HIVE Reports Record Top Line Income From Digital Currency Mining for Q3 F2021 up 174% From Q3 F2020 or $13.7 Million, and Record Year Over Year Cash Flow Growth. Total Income for 9 Months F2021 was $28 Million or $0.08 Cents per Share and $0.05 per Share for Q3 F2021

HIVE Blockchain Technologies Ltd. (HVBTF) reported impressive third-quarter results for the period ending December 31, 2020. Income from digital currency mining surged by 174% year-over-year to $13.7 million, with a gross mining margin of $10.6 million, representing 78% of revenue. Net income increased to $17.2 million, or $0.05 per share, compared to $3.4 million a year earlier. Mining operations in Sweden and Iceland remain profitable, producing approximately 20,000 Ethereum coins quarterly. Despite a drop in Ethereum production, Bitcoin output doubled, contributing to record cash flow.

- Income from digital currency mining rose by 174% year-over-year to $13.7 million.

- Gross mining margin increased to $10.6 million, or 78% of income from digital currencies.

- Net income for the quarter was $17.2 million, up from $3.4 million the previous year.

- Mining operations in Sweden and Iceland are stable and profitable, with around 20,000 Ethereum coins mined per quarter.

- Cash flow from operations reached a record $13.7 million.

- Decrease in Ethereum coins mined due to lower transaction fees compared to the previous quarter.

- Challenges in upgrading mining equipment due to COVID-19 lockdowns in Europe.

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated February 2, 2021 to its short form base shelf prospectus dated January 27, 2021.

VANCOUVER, BC / ACCESSWIRE / March 2, 2021 / HIVE Blockchain Technologies Ltd. (TSX.V:HIVE)(OTCQX:HVBTF)(FSE:HBF) (the "Company" or "HIVE") announces its results for the third quarter ended December 31, 2020 (all amounts in US dollars, unless otherwise indicated).

Income from digital currency mining was

"In spite of the decreased number of Ethereum coins mined during this quarter as a result of the lower transaction fees when compared to the previous quarter, our Bitcoin operations doubled in the quarter so that our combined revenue and cash flow made new highs. In addition, we started upgrading our memory chips during the quarter from 4 Gigabyte to 8 Gigabyte which has been a big challenge with Europe locking down due to COVID-19 crisis, but we were able to upgrade over

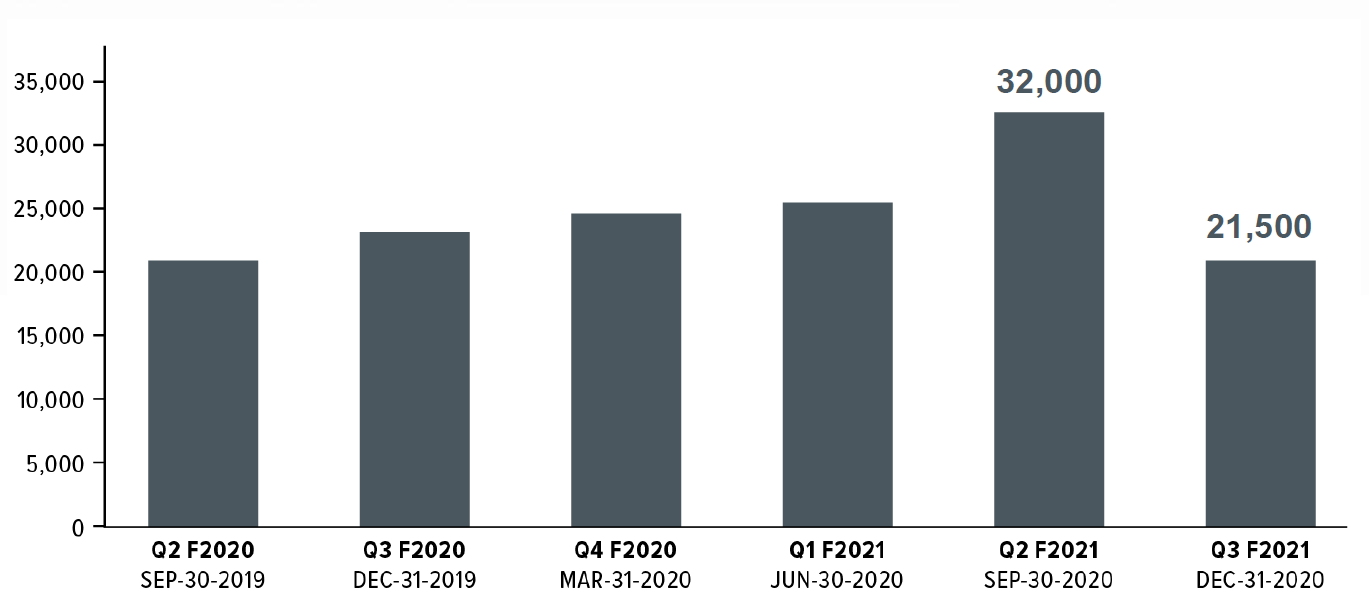

"Our Sweden and Iceland operations mining Ethereum on the cloud has been and continues to be a very stable and profitable business for us. On average we have been producing around 20,000 Ethereum coins per quarter, and when we experience quarters above that level it is due to bonus transaction fees that vary from quarter to quarter,'" expanded Mr. Holmes.

Ethereum Mined by HIVE Blockchain Technologies

"As we have mentioned previously and we are so proud of is that HIVE is the only public crypto mining company producing Ethereum on an industrial scale, sourcing green energy from facilities in Sweden and Iceland. With the continued explosion in DeFi, which has increased the demand for Ethereum, and now the debut of Ethereum 2.0, which will shrink the supply of Ethereum, we continue to be in a very envious position," continues Mr. Holmes.

Q3 F2021 Highlights

- Generated income from digital currency mining of

$13.7 million , an increase of174% year-over-year - Generated gross mining margin[1] of

$10.6 million , or78% of income from digital currencies - Mining output of newly minted digital currencies:

- 21,500 Ethereum

- 165 Bitcoin

- Generated Adjusted EBITDA1 of

$13.7 million , a significant increase from$5.7 million a year earlier - Generated net income of

$17.2 million for the period, or$0.05 per share, compared to$3.4 million , or$0.01 per share, last year - Digital currencies of

$15.0 million , as at December 31, 2020 - Working capital was

$23.2 million as at December 31, 2020

Q3 F2021 Financial Review

For the three months ended December 31, 2020, income from digital currency mining was

Gross mining margin1 during the quarter was

Net income during the quarter ended December 31 was

| Three months ended December 31, | Nine months ended December 31, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

Income from digital currency mining | $ | 13,707,879 | $ | 5,003,944 | $ | 33,277,753 | $ | 23,968,532 | ||||||||

Operating and maintenance costs of digital currency mining | (3,078,934 | ) | (1,170,145 | ) | (10,846,921 | ) | (19,296,937 | ) | ||||||||

Gross Mining Margin1 | 10,628,945 | 3,833,799 | 22,430,832 | 4,671,595 | ||||||||||||

Gross Mining Margin %1 | 78 | % | 77 | % | 67 | % | 19 | % | ||||||||

Depreciation | (2,476,592 | ) | (1,345,212 | ) | (5,903,235 | ) | (3,850,241 | ) | ||||||||

Gross gain | 8,152,353 | 2,488,587 | 16,527,597 | 821,354 | ||||||||||||

Revaluation of digital currencies2 | 6,315,970 | (727,064 | ) | 8,635,736 | (2,639,579 | ) | ||||||||||

Gain on sale of digital currencies | 1,679,213 | 107,960 | 4,156,500 | 934,220 | ||||||||||||

Hosting revenues | 393,518 | - | 585,318 | - | ||||||||||||

General and administrative expenses | (911,076 | ) | (1,125,864 | ) | (2,039,296 | ) | (3,791,320 | ) | ||||||||

Foreign exchange | 1,746,573 | 2,860,408 | 1,661,155 | 1,192,270 | ||||||||||||

Share-based compensation | (209,726 | ) | (62,220 | ) | (868,947 | ) | (371,119 | ) | ||||||||

Realized gain on investments | 6,639 | - | 6,639 | 1,531,464 | ||||||||||||

Unrealized gain on investments | 148,967 | - | 148,967 | - | ||||||||||||

Finance expense | (111,918 | ) | (153,792 | ) | (342,283 | ) | (261,314 | ) | ||||||||

Net income (loss) from continuing operations | $ | 17,210,513 | $ | 3,388,015 | $ | 28,471,386 | $ | (2,584,024 | ) | |||||||

EBITDA1 | $ | 19,799,023 | $ | 4,887,019 | $ | 34,465,698 | $ | (3,933 | ) | |||||||

Adjusted EBITDA1 | $ | 13,692,779 | $ | 5,676,303 | $ | 26,950,115 | $ | 3,006,765 | ||||||||

Diluted income (loss) per share | $ | 0.05 | $ | 0.01 | $ | 0.08 | $ | (0.01 | ) | |||||||

Net cash inflows from operating activities | $ | 12,877,046 | $ | (2,404,273 | ) | $ | 18,792,467 | $ | (1,216,180 | ) | ||||||

Net cash outflows from investing activities | $ | (17,999,415 | ) | $ | - | $ | (22,094,739 | ) | $ | - | ||||||

Net cash inflows (outflows) from financing activities | $ | (497,629 | ) | $ | - | $ | (1,052,112 | ) | $ | 306,712 | ||||||

1. Non-IFRS measure. A reconciliation to its nearest IFRS measures is provided under "Reconciliations of Non-IFRS Financial Performance Measures" in the Company's MD&A.

