Idaho Strategic Provides Rare Earth Elements Update and Plans for the 2025 REE Field Season Focused on Lemhi Pass

Idaho Strategic Resources (IDR) has provided an update on its rare earth elements (REE) operations and plans for 2025, focusing on the Lemhi Pass project. The company reported favorable REE mix with high concentrations of valuable elements, including 58% Nd, 8% Pr, 8% Sm, and 2% Dy, accounting for 76% of total REEs. Comparative analysis shows IDR's prospects performing well against global REE mines. For 2025, IDR plans a larger trenching and low-impact air rotary drilling program at the 12,000-acre Lemhi Pass project. The company is also collaborating with national laboratories to advance minerology understanding and develop processing technologies specific to Idaho's REE projects.

Idaho Strategic Resources (IDR) ha fornito un aggiornamento sulle sue operazioni di elementi delle terre rare (REE) e sui piani per il 2025, concentrandosi sul progetto Lemhi Pass. L'azienda ha riportato una composizione favorevole di REE con alte concentrazioni di elementi preziosi, tra cui 58% Nd, 8% Pr, 8% Sm e 2% Dy, che rappresentano il 76% del totale delle REE. Un'analisi comparativa mostra che le prospettive di IDR si comportano bene rispetto alle miniere di REE globali. Per il 2025, IDR prevede un programma di scavo più ampio e un'attività di perforazione rotativa a bassa impatto nel progetto Lemhi Pass di 12.000 acri. L'azienda collabora inoltre con laboratori nazionali per migliorare la comprensione della mineralogia e sviluppare tecnologie di lavorazione specifiche per i progetti REE dell'Idaho.

Idaho Strategic Resources (IDR) ha proporcionado una actualización sobre sus operaciones de elementos de tierras raras (REE) y los planes para 2025, centrándose en el proyecto Lemhi Pass. La empresa informó sobre una mezcla de REE favorable con altas concentraciones de elementos valiosos, incluyendo 58% Nd, 8% Pr, 8% Sm y 2% Dy, que representan el 76% del total de REE. Un análisis comparativo muestra que las perspectivas de IDR están teniendo un buen desempeño en comparación con las minas de REE a nivel global. Para 2025, IDR planea un programa de zanjas más grande y una perforación rotativa de bajo impacto en el proyecto Lemhi Pass de 12,000 acres. La empresa también está colaborando con laboratorios nacionales para avanzar en la comprensión de la mineralogía y desarrollar tecnologías de procesamiento específicas para los proyectos de REE de Idaho.

아이다호 전략 자원(IDR)는 희토류(REE) 작업과 2025년 계획에 대한 업데이트를 제공하며 Lemhi Pass 프로젝트에 중점을 두었습니다. 이 회사는 58% Nd, 8% Pr, 8% Sm 및 2% Dy를 포함한 귀중한 요소의 높은 농도로 희토류 혼합이 유리하다고 보고했으며, 이는 총 REE의 76%를 차지합니다. 비교 분석에 따르면 IDR의 전망은 전세계 REE 광산에 비해 잘 수행되고 있습니다. 2025년을 위해 IDR은 12,000에이커 규모의 Lemhi Pass 프로젝트에서 더 큰 굴착 및 저영향 공기 회전 드릴링 프로그램을 계획하고 있습니다. 이 회사는 또한 아이다호의 REE 프로젝트에 특화된 처리 기술을 개발하고 광물학 이해를 심화하기 위해 국가 연구소와 협력하고 있습니다.

Idaho Strategic Resources (IDR) a fourni une mise à jour sur ses opérations d'éléments de terres rares (REE) et ses projets pour 2025, en se concentrant sur le projet Lemhi Pass. L'entreprise a rapporté un mélange de REE favorable avec de fortes concentrations d'éléments précieux, y compris 58 % Nd, 8 % Pr, 8 % Sm et 2 % Dy, représentant 76 % du total des REE. Une analyse comparative montre que les perspectives d'IDR performe bien par rapport aux mines de REE dans le monde. Pour 2025, IDR prévoit un programme de fouilles plus important et un forage rotatif à faible impact sur le projet Lemhi Pass de 12 000 acres. L'entreprise collabore également avec des laboratoires nationaux pour améliorer la compréhension de la minéralogie et développer des technologies de traitement spécifiques aux projets REE de l'Idaho.

Idaho Strategic Resources (IDR) hat ein Update zu seinen Aktivitäten im Bereich der seltenen Erden (REE) und den Plänen für 2025 veröffentlicht, wobei der Fokus auf dem Lemhi Pass-Projekt liegt. Das Unternehmen berichtete von einer vorteilhaften Mischung der REE mit hohen Konzentrationen wertvoller Elemente, darunter 58% Nd, 8% Pr, 8% Sm und 2% Dy, die 76% der gesamten REE ausmacht. Eine vergleichende Analyse zeigt, dass die Perspektiven von IDR im Vergleich zu globalen REE-Minen gut abschneiden. Für 2025 plant IDR ein umfangreicheres Graben und ein umweltfreundliches Rotationsbohrprogramm im 12.000 Acres großen Lemhi Pass-Projekt. Das Unternehmen arbeitet auch mit nationalen Laboren zusammen, um das Verständnis der Mineralogie voranzubringen und spezifische Verarbeitungstechnologien für die REE-Projekte Idahos zu entwickeln.

