IHS Markit: Rankings Show United States Already the World’s Most Attractive Market for Renewables Investment

As the Biden Administration aims to significantly increase federal investment in renewable energy under the American Jobs Plan, the United States already ranks as the most attractive market for renewables investment, according to results from a new ranking by IHS Markit (NYSE: INFO), a world leader in critical information, analytics and solutions.

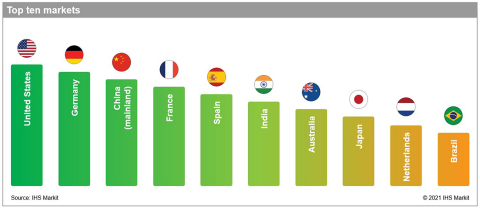

Top 10 markets. IHS Markit Global Renewable Markets Attractiveness Rankings. (Source: IHS Markit)

The IHS Markit Global Renewables Markets Attractiveness Rankings, which tracks attractiveness for investment for non-hydro renewables (offshore wind, onshore wind and solar PV), placed the United States in the number one spot for the period ending December 2020. The United States claimed the top spot on account of sound market fundamentals and the availability of an attractive—though phasing down—support scheme.

Mainland China, which accounted for over half of the world’s total non-hydro renewables additions last year, ranked third on the attractiveness ranking—just behind number two Germany—as difficulties in accessing the market weighed down its overall score.

The IHS Markit Global Renewable Markets Attractiveness Rankings utilize an integrated proprietary methodology to provide comparable views of 35 markets that are expected to account for

The ranking evaluates each country on the basis of seven subcategories that include the current policy framework, market fundamentals, investor friendliness, infrastructure readiness, revenue risks and return expectations, easiness to compete and the overall opportunity size for each market. Each market is scored in individual categories for solar PV, onshore wind, offshore wind and an overall renewables score is calculated.

The overall country rankings are based on a combined score for offshore wind, onshore wind and solar PV that weights the different technologies based on their expected levels of installations over the next decade.

“Onshore wind, offshore wind and solar PV are set to account for over