines saw 16% revenue growth, led by a 19% increase in Workplace Management. Transactional revenues grew 5%, with Leasing up 5% and Capital Markets up 3%. Net income attributable to shareholders was $84.4 million, compared to $2.5 million in Q2 2023. Adjusted EBITDA rose 9% to $246.3 million. The company reduced net debt by nearly $150 million and improved its leverage ratio. JLL highlighted continued profitability improvement driven by revenue growth and cost management efforts.

JLL ha riportato risultati finanziari solidi per il secondo trimestre del 2024, con un fatturato aumentato del 12% a $5,6 miliardi. Gli utili per azione diluiti sono saliti a $1,75 rispetto a $0,05 dell'anno scorso, mentre l'EPS diluiti rettificati è aumentato a $2,55 rispetto a $2,12. Le linee di business resilienti hanno registrato una crescita del fatturato del 16%, guidata da un aumento del 19% nella Gestione degli Spazi di Lavoro. Le entrate transazionali sono cresciute del 5%, con il Leasing in aumento del 5% e i Mercati Capitale in crescita del 3%. Il reddito netto attribuibile agli azionisti è stato di $84,4 milioni, rispetto a $2,5 milioni nel secondo trimestre del 2023. L'EBITDA rettificato è aumentato del 9%, raggiungendo i $246,3 milioni. L'azienda ha ridotto il debito netto di quasi $150 milioni e migliorato il suo rapporto di leva. JLL ha sottolineato un miglioramento costante della redditività grazie alla crescita del fatturato e agli sforzi di gestione dei costi.

JLL reportó resultados financieros sólidos para el segundo trimestre de 2024, con un aumento del 12% en los ingresos, alcanzando $5.6 mil millones. Las ganancias por acción diluidas subieron a $1.75 desde $0.05 del año pasado, mientras que el EPS diluido ajustado aumentó a $2.55 desde $2.12. Las líneas de negocio resilientes vieron un crecimiento del 16% en los ingresos, lideradas por un aumento del 19% en la Gestión de Espacios de Trabajo. Los ingresos transaccionales crecieron un 5%, con Leasing subiendo un 5% y Mercados de Capital aumentando un 3%. El ingreso neto atribuible a los accionistas fue de $84.4 millones, en comparación con $2.5 millones en el segundo trimestre de 2023. El EBITDA ajustado aumentó un 9% a $246.3 millones. La compañía redujo su deuda neta en casi $150 millones y mejoró su relación de apalancamiento. JLL destacó una mejora continua en la rentabilidad impulsada por el crecimiento de los ingresos y los esfuerzos en la gestión de costos.

JLL은 2024년 2분기 강력한 재무 결과를 보고했으며, 수익은 12% 증가하여 56억 달러에 달했습니다. 희석 주당 순이익은 지난해 $0.05에서 $1.75로 상승했습니다, 또한 조정된 희석 EPS는 $2.12에서 $2.55로 증가했습니다. 탄력적인 비즈니스 라인은 16%의 수익 성장을 기록했으며, 이는 19% 증가한 근무 환경 관리가 이끌었습니다. 거래 수익은 5% 성장했으며, 리스가 5%, 자본 시장이 3% 증가했습니다. 주주에게 귀속되는 순이익은 8,440만 달러로, 2023년 2분기 250만 달러에 비해 큰 증가세를 보였습니다. 조정된 EBITDA는 9% 증가하여 2억 4,630만 달러에 도달했습니다. 회사는 순부채를 거의 1억 5천만 달러 줄였고 레버리지 비율을 개선했습니다. JLL은 수익 성장과 비용 관리 노력에 의해 지속적인 수익성 개선을 강조했습니다.

JLL a rapporté des résultats financiers solides pour le deuxième trimestre 2024, avec des revenus en hausse de 12 % à 5,6 milliards de dollars. Le bénéfice net par action diluée a augmenté à 1,75 $ contre 0,05 $ l'année dernière, tandis que l'EPS dilué ajusté a augmenté à 2,55 $ contre 2,12 $. Les lignes d'activité résilientes ont enregistré une croissance du chiffre d'affaires de 16 %, portée par une augmentation de 19 % dans la gestion des espaces de travail. Les revenus transactionnels ont augmenté de 5 %, avec une hausse de 5 % pour les baux et de 3 % pour les marchés de capitaux. Le résultat net attribuable aux actionnaires s'élevait à 84,4 millions de dollars, contre 2,5 millions de dollars au deuxième trimestre 2023. L'EBITDA ajusté a augmenté de 9 % pour atteindre 246,3 millions de dollars. L'entreprise a réduit sa dette nette de près de 150 millions de dollars et amélioré son ratio de leverage. JLL a souligné une amélioration continue de la rentabilité grâce à la croissance des revenus et aux efforts de gestion des coûts.

JLL berichtete von starken finanziellen Ergebnissen im zweiten Quartal 2024, mit einem Umsatzanstieg von 12% auf 5,6 Milliarden Dollar. Der verwässerte Gewinn pro Aktie stieg von 0,05 Dollar auf 1,75 Dollar, während das angepasste verwässerte EPS von 2,12 Dollar auf 2,55 Dollar erhöht wurde. Die resilienten Geschäftsfelder verzeichneten ein Umsatzwachstum von 16%, angeführt von einem Anstieg von 19% im Bereich Arbeitsplatzmanagement. Die transaktionalen Einnahmen wuchsen um 5%, wobei das Leasing um 5% und die Kapitalmärkte um 3% zulegten. Der den Aktionären zurechenbare Nettogewinn betrug 84,4 Millionen Dollar, gegenüber 2,5 Millionen Dollar im zweiten Quartal 2023. Das angepasste EBITDA stieg um 9% auf 246,3 Millionen Dollar. Das Unternehmen reduzierte die Nettoverschuldung um fast 150 Millionen Dollar und verbesserte sein Verschuldungsverhältnis. JLL hob die kontinuierliche Verbesserung der Rentabilität hervor, die durch Umsatzwachstum und Kostenmanagementmaßnahmen vorangetrieben wurde.

- Revenue increased 12% year-over-year to $5.6 billion

- Diluted EPS rose to $1.75 from $0.05 last year

- Adjusted diluted EPS increased to $2.55 from $2.12

- Net income attributable to shareholders grew to $84.4 million from $2.5 million

- Adjusted EBITDA rose 9% to $246.3 million

- Resilient business lines saw 16% revenue growth

- Workplace Management revenue increased 19%

- Net debt reduced by nearly $150 million

- LaSalle segment revenue decreased 29% due to lower incentive fees

- JLL Technologies revenue declined 7%

Diluted earnings per share were

- Second-quarter revenue was

$5.6 billion 12% in local currency1 - Resilient6 revenues increased

16% in local currency and Transactional6 revenues grew5% in local currency- Work Dynamics again achieved double-digit growth, highlighted by a

19% increase in Workplace Management - Property Management, within Markets Advisory, was up

8% with contributions from most geographies - Leasing, also within Markets Advisory, increased

5% with broad-based geographic growth led by improvement in the office sector - Capital Markets delivered modest growth, up

3% , even as investment sales market volumes remain historically suppressed

- Work Dynamics again achieved double-digit growth, highlighted by a

- Continued profitability improvement primarily driven by revenue growth and the benefit of cost mitigation actions

- Higher cash provided by operating activities contributed to nearly

$150 million

"We are pleased with our second quarter results as Work Dynamics led strong resilient revenue growth and our transactional business lines benefited from investments we have made to take advantage of greater commercial real estate activity," said Christian Ulbrich, JLL CEO. "Our bottom-line performance demonstrated the success of our recent and ongoing cost management efforts. In addition to remaining focused on scaling our platform as we anticipate future growth, our connected and diversified platform, along with strategic investments to further differentiate our business, will enhance long-term stakeholder value."