- High-value REE concentration with 76% comprising valuable elements (58% Nd, 8% Pr, 8% Sm, 2% Dy)

- Large land position with 12,000-acre Lemhi Pass project

- Favorable REE mix compared to major global producers

- Development of tailored processing technologies through national laboratory partnerships

- Extensive exploration work still required before resource definition

- Time-intensive exploration process due to large project area

- Processing and separation technology still in development phase

Insights

The REE analysis from Lemhi Pass reveals a highly favorable composition with up to

The substitution of lower-value lanthanum with higher-value neodymium could significantly enhance project economics. The planned 12,000-acre exploration program using cost-effective trenching and air rotary drilling methods demonstrates a pragmatic approach to resource definition. The parallel development of tailored processing technologies through partnerships with national laboratories is strategically sound, as processing capabilities often determine project viability in the REE sector.

The strategic positioning of IDR's Lemhi Pass project aligns with growing domestic REE demand and heightened focus on supply chain security. The company's dual focus on gold production and REE exploration provides unique market positioning and risk diversification. The methodical exploration approach using low-impact methods indicates careful capital management while maintaining exploration momentum.

The collaboration with national laboratories for processing technology development is particularly noteworthy, as it could provide IDR with a competitive advantage in extraction efficiency and cost management. The project's scale and early results suggest significant potential for becoming a strategic domestic REE source, though extensive work remains to define a commercial resource.

Recent Study Indicates Favorable Rare Earth Elements Mix at Lemhi Pass - Abundant Concentrations of Magnet and Heavy REEs Relative to Many Current and Proposed REE Mines Globally

COEUR D'ALENE, ID / ACCESSWIRE / November 13, 2024 / Idaho Strategic Resources, Inc. (NYSE American:IDR) ("IDR" or the "Company") is pleased to provide an update on its extensive Idaho-based rare earth elements (REE) landholdings, including its plans for the 2025 REE exploration field season focusing on the Company's Lemhi Pass project.

To recap, on November 15th, 2023 IDR announced impressive results from analysis of sampling at two prospects within its Lemhi Pass project (Idaho Strategic's Lemhi Trenching Returns Up to

Idaho Strategic's geologists, among others, speculate the favorable mix of REEs may be due to the substitution of lanthanum (a common lower value REE) for a greater concentration of neodymium as illustrated in many Lemhi Pass samples analyzed to date. While much more work is required (and planned) the Company's initial findings support the potential for favorable project economics moving forward. As part of its ongoing analysis, and ahead of the 2025 work season, the company contracted Alpha Geologic for further study of samples from its Mineral Hill, Diamond Creek and Lemhi Pass projects.

