Intuit QuickBooks’ Integrated Small Business Bank Account Is Now QuickBooks Checking

Intuit (NASDAQ: INTU) enhances its QuickBooks Checking with new features aimed at small businesses. Over 150,000 businesses have adopted this banking solution since its 2020 launch, with a 4x increase in active customers since January 2021. Key offerings include mobile check deposit, a virtual debit card, and a competitive 1.00% APY on balances. Additionally, the Cash Flow Planner and Envelopes features provide financial planning tools. This initiative supports small businesses by increasing cash flow visibility and management capabilities.

- Over 150,000 small businesses have signed up for QuickBooks Checking since launch.

- Active customer base grew 4x since January 2021, indicating strong demand.

- Competitive 1.00% APY on all balances enhances value for customers.

- Integration with QuickBooks Payments facilitates efficient transaction processing.

- New features like Mobile Check Deposit and Virtual Debit Card improve user experience.

- None.

Insights

Analyzing...

Differentiated banking experience enhanced with new features to deliver greater value, visibility and cash management capabilities to small businesses

(Photo: Business Wire)

In less than two years, more than 150,000 small businesses have signed up for a QuickBooks Checking account which has zero opening fees, no minimum balance requirements and no monthly maintenance fees.* Since

As an online and mobile-optimized banking solution, small businesses can apply for a QuickBooks Checking account in minutes and access a range of services and features, including a debit card (physical and virtual)*, a competitive

“Thousands of small businesses are turning to QuickBooks Checking to manage their cash flow and we’re laser focused on continuing to refine and design an even more robust banking experience with their specific needs in mind,” said

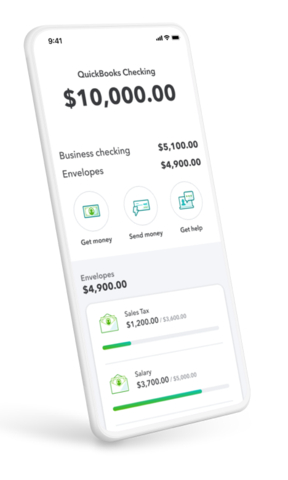

QuickBooks Checking will continue to offer industry-leading banking services small business customers have come to love including two key features that help customers better manage their overall cash flow. The Cash Flow Planner* delivers powerful insights to help plan for the future by predicting cash flow 90 days out leveraging machine learning and data analysis. The planner proactively alerts business owners when cash flow might become a concern and provides recommendations on how to navigate potential challenges.

Another QuickBooks Checking feature small businesses will continue to enjoy is Envelopes*, which allows them to partition money for planned or unexpected expenditures and avoid spending funds before their intended use. Small businesses commonly use the Envelopes feature to set aside funds for expenses like taxes and payroll. Sales tax in particular is something businesses need to plan for and trying to manage this manually can take significant time and energy. By applying advanced machine learning, QuickBooks Checking will also be streamlining this process for small businesses with the introduction of Sales Tax Automation*. Coming soon, this feature will automatically set aside sales tax for payments in a sales tax envelope.

QuickBooks Checking is also introducing new features to create an even more powerful one-stop business banking solution. New features include:

- Mobile Check Deposit*, giving small businesses the ability to accept checks from customers or vendors and deposit those funds into their account seamlessly from anywhere. Mobile check deposit will begin rolling out to eligible QuickBooks Checking customers in the coming weeks.

- A Virtual Debit Card* made available immediately upon account approval, giving customers greater flexibility to start spending their balance even before their physical debit card arrives.

-

Apple Pay/

Google Pay*, delivering even more convenience, flexibility and speed in making purchases with your debit card in-store and online.

QuickBooks Checking, a business checking account provided by our partner,

More information on QuickBooks Checking is available here.

About Intuit:

Intuit is the global technology platform that helps consumers and small businesses overcome their most important financial challenges. Serving more than 100 million customers worldwide with TurboTax, QuickBooks, Mint, Credit Karma, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us for the latest information about Intuit, our products and services, and find us on social.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner,

QuickBooks Checking Account opening is subject to identity verification and approval by

QuickBooks Payments and QuickBooks Checking accounts: Users must apply for both QuickBooks Payments and QuickBooks Checking accounts when bundled. QuickBooks Payments’ Merchant Agreement and QuickBooks Checking account’s Deposit Account Agreement apply.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by

Mobile Check Deposit: Limited availability. Offering coming soon.

*Important offers, pricing details and disclaimers

View source version on businesswire.com: https://www.businesswire.com/news/home/20211215005264/en/

Intuit QuickBooks:

Dan_Mahoney@intuit.com

Jeng@accesstheagency.com

Source: