New Care.com Report Reveals Soaring Childcare Costs Are Crippling Majority of American Families

– Both Single and Married Working Parents Spend on Average in Excess of

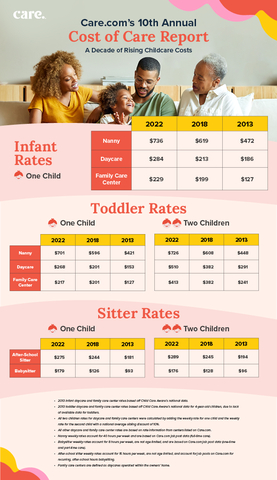

A decade of rising childcare costs from Care.com's 2023 Cost of Care Report. (Graphic: Business Wire)

The report comprises survey results of 3,000 parents and a decade of childcare cost data. It reveals an imploding post-pandemic childcare landscape for

“America’s childcare crisis is just that: a crisis for the entire country and it impacts us all, whether you have children or not,” said Tim Allen, CEO, Care.com. “Childcare is claiming a disproportionate amount of household incomes and a decade of rising childcare costs should be a wakeup call that the system as we know it completely fails the vast majority of families.”

Natalie Mayslich, President, Consumer for Care.com added, “So much is discussed about the staggering college debt families incur. What does it say about our system that a year of childcare for more than half of American families is actually double the cost of in-state college tuition?”

Highlights from the 2023 Cost of Care Report:

A Decade of Rising Weekly Costs*:

-

Nanny:

$736 56% from$472 -

Daycare:

$284 53% from$186 -

Family Care Center:

$229 80% from$127 -

Babysitter:

$179 92% from$93

* infant rates except for babysitter, which is not age limited. Rates for toddlers, after school sitters, as well as multiple children, can be found within the report.

Childcare Costs Continue to Soar:

-

● Parents are spending increasingly more of their earnings on childcare:

-

67% spend20% or more of their annual HHI on childcare (up from51% in 2022). -

89% spend10% or more of their annual HHI on childcare (up from72% in 2022).

-

-

● On average, families spend

27% of their HHI on childcare with the majority of parents (59% ) planning to spend more than$18,000 -

With a national family median household income of

$91 K-

45% of families earning less than$100 K$18,000 18% of their HHI; -

43% of families earning less than$75 K$18,000 24% of their HHI; and -

39% of families earning less than$50 K$18,000 36% of their HHI.

-

-

With a national family median household income of

The Daycare Dilemma:

-

Three in four parents (

75% ) estimate that there are fewer than half a dozen daycare centers within a 20-minute drive of their home. Additionally,64% have been waitlisted for daycare with nearly half (49% ) waiting longer than three months to get a spot. -

Beyond the inconvenience, waiting proves costly with

68% spending an additional$200 $2

Childcare Villages Are Changing:

-

Parents now rely equally on daycare centers and nannies (each

30% ), as compared to last year when daycares were used more frequently (31% vs.22% ). The shift reflects the changing nature of work for parents who now need more flexibility. -

In fact,

45% use childcare in sporadic, nontraditional hours, such as 10am to 1pm. The desire for flexible care solutions is further reflected by the fact that, if both cost and availability were no object, parents would choose a nanny (37% ) over daycare (35% ).

Childcare’s Impact on Families

Family Type |

Work Type |

Top Childcare Arrangement |

Preferred Childcare Arrangement |

Percent (%) Spending More Than |

Avg. Percent (%) of HHI Spent on Childcare |

Single Moms |

Hourly |

Daycare ( |

Daycare ( |

|

|

Salaried |

Daycare ( |

Daycare ( |

|

|

|

Single Dads |

Hourly |

Paid Family ( |

Paid Friends/Nanny ( |

|

|

Salaried |

Paid Friends ( |

Nanny ( |

|

|

|

Married Moms |

Hourly |

Paid Family ( |

Nanny ( |

|

|

Salaried |

Daycare ( |

Nanny ( |

|

|

|

Married Dads |

Hourly |

Paid Friends ( |

Nanny ( |

|

|

Salaried |

Nanny ( |

Daycare ( |

|

|

Top 5 Most Expensive States for Childcare

Top 5 most expensive states to hire a nanny: |

Top 5 most expensive states to hire a babysitter: |

Top 5 most expensive states for daycare (infants): |

|||

State |

Weekly Rate |

State |

Weekly Rate |

State |

Weekly Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Along with the report, Care.com released a new childcare cost calculator for families to estimate hourly rates for in-home care in their city.

The full results of the 2023 Cost of Care Report can be found here and access to graphics displaying the data can be made available upon request.

2023 Cost of Care Report Methodology

This sample of 3,000

Weekly rates for nanny, babysitter and after-school sitter are based on 2022 advertised rates on Care.com. All daycare and family center rates are based on rate information from centers listed on Care.com, except for 2013 rates, where daycare and family care center rates for infants and toddlers are based on Child Care Aware’s national data.

About Care.com

Available in more than 17 countries, Care.com is the largest online platform for finding and managing high-quality family care. Care.com is designed to meet the evolving needs of today’s families and caregivers, offering everything from household tax and payroll services and customized corporate benefits packages covering the care needs of working families, to innovating new ways for caregivers to book jobs. Since 2007, families have relied on Care.com’s products—from child and elder care to pet care and home care. Care.com is an IAC company (NASDAQ: IAC).

View source version on businesswire.com: https://www.businesswire.com/news/home/20230613495283/en/

Natasha Fellion

Communications Manager, Care.com

natasha.fellion@care.com

Source: Care.com