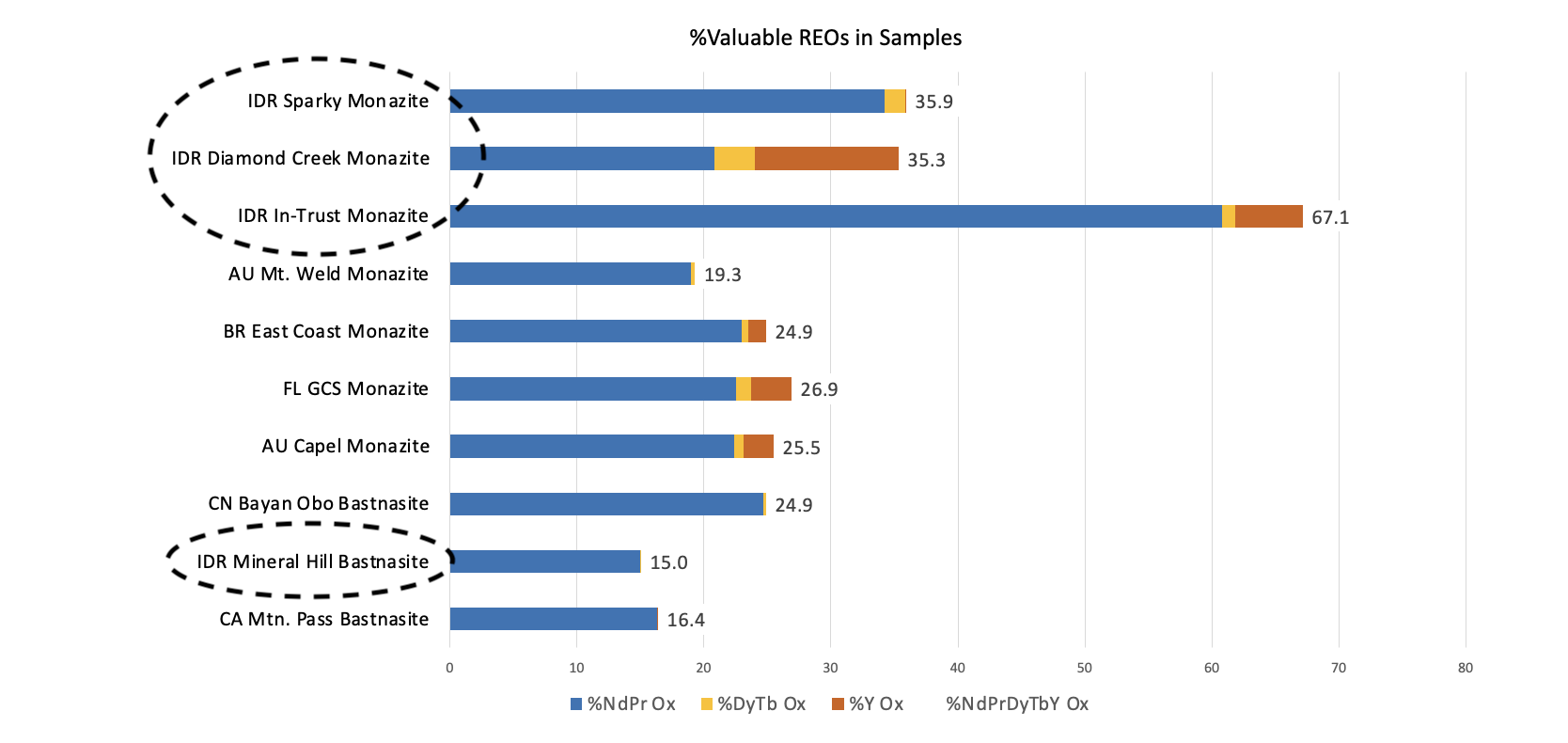

The two charts below depict the percentages of valuable rare earth oxides in samples obtained from the Company's Sparky and In-Trust (IT) prospects at Lemhi Pass. Along with additional samples obtained from Diamond Creek (DC) and Mineral Hill (MH) in order to provide early-stage comparisons to the reported percentage of valuable rare earth elements in other globally significant projects; including the producing Mountain Pass (California), Mt. Weld (Australia), and Bayan Obo (China) REE mines.

Chart #1 measures the ratio of neodymium ("Nd"), praseodymium ("Pr"), dysprosium ("Dy"), terbium ("Tb"), and Yttrium ("Y") compared to the total rare earth oxides for each respective project

Chart #2 measures the ratio of samarium ("Sm"), Europium ("Eu"), and Gadolinium ("Gd") compared to the total rare earth oxides for each respective project

In 2025 the Company has plans for a considerably larger trenching and low-impact air rotary drilling program at Lemhi Pass in comparison to past efforts. Spanning over 12,000 acres, the Company's Lemhi Pass project is expansive and exploring it thoroughly will take time. Using a combination of trenching and air rotary drilling is the best and lowest cost method for quick, larger scale exploration to aid in the eventual planning for a core drilling program and future resource definition.

Idaho Strategic's President and CEO, John Swallow commented, "We are understandably pleased with the results coming out of our Lemhi Pass project, especially in comparison to other well-known deposits across the globe, and just as domestic sourcing of REEs and mining in Idaho is receiving increased attention. It is also important to note that in concert with planned and ongoing REE exploration, we are also working with multiple national laboratories and independent companies to advance our understanding of the minerology of Idaho's REE projects, and to investigate various separation and processing technologies. Given the specific nature of processing and separating REEs, we felt it necessary to supply REE samples from our projects for the development of innovative processing and separation technologies, which could inevitably result in those solutions/technologies being tailored to the minerology of our projects."

Qualified person

IDR's Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person as such term is defined under S-K 1300 and has reviewed and approved the technical information and data included in this press release.

About Idaho Strategic Resources, Inc.

Idaho Strategic Resources (IDR) is an Idaho-based gold producer which also owns the largest rare earth elements land package in the United States. The Company's business plan was established in anticipation of today's volatile geopolitical and macroeconomic environment. IDR finds itself in a unique position as the only publicly traded company with growing gold production and significant blue-sky potential for rare earth elements exploration and development in one Company.

For more information on Idaho Strategic Resources, visit https://idahostrategic.com/presentation/, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but are not limited to, The potential operational and economic viability of REEs at Lemhi Pass, the potential for REE exploration to take place in 2025, the potential for additional discoveries from drilling and trenching, the potential for trenching and air rotary drilling to be quick and low cost, and the potential for Lemhi Pass' REE mineralization to continue to display results similar to the two charts included in this press release. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. Investors should note that IDR's claim as the largest rare earth elements landholder in the U.S. is based on the Company's internal review of publicly available information regarding the rare earth landholdings of select companies within the U.S., which IDR is aware of. Investors are encouraged not to rely on IDR's claim as the largest rare earth elements landholder in the U.S. while making investment decisions. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; the ability to operate the Company's projects; and risks associated with the mining industry such as economic factors (including future commodity prices, and energy prices), ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.

View the original press release on accesswire.com