NRSInsights’ December and Full Year 2024 Retail Same-Store Sales Report

NRSInsights reported December 2024 same-store sales increased 1.7% year-over-year, while full-year 2024 sales grew 1.8% compared to 2023. The NRS retail network, comprising approximately 34,300 active terminals nationwide, showed mixed performance in December with units sold and transactions both declining 0.5% year-over-year, while average prices rose 2.4%.

For full-year 2024, units sold increased 2.3%, while transactions slightly decreased by 0.1%. The network processed $1.9 billion in sales across 125 million transactions in December 2024, representing a 17% year-over-year increase. Notable growth categories included smokeless tobacco, tequila, and prepared cocktails, while categories like vape, cognac, and cigarettes experienced the largest decreases.

NRSInsights ha riportato che nel dicembre 2024 le vendite nei punti vendita omologhi sono aumentate dell'1,7% rispetto allo scorso anno, mentre le vendite totali dell'anno 2024 sono cresciute dell'1,8% rispetto al 2023. La rete retail NRS, composta da circa 34.300 terminal attivi in tutto il paese, ha mostrato una performance mista a dicembre, con una diminuzione sia delle unità vendute che delle transazioni dell'0,5% rispetto all'anno precedente, mentre i prezzi medi sono aumentati del 2,4%.

Nel complesso dell'anno 2024, le unità vendute sono aumentate del 2,3%, mentre le transazioni hanno leggermente registrato una diminuzione dello 0,1%. La rete ha elaborato $1,9 miliardi di vendite attraverso 125 milioni di transazioni a dicembre 2024, rappresentando un incremento del 17% rispetto all'anno precedente. Le categorie di crescita più significative includevano il tabacco senza fumo, il tequila e i cocktail preparati, mentre categorie come le sigarette elettroniche, il cognac e le sigarette hanno subito le maggiori diminuzioni.

NRSInsights informó que en diciembre de 2024, las ventas en tiendas comparables aumentaron un 1.7% interanual, mientras que las ventas del año completo 2024 crecieron un 1.8% en comparación con 2023. La red minorista de NRS, que cuenta con aproximadamente 34,300 terminales activos en todo el país, mostró un rendimiento mixto en diciembre, con una caída tanto en las unidades vendidas como en las transacciones del 0.5% interanual, mientras que los precios promedio aumentaron un 2.4%.

En el año completo 2024, las unidades vendidas aumentaron un 2.3%, mientras que las transacciones disminuyeron ligeramente en un 0.1%. La red procesó $1.9 mil millones en ventas a través de 125 millones de transacciones en diciembre de 2024, lo que representa un aumento del 17% interanual. Las categorías de crecimiento notables incluyeron tabaco sin humo, tequila y cócteles preparados, mientras que categorías como vape, coñac y cigarrillos experimentaron las mayores disminuciones.

NRSInsights는 2024년 12월 동일 점포 매출이 작년 대비 1.7% 증가했으며, 2024년 전체 연도 매출은 2023년과 비교하여 1.8% 성장했다고 보고했습니다. 약 34,300개의 활성 단말기로 구성된 NRS 소매 네트워크는 12월에 혼합된 성과를 보였으며, 판매된 단위와 거래 모두 연간 기준으로 0.5% 감소했지만 평균 가격은 2.4% 상승했습니다.

2024년 전체 연도 동안 판매된 단위는 2.3% 증가했으며, 거래는 0.1% 소폭 감소했습니다. 네트워크는 2024년 12월에 1,900억 달러의 매출을 처리했으며, 이는 1억 2500만 건의 거래를 통해 이루어져 연간 17% 증가한 수치입니다. 주요 성장 카테고리에는 무연 담배, 테킬라 및 준비된 칵테일이 포함되었으며, 전자담배, 코냑 및 담배와 같은 카테고리는 가장 큰 감소를 경험했습니다.

NRSInsights a rapporté qu'en décembre 2024, les ventes des magasins comparables ont augmenté de 1,7 % d'une année sur l'autre, tandis que les ventes totales de l'année 2024 ont crû de 1,8 % par rapport à 2023. Le réseau de détail NRS, composé d'environ 34 300 terminaux actifs à l'échelle nationale, a montré des performances variées en décembre, avec à la fois une diminution des unités vendues et des transactions de 0,5 % d'une année sur l'autre, tandis que les prix moyens ont augmenté de 2,4 %.

Pour l'année 2024 dans son ensemble, les unités vendues ont augmenté de 2,3 %, tandis que les transactions ont légèrement diminué de 0,1 %. Le réseau a traité 1,9 milliard de dollars de ventes à travers 125 millions de transactions en décembre 2024, représentant une augmentation de 17 % d'une année sur l'autre. Les catégories de croissance notables comprenaient le tabac sans fumée, la tequila et les cocktails préparés, tandis que des catégories comme les vaporisateurs, le cognac et les cigarettes ont connu les plus fortes baisses.

NRSInsights berichtete, dass die Same-Store-Verkäufe im Dezember 2024 im Vergleich zum Vorjahr um 1,7% gestiegen sind, während die Gesamtverkäufe für das Jahr 2024 im Vergleich zu 2023 um 1,8% gewachsen sind. Das NRS-Einzelhandelsnetzwerk, das aus etwa 34.300 aktiven Terminals im ganzen Land besteht, zeigte im Dezember eine gemischte Leistung, wobei sowohl die verkauften Einheiten als auch die Transaktionen im Jahresvergleich um 0,5% zurückgingen, während die Durchschnittspreise um 2,4% stiegen.

Für das gesamte Jahr 2024 stiegen die verkauften Einheiten um 2,3%, während die Transaktionen leicht um 0,1% zurückgingen. Das Netzwerk verarbeitete im Dezember 2024 Verkäufe in Höhe von 1,9 Milliarden US-Dollar über 125 Millionen Transaktionen, was einen Anstieg von 17% im Vergleich zum Vorjahr darstellt. Zu den bemerkenswerten Wachstumsbereichen gehörten rauchfreier Tabak, Tequila und zubereitete Cocktails, während Kategorien wie Vape, Cognac und Zigaretten die größten Rückgänge verzeichneten.

- Same-store sales increased 1.7% YoY in December and 1.8% for full-year 2024

- Network processed $1.9B in sales in December 2024 (+17% YoY)

- Transaction volume increased 14% YoY in December

- Units sold grew 2.3% in 2024 compared to 2023

- December units sold decreased 0.5% YoY

- December transactions (baskets) decreased 0.5% YoY

- Full-year transactions decreased 0.1% compared to 2023

- Sales growth rate declined from 5.2% in 2023 to 1.8% in 2024

Insights

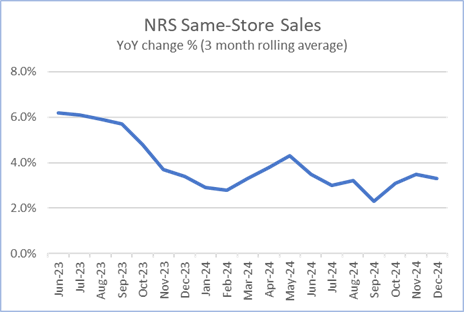

The December and full-year 2024 retail same-store sales data from NRSInsights reveals critical trends in consumer behavior and retail performance. The 1.7% December and 1.8% full-year same-store sales growth, while positive, shows significant deceleration from 2023's 5.2% growth rate. This slowdown, combined with declining transaction volumes and units sold, suggests mounting pressure on consumer spending.

Most notably, the report highlights potential disruption from GLP-1 weight loss drugs affecting snacking categories, which could impact future revenue streams for CPG companies. The shift in consumer preferences is evidenced by declining sales in traditional high-margin categories like confections and RTD coffee, while healthier alternatives like supplements and performance nutrition showed strong growth.

