Introducing Intuit Assist: The Generative AI-Powered Financial Assistant for Small Businesses and Consumers

- Intuit Assist will help customers make smart financial decisions and put more money in their pockets

- Intuit Assist spans across Intuit's platform and products, delivering personalized financial insights to small business and consumer customers

- None.

Insights

Analyzing...

Intuit Assist delivers personalized recommendations and does the hard work for you

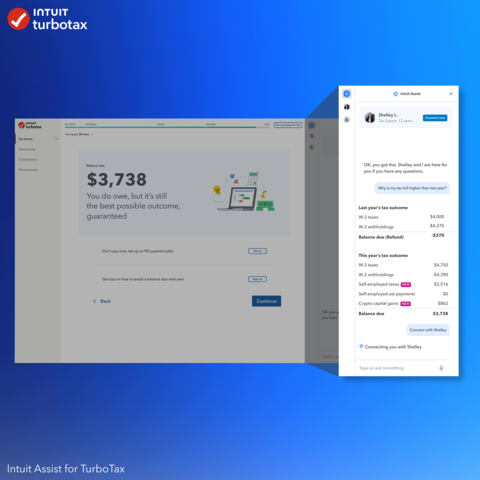

(Graphic: Business Wire)

Embedded across Intuit’s platform and products with a common user interface, Intuit Assist will put the power of next-generation AI in the hands of customers. Intuit Assist uses powerful and relevant contextual data sets spanning small business, consumer finance, and tax to deliver personalized financial insights to our 100 million small business and consumer customers. This data, combined with the power of Intuit’s AI-driven expert platform and the accelerated investment the company has made in GenAI, will deliver game-changing new experiences. Intuit Assist will intuitively show, guide, help, and do the hard work for users, and connect customers to experts on our Live Platform to provide human assistance when needed.

“With the introduction of Intuit Assist, we’re taking a giant step forward in powering prosperity for all. We’re creating a future where we do the hard work for small businesses and consumers to fuel their financial success, helping them achieve their dreams,” said Sasan Goodarzi, chief executive officer of Intuit. “Leveraging our vast amounts of rich data and years of investment in AI and GenAI, we’re unlocking the power of our platform to reimagine AI-assisted customer experiences.”

Intuit Assist spans the company’s products to harness their power and deliver new benefits in all-new ways to improve customers’ financial lives. Intuit Assist will leverage rich customer data with AI and human experts to empower consumers and small business owners to more confidently make smart financial decisions. It will help level the playing field for entrepreneurs and small businesses that don’t have access to the same resources their larger enterprise competitors do, supporting those who need it the most.

“AI is fundamentally changing how we work and live. As people start to make financial decisions with the help of this technology, responsible stewardship and accuracy are paramount,” said Patrick Moorhead, founder, CEO, and chief analyst at Moor Insights & Strategy. “We believe Intuit stands out for its ability to harness robust data across the small business, tax, and consumer finance segments to deliver accurate and personalized AI-driven experiences at scale. This responsible stewardship, paired with Intuit’s investments in AI and data over the last decade, boils down to a generative AI leadership position in the consumer and small business fintech space.”

Consumers will find it easier than ever to manage and improve their financial lives. They’ll be able to get personalized recommendations throughout the year, with actions they can take to maximize their tax refund and accurately file taxes in record time with TurboTax. And they’ll be given the tools to make smart money decisions throughout their financial journey with Credit Karma. For example:

-

Intuit Assist for TurboTax - Underpinned by Intuit’s decades of tax domain expertise, rich data, and proprietary, AI-powered Tax Knowledge Engine, Intuit Assist will work alongside tax filers of any income or complexity, helping them every step of the way. It will get to know a consumer’s individual tax situation and apply its knowledge, navigating the tax code, including the latest changes. This will help reduce tax preparation time and help consumers gain faster access to refunds, with complete confidence that their taxes are done accurately.

At the start of the tax preparation process, Intuit Assist will create a personalized tax checklist based on data the customer shares, enabling TurboTax and human tax experts to leverage the power of AI to proactively provide fast answers, personalized insights, and recommendations. In TurboTax Live, Intuit Assist will work alongside the experts to help them serve customers even more efficiently. Intuit Assist will augment tax experts’ knowledge with fast, personalized answers based on aggregated, data-driven insights, reducing the time spent searching, finding, and synthesizing responses for customers.

Whether a customer is filing on their own in TurboTax or working with a tax expert assisted by AI in TurboTax Live, Intuit Assist will unlock new value in TurboTax. Intuit Assist is available to customers now, with enhancements rolling out in the coming months for the 2023 tax season. More information is available here.