Summary Financial Results ($ in millions, except per share data, "LC" = local currency) | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||

2024 | 2023 | % Change | % Change | 2024 | 2023 | % Change | % Change | ||||||||

Revenue | $ 5,628.7 | $ 5,052.5 | 11 % | 12 % | $ 10,753.2 | $ 9,768.0 | 10 % | 10 % | |||||||

Net income (loss) attributable to common shareholders | $ 84.4 | $ 2.5 | n.m. | n.m. | $ 150.5 | $ (6.7) | n.m. | n.m. | |||||||

Adjusted net income attributable to common shareholders1 | 123.2 | 102.2 | 21 % | 23 % | 209.2 | 136.4 | 53 % | 59 % | |||||||

Diluted earnings (loss) per share | $ 1.75 | $ 0.05 | n.m. | n.m. | $ 3.12 | $ (0.14) | n.m. | n.m. | |||||||

Adjusted diluted earnings per share1 | 2.55 | 2.12 | 20 % | 23 % | 4.33 | 2.82 | 54 % | 59 % | |||||||

Adjusted EBITDA1 | $ 246.3 | $ 225.1 | 9 % | 11 % | $ 433.4 | $ 338.0 | 28 % | 31 % | |||||||

Cash flows from operating activities | $ 273.9 | $ 237.0 | 16 % | n/a | $ (403.6) | $ (479.3) | 16 % | n/a | |||||||

Free Cash Flow5 | 235.7 | 198.1 | 19 % | n/a | (485.0) | (567.5) | 15 % | n/a | |||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. |

Consolidated Second-Quarter 2024 Performance Highlights:

Consolidated

| Three Months Ended June 30, | % Change | % Change | Six Months Ended June 30, | % Change | % Change | |||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||

Markets Advisory | $ 1,078.8 | $ 1,025.4 | 5 % | 6 % | $ 2,028.9 | $ 1,931.8 | 5 % | 5 % | |||||||

Capital Markets | 457.6 | 448.0 | 2 | 3 | 835.2 | 805.1 | 4 | 4 | |||||||

Work Dynamics | 3,933.3 | 3,374.6 | 17 | 17 | 7,572.8 | 6,650.8 | 14 | 14 | |||||||

JLL Technologies | 56.4 | 60.6 | (7) | (7) | 110.3 | 122.0 | (10) | (10) | |||||||

102.6 | 143.9 | (29) | (27) | 206.0 | 258.3 | (20) | (19) | ||||||||

Total revenue | $ 5,628.7 | $ 5,052.5 | 11 % | 12 % | $ 10,753.2 | $ 9,768.0 | 10 % | 10 % | |||||||

Gross contract costs5 | $ 3,747.4 | $ 3,205.8 | 17 % | 18 % | $ 7,246.1 | $ 6,339.1 | 14 % | 15 % | |||||||

Platform operating expenses | 1,717.4 | 1,685.7 | 2 | 2 | 3,227.3 | 3,214.4 | — | 1 | |||||||

Restructuring and acquisition charges4 | 11.5 | 11.8 | (3) | (2) | 13.2 | 47.5 | (72) | (72) | |||||||

Total operating expenses | $ 5,476.3 | $ 4,903.3 | 12 % | 12 % | $ 10,486.6 | $ 9,601.0 | 9 % | 10 % | |||||||

Net non-cash MSR and mortgage banking derivative activity1 | $ (11.8) | $ (0.6) | n.m. | n.m. | $ (20.8) | $ (2.4) | (767) % | (753) % | |||||||

Adjusted EBITDA1 | $ 246.3 | $ 225.1 | 9 % | 11 % | $ 433.4 | $ 338.0 | 28 % | 31 % | |||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

Revenue

Revenue increased

Businesses with Resilient6 revenues continued to deliver strong revenue growth, collectively up

The collective increase in Transactional6 revenue was led by Project Management, within Work Dynamics, which grew

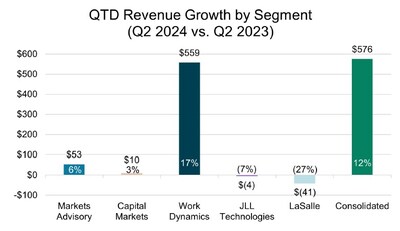

Refer to segment performance highlights for additional detail. The following chart reflects changes in revenue ($ in millions), and percentage changes, for the second quarter of 2024 compared with 2023.

Net income and Adjusted EBITDA

Net income attributable to common shareholders for the second quarter was

Diluted earnings per share for the second quarter were

The growth in consolidated profit was primarily attributable to (i) higher revenues, particularly Resilient revenues as well as certain Transactional revenue streams like Leasing, within Markets Advisory, (ii) the benefit of cost reduction actions largely executed in 2023 coupled with continued cost discipline and (iii) a positive impact associated with the year-over-year timing of incentive compensation accruals. These positive profit drivers were partially offset by (i)

Net income attributable to common shareholders was

The following chart reflects the aggregation of segment Adjusted EBITDA for the second quarter of 2024 and 2023.

Cash Flows and Capital Allocation:

Net cash provided by operating activities was

In the second quarter of 2024, the company repurchased 103,701 shares for

In the second quarter of 2024, the company acquired SKAE Power Solutions (SKAE), a

Net Debt, Leverage and Liquidity5:

June 30, 2024 | March 31, 2024 | June 30, 2023 | |||

Total Net Debt (in millions) | $ 1,752.0 | 1,900.8 | 1,941.5 | ||

Net Leverage Ratio | 1.7x | 1.9x | 2.0x | ||

Corporate Liquidity (in millions) | $ 2,449.4 | 2,301.7 | 1,902.5 |

The decrease in Net Debt from March 31, 2024, reflected incremental cash flows from operating activities during the second quarter of 2024. The Net Debt reduction from June 30, 2023, was largely attributable to improved cash flows from operations over the trailing twelve months ended June 30, 2024, compared with the twelve-month period ended June 30, 2023.

In addition to the Corporate Liquidity detailed above, the company initiated a commercial paper program (the "Program") with

Markets Advisory Second-Quarter 2024 Performance Highlights:

Markets Advisory

| Three Months Ended June 30, | % Change | % Change | Six Months Ended June 30, | % Change | % Change | |||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||

Revenue | $ 1,078.8 | $ 1,025.4 | 5 % | 6 % | $ 2,028.9 | $ 1,931.8 | 5 % | 5 % | |||||||

Leasing | 619.1 | 591.4 | 5 | 5 | 1,116.4 | 1,078.4 | 4 | 4 | |||||||

Property Management | 436.6 | 409.9 | 7 | 8 | 866.3 | 810.1 | 7 | 8 | |||||||

Advisory, Consulting and Other | 23.1 | 24.1 | (4) | (3) | 46.2 | 43.3 | 7 | 7 | |||||||

Segment operating expenses | $ 965.6 | $ 941.4 | 3 % | 3 % | $ 1,837.3 | $ 1,792.2 | 3 % | 3 % | |||||||

Segment platform operating expenses | 652.9 | 657.1 | (1) | — | 1,219.7 | 1,228.8 | (1) | — | |||||||

Gross contract costs5 | 312.7 | 284.3 | 10 | 11 | 617.6 | 563.4 | 10 | 11 | |||||||

Adjusted EBITDA1 | $ 129.6 | $ 99.4 | 30 % | 30 % | $ 224.9 | $ 171.0 | 32 % | 31 % | |||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

The increase in Markets Advisory revenue was primarily driven by Leasing, which achieved growth in most geographies, most notably in the

The Adjusted EBITDA increase was predominantly driven by revenue growth and the benefit of cost management actions largely executed in 2023. In addition, the timing of incentive compensation accruals positively impacted year-over-year profit performance for the quarter.

Capital Markets Second-Quarter 2024 Performance Highlights:

Capital Markets

| Three Months Ended June 30, | % Change | % Change | Six Months Ended June 30, | % Change | % Change | |||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||

Revenue | $ 457.6 | $ 448.0 | 2 % | 3 % | $ 835.2 | $ 805.1 | 4 % | 4 % | |||||||

Investment Sales, Debt/Equity Advisory and | 332.1 | 320.1 | 4 | 4 | 599.8 | 562.5 | 7 | 7 | |||||||

Net non-cash MSR and mortgage banking | (11.8) | (0.6) | n.m. | n.m. | (20.8) | (2.4) | (767) | (753) | |||||||

Value and Risk Advisory | 95.8 | 89.5 | 7 | 8 | 176.0 | 168.6 | 4 | 5 | |||||||

Loan Servicing | 41.5 | 39.0 | 6 | 6 | 80.2 | 76.4 | 5 | 5 | |||||||

Segment operating expenses | $ 453.5 | $ 433.9 | 5 % | 5 % | $ 831.9 | $ 799.1 | 4 % | 5 % | |||||||

Segment platform operating expenses | 441.7 | 420.8 | 5 | 6 | 806.5 | 776.7 | 4 | 4 | |||||||

Gross contract costs5 | 11.8 | 13.1 | (10) | (9) | 25.4 | 22.4 | 13 | 15 | |||||||

Equity earnings | $ 0.5 | $ 4.8 | (90) % | (90) % | $ 0.6 | $ 5.4 | (89) % | (89) % | |||||||

Adjusted EBITDA1 | $ 33.8 | $ 36.0 | (6) % | (8) % | $ 58.8 | $ 46.7 | 26 % | 27 % | |||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||

(a) Historically, net non-cash MSR and mortgage banking derivative activity was included in the Investment Sales, Debt/Equity Advisory and Other caption. Effective for Q2 2024, the net non-cash MSR and mortgage banking derivative activity revenue is separately presented in the above table and prior period financial information recast to conform with this presentation. |

Capital Markets achieved broad-based revenue growth across all business lines despite residual macroeconomic headwinds, including interest rate uncertainty during the current quarter. Investment Sales, Debt/Equity Advisory and Other, excluding Net non-cash MSR, increased in the office, industrial, and hotels sectors, and was geographically led by the

The increase in segment operating expenses was largely due to an

The slight decline in Adjusted EBITDA was attributable to the aforementioned negative impact associated with the repurchased loan, which overshadowed the revenue growth described above and the benefit associated with cost management actions largely executed in 2023. In addition, the lower equity earnings reflected a

Work Dynamics Second-Quarter 2024 Performance Highlights:

Work Dynamics

| Three Months Ended June 30, | % Change | % Change | Six Months Ended June 30, | % Change | % Change | |||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||

Revenue | $ 3,933.3 | $ 3,374.6 | 17 % | 17 % | $ 7,572.8 | $ 6,650.8 | 14 % | 14 % | |||||||

Workplace Management | 3,021.1 | 2,553.4 | 18 | 19 | 5,892.8 | 5,050.6 | 17 | 17 | |||||||

Project Management | 788.1 | 703.2 | 12 | 13 | 1,444.5 | 1,379.5 | 5 | 5 | |||||||

Portfolio Services and Other | 124.1 | 118.0 | 5 | 5 | 235.5 | 220.7 | 7 | 6 | |||||||

Segment operating expenses | $ 3,883.3 | $ 3,338.9 | 16 % | 17 % | $ 7,493.7 | $ 6,608.9 | 13 % | 14 % | |||||||

Segment platform operating expenses | 470.6 | 442.1 | 6 | 7 | 910.4 | 877.9 | 4 | 4 | |||||||

Gross contract costs5 | 3,412.7 | 2,896.8 | 18 | 18 | 6,583.3 | 5,731.0 | 15 | 15 | |||||||

Adjusted EBITDA1 | $ 71.1 | $ 56.2 | 27 % | 26 % | $ 122.0 | $ 81.9 | 49 % | 50 % | |||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

Work Dynamics revenue growth was led by continued strong performance in Workplace Management, as

The increase in Adjusted EBITDA was primarily attributable to the top-line performance described above, largely driven by Workplace Management, and continued cost discipline. In addition, the timing of incentive compensation accruals positively impacted year-over-year profit performance for the quarter.

JLL Technologies Second-Quarter 2024 Performance Highlights:

JLL Technologies

| Three Months Ended June 30, | % Change | % Change | Six Months Ended June 30, | % Change | % Change | |||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||

Revenue | $ 56.4 | $ 60.6 | (7) % | (7) % | $ 110.3 | $ 122.0 | (10) % | (10) % | |||||||

Segment operating expenses | $ 72.1 | $ 66.0 | 9 % | 9 % | $ 135.6 | $ 149.5 | (9) % | (9) % | |||||||

Segment platform operating expenses(a) | 70.7 | 61.9 | 14 | 14 | 133.0 | 141.8 | (6) | (6) | |||||||

Gross contract costs5 | 1.4 | 4.1 | (66) | (65) | 2.6 | 7.7 | (66) | (66) | |||||||

Adjusted EBITDA1 | $ (10.9) | $ (1.3) | (738) % | (704) % | $ (16.0) | $ (19.5) | 18 % | 19 % | |||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||

(a) Included in Segment platform operating expenses is carried interest expense of |

The decline in JLL Technologies revenue was partially due to lower contract signings over the last few quarters and delayed decisions on technology spend from existing solutions clients, which included certain contract renewals.

Segment operating expenses includes carried interest, which was a

The lower Adjusted EBITDA was entirely attributable to the

LaSalle Second-Quarter 2024 Performance Highlights:

| Three Months Ended June 30, | % Change | % Change | Six Months Ended June 30, | % Change | % Change | |||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||

Revenue | $ 102.6 | $ 143.9 | (29) % | (27) % | $ 206.0 | $ 258.3 | (20) % | (19) % | |||||||

Advisory fees | 93.1 | 103.1 | (10) | (8) | 185.4 | 203.6 | (9) | (8) | |||||||

Transaction fees and other | 6.9 | 5.0 | 38 | 39 | 15.8 | 15.4 | 3 | 7 | |||||||

Incentive fees | 2.6 | 35.8 | (93) | (92) | 4.8 | 39.3 | (88) | (87) | |||||||

Segment operating expenses | $ 90.3 | $ 111.3 | (19) % | (18) % | $ 174.9 | $ 203.8 | (14) % | (14) % | |||||||

Segment platform operating expenses | 81.5 | 103.8 | (21) | (20) | 157.7 | 189.2 | (17) | (16) | |||||||

