NRSInsights’ January 2025 Retail Same-Store Sales Report

NRSInsights reported a 4.7% increase in January 2025 same-store sales compared to January 2024. The NRS retail network, comprising approximately 34,800 active terminals nationwide, showed mixed performance metrics:

Key highlights include:

- Units sold increased 2.3% year-over-year

- Baskets (transactions) grew 1.1% year-over-year

- Average prices for top 500 items rose 2.9%

- Total network processed $1.8 billion in sales (+20% YoY)

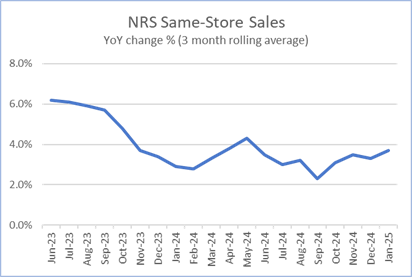

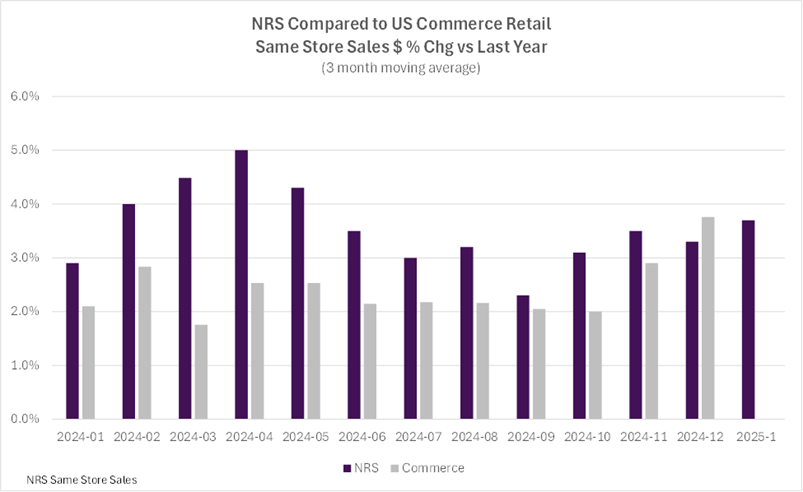

Despite record cold temperatures and snowfalls, January saw robust performance in unexpected categories including Tobacco Products, Alcohol, and Diet & Nutrition. The network's three-month moving average same-store sales outpaced the US Commerce Department's data by 1.1 percentage points on average over the past year.

NRSInsights ha riportato un aumento del 4,7% nelle vendite negli stessi negozi di gennaio 2025 rispetto a gennaio 2024. La rete di vendita NRS, composta da circa 34.800 terminali attivi a livello nazionale, ha mostrato metriche di prestazione miste:

I punti salienti includono:

- Le unità vendute sono aumentate del 2,3% rispetto all'anno precedente

- Le transazioni (cestini) sono cresciute dell'1,1% rispetto all'anno precedente

- I prezzi medi per i primi 500 articoli sono aumentati del 2,9%

- La rete ha elaborato vendite per un totale di 1,8 miliardi di dollari (+20% rispetto all'anno precedente)

Nonostante le temperature record e le nevicate, gennaio ha registrato prestazioni solide in categorie inaspettate tra cui Prodotti del Tabacco, Alcol e Dieta & Nutrizione. La media mobile su tre mesi delle vendite negli stessi negozi della rete ha superato i dati del Dipartimento del Commercio degli Stati Uniti di 1,1 punti percentuali in media nell'ultimo anno.

NRSInsights informó un incremento del 4,7% en las ventas en las mismas tiendas de enero de 2025 en comparación con enero de 2024. La red minorista de NRS, que comprende aproximadamente 34,800 terminales activos a nivel nacional, mostró métricas de rendimiento mixtas:

Los aspectos destacados incluyen:

- Las unidades vendidas aumentaron un 2,3% interanual

- Los cestas (transacciones) crecieron un 1,1% interanual

- Los precios promedio de los 500 artículos principales aumentaron un 2,9%

- La red procesó ventas totales de $1.8 mil millones (+20% interanual)

A pesar de las temperaturas extremadamente frías y las nevadas, enero vio un rendimiento robusto en categorías inesperadas, incluidos Productos de Tabaco, Alcohol y Dieta & Nutrición. La media móvil de tres meses de las ventas en las mismas tiendas superó los datos del Departamento de Comercio de EE. UU. en 1.1 puntos porcentuales en promedio durante el último año.

NRSInsights는 2025년 1월의 동종 매장 판매가 2024년 1월에 비해 4.7% 증가했다고 보고했습니다. 약 34,800개의 활성 터미널로 구성된 NRS 소매 네트워크는 혼합된 성과 지표를 보여주었습니다:

주요 하이라이트는 다음과 같습니다:

- 판매된 유닛이 전년 대비 2.3% 증가했습니다.

- 거래 수(바구니)가 전년 대비 1.1% 증가했습니다.

- 상위 500개 품목의 평균 가격이 2.9% 상승했습니다.

- 전체 네트워크는 18억 달러의 판매를 처리했습니다 (+20% 전년 대비)

기록적인 한파와 폭설에도 불구하고, 1월은 담배 제품, 알콜 및 다이어트 & 영양과 같은 예상치 못한 카테고리에서 강력한 성과를 보였습니다. 네트워크의 3개월 이동 평균 동종 매장 판매는 지난해 평균적으로 미국 상무부의 데이터보다 1.1 퍼센트 포인트를 초과했습니다.

NRSInsights a rapporté une augmentation de 4,7% des ventes dans les mêmes magasins en janvier 2025 par rapport à janvier 2024. Le réseau de vente au détail NRS, qui comprend environ 34 800 terminaux actifs à l'échelle nationale, a montré des indicateurs de performance mixtes :

Les points forts incluent :

- Les unités vendues ont augmenté de 2,3 % d'une année sur l'autre

- Les transactions (panier) ont crû de 1,1 % d'une année sur l'autre

- Les prix moyens des 500 premiers articles ont augmenté de 2,9 %

- Le réseau a traité un montant total de 1,8 milliard de dollars de ventes (+20 % par rapport à l'année précédente)

Malgré des températures glaciales record et des chutes de neige, janvier a connu de solides performances dans des catégories inattendues telles que les produits du tabac, l'alcool et la diète & nutrition. La moyenne mobile sur trois mois des ventes dans les mêmes magasins du réseau a dépassé les données du ministère du Commerce des États-Unis de 1,1 point de pourcentage en moyenne au cours de l'année écoulée.

NRSInsights berichtete von einem Umsatzanstieg von 4,7% im Januar 2025 im Vergleich zum Januar 2024 in den selben Geschäften. Das NRS Einzelhandelsnetz, das aus etwa 34.800 aktiven Terminals landesweit besteht, zeigte gemischte Leistungskennzahlen:

Wichtige Highlights umfassen:

- Die verkauften Einheiten stiegen im Jahresvergleich um 2,3%

- Die Warenkörbe (Transaktionen) wuchsen im Jahresvergleich um 1,1%

- Die Durchschnittspreise der 500 meistverkauften Artikel stiegen um 2,9%

- Das gesamte Netzwerk verarbeitete 1,8 Milliarden Dollar Umsatz (+20% im Jahresvergleich)

Trotz rekordverdächtiger Kälte und Schneefällen zeigten sich im Januar überraschend starke Leistungen in Kategorien wie Tabakwaren, Alkohol und Diät & Ernährung. Der gleitende Dreimonatsdurchschnitt der gleichen Geschäfte im Netzwerk übertraf die Daten des US-Handelsministeriums im Durchschnitt um 1,1 Prozentpunkte im letzten Jahr.

- Same-store sales increased 4.7% year-over-year

- Network processed $1.8 billion in sales (+20% YoY)

- Transaction volume increased 15% year-over-year

- Units sold grew 2.3% year-over-year

- Three-month same-store sales increased 3.7% YoY

- Same-store sales decreased 7.5% compared to previous month

- Units sold decreased 3.1% compared to previous month

- Baskets decreased 5.3% month-over-month

- Average prices increased 2.9%, indicating inflationary pressure

Insights

The January 2025 NRSInsights report reveals compelling growth metrics that underscore IDT's expanding footprint in the retail analytics space. The 4.7% year-over-year same-store sales growth significantly outpaces general retail trends, while the platform's expansion to 34,800 active terminals represents substantial market penetration in the independent retailer segment.

Several key performance indicators deserve attention:

- Transaction volume grew 15% YoY to 119 million transactions

- Total processed sales increased 20% YoY to

$1.8 billion - The network expanded to cover 202 out of 210 U.S. designated market areas

The platform's ability to capture granular consumer behavior data, particularly in urban and multicultural markets, creates a valuable proposition for CPG companies and advertisers. The unexpected growth in tobacco and alcohol sales, coupled with the surge in wellness categories, demonstrates the platform's capability to identify emerging consumer trends ahead of broader market indicators.

Most significantly, NRS's consistent outperformance versus the U.S. Commerce Department's retail data by

The expansion of NRS's terminal network represents a scalable revenue stream for IDT, combining payment processing fees with valuable data monetization opportunities. The platform's penetration into previously underserved markets creates barriers to entry and positions IDT favorably in the retail technology sector.

January same-store sales increased

NEWARK, N.J., Feb. 07, 2025 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative retail same-store sales results for January 2025.

As of January 31, 2025, the NRS retail network comprised approximately 34,800 active terminals nationwide, scanning purchases at approximately 30,100 independent retailers including convenience stores, bodegas, liquor stores, grocers, tobacco, and sundries sellers, predominantly serving urban consumers.

January Highlights

(Same-store sales, unit sales, transactions, and average price data refer to January 2025 and are compared to January 2024 unless otherwise noted. All comparisons are provided on a “per calendar day” basis to remove from consideration variability in the number of days per month.)

- SALES

- Same-store sales increased

4.7% year-over-year. In the previous month (December 2024), same-store sales had increased1.7% year-over-year.

- Same-store sales decreased (7.5)% compared to the previous month (December 2024). Same-store sales in December 2024 had increased

0.5% compared to the previous month (November 2024).

- Same-store sales decreased (7.5)% compared to the previous month (December 2024). Same-store sales in December 2024 had increased

- For the three months ended January 31, 2025, same-store sales increased

3.7% compared to the corresponding three months a year ago.

- Same-store sales increased

- UNITS SOLD

- Units sold increased

2.3% year-over-year. In the previous month (December 2024), the number of units sold had decreased (0.5)% year-over-year. - Units sold decreased (3.1)% compared to the previous month (December 2024). Units sold in December 2024 had decreased (1.1)% compared to the previous month (November 2024).

- Units sold increased

- BASKETS (TRANSACTIONS) PER STORE

- Baskets increased

1.1% year-over-year. In the previous month (December 2024), baskets had decreased (0.5)% year-over-year. - Baskets decreased (5.3)% compared to the previous month (December 2024). Baskets in December 2024 had decreased (3.4)% compared to the previous month (November 2024).

- Baskets increased

- AVERAGE PRICES

- A dollar-weighted average of prices for the top 500 items purchased increased

2.9% year-over-year, a higher rate of increase than the2.4% year-over-year increase recorded in December 2024.

- A dollar-weighted average of prices for the top 500 items purchased increased

Retail Trade Comparative Data

The table below provides historical comparative data with the U.S. Commerce Department’s Advance Monthly Retail Trade same-store sales data excluding food service:

Over the past twelve months, the NRS network’s three-month moving average same-store sales have outpaced the US Commerce Department’s Advance Monthly Retail Trade data, excluding food services, by

The NRSInsights data in the chart above have not been adjusted to reflect inflation, demographic distributions, seasonal buying patterns, item substitution, days per month, or other factors that may facilitate comparisons to other periods, to other same-store retail sales data, or to the U.S. Commerce Department’s retail data.

Commentary from Suzy Silliman (SVP, Data Strategy and Sales at NRS)

“Despite record-breaking cold temperatures and historic snowfalls in mid-January across much of the U.S., January 2025 saw robust dollar, unit and transaction same-store sales growth versus the year ago while decreasing sequentially, as expected, following the holiday season.

“Our analysis of January’s data revealed several unexpected developments across the NRS network, while other categories continued trends that carried over from 2024.

“January sales typically follow well-established patterns related to New Year's resolutions, wellness goals, and ‘dry January.’ So this January’s dollar sales growth in Tobacco Products & Accessories (cigarettes, cigars, smokeless tobacco, pipe tobacco, lighters and rolling papers), Alcohol (beer, FMB/cider/seltzer, vodka, still wine, tequila, prepared cocktails, wine-based cocktails, and cordials), and even Chocolate and Cookies was unusual.

“On the other hand, the Diet & Nutrition category outperformed, driven by growth in health/nutrition and meal replacement shakes, health/nutrition and meal replacement bars, protein salty snacks, and health/nutrition powder. While Diet & Nutrition sales had been trending up with the increased popularity of GLP-1 agonists for the treatment of diabetes and obesity, January’s year-over-year growth exceeded the prior months’ trendline.

“And finally, sales of Cold/Flu OTC products and GI Care surged year-over-year as flu, RSV, norovirus and other contagions surged nationwide, arriving a little later in the season than usual but not unexpectedly.”

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of January 2025 with January 2024 are derived from approximately 183 million transactions processed through the approximately 20,800 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of January 2025 with December 2024 are derived from approximately 239 million transactions processed through approximately 29,000 stores.

Same-store data comparisons for the three months ended January 31, 2025 with the year-ago three months are derived from approximately 546 million scanned transactions processed through those stores that were in the NRS network in both quarters.

NRS POS Platform

The NRS platform predominantly serves small-format, independent, retail stores nationwide including convenience stores, bodegas, liquor stores, grocers, tobacco, and sundries sellers. These independent retailers operate in all 50 states as well as the District of Columbia, and in 202 of the 210 designated market areas (DMAs) in the United States. During January 2025, NRS’ POS terminals processed

About National Retail Solutions (NRS):

National Retail Solutions operates the largest point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Suzy Silliman

SVP, Data Strategy and Sales at NRS

National Retail Solutions

suzy.silliman@nrsplus.com

IDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #