Huntsman Files Definitive Proxy Materials and Mails Letter to Shareholders

Huntsman Corporation (NYSE: HUN) filed definitive proxy materials for its Annual Meeting of Stockholders on March 25, 2022. Stockholders as of February 1, 2022, can vote. Key highlights include record financial results in 2021, with adjusted EBITDA of $349 million and free cash flow of $698 million in Q4, 45% and 691% increases year-over-year, respectively. Huntsman has engaged with activist investor Starboard since September 2021, asserting that their proxy campaign risks value destruction. The Board has been refreshed, appointing eight new independent directors since 2018, enhancing oversight and governance.

- Record financial results with adjusted EBITDA of $349 million in Q4 2021, up 45% year-over-year.

- Significant free cash flow of $698 million in Q4 2021, compared to $88 million in Q4 2020.

- Board refreshment with eight new independent directors since 2018, supporting strategic execution.

- Approved new $1 billion share repurchase authorization expected to complete within two years.

- Guidance for Q1 2022 adjusted EBITDA between $350 million and $380 million.

- Starboard's proxy contest is viewed as unnecessary and risks value destruction for shareholders.

THE WOODLANDS, Texas, Feb. 17, 2022 /PRNewswire/ -- Huntsman Corporation (NYSE: HUN) today announced that it has filed definitive proxy materials with the Securities and Exchange Commission ("SEC") in connection with its upcoming Annual Meeting of Stockholders scheduled for March 25, 2022. Stockholders of record as of February 1, 2022, will be entitled to vote at the meeting.

In conjunction with the definitive proxy filing, Huntsman has mailed a letter to the Company's shareholders. Highlights from the letter include:

- 2021 was the best year in Huntsman's history: Huntsman's recent financial results demonstrate that the Company's plan is working. The Company reported the strongest profit and margin performance it has ever achieved with its current portfolio, delivering

$349 million of adjusted EBITDA in the fourth quarter 2021, up45% year over year, and significant free cash flow of$698 million , while achieving ahead of schedule an annualized run rate of$120 million on the Company's$240 million cost optimization and synergy program. - Huntsman is executing on a deliberate, long-term strategy: The Company has taken significant actions that have delivered industry leading long-term total shareholder returns. Among other strategic initiatives, Huntsman has transformed its portfolio to deliver higher-margin, differentiated products in higher value markets, deleveraged its balance sheet and enhanced its financial profile, increased return of capital to shareholders and commenced a strategic review of its Textile Effects business. With a strong balance sheet and transformed portfolio, Huntsman is primed for further success, growth and value creation.

- Huntsman's Board has been refreshed and is best suited to oversee the Company's strategy going forward: The Board has completed an extensive refreshment plan, appointing eight new independent directors since 2018. Each of Huntsman's directors bring unique backgrounds and expertise to effectively oversee the Company's transformed portfolio, differentiated business strategies and long-term success. The Company has also implemented corporate governance enhancements, including the appointment of Cynthia Egan as Non-Executive Vice Chair and Lead Independent Director and of new Committee Chairs.

- Huntsman's engagement with Starboard has been extensive, including attempts to reach a negotiated resolution: Since September 2021, the Huntsman Board and management team have had over a dozen calls or meetings with Starboard. Huntsman offered to appoint one of Starboard's nominees to the Board, but Starboard was unwilling to agree to a reasonable negotiated resolution.

- Starboard's campaign is unnecessary and risks value destruction: After repeatedly endorsing Huntsman's strategy and execution, Starboard has refused to recognize our portfolio transformation and the Company's current strength. It is clear that there was, and continues to be, no misalignment with Starboard on the Company's objectives and strategic plan. In stark contrast with Huntsman's world-class Board, Starboard's nominees add no incremental value and lack relevant expertise to effectively serve on the Huntsman Board.

Huntsman's definitive proxy materials and other materials regarding the Board of Directors' recommendation for the 2022 Annual Meeting can be found at voteforhuntsman.com.

The full text of the letter being mailed to shareholders follows:

Dear Fellow Huntsman Shareholder:

We are writing to you, our fellow shareholders, because a New York-based activist hedge fund, Starboard Value LP – who just recently bought shares in our company – is attempting to replace four members of your Board of Directors who are integral to the continued execution of our successful strategy and delivering a promising future for Huntsman and you, our shareholders.

That promising future is not some vague hope. The price of our shares closed at an all-time high in response to our latest results as reported on our 2021 earnings call on February 15, 2022. Those results were driven by the strategic transformation of our portfolio, the material deleveraging of our balance sheet and our focus on sustainability and securing a sustainable future.

To give you a clear sense of what is at stake: our 2021 results were the best in our history with our current portfolio. The Company delivered the strongest profit and margin performance we have ever achieved while delivering on our commitment to significantly increase free cash flow. Our results demonstrate that Huntsman is already delivering higher margins, a less cyclical business and a more valuable company that is primed to take advantage of megatrends in the chemical industry. We reported:

- Adjusted EBITDA of

$349 million in fourth quarter 2021 up45% from$240 million in fourth quarter 2020; - Free cash flow of

$698 million in fourth quarter 2021 compared to$88 million in fourth quarter 2020; - Achievement ahead of schedule of an annualized run rate of

$120 million on our$240 million cost optimization and synergy program; and - Repurchase of more than

$200 million shares in the second half of 2021 and a13% increase to the quarterly dividend.

In addition to reporting our 2021 earnings, we gave first quarter 2022 adjusted EBITDA guidance of

- 2022 adjusted EBITDA of approximately

$1.4 billion and free cash flow conversion above40% ; - Post-2022 financial targets of 18

-20% adjusted EBITDA margins by 2024; - Approximately

$240 million in annualized cost optimization and synergies by the end of 2023; - Continued investments in higher-margin, higher-return projects like the Geismar, Louisiana MDI Splitter, E-GRADE®, UPEC and polyurethane catalysts;

- Upgrade of the polyurethanes portfolio, improving margins and reducing volatility;

- Strategic bolt-on acquisitions consistent with maintaining an investment grade balance sheet and balanced capital allocation plan; and

- Continued return of capital to shareholders through dividends and share repurchases, including a new

$1 billion repurchase authorization that we now expect to complete within two years.

With our strong balance sheet and liquidity position, solution-driven product portfolio and dedicated associates, we are firmly on the right track for continued success, growth and driving value creation for you.

You face a pivotal decision about our future and the future of your investment in Huntsman in less than six weeks when we gather for our 2022 Annual Meeting of Shareholders. Starboard has launched an unnecessary proxy contest - refusing to recognize our portfolio transformation and the Company's current strength - risking all the value we have created for you by seeking to replace four key members of your Board with four of their own hand-picked nominees. For the reasons stated here, we urge you to reject Starboard's unwarranted attempt to change your Board and the direction of the Company, and to re-elect all of your Board's 10 nominees.

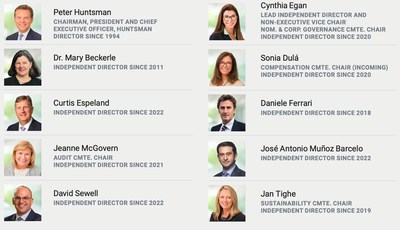

To be clear, Huntsman has already completed the substantial refreshment of your Board that began in late 2017, appointing eight new independent directors since Peter Huntsman became Chairman in January 2018. These directors were each selected based on their unique backgrounds and expertise needed to effectively oversee our company. Today, your refreshed Board brings the right combination of experience, knowledge and diversity that is critical to oversee our transformed portfolio, differentiated business strategies and long-term success.

VOTE "FOR ALL" OF HUNTSMAN'S HIGHLY QUALIFIED DIRECTOR NOMINEES ON THE WHITE PROXY CARD

Under the leadership of your Board and experienced management team, the Company was its own change agent, implementing a deliberate and long-term program that delivered industry leading total shareholder returns over the past five years and positioning Huntsman for an even brighter future. Our 2021 results confirm that this is the right strategy for Huntsman, and the financial results are the product of the Company's relentless execution during the past five years, including:

- Transformed the overall portfolio to deliver higher-margin, differentiated products in higher value markets;

- Reduced our exposure to lower-margin commodity products that brought volatility to our portfolio and performance;

- Continued to drive margin improvement with our relentless focus on value over volume and disciplined cost optimization strategies;

- Effectively addressed our customers' and communities' needs for sustainability and lower carbon footprints;

- Commenced a strategic review of our Textile Effects business;

- Enhanced our financial profile by further deleveraging our balance sheet and securing investment grade ratings;

- Repurchased nearly

$800 million in shares since 2018 and authorized a new$1 billion share repurchase program; - Increased the quarterly dividend by

70% since 2018; and - Implemented a multi-year incentive compensation program to align our top 80 leaders with the delivery of our 2021 Investor Day targets.

With these critical initiatives either completed or on track to be completed on schedule, and with our record 2021 financial results, Starboard's campaign unnecessarily risks derailing our momentum and the value we have created for you.

A vote for Huntsman's nominees is a vote for the right strategy, the right execution and the right Board. Voting "FOR ALL" on the WHITE proxy card is in the best interests of all shareholders.

TRACK RECORD OF OUTPERFORMANCE

Over the past five years, we have combined large-scale divestitures, including the sale of

Over the last five years, your Board and management team have generated a TSR of over

Importantly, the markets recognize that our transformation is working.

FOCUSING ON ESG AND SUSTAINABILITY

Our portfolio transformation towards differentiated chemicals and our investment in innovation has been keenly focused on sustainability and meeting our customers' and communities' demand for sustainable products and lower carbon footprints. For example:

- We are the market leader in spray polyurethane foam, the world's most effective and cost-efficient insulation material, conserving energy and offering lower total lifetime cost.

- We provide advanced materials for making vehicles and planes lighter and stronger, reducing fuel usage and making all forms of transportation more energy efficient.

- We develop leading technology to turn methane gas – the world's greatest contributor to GHG and global warming – into structural carbon fiber, the building product of the future, and clean hydrogen, eliminating

100% of the GHG in the process.

In short, we provide products the changing world needs to be sustainable.

The Board oversees this ESG focus through the Sustainability Committee, created at the end of 2020, to provide further Board-level focus on sustainability, corporate social responsibility and governance matters. We have already achieved more than

THE RIGHT BOARD

The Board continues to oversee the Company's portfolio transformation strategies, balance sheet quality and comprehensive initiatives, all of which enhance accountability and alignment with our shareholders.

The Board's refreshment process, executed through rigorous selection criteria, has created a dynamic boardroom with a variety of new and diverse experiences and perspectives to ensure proper oversight of our transformed portfolio. After the Annual Meeting, your Board will consist of 10 directors – nine of whom are independent and eight of whom have been appointed since 2018 – all of whom work closely with management and will continue to be a significant agent of change to improve Huntsman's performance. Each new member brings a specific set of skills gained through highly relevant experience at global institutions to oversee our strategic execution and drive continued transformation.

Vote the WHITE proxy card and against Starboard's risky proposals:

|

MEET YOUR BOARD

We also implemented extensive corporate governance enhancements, including appointing a new Non-Executive Vice Chair and Lead Independent Director, Cynthia Egan, and new Committee Chairs, resulting in four of five Board committees being chaired by women as of the upcoming Annual Meeting.

Our Board is a powerful advocate for all shareholders and is driving change and delivering significant value.

EXTENSIVE ENGAGEMENT WITH STARBOARD TO NO AVAIL

Starboard first disclosed its stake in September 2021 and Huntsman has since engaged frequently and extensively. Your Board and management have had over a dozen calls or meetings with Starboard, including an invitation to our headquarters to hear their perspectives. We previewed our November Investor Day presentation with Starboard and invited them to provide suggestions. Following our Investor Day, Starboard publicly praised our operational and financial initiatives, making it abundantly clear that there was, and continues to be, no misalignment with Starboard on the Company's objectives and strategic initiatives.

Unfortunately and despite extensive engagement, Starboard was unwilling to agree to our reasonable proposed resolution of their proxy contest. Instead, Starboard nominated four candidates and is seeking to unseat four Huntsman directors who are critical to the continued success of your company. This is not the right outcome – for Huntsman and for your investment – and Starboard has no strategic plan to create additional value.

In stark contrast to your world-class Board, Starboard's nominees add no incremental value and lack relevant expertise to effectively oversee the successful transformation of the Company's portfolio towards differentiated and downstream products. Starboard's disruptive public campaign is solely about installing their handpicked board candidates rather than allowing Huntsman's refreshed and highly qualified Board to continue its laser focus on executing the Company's strategic initiatives.

YOUR VOTE IS IMPORTANT

Help Ensure Huntsman's Progress and Positive Momentum.

We urge you to use the enclosed WHITE proxy card to vote today "FOR ALL" 10 of Huntsman's highly qualified nominees: Peter R. Huntsman, Dr. Mary C. Beckerle, Sonia Dulá, Cynthia L. Egan, Curtis E. Espeland, Daniele Ferrari, Jeanne McGovern, José Muñoz, David B. Sewell and Jan E. Tighe. Simply follow the easy instructions to vote by telephone, by Internet, or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided.

Please do not vote using any blue proxy card you may receive from Starboard—even as a "protest vote." Any vote on the blue proxy card will revoke your prior vote on a WHITE proxy card, and only your latest-dated proxy counts.

Your vote "FOR ALL" of our director nominees will help ensure that you, as a Huntsman investor, have a Board focused on sustaining our positive momentum and creating lasting value for all shareholders.

We appreciate your continued support.

Sincerely,

Peter Huntsman, Chairman, President and Chief Executive Officer

Cynthia Egan, Lead Independent Director and Non-Executive Vice Chair

Advisors:

BofA Securities and Moelis & Company LLC are serving as financial advisors to Huntsman. Kirkland & Ellis LLP is serving as legal advisor to Huntsman.

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated and specialty chemicals with 2021 revenues of approximately

Social Media:

Twitter: www.twitter.com/Huntsman_Corp

Facebook: www.facebook.com/huntsmancorp

LinkedIn: www.linkedin.com/company/huntsman

Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements include statements concerning our plans, objectives, goals, financial targets, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, divestitures or strategic transactions, including the review of the Textile Effects Division, business trends and any other information that is not historical information. When used in this press release, the words "estimates," "expects," "anticipates," "likely," "projects," "outlook," "plans," "intends," "believes," "forecasts," "targets," or future or conditional verbs, such as "will," "should," "could" or "may," and variations of such words or similar expressions are intended to identify forward-looking statements. These forward-looking statements, including, without limitation, management's examination of historical operating trends and data, are based upon our current expectations and various assumptions and beliefs. In particular, such forward-looking statements are subject to uncertainty and changes in circumstances and involve risks and uncertainties that may affect the Company's operations, markets, products, prices and other factors as discussed in the Company's filings with the Securities and Exchange Commission (the "SEC"). In addition, there can be no assurance that the review of the Textile Effects Division will result in one or more transactions or other strategic change or outcome. Significant risks and uncertainties may relate to, but are not limited to, ongoing impact of COVID-19 on our operations and financial results, volatile global economic conditions, cyclical and volatile product markets, disruptions in production at manufacturing facilities, timing of proposed transactions, reorganization or restructuring of the Company's operations, including any delay of, or other negative developments affecting the ability to implement cost reductions and manufacturing optimization improvements in the Company's businesses and to realize anticipated cost savings, and other financial, operational, economic, competitive, environmental, political, legal, regulatory and technological factors. Any forward-looking statement should be considered in light of the risks set forth under the caption "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2021, which may be supplemented by other risks and uncertainties disclosed in any subsequent reports filed or furnished by the Company from time to time. All forward-looking statements apply only as of the date made. Except as required by law, the Company undertakes no obligation to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Additional Information and Where to Find It

The Company has filed a definitive proxy statement and accompanying WHITE proxy card with the SEC in connection with the solicitation of proxies for the Company's 2022 Annual Meeting of Stockholders (the "2022 Annual Meeting"). The Company's shareholders are strongly encouraged to read the definitive proxy statement, the accompanying WHITE proxy card and other documents filed with the SEC carefully in their entirety because they will contain important information. The Company's shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC free of charge at the SEC's website at www.sec.gov. Copies will also be available free of charge at the Company's website at www.huntsman.com.

Certain Information Regarding Participants

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company's shareholders in connection with the matters to be considered at the 2022 Annual Meeting. Information about the Company's directors and executive officers is available in the definitive proxy statement filed with the SEC on February 17, 2022 with respect to the 2022 Annual Meeting and, with respect to directors and executive officers appointed following such date, will be available in certain of the Company's other SEC filings made subsequent to the date of the definitive proxy statement. To the extent holdings of the Company's securities by such directors or executive officers have changed since the amounts printed in the definitive proxy statement, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC.

1Represents the period from February 16, 2017 to February 16, 2022.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/huntsman-files-definitive-proxy-materials-and-mails-letter-to-shareholders-301484954.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/huntsman-files-definitive-proxy-materials-and-mails-letter-to-shareholders-301484954.html

SOURCE Huntsman Corporation

FAQ

What is Huntsman's recent financial performance in 2021?

When is Huntsman's Annual Meeting of Stockholders?

What is the stock symbol for Huntsman Corporation?

What actions has Huntsman taken regarding shareholder engagement?