- Intuit Assist for Credit Karma - Credit Karma members will be able to use Intuit Assist to get highly personalized answers to their money questions. When a member comes to Credit Karma with a question about how to manage their finances, they aren’t met with a generic response. Instead, Intuit Assist will be able to connect the dots for members and provide personalized assistance based on their own financial data. This is what Intuit Assist does best: it will identify the right opportunities at the right time and make relevant recommendations, so members can take advantage of better financial products and optimize their spending. By helping members contextualize and understand their finances through two-way conversations, Intuit Assist will empower members to confidently take action, or give it permission to take action on their behalf. Take the example of a member who has connected their accounts, lives paycheck to paycheck, and has an unexpected expense, such as a car breakdown costing them hundreds of dollars. Intuit Assist will notify the member that they’re running low on cash for the month and help formulate a plan to avoid a cash crunch. It will provide a personalized set of financing options, enable the member to clearly assess their options and tradeoffs, and empower them to apply for the product that’s right for them. This can help the member find ways to cover their upcoming expenses until their next paycheck. Intuit Assist is now available to select US members and will become available more widely in the coming months. More information is available here.

Small businesses will grow and thrive using QuickBooks and Mailchimp to run their business end to end and engage their customers with powerful marketing tools, all available with the click of a button. Whether starting up or scaling up, small businesses will have more time to do the work they love in service to their customers. For example:

-

Intuit Assist for QuickBooks - Intuit Assist will tip the odds of success in favor of small businesses, providing guidance on how to adapt, react, and make informed business decisions. From surfacing cash flow hot spots to identifying top-selling products and spending anomalies, small businesses will have access to AI-powered assistance that unearths relevant insights based on their business performance and their customers’ behavior. For example, Intuit Assist will be able to deliver deep insights based on simple requests or questions such as “show me my profit and loss for last month” or “how many of my invoices are overdue?” It will dynamically predict follow-up questions and answer in clear, natural language.

For small and mid-size businesses not yet using QuickBooks, Intuit Assist will revolutionize how they get started, automatically importing data from their website into QuickBooks to personalize the business’s profile. It will take on day-to-day tasks, such as generating invoice reminders, which can be customized to be more friendly in tone or shorter in length. In QuickBooks Live, Intuit Assist will work alongside human bookkeeping and tax experts to help them serve more customers even more efficiently. Intuit Assist is now live to select beta customers and will roll out to allU.S. QuickBooks customers in the coming months. More information is available here.

- Intuit Assist for Mailchimp - Small businesses, entrepreneurs, and marketers at any size business can direct Intuit Assist to do more of their marketing. As their new GenAI assistant, it will help them personalize marketing at scale and make data-backed decisions to measure, fine-tune, and optimize campaign effectiveness. For example, Intuit Assist will help them create an entire marketing campaign based on a brand's identity and marketing intent, targeted toward a specific audience. With a few clicks it will change the tone, the text, the image, or generate something totally new based on the guidance it’s given and the information it has from its rich, relevant data sets. Once customers are happy with the campaign, they can schedule it to be sent, and it will be added to the company’s marketing calendar. Intuit Assist for Mailchimp will then surface a follow-up action plan to ensure high campaign engagement. It will also generate automated draft email content in their Mailchimp inbox using product and service data from QuickBooks. For businesses with longer sales cycles or lead qualification processes, Intuit Assist will automatically add a customer to their Mailchimp sales pipeline for easy tracking of the customer life cycle, from lead to sale. This helps them prioritize leads and automate follow-ups so that they can take on higher-value clients and more profitable work. Intuit Assist is now live to select Mailchimp customers and will roll out more widely in the coming months. More information is available here.

Intuit’s Proprietary Generative AI Operating System (GenOS) Enables Rapid Innovation Intuit Assist was developed using the company’s proprietary GenAI operating system (GenOS), and is designed to run with our own financial large language models (LLMs) that are fine-tuned to solve tax, accounting, cash flow, personal finance, and marketing challenges. Intuit’s GenOS empowers Intuit technologists to design, build, and deploy breakthrough GenAI experiences, such as Intuit Assist, to fuel rapid innovation at scale across Intuit’s products and services to solve its customers’ most important financial problems and drive durable growth.

A Strong Commitment to Responsible AI and Data Stewardship

Intuit Assist has been built in keeping with the company’s commitment to data privacy, security, and responsible AI governance. For nearly a decade, Intuit has been innovating with AI, and its robust data and AI capabilities are foundational to the company’s success as an industry leader in the financial technology sector. Intuit safeguards customer data and protects privacy using industry-leading technology and practices, and adheres to responsible AI principles that guide how the company operates and scales its AI-driven expert platform with its customers' best interests in mind.

Learn More and Join Us Today at Intuit Innovation Day

For more information:

- Join us for more details about Intuit Assist and the company's GenAI innovations on Wednesday, September 6, at 9:30 a.m. PT at Intuit Innovation Day.

- For more information about how Intuit is using AI across its platform, see fact sheet.

About Intuit

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With 100 million customers worldwide using TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services. © 2023 Intuit Inc. All rights reserved. Intuit, QuickBooks, TurboTax, Mailchimp and Credit Karma are registered trademarks of Intuit Inc. in the

This press release contains forward-looking statements, including our expectations regarding the functionality and availability of current or future features. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from these expectations, as described in our SEC filings. This represents no obligation to deliver future features and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230906246525/en/

Bruce Chan

bruce_chan@intuit.com

Source: Intuit Inc.