2. Revaluation is calculated as the change in value (gain or loss) on the coin inventory. When coins are sold, the net difference between the proceeds and the carrying value of the digital currency (including the revaluation), is recorded as a gain (loss) on the sale of digital currencies

Financial Statements and MD&A

The Company's Condensed Interim Consolidated Financial Statements and Management's Discussion and Analysis (MD&A) thereon for the three and nine months ended December 31, 2020 will be accessible on SEDAR at www.sedar.com under HIVE's profile, and on the Company's website at www.HIVEblockchain.com.

Webcast Details

Management will host a webcast on Tuesday, March 2, 2021 at 10:00 am Eastern Time to discuss the Company's financial results. Presenting on the webcast will be Frank Holmes, Interim Executive Chairman and Darcy Daubaras, Chief Financial Officer. IMPORTANT - Click here to register for the webcast. The direct link is https://us02web.zoom.us/webinar/register/WN_c5rTbXcwQ8uOyYHX6023wQ.

At-the-Market Offering

Pursuant to the ATM Equity Program, as required pursuant to National Instrument 44-102 - Shelf Distributions and the policies of the TSX Venture Exchange ("TSXV"), the Company announces that, since the beginning of the program on February 3, 2021, it has issued an aggregate of 13,201,800 common shares (the "ATM Shares") over the TSX-V, for aggregate gross proceeds to the Company of C

Pursuant to the EDA, the Company may, from time to time, sell up to US

This news release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States or in any jurisdiction where the offer, sale or solicitation would be unlawful. The Common Shares referred to in this news release may not be offered or sold in the United States absent registration or an applicable exemption from registration.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. is a growth oriented, TSX.V-listed company building a bridge from the blockchain sector to traditional capital markets. HIVE owns state-of-the-art green energy-powered data centre facilities in Canada, Sweden, and Iceland which produce newly minted digital currencies like Bitcoin and Ethereum continuously on the cloud. Our deployments provide shareholders with exposure to the operating margins of digital currency mining as well as a portfolio of crypto-coins.

For more information and to register to HIVE's mailing list, please visit www.HIVEblockchain.com. Follow @HIVEblockchain on Twitter and subscribe to HIVE's YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

"Frank Holmes"

Interim Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes information about the Company's continued upgrade and expansion efforts; the potential for the Company's long-term growth; the business goals and objectives of the Company, and other forward-looking information includes but is not limited to information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward-looking information, and potentially lead to material adverse effects on the Company's operations and results include, but are not limited to, further improvements to the Company's profitability and efficiency may not be realized as currently anticipated, or at all; favourable factors (such as reduction in energy costs and increasing Ethereum prices and DeFi applications) may not continue; the effects of COVID-19 on global supply chains, including increased shipping costs and delays in obtaining equipment from China; the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on the Company's operations; the volatility of digital currency prices; and other related risks as more fully set out in the Filing Statement of the Company and other documents disclosed under the Company's filings at www.sedar.com.

This news release also contains "financial outlook" in the form of gross mining margins, which is intended to provide additional information only and may not be an appropriate or accurate prediction of future performance, and should not be used as such. The gross mining margins disclosed in this news release are based on the assumptions disclosed in this news release and the Company's Management Discussion and Analysis for the quarter ended December 31, 2020, which assumptions are based upon management's best estimates but are inherently speculative and there is no guarantee that such assumptions and estimates will prove to be correct.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's ability to realize operational efficiencies going forward into profitability; profitable use of the Company's assets going forward; the Company's ability to profitably liquidate its digital currency inventory as required; historical prices of digital currencies and the ability of the Company to mine digital currencies will be consistent with historical prices; and there will be no regulation or law that will prevent the Company from operating its business. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

[1] Non-IFRS measure. A reconciliation to its nearest IFRS measures is provided under "Reconciliations of Non-IFRS Financial Performance Measures" in the Company's MD&A.

SOURCE: Hive Blockchain Technologies Ltd

View source version on accesswire.com:

https://www.accesswire.com/632905/HIVE-Reports-Record-Top-Line-Income-From-Digital-Currency-Mining-for-Q3-F2021-up-174-From-Q3-F2020-or-137-Million-and-Record-Year-Over-Year-Cash-Flow-GrowthTotal-Income-for-9-Months-F2021-was-28-Million-or-008-Cents-per-Share-and-005-per-Share

FAQ

What were HIVE Blockchain's Q3 2021 financial results?

How much Ethereum does HIVE mine quarterly?

What is HIVE's gross mining margin for Q3 2021?

What challenges did HIVE face in Q3 2021?