The platform's expansion to 34,300 active terminals processing

The granular category performance data reveals compelling shifts in consumer preferences that could reshape retail strategies. The strong performance in smokeless tobacco, tequila and prepared cocktails, contrasted with declining vape and traditional cigarette sales, indicates a fundamental transformation in tobacco and alcohol consumption patterns.

The continued growth in non-alcoholic beer and performance nutrition categories aligns with broader wellness trends. The 2.4% increase in average prices for top 500 items, down from previous months, suggests improving price stability but continued margin pressure for retailers. The sequential decline in transaction baskets by 3.4% month-over-month warrants attention as a potential early indicator of changing consumer behavior.

The network's presence in 201 out of 210 DMAs provides unprecedented visibility into urban, multi-cultural consumer segments, making this dataset particularly valuable for CPG companies' strategic planning and marketing optimization.

The expansion of NRS's POS network represents a significant advancement in retail analytics capabilities. Processing 1.8 billion transactions annually through approximately 13,800 same-store locations provides a robust dataset for AI-driven insights and trend analysis. The 17% year-over-year growth in processed sales volume demonstrates strong platform adoption and scaling.

The platform's ability to track category-specific trends and price movements across thousands of independent retailers creates valuable data monetization opportunities. This positions IDT strategically in the retail analytics space, offering CPG companies and advertisers access to real-time consumer behavior data in traditionally underserved market segments.

The detailed tracking of emerging categories and price dynamics suggests sophisticated data analytics capabilities that could drive additional revenue streams through enhanced services to both retailers and CPG companies.

December same-store sales increased

Full year 2024 same-store sales increased

NEWARK, N.J., Jan. 09, 2025 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative retail same-store sales results for December and the full year 2024.

As of December 31, 2024, the NRS retail network comprised approximately 34,300 active terminals nationwide, scanning purchases at approximately 30,000 independent retailers including convenience stores, bodegas, liquor stores, grocers, tobacco, and sundries sellers, predominantly serving urban consumers.

December Highlights

(Same-store sales, unit sales, transactions, and average price data refer to December 2024 and are compared to December 2023 unless otherwise noted. All comparisons are provided on a “per calendar day” basis to remove from consideration variability in the number of days per month.)

- SALES

-

- Same-store sales increased

1.7% year-over-year. In the previous month (November 2024), same-store sales had increased6.6% year-over-year.

- Same-store sales increased

-

- Same-store sales increased

0.5% compared to the previous month (November 2024). Same-store sales in November 2024 had increased1.5% compared to the previous month (October 2024).

- Same-store sales increased

-

- For the three months ended December 31, 2024, same-store sales increased

3.3% compared to the corresponding three months a year ago.

- For the three months ended December 31, 2024, same-store sales increased

-

- UNITS SOLD

- Units sold decreased (0.5)% year-over-year. In the previous month (November 2024), the number of units sold had increased

4.5% year-over-year. - Units sold decreased (1.1)% compared to the previous month (November 2024). Units sold in November 2024 had decreased (0.4)% compared to the previous month (October 2024).

- Units sold decreased (0.5)% year-over-year. In the previous month (November 2024), the number of units sold had increased

- BASKETS (TRANSACTIONS) PER STORE

- Baskets also decreased (0.5)% year-over-year. In the previous month (November 2024), transactions had increased

3.2% year-over-year. - Baskets decreased (3.4)% compared to the previous month (November 2024). Transactions in November 2024 had decreased (2.5)% compared to the previous month (October 2024).

- Baskets also decreased (0.5)% year-over-year. In the previous month (November 2024), transactions had increased

- AVERAGE PRICES

- A dollar-weighted average of prices for the top 500 items purchased increased

2.4% year-over-year, a lower rate of increase than the3.9% year-over-year increase recorded in November 2024.

- A dollar-weighted average of prices for the top 500 items purchased increased

Full Year 2024 Highlights

(Same-store sales, unit sales, transactions, and average price data refer to the full year 2024 and are compared to the full year 2023. All comparisons are provided on a “per calendar day” basis to remove from consideration the impact of the additional day in 2024, a leap year.)

- Same-store sales increased

1.8% compared to 2023. In 2023, same-store sales had increased5.2% compared to 2022. - Units sold increased

2.3% compared to 2023. In 2023, units sold had increased6.4% compared to 2022. - Baskets (transactions per store) decreased (0.1)% compared to 2023. In 2023, baskets had increased

3.3% compared to 2022. - A dollar-weighted average of prices for the top 500 items purchased increased

2.3% compared to 2023. Prices in 2023 had increased3.5% compared to 2022.

Commentary from Suzy Silliman (SVP, Data Strategy and Sales at NRS)

DECEMBER 2024:

“December 2024 performance was relatively steady compared to December 2023. Sales increased modestly, largely because of nominal price increases, while transaction baskets and units sold decreased slightly. The timing of New Year’s Eve, which fell on a weekday in 2024 versus a weekend in 2023, contributed to softer traffic and sales across the NRS network during the final three days of the year.”

“Continuing a prominent trend of recent months, smokeless tobacco - driven by sales of oral pouches -, tequila, and prepared cocktails - including wine-based cocktails -, continued their strong year-over-year growth.

“In addition to the categories that performed well throughout December, several others experienced notable growth versus the year ago during the week leading up to Christmas Day/First day of Hanukkah. These categories were led by beverages and included beer/fermented malt beverages (FMBs)/cider/seltzer, soft drinks, vodka, whiskey, non-alcoholic beer, and energy beverages.

FULL YEAR 2024:

“The NRS network registered a modest increase of

“Categories experiencing the largest net dollar increases in 2024 included smokeless tobacco, tequila, soft drinks, prepared cocktails, beer, FMB/cider/seltzer, wine-based cocktails, and rolling papers. The categories recording the largest percentage increases included prepared and wine-based cocktails, supplements, smokeless tobacco, non-alcoholic beer, performance nutrition shakes, pork rinds, and sparkling water.

“Categories experiencing the largest net dollar decreases included vape, cognac, cigarettes, confections, cow’s milk, ready-to-drink (RTD) coffee, meat snacks, fruit juice, sparkling wine, and chocolate. The categories recording the largest percentage decreases included cognac, vape, dessert bars, cookies, sparkling wine, and RTD coffee.

“The combination of pricing shifts and changes in consumer snacking habits driven by the popularity of GLP-1 agonists weight loss drugs suggests a strong likelihood that many categories that have traditionally experienced stability will be disrupted in the coming months.”

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of December 2024 with December 2023 are derived from approximately 192 million transactions processed through the approximately 20,500 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of December 2024 with November 2024 are derived from approximately 243 million transactions processed through approximately 28,600 stores.

Same-store data comparisons for the three months ended December 31, 2024 with the year-ago three months are derived from approximately 559 million scanned transactions processed through those stores that were in the NRS network in both quarters.

Same-store data comparison for the twelve months ended December 31, 2024 with the preceding twelve months are derived from approximately 1.8 billion scanned transactions processed through approximately 13,800 stores that were in the NRS network in both years.

NRS POS Platform

The NRS platform predominantly serves small-format, independent, retail stores nationwide including convenience stores, bodegas, liquor stores, grocers, tobacco, and sundries sellers. These independent retailers operate in all 50 states as well as the District of Columbia, and in 201 of the 210 designated market areas (DMAs) in the United States. During December 2024, NRS’ POS terminals processed

About National Retail Solutions (NRS):

National Retail Solutions operates the largest point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Suzy Silliman

SVP, Data Strategy and Sales at NRS

National Retail Solutions

suzy.silliman@nrsplus.com

IDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #