IHS Markit: Ability of Natural Gas Infrastructure to be Converted to Carry Low-Carbon Fuels Will Enable Gas to Become a “Second Pillar” of Decarbonization Alongside Renewables

IHS Markit released a study titled A Sustainable Flame: The Role of Gas in Net Zero, highlighting natural gas's potential as a key player in emissions reduction and the transition to low-carbon fuels. The report suggests that natural gas infrastructure can be adapted to transport renewable gases like hydrogen and ammonia, making it a vital asset in decarbonization efforts. It identifies a carbon price of $40-$60 per ton as economically viable for low-carbon gas applications and emphasizes the role of natural gas in replacing coal, which could cut global GHG emissions by 3%.

- Natural gas can reduce emissions by up to 50% compared to coal when used for power generation.

- The transition to natural gas could cut GHG emissions by around 1 Gt, approximately 3% of total energy sector emissions.

- Infrastructure can adapt to low-carbon gas, providing flexibility for future energy needs.

- Concerns exist that investments in natural gas may lock in emissions for decades.

- An increase in global gas production of about 15% is necessary to replace coal with natural gas.

The inherent versatility of gas infrastructure—particularly its ability to be converted to carry low-carbon fuels in the future—creates an opportunity for gas to be a “second pillar of decarbonization” over the long-term, according to a new study by IHS Markit (NYSE: INFO), a world leader in critical information, analytics and solutions.

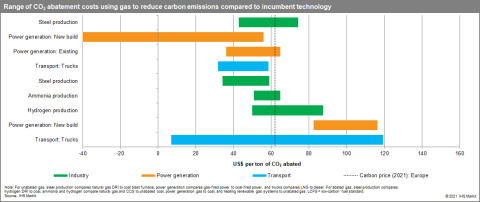

Gas can be used in a variety of sectors to reduce carbon emission intensity. Costs vary widely but many of the proposed uses could be economically viable within the range of

Entitled A Sustainable Flame: The Role of Gas in Net Zero, the new study says that natural gas can play a critical role both in early action on emissions reductions and also acting as a pre-build to greater decarbonization given the potential for the infrastructure to carry low-carbon gases—such as ammonia, hydrogen, synthetic methane and renewable natural gas—in the future.

Specifically, the study finds that these low-carbon gas applications could be viable with a carbon price between

“The versatility of natural gas infrastructure presents an opportunity to seize the low-hanging fruit of emissions reduction in the near-term while also making a down payment for deeper decarbonization,” said Michael Stoppard, chief strategist, global gas, IHS Markit. “Switching to natural gas can support vital early action by replacing coal and oil and their associated higher emissions while also acting as a pre-build of energy carriers for a low-carbon future.”

Replacing older and less efficient power plants with best-in-class natural gas generation reduces emissions by

While substituting natural gas for higher-emitting fuels has an immediate and discernible impact on GHG emissions, some express concern that these investments may embed or lock in future emissions for several decades. However, the study finds that these “lock-in” concerns need not be the case because the infrastructure can be repurposed:

-

Pipelines—both transmission and distribution—can ship renewable natural gas. In an early stage, they can blend in ‘green’ gases to lower the carbon footprint, while in the longer term they can be repurposed for shipping of

100% hydrogen. So too with much of gas storage infrastructure

-

Gas-fired power plants can convert to run on hydrogen or sustainable ammonia, or in some circumstances can retro-fit carbon capture, utilization and storage (CCUS)

-

Liquefaction plants can be converted to liquefy hydrogen, likely at a lower cost than building a liquefied hydrogen plant from scratch

- Industrial and domestic gas boilers can be manufactured to be readily adaptable from natural gas to hydrogen

“Repurposing infrastructure has technical challenges but the costs, while significant, are still lower than building entirely new facilities,” said Shankari Srinivasan, vice president, global and renewable gas, IHS Markit. “And it provides flexibility to policymakers and lenders who could structure authorizations and loans such that any new-build infrastructure be conversion-ready and have defined performance standards with limits on the life that the asset can operate before being converted.”

Investors could then decide whether to risk the investment on the basis of later conversion, or to run the economics on shorter asset life assumptions, the study says.

The underlying versatility of the infrastructure is important because gas will continue to be a vital component of the energy mix up to and through the transition to low-carbon gases, the study says.

For example, electricity delivered by wire is less well suited for meeting the need to produce heat, either for industrial processes or for heating buildings, the study notes. The IHS Markit case study of New York—whose current power system is sized at 31 GW—would require a system sized to over 150 GW for the full electrification of heating (and even with the full deployment of air-sourced heat pumps, the system would need to be 133 GW).

“Renewable capacity will continue to grow, electrification will broaden its reach and improvements in battery storage will make a decarbonized grid more reliable,” said Stoppard. “But the transition to a low-carbon gas supply will also be needed to serve the sectors beyond the reach of electrification and wires.”

About A Sustainable Flame:

A Sustainable Flame is a six-month research effort undertaken by the IHS Markit Climate and Sustainability Group.

The study explores the role, contribution and limitations of gas in driving forward decarbonization both globally and in the United States.

The complete report is available at: https://ihsmarkit.com/sustainable-flame

About IHS Markit (www.ihsmarkit.com)

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2021 IHS Markit Ltd. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210803005194/en/

FAQ

What is the significance of the IHS Markit report on gas and decarbonization?

What carbon price is identified as viable for low-carbon gas applications?

How much can natural gas usage cut global GHG emissions?

What are the immediate impacts of switching to natural gas?