New Year, Same Concerns: Despite Increased Optimism, Skilled Worker Shortage Will Continue to Impact Infrastructure Work in 2022

Civil contractors are optimistic about 2022; however, over half expect difficulty meeting schedule and budget demands due to skilled worker shortage

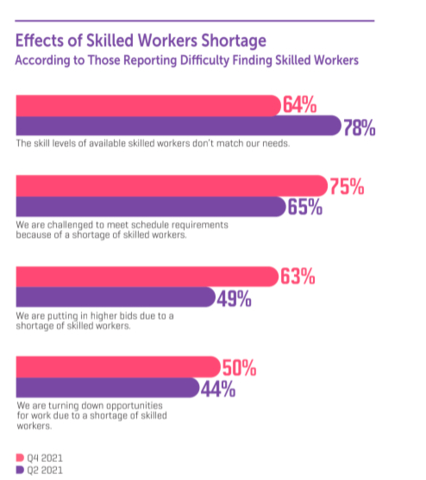

Effects of Skilled Workers Shortage (Graphic: Business Wire)

The report, produced by Dodge Construction Network in partnership with Infotech, Hexagon,

However, the report also reveals an increasing concern about the skilled worker shortage In civil construction. Nearly three-quarters (

-

54% of civil contractors report that the difficulty in finding workers is impacting their ability to meet project schedule requirements -

53% report that the increased cost of those workers makes it difficult for them to meet budgets on their projects

As workloads increase in wake of the

The study also captured contractors' insights into worker recruitment and retention:

- Most contractors believe that good benefits and a reputation for high pay are the best ways to recruit workers, with a greater emphasis on high pay to help recruit workers under 30 years of age.

- Respondents also believe the best way to increase the skilled labor force is to increase enrollment in technical high schools/vocational training.

- The study shows there is no consistent way in which civil contractors recruit workers, but the top three means used are traditional advertisements, working with industry organizations and working with local trade unions. Of these, the most effective is working with local trade unions.

In addition to examining business conditions and worker recruitment, the study also looked at sustainability in this sector. The data shows that green construction is still an emerging practice for civil contractors, with only

Currently, the findings suggest that civil engineers are more engaged with sustainability than civil contractors. Nearly one third of civil engineers (

The Civil Quarterly provides a quarterly snapshot of the current business health of contractors operating in this dynamic environment and explores trends in the industry: the report is the result of a partnership with Founding partner Infotech®, Platinum partner Hexagon and Gold partners

About Dodge Construction Network: Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem. Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com.

About Infotech®:

About Hexagon: Hexagon is a global leader in digital reality solutions, combining sensor, software and autonomous technologies. We are putting data to work to boost efficiency, productivity, quality and safety across industrial, manufacturing, infrastructure, public sector, and mobility applications. Our technologies are shaping production and people related ecosystems to become increasingly connected and autonomous - ensuring a scalable, sustainable future.

Hexagon (Nasdaq Stockholm: HEXA B) has approximately 21,000 employees in 50 countries and net sales of approximately

About

About Digital Construction Works: Digital Construction Works (DCW) is a leading industry application and technology integration services and solution company. We help owner-operators and constructors accelerate the adoption and use of digital workflows, incorporate digital twins of assets, implement best practices, and, if needed, include the right combination of fit-for-purpose third-party technology to improve construction planning, design-build, operations, and project outcomes. We take current disparate third-party applications and integrate them so they all work together, and they can be managed in a single, secure, integrated platform with project insights. Learn more: www.digitalconstructionworks.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20220120005215/en/

dodge@104west.com

Source: Dodge Construction Network