Idaho Strategic Provides Full Year 2022 Top-line Performance Numbers

Idaho Strategic Resources (IDR) reported strong performance for 2022, with estimated revenues of $9.5 million and production of 6,000 ounces of gold, marking increases of 24.5% and 24.3% respectively over 2021. CEO John Swallow highlighted the company's strategy of starting small and expanding gradually, leading to consistent shareholder value creation. IDR has implemented a revised mine plan, improving efficiency amid inflation and fluctuating gold prices. The company is also advancing its rare earth elements projects, positioning itself as a credible U.S. operator in a critical minerals sector.

- In 2022, IDR achieved a revenue increase of 24.5% to $9.5 million.

- Gold production rose by 24.3% to 6,000 ounces.

- The company implemented a revised mine plan prioritizing higher-grade resources, enhancing mining efficiency.

- IDR's operations are advancing, leading to strong cash flow growth.

- Strategic focus on rare earth elements enhances market position.

- The company faces uncertainties associated with fluctuating mineral and commodity prices.

- Dependency on market conditions could impact future revenue and production outcomes.

Insights

Analyzing...

Golden Chest Mine Continues to be Proof-of-Concept as Rare Earth Elements Projects Advance

COEUR D'ALENE, IDAHO / ACCESSWIRE / January 31, 2023 / Idaho Strategic Resources (NYSE American:IDR)("IDR" or the "Company") is pleased to announce that it has continued its track record of consistent revenue growth and operating results with estimated top-line revenue and production for 2022 of

Idaho Strategic President and CEO, John Swallow stated, "The top-line 2022 revenue and production numbers from our gold operations are evidence that our production-based approach is working. Our unique focus on starting small and building bigger affords us a healthier business approach, which in turn delivers shareholder value creation and consistent performance improvement. As the CEO of Idaho Strategic, I am proud of the way our 50+ team members have advanced our operations and our rare earth projects to realize a record revenue 4th quarter. Mining is a tough business, and while nothing in this industry is ever guaranteed, the ability to construct and grow an actual producing company is what the IDR team is built for."

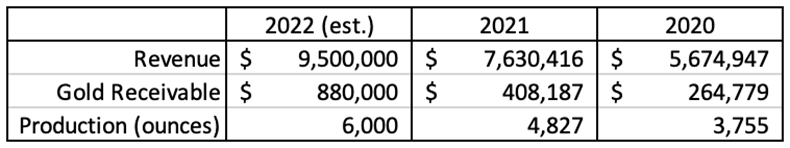

The table below shows select estimated financial and production results related to Idaho Strategic's gold operations from fiscal years 2020-2022:

IDR was able to drive results through a period of increased inflation and lower gold prices in the third quarter by pivoting to a revised mine plan which includes prioritizing the higher-grade on the northern end of the Skookum shoot, while preserving access to the south end for potential future mining as gold prices continue to improve. At the Golden Chest Mine, Idaho Strategic added a Resemin Muki narrow-vein underground bolter (pictured below), a Sandvik underground loader, and completed the commissioning of its Tamrock double-boom jumbo (pictured below). The importance of adding these three new machines underground has helped increase mine efficiency and provided IDR's miners with much needed tools to drive our growing base of cash flow.

The Company has also adjusted its mining schedule to a 7 and 7 schedule which has increased the efficiency and continuity of its miners on a day-to-day basis. The company is currently evaluating the potential to expand its underground production by updating its resource model with results from core drilling over the past year.

Mr. Swallow concluded, "As we continue to advance our rare earth elements projects, the credibility afforded to us by being able to point to the Golden Chest Mine as our proof-of-concept is an advantage not many other companies in the U.S. rare earth industry possess. There is an unmistakable value to being a proven mine operator. Starting big can sometimes come with an associated level of risk and dilution and many times shareholders that started the journey are not the ones that benefit upon reaching the destination. And as a fellow shareholder, my focus has been on traveling this road together. The managerial and production skillsets that we have at IDR have resulted in a steady growth plan at the Golden Chest and allowed for our domestic expansion into rare earths and other critical minerals at a time when our country is searching for answers to its supply chain security shortfalls."

Resemin Muki Bolter Photo:

Tamrock Double-Boom Jumbo Photo:

About Idaho Strategic Resources, Inc.

Domiciled in Idaho and headquartered in the Panhandle of northern Idaho, Idaho Strategic Resources (IDR) is one of the few resource-based companies (public or private) possessing the combination of officially recognized U.S. domestic rare earth element properties (in Idaho), the largest known concentration of thorium resources in the U.S., and Idaho-based gold production located in an established mining community.

Idaho Strategic Resources produces gold at the Golden Chest Mine located in the Murray Gold Belt (MGB) area of the world-class Coeur d'Alene Mining District, north of the prolific Silver Valley. With over 7,000 acres of patented and unpatented land, the Company has the largest private land position in the area following its consolidation of the Murray Gold Belt for the first time in over 100-years.

In addition to gold and gold production, the Company maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more "at-risk" Rare Earth Elements (REE's) and Thorium. The Company's Diamond Creek and Roberts REE properties are included the U.S. national REE inventory as listed in USGS, IGS and DOE publications. IDR's Lemhi Pass Thorium-REE Project is recognized by the USGS and IGS as containing the largest concentration of thorium resources in the country. All three projects are located in central Idaho and participating in the USGS Earth MRI program.

With an impressive mix of experience and dedication, the folks at IDR maintain a long-standing "We Live Here" approach to corporate culture, land management, and historic preservation. Furthermore, it is our belief that successful operations begin with the heightened responsibility that only local oversight and a community mindset can provide. Its "everyone goes home at night" policy would not be possible without the multi-generational base of local exploration, drilling, mining, milling, and business professionals that reside in and near the communities of the Silver Valley and North Idaho.

For more information on Idaho Strategic Resources click here for our corporate presentation, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but are not limited to, Idaho Strategic Resources targeted production rates and results, including those reported in this release; the expected market prices of gold, individual rare earth elements, and/or thorium, as well as the related costs, expenses and capital expenditures; the potential advancement of the Company's projects; the potential development into the Paymaster, the H-vein, and/or the Jumbo vein, and the economics of the Paymaster, H-vein, and the Jumbo vein; as well as the expected benefits of the 7 and 7 schedule, revised mine plan, updated mine equipment and increased tailings storage facility. Investors are cautioned that the numbers discussed in this release are not final and subject to change prior to the filing of the Company's annual financials. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks, if they occur, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; the ability to operate the Company's projects; and risks associated with the mining industry such as economic factors (including future commodity prices, and energy prices), ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/737365/Idaho-Strategic-Provides-Full-Year-2022-Top-line-Performance-Numbers