Gross contract costs5 | 8.8 | 7.5 | 17 | 16 | 17.2 | 14.6 | 18 | 18 | |||||||

Adjusted EBITDA1 | $ 22.7 | $ 34.8 | (35) % | (31) % | $ 43.7 | $ 57.9 | (25) % | (20) % | |||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

The Adjusted EBITDA contraction was driven by lower revenues and a few discrete, individually immaterial items, partially offset by (i) the benefit of cost management actions largely executed in 2023 and (ii) an

As of June 30, 2024,

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of

Connect with us

https://www.linkedin.com/company/jll

https://www.facebook.com/jll

https://twitter.com/jll

Live Webcast | Conference Call | ||

Management will offer a live webcast for shareholders, analysts and investment The link to the live webcast and audio replay can be accessed at the Investor | The conference call can be accessed live over the phone by dialing (800) 715-9871; the conference ID number is 5398158. Listeners are asked to please dial in 10 minutes prior to the call start time and provide the conference ID number to be connected. | ||

Supplemental Information | Contact | ||

Supplemental information regarding the second quarter 2024 earnings call has been posted to the Investor Relations section of JLL's website: ir.jll.com. | If you have any questions, please contact Scott Einberger, | ||

Phone: | +1 312 252 8943 | ||

Email: |

| ||

Cautionary Note Regarding Forward-Looking Statements

Statements in this news release regarding, among other things, future financial results and performance, achievements, plans, objectives and shares repurchases may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors, the occurrence of which are outside JLL's control which may cause JLL's actual results, performance, achievements, plans, and objectives to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties, and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL's business in general, please refer to those factors discussed under "Risk Factors," "Business," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Quantitative and Qualitative Disclosures about Market Risk," and elsewhere in JLL's filed Annual Report on Form 10-K for the year ended December 31, 2023, soon to be filed Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 and other reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this release, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in expectations or results, or any change in events.

JONES LANG LASALLE INCORPORATED | |||||||

Consolidated Statements of Operations (Unaudited) | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||

(in millions, except share and per share data) | 2024 | 2023 | 2024 | 2023 | |||

Revenue | $ 5,628.7 | $ 5,052.5 | $ 10,753.2 | $ 9,768.0 | |||

Operating expenses: | |||||||

Compensation and benefits | $ 2,599.2 | $ 2,417.0 | $ 5,014.8 | $ 4,670.0 | |||

Operating, administrative and other | 2,803.3 | 2,414.6 | 5,335.3 | 4,766.1 | |||

Depreciation and amortization | 62.3 | 59.9 | 123.3 | 117.4 | |||

Restructuring and acquisition charges4 | 11.5 | 11.8 | 13.2 | 47.5 | |||

Total operating expenses | $ 5,476.3 | $ 4,903.3 | $ 10,486.6 | $ 9,601.0 | |||

Operating income | $ 152.4 | $ 149.2 | $ 266.6 | $ 167.0 | |||

Interest expense, net of interest income | 41.7 | 40.5 | 72.2 | 66.8 | |||

Equity losses | (15.4) | (103.5) | (19.1) | (106.1) | |||

Other income (expense) | 9.7 | (1.2) | 11.2 | (1.1) | |||

Income (loss) before income taxes and noncontrolling interest | 105.0 | 4.0 | 186.5 | (7.0) | |||

Income tax provision (benefit) | 20.5 | 0.8 | 36.4 | (1.5) | |||

Net income (loss) | 84.5 | 3.2 | 150.1 | (5.5) | |||

Net income (loss) attributable to noncontrolling interest | 0.1 | 0.7 | (0.4) | 1.2 | |||

Net income (loss) attributable to common shareholders | $ 84.4 | $ 2.5 | $ 150.5 | $ (6.7) | |||

Basic earnings (loss) per common share | $ 1.77 | $ 0.05 | $ 3.17 | $ (0.14) | |||

Basic weighted average shares outstanding (in 000's) | 47,539 | 47,748 | 47,512 | 47,652 | |||

Diluted earnings (loss) per common share | $ 1.75 | $ 0.05 | $ 3.12 | $ (0.14) | |||

Diluted weighted average shares outstanding (in 000's) | 48,317 | 48,334 | 48,302 | 47,652 | |||

Please reference accompanying financial statement notes. | |||||||

JONES LANG LASALLE INCORPORATED | |||||||

Selected Segment Financial Data (Unaudited) | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | |||

MARKETS ADVISORY | |||||||

Revenue | $ 1,078.8 | $ 1,025.4 | $ 2,028.9 | $ 1,931.8 | |||

Platform compensation and benefits | $ 543.4 | $ 546.4 | $ 1,005.9 | $ 1,007.4 | |||

Platform operating, administrative and other | 92.1 | 93.3 | 179.0 | 186.9 | |||

Depreciation and amortization | 17.4 | 17.4 | 34.8 | 34.5 | |||

Segment platform operating expenses | 652.9 | 657.1 | 1,219.7 | 1,228.8 | |||

Gross contract costs5 | 312.7 | 284.3 | 617.6 | 563.4 | |||

Segment operating expenses | $ 965.6 | $ 941.4 | $ 1,837.3 | $ 1,792.2 | |||

Segment operating income | $ 113.2 | $ 84.0 | $ 191.6 | $ 139.6 | |||

Add: | |||||||

Equity (losses) earnings | — | (0.1) | 0.4 | 0.2 | |||

Depreciation and amortization(a) | 16.5 | 16.5 | 32.9 | 32.6 | |||

Other income (expense) | 0.7 | (1.6) | 1.6 | (1.3) | |||

Net income attributable to noncontrolling interest | (0.2) | (0.4) | (0.3) | (0.6) | |||

Adjustments: | |||||||

Net loss on disposition | — | 1.8 | — | 1.8 | |||

Interest on employee loans, net of forgiveness | (0.6) | (0.8) | (1.3) | (1.3) | |||

Adjusted EBITDA1 | $ 129.6 | $ 99.4 | $ 224.9 | $ 171.0 | |||

(a) This adjustment excludes the noncontrolling interest portion of amortization of acquisition-related intangibles which is not attributable to common shareholders. | |||||||

JONES LANG LASALLE INCORPORATED | |||||||

Selected Segment Financial Data (Unaudited) Continued | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | |||

CAPITAL MARKETS | |||||||

Revenue | $ 457.6 | $ 448.0 | $ 835.2 | $ 805.1 | |||

Platform compensation and benefits | $ 341.1 | $ 335.4 | $ 628.7 | $ 619.3 | |||

Platform operating, administrative and other | 83.3 | 69.2 | 144.1 | 125.3 | |||

Depreciation and amortization | 17.3 | 16.2 | 33.7 | 32.1 | |||

Segment platform operating expenses | 441.7 | 420.8 | 806.5 | 776.7 | |||

Gross contract costs5 | 11.8 | 13.1 | 25.4 | 22.4 | |||

Segment operating expenses | $ 453.5 | $ 433.9 | $ 831.9 | $ 799.1 | |||

Segment operating income | $ 4.1 | $ 14.1 | $ 3.3 | $ 6.0 | |||

Add: | |||||||

Equity earnings | 0.5 | 4.8 | 0.6 | 5.4 | |||

Depreciation and amortization | 17.3 | 16.2 | 33.7 | 32.1 | |||

Other income | 0.8 | 0.4 | 1.4 | 0.2 | |||

Adjustments: | |||||||

Net non-cash MSR and mortgage banking derivative activity | 11.8 | 0.6 | 20.8 | 2.4 | |||

Interest on employee loans, net of forgiveness | (0.7) | (0.1) | (1.0) | 0.6 | |||

Adjusted EBITDA1 | $ 33.8 | $ 36.0 | $ 58.8 | $ 46.7 | |||

JONES LANG LASALLE INCORPORATED | ||||||||

Selected Segment Financial Data (Unaudited) Continued | ||||||||

Three Months Ended June 30, | Six Months Ended June 30, | |||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | ||||

WORK DYNAMICS | ||||||||

Revenue | $ 3,933.3 | $ 3,374.6 | $ 7,572.8 | $ 6,650.8 | ||||

Platform compensation and benefits | $ 333.8 | $ 321.0 | $ 653.6 | $ 626.0 | ||||

Platform operating, administrative and other | 116.0 | 101.2 | 215.3 | 212.7 | ||||

Depreciation and amortization | 20.8 | 19.9 | 41.5 | 39.2 | ||||

Segment platform operating expenses | 470.6 | 442.1 | 910.4 | 877.9 | ||||

Gross contract costs5 | 3,412.7 | 2,896.8 | 6,583.3 | 5,731.0 | ||||

Segment operating expenses | $ 3,883.3 | $ 3,338.9 | $ 7,493.7 | $ 6,608.9 | ||||

Segment operating income | $ 50.0 | $ 35.7 | $ 79.1 | $ 41.9 | ||||

Add: | ||||||||

Equity earnings | 0.4 | 0.8 | 1.1 | 1.2 | ||||

Depreciation and amortization | 20.8 | 19.9 | 41.5 | 39.2 | ||||

Net (income) loss attributable to noncontrolling interest | (0.1) | (0.2) | 0.3 | (0.4) | ||||

Adjusted EBITDA1 | $ 71.1 | $ 56.2 | $ 122.0 | $ 81.9 | ||||

JONES LANG LASALLE INCORPORATED | ||||||||

Selected Segment Financial Data (Unaudited) Continued | ||||||||

Three Months Ended June 30, | Six Months Ended June 30, | |||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | ||||

JLL TECHNOLOGIES | ||||||||

Revenue | $ 56.4 | $ 60.6 | $ 110.3 | $ 122.0 | ||||

Platform compensation and benefits(a) | $ 53.5 | $ 45.3 | $ 100.8 | $ 106.6 | ||||

Platform operating, administrative and other | 12.4 | 12.5 | 22.9 | 27.2 | ||||

Depreciation and amortization | 4.8 | 4.1 | 9.3 | 8.0 | ||||

Segment platform operating expenses | 70.7 | 61.9 | 133.0 | 141.8 | ||||

Gross contract costs5 | 1.4 | 4.1 | 2.6 | 7.7 | ||||

Segment operating expenses | $ 72.1 | $ 66.0 | $ 135.6 | $ 149.5 | ||||

Segment operating loss | $ (15.7) | $ (5.4) | $ (25.3) | $ (27.5) | ||||

Add: | ||||||||

Depreciation and amortization | 4.8 | 4.1 | 9.3 | 8.0 | ||||

Adjusted EBITDA1 | $ (10.9) | $ (1.3) | $ (16.0) | $ (19.5) | ||||

Equity losses | $ (9.0) | (103.9) | $ (10.0) | $ (99.0) | ||||

(a) Included in Platform compensation and benefits is carried interest expense of | ||||||||

Three Months Ended June 30, | Six Months Ended June 30, | |||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | ||||

Revenue | $ 102.6 | $ 143.9 | $ 206.0 | $ 258.3 | ||||

Platform compensation and benefits | $ 59.0 | $ 84.4 | $ 120.3 | $ 153.3 | ||||

Platform operating, administrative and other | 20.5 | 17.1 | 33.4 | 32.3 | ||||

Depreciation and amortization | 2.0 | 2.3 | 4.0 | 3.6 | ||||

Segment platform operating expenses | 81.5 | 103.8 | 157.7 | 189.2 | ||||

Gross contract costs5 | 8.8 | 7.5 | 17.2 | 14.6 | ||||

Segment operating expenses | $ 90.3 | $ 111.3 | $ 174.9 | $ 203.8 | ||||

Segment operating income | $ 12.3 | $ 32.6 | $ 31.1 | $ 54.5 | ||||

Add: | ||||||||

Depreciation and amortization | 2.0 | 2.3 | 4.0 | 3.6 | ||||

Other income | 8.2 | — | 8.2 | — | ||||

Net loss (income) attributable to noncontrolling interest | 0.2 | (0.1) | 0.4 | (0.2) | ||||

Adjusted EBITDA1 | $ 22.7 | $ 34.8 | $ 43.7 | $ 57.9 | ||||

Equity losses | $ (7.3) | (5.1) | $ (11.2) | $ (13.9) | ||||

JONES LANG LASALLE INCORPORATED | ||||||||

Consolidated Statement of Cash Flows (Unaudited) | ||||||||

Six Months Ended June 30, | Six Months Ended June 30, | |||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | ||||

Cash flows from operating activities7: | Cash flows from investing activities: | |||||||

Net income (loss) | $ 150.1 | $ (5.5) | Net capital additions – property and equipment | $ (81.4) | $ (88.2) | |||

Reconciliation of net income to net cash used in operating activities: | Business acquisitions, net of cash acquired | (39.3) | (13.6) | |||||

Depreciation and amortization | 123.3 | 117.4 | Capital contributions to investments | (41.0) | (66.2) | |||

Equity losses | 19.1 | 106.1 | Distributions of capital from investments | 9.6 | 12.7 | |||

Net loss on dispositions | — | 1.8 | Other, net | (2.0) | (5.4) | |||

Distributions of earnings from investments | 7.2 | 6.0 | Net cash used in investing activities | (154.1) | (160.7) | |||

Provision for loss on receivables and other assets | 31.7 | 19.0 | Cash flows from financing activities: | |||||

Amortization of stock-based compensation | 56.8 | 53.0 | Proceeds from borrowings under credit facility | 4,713.0 | 4,478.0 | |||

Net non-cash mortgage servicing rights and mortgage banking derivative activity | 20.8 | 2.4 | Repayments of borrowings under credit facility | (4,063.0) | (3,853.0) | |||

Accretion of interest and amortization of debt issuance costs | 2.6 | 2.1 | Net repayments of short-term borrowings | (15.4) | (55.3) | |||

Other, net | (0.7) | 3.6 | Payments of deferred business acquisition obligations and earn-outs | (4.9) | (21.8) | |||

Change in: | Repurchase of common stock | (40.4) | (19.5) | |||||

Receivables | 114.9 | 139.8 | Noncontrolling interest contributions, net | 3.3 | — | |||

Reimbursable receivables and reimbursable payables | (79.3) | (51.0) | Other, net | (26.0) | (24.5) | |||

Prepaid expenses and other assets | 16.2 | (4.9) | Net cash provided by financing activities | 566.6 | 503.9 | |||

Income taxes receivable, payable and deferred | (150.3) | (116.1) | Effect of currency exchange rate changes on cash, cash equivalents and restricted cash | (14.7) | 3.8 | |||

Accounts payable, accrued liabilities and other liabilities | (139.4) | (119.8) | Net change in cash, cash equivalents and restricted cash | $ (5.8) | $ (132.3) | |||

Accrued compensation (including net deferred compensation) | (576.6) | (633.2) | Cash, cash equivalents and restricted cash, beginning of the period | 663.4 | 746.0 | |||

Net cash used in operating activities | $ (403.6) | $ (479.3) | Cash, cash equivalents and restricted cash, end of the period | $ 657.6 | $ 613.7 | |||

Please reference accompanying financial statement notes. | ||||||||

JONES LANG LASALLE INCORPORATED | ||||||||||||

Consolidated Balance Sheets | ||||||||||||

June 30, | December 31, | June 30, | December 31, | |||||||||

(in millions, except share and per share data) | 2024 | 2023 | 2024 | 2023 | ||||||||

ASSETS | (Unaudited) | LIABILITIES AND EQUITY | (Unaudited) | |||||||||

Current assets: | Current liabilities: | |||||||||||

Cash and cash equivalents | $ 424.4 | $ 410.0 | Accounts payable and accrued liabilities | $ 1,154.0 | $ 1,406.7 | |||||||

Trade receivables, net of allowance | 1,911.5 | 2,095.8 | Reimbursable payables | 1,746.0 | 1,796.9 | |||||||

Notes and other receivables | 417.9 | 446.4 | Accrued compensation and benefits | 1,098.0 | 1,698.3 | |||||||

Reimbursable receivables | 2,345.2 | 2,321.7 | Short-term borrowings | 126.2 | 147.9 | |||||||

Warehouse receivables | 642.4 | 677.4 | Short-term contract liability and deferred income | 217.9 | 226.4 | |||||||

Short-term contract assets, net of allowance | 310.3 | 338.3 | Warehouse facilities | 655.5 | 662.7 | |||||||

Prepaid and other | 582.3 | 567.4 | Short-term operating lease liability | 155.6 | 161.9 | |||||||

Total current assets | 6,634.0 | 6,857.0 | Other | 360.8 | 345.3 | |||||||

Property and equipment, net of accumulated depreciation | 596.9 | 613.9 | Total current liabilities | 5,514.0 | 6,446.1 | |||||||

Operating lease right-of-use asset | 759.4 | 730.9 | Noncurrent liabilities: | |||||||||

Goodwill | 4,609.2 | 4,587.4 | Credit facility, net of debt issuance costs | 1,262.1 | 610.6 | |||||||

Identified intangibles, net of accumulated amortization | 743.9 | 785.0 | Long-term debt, net of debt issuance costs | 767.9 | 779.3 | |||||||

Investments | 819.7 | 816.6 | Long-term deferred tax liabilities, net | 42.5 | 44.8 | |||||||

Long-term receivables | 394.1 | 363.8 | Deferred compensation | 620.0 | 580.0 | |||||||

Deferred tax assets, net | 507.8 | 497.4 | Long-term operating lease liability | 779.8 | 754.5 | |||||||

Deferred compensation plans | 639.8 | 604.3 | Other | 424.4 | 439.6 | |||||||

Other | 204.2 | 208.5 | Total liabilities | $ 9,410.7 | $ 9,654.9 | |||||||

Total assets | $ 15,909.0 | $ 16,064.8 | ||||||||||

Company shareholders' equity | ||||||||||||

Common stock | 0.5 | 0.5 | ||||||||||

Additional paid-in capital | 2,013.3 | 2,019.7 | ||||||||||

Retained earnings | 5,941.9 | 5,795.6 | ||||||||||

Treasury stock | (913.6) | (920.1) | ||||||||||

Shares held in trust | (11.9) | (10.4) | ||||||||||

Accumulated other comprehensive loss | (651.0) | (591.5) | ||||||||||

Total company shareholders' equity | 6,379.2 | 6,293.8 | ||||||||||

Noncontrolling interest | 119.1 | 116.1 | ||||||||||

Total equity | 6,498.3 | 6,409.9 | ||||||||||

Total liabilities and equity | $ 15,909.0 | $ 16,064.8 | ||||||||||

Please reference accompanying financial statement notes. | ||||||||||||

JONES LANG LASALLE INCORPORATED

Financial Statement Notes

1. Management uses certain non-GAAP financial measures to develop budgets and forecasts, measure and reward performance against those budgets and forecasts, and enhance comparability to prior periods. These measures are believed to be useful to investors and other external stakeholders as supplemental measures of core operating performance and include the following:

(i) Adjusted EBITDA attributable to common shareholders ("Adjusted EBITDA"),

(ii) Adjusted net income attributable to common shareholders and Adjusted diluted earnings per share,

(iii) Free Cash Flow (refer to Note 5),

(iv) Net Debt (refer to Note 5), and

(v) Percentage changes against prior periods, presented on a local currency basis.

However, non-GAAP financial measures should not be considered alternatives to measures determined in accordance with

Effective January 1, 2024, the definitions of Adjusted EBITDA and Adjusted net income attributable to common shareholders were updated to exclude certain equity earnings/losses as further described below. Comparable periods have been recast to conform to the revised presentation.

Also effective with first-quarter 2024 reporting, the company no longer reports the non-GAAP measures "Fee revenue" and "Fee-based operating expenses" following the conclusion of a comment letter from the Securities and Exchange Commission Staff in February 2024.

Adjustments to GAAP Financial Measures Used to Calculate non-GAAP Financial Measures

Net Non-Cash Mortgage Servicing Rights ("MSR") and Mortgage Banking Derivative Activity consists of the balances presented within Revenue composed of (i) derivative gains/losses resulting from mortgage banking loan commitment and warehousing activity and (ii) gains recognized from the retention of MSR upon origination and sale of mortgage loans, offset by (iii) amortization of MSR intangible assets over the period that net servicing income is projected to be received. Non-cash derivative gains/losses resulting from mortgage banking loan commitment and warehousing activity are calculated as the estimated fair value of loan commitments and subsequent changes thereof, primarily represented by the estimated net cash flows associated with future servicing rights. MSR gains and corresponding MSR intangible assets are calculated as the present value of estimated cash flows over the estimated mortgage servicing periods. The above activity is reported entirely within Revenue of the Capital Markets segment. Excluding net non-cash MSR and mortgage banking derivative activity reflects how the company manages and evaluates performance because the excluded activity is non-cash in nature.

Restructuring and Acquisition Charges primarily consist of: (i) severance and employment-related charges, including those related to external service providers, incurred in conjunction with a structural business shift, which can be represented by a notable change in headcount, change in leadership or transformation of business processes; (ii) acquisition, transaction and integration-related charges, including fair value adjustments, which are generally non-cash in the periods such adjustments are made, to assets and liabilities recorded in purchase accounting such as earn-out liabilities and intangible assets; and (iii) lease exit charges. Such activity is excluded as the amounts are generally either non-cash in nature or the anticipated benefits from the expenditures would not likely be fully realized until future periods. Restructuring and acquisition charges are excluded from segment operating results and therefore are not line items in the segments' reconciliation to Adjusted EBITDA.

Amortization of Acquisition-Related Intangibles is primarily associated with the fair value ascribed at closing of an acquisition to assets such as acquired management contracts, customer backlog and relationships, and trade name. Such activity is excluded as it is non-cash and the change in period-over-period activity is generally the result of longer-term strategic decisions and therefore not necessarily indicative of core operating results.

Gain or Loss on Disposition reflects the gain or loss recognized on the sale of businesses. Given the low frequency of business disposals by the company historically, the gain or loss directly associated with such activity is excluded as it is not considered indicative of core operating performance. In 2023, the

Interest on Employee Loans, Net of Forgiveness reflects interest accrued on employee loans less the amount of accrued interest forgiven. Certain employees (predominantly in our Leasing and Capital Markets businesses) receive cash payments structured as loans, with interest. Employees earn forgiveness of the loan based on performance, generally calculated as a percentage of revenue production. Such forgiven amounts are reflected in Compensation and benefits expense. Given the interest accrued on these employee loans and subsequent forgiveness are non-cash and the amounts perfectly offset over the life of the loan, the activity is not indicative of core operating performance and is excluded from non-GAAP measures.

Equity Earnings/Losses (JLL Technologies and

Note: Equity earnings/losses in the remaining segments represent the results of unconsolidated operating ventures (not investments), and therefore the amounts are included in adjusted profit measures on both a segment and consolidated basis.

Reconciliation of Non-GAAP Financial Measures

Below are (i) a reconciliation of Net income attributable to common shareholders to Adjusted EBITDA, (ii) a reconciliation to Adjusted net income and (iii) components of Adjusted diluted earnings per share.

Three Months Ended June 30, | Six Months Ended June 30, | ||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | |||

Net income (loss) attributable to common shareholders | $ 84.4 | $ 2.5 | $ 150.5 | $ (6.7) | |||

Add: | |||||||

Interest expense, net of interest income | 41.7 | 40.5 | 72.2 | 66.8 | |||

Income tax provision (benefit) | 20.5 | 0.8 | 36.4 | (1.5) | |||

Depreciation and amortization(a) | 61.4 | 59.0 | 121.4 | 115.5 | |||

Adjustments: | |||||||

Restructuring and acquisition charges4 | 11.5 | 11.8 | 13.2 | 47.5 | |||

Net loss on disposition | — | 1.8 | — | 1.8 | |||

Net non-cash MSR and mortgage banking derivative activity | 11.8 | 0.6 | 20.8 | 2.4 | |||

Interest on employee loans, net of forgiveness | (1.3) | (0.9) | (2.3) | (0.7) | |||

Equity losses - JLL Technologies and | 16.3 | 109.0 | 21.2 | 112.9 | |||

Adjusted EBITDA | $ 246.3 | $ 225.1 | $ 433.4 | $ 338.0 | |||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||

(In millions, except share and per share data) | 2024 | 2023 | 2024 | 2023 | |||

Net income (loss) attributable to common shareholders | $ 84.4 | $ 2.5 | $ 150.5 | $ (6.7) | |||

Diluted shares (in thousands)(b) | 48,317 | 48,334 | 48,302 | 47,652 | |||

Diluted earnings (loss) per share | $ 1.75 | $ 0.05 | $ 3.12 | $ (0.14) | |||

Net income (loss) attributable to common shareholders | $ 84.4 | $ 2.5 | $ 150.5 | $ (6.7) | |||

Adjustments: | |||||||

Restructuring and acquisition charges4 | 11.5 | 11.8 | 13.2 | 47.5 | |||

Net non-cash MSR and mortgage banking derivative activity | 11.8 | 0.6 | 20.8 | 2.4 | |||

Amortization of acquisition-related intangibles(a) | 15.8 | 17.2 | 31.0 | 33.7 | |||

Net loss on disposition | — | 1.8 | — | 1.8 | |||

Interest on employee loans, net of forgiveness | (1.3) | (0.9) | (2.3) | (0.7) | |||

Equity losses - JLL Technologies and | 16.3 | 109.0 | 21.2 | 112.9 | |||

Tax impact of adjusted items(c) | (15.3) | (39.8) | (25.2) | (54.5) | |||

Adjusted net income attributable to common shareholders | $ 123.2 | $ 102.2 | $ 209.2 | $ 136.4 | |||

Diluted shares (in thousands) | 48,317 | 48,334 | 48,302 | 48,357 | |||

Adjusted diluted earnings per share | $ 2.55 | $ 2.12 | $ 4.33 | $ 2.82 | |||

(a) This adjustment excludes the noncontrolling interest portion of amortization of acquisition-related intangibles which is not attributable to common shareholders. |

(b) For the six months ended June 30, 2023, basic shares outstanding were used in the calculation of dilutive loss per share as the impact of unvested stock-based compensation awards would be anti-dilutive. |

(c) For the first half of 2024 and 2023, the tax impact of adjusted items was calculated using the applicable statutory rates by tax jurisdiction. |

Operating Results - Local Currency

In discussing operating results, the company refers to percentage changes in local currency, unless otherwise noted. Amounts presented on a local currency basis are calculated by translating the current period results of foreign operations to

The following table reflects the reconciliation to local currency amounts for consolidated (i) Revenue, (ii) Operating income and (iii) Adjusted EBITDA.

Three Months Ended June 30, | Six Months Ended June 30, | ||||||

($ in millions) | 2024 | % Change | 2024 | % Change | |||

Revenue: | |||||||

At current period exchange rates | $ 5,628.7 | 11 % | $ 10,753.2 | 10 % | |||

Impact of change in exchange rates | 32.5 | n/a | 38.1 | n/a | |||

At comparative period exchange rates | $ 5,661.2 | 12 % | $ 10,791.3 | 10 % | |||

Operating income: | |||||||

At current period exchange rates | $ 152.4 | 2 % | $ 266.6 | 60 % | |||

Impact of change in exchange rates | 2.7 | n/a | 8.1 | n/a | |||

At comparative period exchange rates | $ 155.1 | 4 % | $ 274.7 | 65 % | |||

Adjusted EBITDA: | |||||||

At current period exchange rates | $ 246.3 | 9 % | $ 433.4 | 28 % | |||

Impact of change in exchange rates | 2.7 | n/a | 8.0 | n/a | |||

At comparative period exchange rates | $ 249.0 | 11 % | $ 441.4 | 31 % | |||

2. n.m.: "not meaningful", represented by a percentage change of greater than 1,

3. As of June 30, 2024,

Compared with AUM of

Assets under management data for separate accounts and fund management amounts are reported on a one-quarter lag. In addition,

4. Restructuring and acquisition charges are excluded from the company's measure of segment operating results, although they are included within consolidated Operating income calculated in accordance with GAAP. For purposes of segment operating results, the allocation of Restructuring and acquisition charges to the segments is not a component of management's assessment of segment performance. The table below shows Restructuring and acquisition charges.

Three Months Ended June 30, | Six Months Ended June 30, | ||||||

(in millions) | 2024 | 2023 | 2024 | 2023 | |||

Severance and other employment-related charges | $ 7.2 | $ 5.8 | $ 11.7 | $ 31.5 | |||

Restructuring, pre-acquisition and post-acquisition charges | 6.4 | 6.6 | 14.1 | 16.6 | |||

Fair value adjustments that resulted in a net decrease to earn-out liabilities from | (2.1) | (0.6) | (12.6) | (0.6) | |||

Total Restructuring and acquisition charges | $ 11.5 | $ 11.8 | $ 13.2 | $ 47.5 | |||

5. "Gross contract costs" represent certain costs associated with client-dedicated employees and third-party vendors and subcontractors and are directly or indirectly reimbursed through the fees we receive. These costs are presented on a gross basis in Operating expenses (with the corresponding fees in Revenue).

"Net Debt" is defined as the sum of the (i) Credit facility, inclusive of debt issuance costs, (ii) Long-term debt, inclusive of debt issuance costs and (iii) Short-term borrowings liability balances less Cash and cash equivalents.

"Net Leverage Ratio" is defined as Net Debt divided by the trailing twelve-month Adjusted EBITDA.

Below is a reconciliation of total debt to Net Debt and the components of Net Leverage Ratio.

($ in millions) | June 30, 2024 | March 31, 2024 | June 30, 2023 | ||

Total debt | $ 2,176.4 | $ 2,297.5 | $ 2,344.0 | ||

Less: Cash and cash equivalents | 424.4 | 396.7 | 402.5 | ||

Net Debt | $ 1,752.0 | $ 1,900.8 | $ 1,941.5 | ||

Divided by: Trailing twelve-month Adjusted EBITDA | $ 1,033.8 | $ 1,012.6 | $ 974.3 | ||

Net Leverage Ratio | 1.7x | 1.9x | 2.0x |

"Corporate Liquidity" is defined as the unused portion of the company's Credit facility plus cash and cash equivalents.

"Free Cash Flow" is defined as cash provided by operating activities less net capital additions - property and equipment.

Below is a reconciliation of net cash used in operating activities to Free Cash Flow.

Six Months Ended June 30, | |||

(in millions) | 2024 | 2023 | |

Net cash used in operating activities | $ (403.6) | $ (479.3) | |

Net capital additions - property and equipment | (81.4) | (88.2) | |

Free Cash Flow5 | $ (485.0) | $ (567.5) | |

6. The company defines "Resilient" revenue as (i) Property Management, within Markets Advisory, (ii) Value and Risk Advisory, and Loan Servicing, within Capital Markets, (iii) Workplace Management, within Work Dynamics, (iv) JLL Technologies and (v) Advisory Fees, within

The company defines "Transactional" revenue as (i) Leasing and Advisory, Consulting and Other, within Markets Advisory, (ii) Investment Sales, Debt/Equity Advisory and Other, within Capital Markets, (iii) Project Management and Portfolio Services and Other, within Work Dynamics and (iv) Incentive fees and Transaction fees and other, within

7. Within the Consolidated Statements of Cash Flows, the company made certain presentation changes and recast prior-period information to conform with the current presentation. More specifically, the company recast certain components and captions within Cash flows from operating activities, which had no impact on previously-reported Net cash provided by operating activities or on the other consolidated financial statements.

8.

Appendix: Additional Segment Detail

Three Months Ended June 30, 2024 | |||||||||||||||||||||||

(in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||

Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | Total | ||||||||||

Revenue(a) | $ 619.1 | 436.6 | 23.1 | $ 1,078.8 | $ 320.3 | 95.8 | 41.5 | $ 457.6 | $ 3,021.1 | 788.1 | 124.1 | $ 3,933.3 | $ 56.4 | $ 102.6 | $ 5,628.7 | ||||||||

Gross contract costs5 | $ 5.9 | 304.4 | 2.4 | $ 312.7 | $ 8.6 | 3.2 | — | $ 11.8 | $ 2,793.4 | 555.2 | 64.1 | $ 3,412.7 | $ 1.4 | $ 8.8 | $ 3,747.4 | ||||||||

Platform operating expenses | $ 652.9 | $ 441.7 | $ 470.6 | $ 70.7 | $ 81.5 | $ 1,717.4 | |||||||||||||||||

Adjusted EBITDA1 | $ 129.6 | $ 33.8 | $ 71.1 | $ (10.9) | $ 22.7 | $ 246.3 | |||||||||||||||||

(a) Included as a reduction to Revenue is Net non-cash MSR and mortgage banking derivative activity of |

Three Months Ended June 30, 2023 | |||||||||||||||||||||||

(in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||

Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | Total | ||||||||||

Revenue | $ 591.4 | 409.9 | 24.1 | $ 1,025.4 | $ 319.5 | 89.5 | 39.0 | $ 448.0 | $ 2,553.4 | 703.2 | 118.0 | $ 3,374.6 | $ 60.6 | $ 143.9 | $ 5,052.5 | ||||||||

Gross contract costs5 | $ 3.4 | 278.9 | 2.0 | $ 284.3 | $ 10.2 | 2.9 | — | $ 13.1 | $ 2,365.2 | 473.5 | 58.1 | $ 2,896.8 | $ 4.1 | $ 7.5 | $ 3,205.8 | ||||||||

Platform operating expenses | $ 657.1 | $ 420.8 | $ 442.1 | $ 61.9 | $ 103.8 | $ 1,685.7 | |||||||||||||||||

Adjusted EBITDA1 | $ 99.4 | $ 36.0 | $ 56.2 | $ (1.3) | $ 34.8 | $ 225.1 | |||||||||||||||||

(a) Included as a reduction to Revenue is Net non-cash MSR and mortgage banking derivative activity of |

Appendix: Additional Segment Detail (continued)

Six Months Ended June 30, 2024 | |||||||||||||||||||||||

(in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||

Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | Total | ||||||||||

Revenue(a) | $ 1,116.4 | 866.3 | 46.2 | $ 2,028.9 | $ 579.0 | 176.0 | 80.2 | $ 835.2 | $ 5,892.8 | 1,444.5 | 235.5 | $ 110.3 | $ 206.0 | $ 10,753.2 | |||||||||

Gross contract costs5 | $ 10.1 | 602.9 | 4.6 | $ 617.6 | $ 19.7 | 5.7 | — | $ 25.4 | $ 5,456.5 | 1,001.1 | 125.7 | $ 2.6 | $ 17.2 | $ 7,246.1 | |||||||||

Platform operating expenses | $ 1,219.7 | $ 806.5 | $ 910.4 | $ 133.0 | $ 157.7 | $ 3,227.3 | |||||||||||||||||

Adjusted EBITDA1 | $ 224.9 | $ 58.8 | $ 122.0 | $ (16.0) | $ 43.7 | $ 433.4 | |||||||||||||||||

(a) Included as a reduction to Revenue is Net non-cash MSR and mortgage banking derivative activity of |

Six Months Ended June 30, 2023 | |||||||||||||||||||||||

(in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||

Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | Total | ||||||||||

Revenue(a) | $ 1,078.4 | 810.1 | 43.3 | $ 1,931.8 | $ 560.1 | 168.6 | 76.4 | $ 805.1 | $ 5,050.6 | 1,379.5 | 220.7 | $ 122.0 | $ 258.3 | ||||||||||

Gross contract costs5 | $ 7.9 | 552.0 | 3.5 | $ 563.4 | $ 17.4 | 5.0 | — | $ 22.4 | $ 4,679.2 | 938.9 | 112.9 | $ 7.7 | $ 14.6 | ||||||||||

Platform operating expenses | $ 1,228.8 | $ 776.7 | $ 877.9 | $ 141.8 | $ 189.2 | ||||||||||||||||||

Adjusted EBITDA1 | $ 171.0 | $ 46.7 | $ 81.9 | $ (19.5) | $ 57.9 | $ 338.0 | |||||||||||||||||

(a) Included as a reduction to Revenue is Net non-cash MSR and mortgage banking derivative activity of |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-reports-financial-results-for-second-quarter-2024-302214942.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-reports-financial-results-for-second-quarter-2024-302214942.html

SOURCE JLL-IR

FAQ

What was JLL's revenue for Q2 2024?

How much did JLL's diluted earnings per share increase in Q2 2024?

What was JLL's net income for Q2 2024?

How much did JLL's Adjusted EBITDA grow in Q2 2024?