United States Poised to be World’s Largest LNG Exporter in 2022 as China Becomes Top LNG Importer

The latest report from IHS Markit reveals that the United States and Mainland China are set to become the top players in the liquefied natural gas (LNG) market for 2022. The U.S. is expected to surpass Australia and Qatar as the largest LNG exporter, having added 25 million metric tons (MMt) to its supply in 2021. Conversely, China emerged as the world's largest importer, with imports increasing by 12.3 MMt to 81 MMt in 2021, overtaking Japan. The report highlights significant trends, including record long-term contract signings and soaring spot LNG prices.

- U.S. poised to become largest LNG exporter in 2022 after 25 MMt supply growth in 2021.

- China became the largest LNG importer with 81 MMt, marking a significant market shift.

- Long-term contract signings for LNG hit an all-time high of over 65 MMtpa in 2021.

- European LNG imports fell by 9% in 2021, reflecting global supply constraints.

- Utilization rates for non-U.S. LNG plants fell below the five-year average due to outages.

Insights

Analyzing...

The report, entitled LNG Trade in 2021: Runaway Recovery finds that

Meanwhile, Mainland China has already become the top global importer of LNG. Imports reached 81 MMt in 2021 (increase of 12.3 MMt or

“A new map of LNG is taking shape as 2021 became the year of rapid recovery, making the oversupply and price lows of 2020 seem like a distant memory,” said

Among other key LNG trends observed in the report:

-

Long-term contract signings rebounded to an all-time high after a pause in 2020. Over 65 million metric tons per annum (MMtpa) of firm, long-term contracts were signed in 2021, surpassing the previous record of 61 MMtpa in 2013. Among sellers, signings were roughly evenly split between

the United States ,Russia ,Qatar and portfolio suppliers (although many of the latter are likely to source volumes from US projects). In a notable signpost of potential investment trends in 2022,U.S. projects were by far the largest source of pre-final investment decision (FID) contracts, as most contracts signed inQatar andRussia were for capacity that is either already existing or under construction. Among buyers, mainlandChina was by far the largest specified end-market, with Chinese buyers signing around 25 MMtpa of firm long-term deals.

-

Spot LNG prices have soared past previous records. Spot LNG prices in

Asia spiked to nearly$30 January 2021 during extreme cold weather and transportation challenges before settling back to normal ranges in the first half of the year. However, by August both Asian and European spot LNG prices climbed well above their oil price equivalent and remained above it for the rest of the year. Prices endedDecember 2021 at$40

-

Brazilian imports hit all-time high amidst drought. Persistent dry weather in

Brazil resulted in weak hydropower generation, forcing the market to rely more heavily on LNG imports.Brazil more than tripled its 2020 imports by receiving 7.5 MMt in 2021, surpassing the previous record of 5.8 MMt set in 2014.

-

Amid strong global demand, European LNG imports fell. As one of the most flexible regional import markets in the world, European LNG deliveries are reflective of global market balances. Given strong demand in

Asia andSouth America , less LNG supply was available toEurope and European LNG deliveries fell by9% (7 MMt) in 2021 to 77.2 MMt. However, this is well above the region’s average import level (30-40 MMt) during previous years of LNG market tightness (2012-2018) as imports were kept relatively high by cold weather and low storage levels.

-

Outside of

the United States , utilization rates suffered. Throughout the year, plants across theAtlantic and Pacific Basins faced unexpected outages and gas feedstock shortfalls from maturing production, dragging down average global utilization below the previous five-year average (excluding the price-responsive shut-ins inthe United States in 2020). Utilization was particularly weak during the summer in the northern hemisphere, with non-U.S. global utilization averaging 11 percentage points lower than the five-year average.

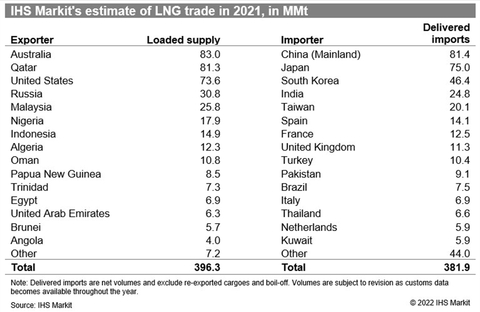

Additional Reference: IHS Markit’s headline 2021 LNG trade numbers

Total loaded LNG supply in 2021 reached 396.3 MMt, up

Net delivered LNG trade* reached 381.9 MMt, up

For more information about the report LNG Trade in 2021: Runaway Recovery or about IHS Markit LNG research services visit https://ihsmarkit.com/products/LNG-market-outlook-demand-forecast.html

* Excluding re-exported cargoes and boil-off.

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20220105006005/en/

News Media:

+1 202 463 8213

Jeff.marn@ihsmarkit.com

Press Team

+1 303 858 6417

press@ihsmarkit.com

Source: