NRSInsights’ January 2024 Retail Same-Store Sales Report

- None.

- None.

Insights

The reported increase in same-store sales by 1.4% in January 2024 compared to January 2023 suggests a modest growth trajectory for the NRS retailers, which could be indicative of consumer spending trends in urban retail sectors. However, the 10% decline in average sales per calendar day from December 2023 to January 2024 is consistent with the expected seasonal downturn post-holiday season. This pattern is typical and reflects consumer spending habits, where a surge in December due to holiday shopping is followed by a contraction in January as consumers recover from holiday expenses.

The slight uptick in average prices for popular items, at 0.3% year-over-year, may signal a cooling of inflationary pressures, which could have positive implications for consumer purchasing power and retailer margins if the trend continues. Additionally, the shift in consumer preferences towards wellness products and the growth in non-alcoholic beverage sales align with broader health and wellness trends that are reshaping consumer behavior.

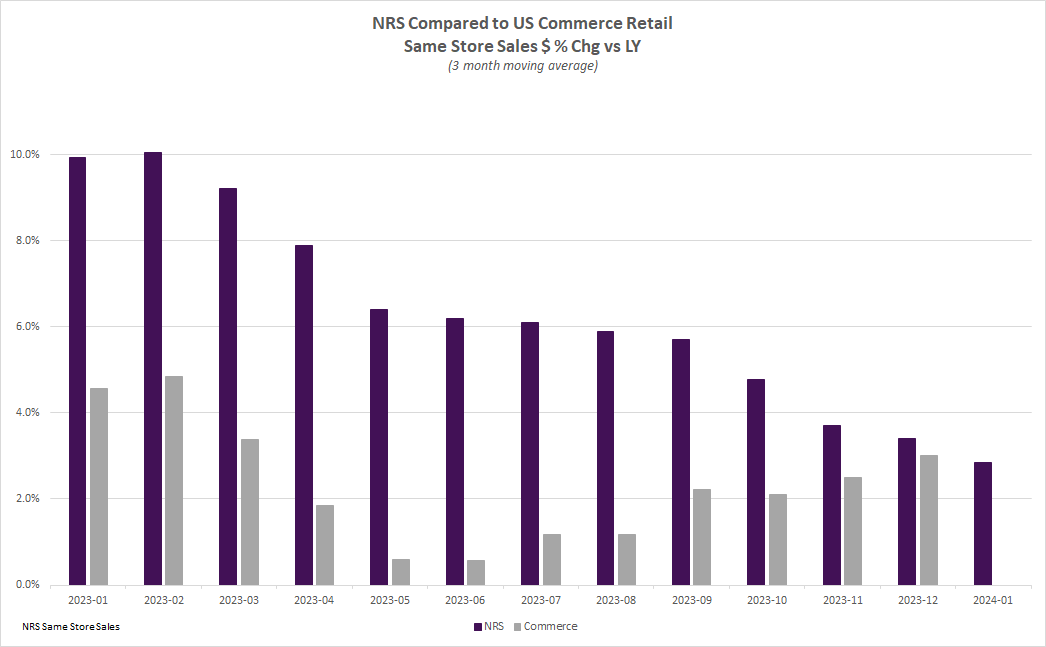

From a market perspective, the fact that NRS same-store sales outperformed the broader retailer market, as reported by the US Commerce Department, could be of interest to investors and analysts. This divergence might reflect the specific demographics and spending patterns of the urban consumer base that NRS predominantly serves. The resilience and potential growth opportunities within this segment could be a focal point for strategic business decisions and investment considerations.

While same-store sales growth is generally a positive indicator for the health of a retail network, the reported 1.4% year-over-year increase for January is relatively modest. It is important to contextualize this figure within the broader economic environment, which includes factors such as inflation rates and consumer confidence. The deceleration in price increases for the top 500 items to a mere 0.3% year-over-year could be viewed as a sign of stabilizing prices, potentially easing the inflationary concerns that have been prevalent in recent times.

The performance of NRS retailers relative to the broader market, as indicated by the 4.3% average outperformance over the past twelve months, may suggest operational efficiencies or a differentiated product mix catering to specific consumer demands. This could potentially translate into a competitive advantage and warrant a closer evaluation of NRS's market positioning and strategy.

For stakeholders, the implications of these sales trends are multifaceted. Retailers within the NRS network may benefit from continued investment in high-growth categories like wellness and non-alcoholic beverages. However, the reported decrease in the average number of transactions per store and per calendar day could be a point of concern, potentially indicating a decrease in foot traffic or consumer engagement that warrants further investigation.

The data presented by NRSInsights provides a snapshot of economic activity within a specific sector of the retail market, predominantly serving urban consumers. The modest increase in same-store sales and the decrease in average sales per calendar day post-holidays are in line with macroeconomic patterns of consumer behavior. The reported shift in consumer preferences towards health and wellness products may reflect broader societal trends and could have implications for future consumption patterns and retail strategies.

The data also suggests that inflationary pressures may be easing, as indicated by the smallest year-over-year price increase since July 2022. This could have broader economic implications, potentially signaling a shift in monetary policy or a stabilization of supply-chain issues that have previously driven prices upwards. However, it is crucial to consider that the data is not adjusted for inflation, demographic distributions, or seasonal buying patterns, which limits the direct comparability to other economic data sets and may necessitate a more nuanced interpretation of the figures presented.

Furthermore, the continued rise in RSV, flu and COVID-19 cases as reflected in the sales of Upper Respiratory products could suggest ongoing public health concerns that may influence consumer behavior and spending. The economic impact of such health trends must be monitored as they can affect workforce productivity, healthcare costs and ultimately, retail sales in related product categories.

Same-store sales at NRS retailers during January increased

Compared to December 2023, same-store-sales per calendar day in January decreased

The average prices for the most popular items sold in January increased

NEWARK, N.J., Feb. 07, 2024 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative same-store sales results for January 2024.

As of January 31, 2024, the NRS retail network comprised approximately 28,700 active terminals scanning purchases at independent retailers including bodegas, convenience stores, liquor stores, grocers, and tobacco and sundries sellers nationwide, predominantly serving urban consumers.

January Retail Same-Store Sales Highlights

(Same-store sales, unit sales and transaction data refer to January 2024 unless otherwise noted)

- Same-store sales increased

1.4% from a year earlier (January 2023). Average sales per calendar day decreased10.0% compared to the preceding month, partly reflecting the seasonal impact of comparison to December’s holiday sales. In January 2023, average sales per calendar day decreased6.0% compared to December 2022. - Same-store sales in the preceding month (December 2023) had increased

5.5% compared to the year-ago month (December 2022). Average sales per calendar day in December 2023 had increased5.3% compared to the preceding month (November 2023). - For the three months ended January 31, 2024, same-store sales increased

2.9% compared to the three months ended January 31, 2023. - The number of items sold increased

4.4% compared to a year earlier (January 2023). Items sold decreased5.1% compared to December 2023 on a per calendar day basis reflecting, in part, the impact of December’s holiday sales. - The average number of transactions per store decreased

0.6% compared to January 2023. The average number of transactions per calendar day decreased6.6% compared to December 2023 again reflecting, in part, the impact of seasonality. - A dollar-weighted average of prices for the top 500 items purchased in January 2024 increased

0.3% year-over-year, a decrease from the1.2% year-over-year increase recorded in December 2023.

Commentary from Suzy Silliman (SVP, Data Strategy and Sales at NRS)

“Year-over-year same-store sales in our network increased

“’Better for you’ resolutions influence the composition of shoppers' baskets during January, and that sentiment was especially strong this year. Tobacco/Tobacco Alternatives, Desserts, and Candy were among the categories experiencing higher than the typical ‘seasonal’ declines, while wellness categories including Vitamins and Supplements, Performance Nutrition, and Vegetables outpaced year-ago same store sales by double-digit percentages.

“Continuing on this theme, during “Dry January" 2024, both Non-Alcoholic Beer and Non-Alcoholic Spirits delivered sizable sales increases over the prior year. More non-alcoholic varieties are taking the shelf as they mainstream with consumers.

“Also of note, Upper Respiratory products saw a

“Our stores’ retail customers got some good news in January. Inflationary pressure, as measured by the prices of the 500 most popular items sold across our network, continued to subside, slowing to a

“NRS same-store sales again outperformed the broader retailer market as measured by the US Commerce Department’s most recent three month rolling average, even as the difference in their respective rates of increase continued to narrow.”

Retail Trade Comparative Data

The table below provides historical comparative data with the U.S. Commerce Department’s Advance Monthly Retail Trade same-store sales data excluding food service:

Over the past twelve months, the NRS network’s three-month moving average same-store sales have outpaced the US Commerce Department’s Advance Monthly Retail Trade data excluding food services by

The NRSInsights data have not been adjusted to reflect inflation, demographic distributions, seasonal buying patterns, item substitution, or other factors that may facilitate comparisons to other periods, to other same-store retail sales data, or to the U.S. Commerce Department’s retail data.

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of January 2024 with January 2023 are derived from approximately 153 million transactions processed through the 16,547 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of January 2024 with December 2023 are derived from approximately 207 million transactions processed through 23,876 stores.

Same-store data comparisons for the three months ended January 31, 2024 with the year-ago three months are derived from approximately 447 million scanned transactions processed through the stores that were in the NRS network in both quarters.

NRS POS Network

The NRS network comprises approximately 28,700 active POS terminals operating in approximately 24,900 independent retail stores. Its platform predominantly serves small-format, independent, retail stores including convenience stores, bodegas, liquor stores, grocers, tobacco and sundries sellers. The network includes retailers in all 50 states and in 196 of the 210 designated market areas (DMAs) in the United States. Over the past twelve months, NRS’ POS terminals have processed

About National Retail Solutions (NRS):

National Retail Solutions operates the largest point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Suzy Silliman

SVP, Data Strategy and Sales at NRS

National Retail Solutions

suzy.silliman@nrsplus.com

suzy.silliman@nrsplus.comIDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #