Wi2Wi Corporation Announces 2021 Year End Results

Wi2Wi Corporation reported its audited consolidated financial results for the fiscal year ended December 31, 2021, showing revenues of $6.453 million and a gross profit of $1.279 million. The company achieved a net income loss of $204,000, an improvement compared to a loss of $588,000 in the previous year. Furthermore, Wi2Wi reported positive cash flow from operations, generating $504,000 versus a negative cash flow of $674,000 in FY20. The reduction of top-line expenses by $644,000 contributed to these results, highlighting the company’s efforts towards cost management and innovation.

- Achieved first positive cash flow since the pandemic with $504,000 generated from operations.

- Reduced top-line expenses by $644,000 compared to FY20, enhancing financial management.

- Showed improvement in net income loss, reduced from $588,000 in FY20 to $204,000 in FY21.

- Revenue decreased from $6.928 million in FY20 to $6.453 million in FY21.

TORONTO, ON / ACCESSWIRE / April 18, 2022 / Wi2Wi Corporation today announced its audited consolidated financial results for the fiscal year ended December 31, 2021.

Key Financial Highlights

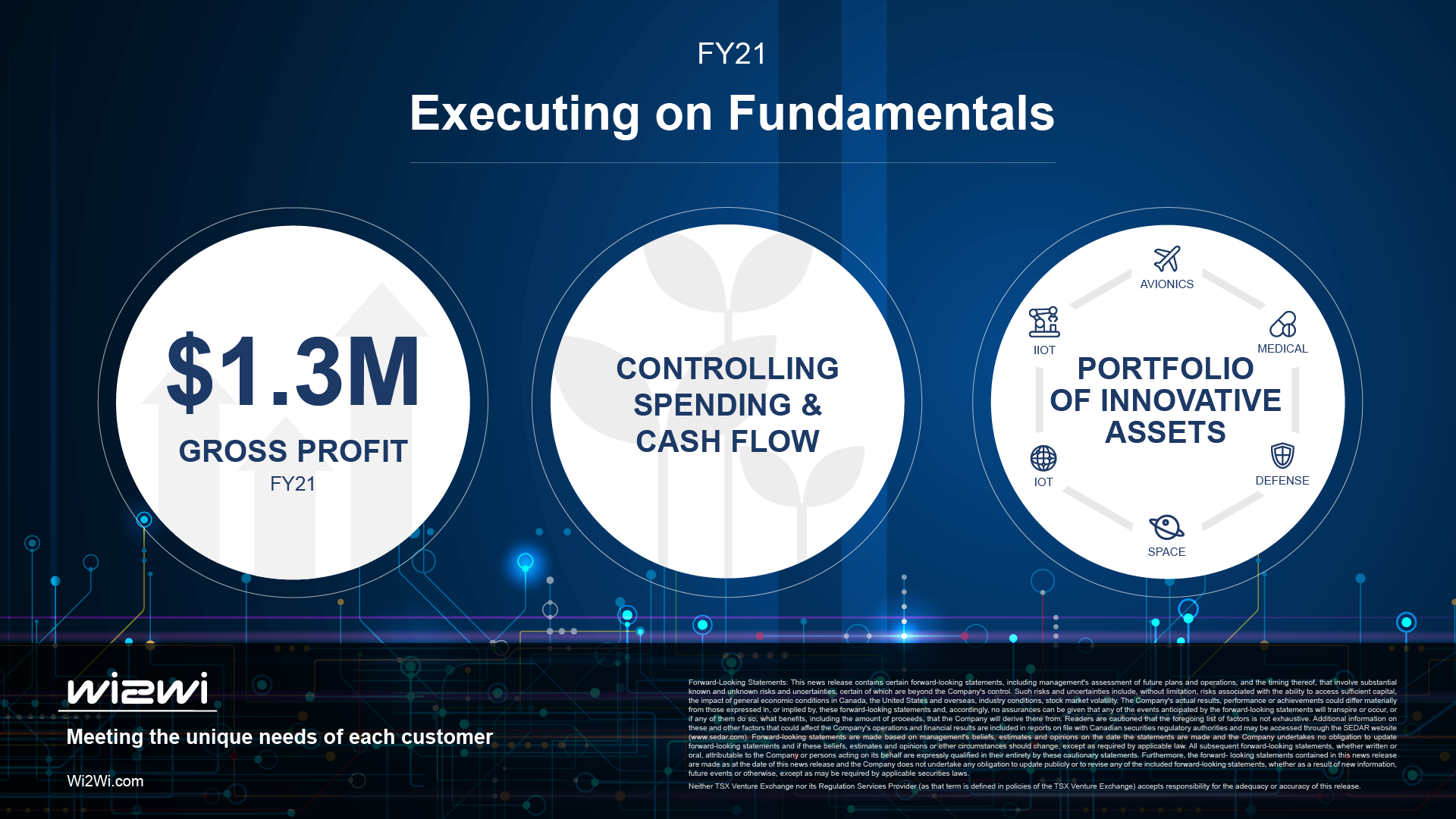

Wi2Wi is executing on the fundamentals of its business by increasing net income and gross profit with positive cash flow for the first time since the COVID-19 global pandemic began.

In FY21, Wi2Wi generated

"We once again prevailed in a challenging environment - controlling spending and effectively utilizing cash for operations with a special focus on innovation and customer success." said Zachariah Mathews, President and CEO of Wi2Wi. "Together with a normalization in Wi2Wi's market order flow, we are actively identifying, seeking, and capturing future opportunities to drive growth. We believe that for Wi2Wi and the company's broadly applicable portfolio of innovative assets, the best is truly yet to come."

FY21 Financial Overview

(In thousands of U.S. dollars) | 12 Months ending December 31, 2021 | 12 Months ending December 31, 2020 | ||||||

Revenue | $ | 6,453 | $ | 6,928 | ||||

Net income | (204 | ) | (588 | ) | ||||

Net cash provided by (used in) operations | 504 | (674 | ) | |||||

Cash and restricted cash | 2,383 | 1,739 | ||||||

Total assets | 10,600 | 11,033 | ||||||

Total current liabilities | 1,240 | 1,055 | ||||||

Shareholders' equity | 6,515 | 6,698 | ||||||

Q4 FY21 Financial Overview

(In thousands of U.S. dollars) | 3 Months ending December 31, 2021 | 3 Months ending December 31, 2020 | ||||||

Revenue | $ | 1,670 | $ | 1,414 | ||||

Net income | 142 | 127 | ||||||

Detailed and historical financial information is available here.

Investor & Media Contact

Dawn Leeder, Chief Financial Officer

+1-608-203-0234

dawn_l@wi2wi.com

About Wi2Wi Corporation

Wi2Wi enables customers to substantially reduce their wireless R&D expenses and time to market. Wi2Wi designs, manufactures and markets deeply integrated, end-to-end wireless connectivity solutions as well as customizable, high-performance timing and frequency control devices. Wi2Wi provides real time technical support throughout the entire product life cycle for customers across the Internet of Things (IoT), Industrial Internet of Things (IIoT), Avionics, Space, Industrial, Medical and Government sectors.

Wi2Wi was founded in 2005 and is strategically headquartered in San Jose, California with satellite offices in Middleton, Wisconsin and Hyderabad, India. Wi2Wi's manufacturing operations, its laboratory for reliability and quality control, together with design and engineering for timing and frequency control devices are located in Middleton, Wisconsin. The branch office, located in Hyderabad, India, focuses on developing end to end wireless connectivity subsystems and solutions.

Wi2Wi has partnered with best-in-class global leaders in technology, manufacturing and sales. The company uses a global network of manufacturer's representatives to promote its products and services, and has partnered with world class distributors for the fulfillment of orders along with direct sales.

Forward-Looking Statements: This news release contains certain forward-looking statements, including management's assessment of future plans and operations, and the timing thereof, that involve substantial known and unknown risks and uncertainties, certain of which are beyond the Company's control. Such risks and uncertainties include, without limitation, risks associated with the ability to access sufficient capital, the impact of general economic conditions in Canada, the United States and overseas, industry conditions, stock market volatility. The Company's actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits, including the amount of proceeds, that the Company will derive there from. Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on these and other factors that could affect the Company's operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com). Forward-looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update forward-looking statements and if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable law. All subsequent forward-looking statements, whether written or oral, attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Furthermore, the forward- looking statements contained in this news release are made as at the date of this news release and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Wi2Wi Corporation

View source version on accesswire.com:

https://www.accesswire.com/697592/Wi2Wi-Corporation-Announces-2021-Year-End-Results

FAQ

What were the financial results of Wi2Wi Corporation for FY21?

How much did Wi2Wi reduce its top-line expenses in FY21?

Did Wi2Wi Corporation achieve positive cash flow in FY21?

What was the net income of Wi2Wi Corporation in FY20 and FY21?