Hudbay Receives Air Quality Permit for Copper World

Hudbay Minerals (TSX, NYSE: HBM) has received the final major permit, the Air Quality Permit, for its Copper World project from the Arizona Department of Environmental Quality. The project is expected to produce 85,000 tonnes of copper annually over a 20-year mine life.

The company has now secured all three key state permits: the Mined Land Reclamation Plan, Aquifer Protection Permit, and Air Quality Permit. The project represents a $1.7 billion capital investment and is projected to become the third largest cathode producer in the U.S., with production intended for domestic customers.

Over its initial 20-year lifespan, Copper World is expected to contribute more than $850 million in U.S. taxes, including $170 million to Arizona. The project will create over 400 direct jobs and up to 3,000 indirect jobs. Hudbay plans to make a project sanctioning decision in 2026, following completion of a definitive feasibility study in early 2026 and securing a minority joint venture partner in 2025.

Hudbay Minerals (TSX, NYSE: HBM) ha ricevuto l'ultima autorizzazione principale, il Permesso per la Qualità dell'Aria, per il suo progetto Copper World dal Dipartimento della Qualità Ambientale dell'Arizona. Si prevede che il progetto produca 85.000 tonnellate di rame all'anno per una vita mineraria di 20 anni.

L'azienda ha ora ottenuto tutti e tre i permessi statali chiave: il Piano di Recupero delle Terre Minerarie, il Permesso di Protezione della Falda Freatica e il Permesso per la Qualità dell'Aria. Il progetto rappresenta un investimento di capitale di 1,7 miliardi di dollari ed è previsto che diventi il terzo produttore di catodi più grande negli Stati Uniti, con produzione destinata ai clienti nazionali.

Nel corso della sua vita iniziale di 20 anni, Copper World dovrebbe contribuire con oltre 850 milioni di dollari in tasse negli Stati Uniti, includendo 170 milioni per l'Arizona. Il progetto creerà oltre 400 posti di lavoro diretti e fino a 3.000 posti di lavoro indiretti. Hudbay prevede di prendere una decisione di sanzionamento del progetto nel 2026, dopo il completamento di uno studio di fattibilità definitivo all'inizio del 2026 e l'acquisizione di un partner di joint venture minoritario nel 2025.

Hudbay Minerals (TSX, NYSE: HBM) ha recibido el último permiso importante, el Permiso de Calidad del Aire, para su proyecto Copper World del Departamento de Calidad Ambiental de Arizona. Se espera que el proyecto produzca 85,000 toneladas de cobre anualmente durante una vida de mina de 20 años.

La empresa ahora ha asegurado los tres permisos estatales clave: el Plan de Recuperación de Tierras Mineras, el Permiso de Protección de Acuíferos y el Permiso de Calidad del Aire. El proyecto representa una inversión de capital de 1.7 mil millones de dólares y se proyecta que se convierta en el tercer mayor productor de cátodos en EE.UU., con una producción destinada a clientes nacionales.

A lo largo de su vida inicial de 20 años, se espera que Copper World contribuya con más de 850 millones de dólares en impuestos en EE.UU., incluyendo 170 millones para Arizona. El proyecto creará más de 400 empleos directos y hasta 3,000 empleos indirectos. Hudbay planea tomar una decisión de aprobación del proyecto en 2026, después de completar un estudio de viabilidad definitiva a principios de 2026 y asegurar un socio de joint venture minoritario en 2025.

Hudbay Minerals (TSX, NYSE: HBM)는 애리조나 환경 품질 부서로부터 Copper World 프로젝트에 대한 마지막 주요 허가인 대기 질 허가를 받았습니다. 이 프로젝트는 20년의 광산 수명 동안 매년 85,000톤의 구리를 생산할 것으로 예상됩니다.

회사는 이제 세 가지 주요 주 정부 허가를 모두 확보했습니다: 광산 토지 복구 계획, 수자원 보호 허가, 대기 질 허가. 이 프로젝트는 17억 달러의 자본 투자를 나타내며 미국에서 세 번째로 큰 음극 생산자가 될 것으로 예상되며, 생산은 국내 고객을 위해 계획되고 있습니다.

최초 20년 동안 Copper World는 미국 세금에 8억 5천만 달러 이상을 기여할 것으로 예상되며, 아리조나주에 1억 7천만 달러가 포함됩니다. 이 프로젝트는 400개 이상의 직접 일자리와 최대 3,000개의 간접 일자리를 창출할 것입니다. Hudbay는 2026년 초에 definitiva 타당성 조사를 완료한 후 2026년에 프로젝트 승인 결정을 내릴 계획이며, 2025년에 소수 파트너와의 합작 투자 파트너를 확보할 예정입니다.

Hudbay Minerals (TSX, NYSE: HBM) a reçu le dernier permis majeur, le Permis de Qualité de l'Air, pour son projet Copper World du Département de la Qualité Environnementale de l'Arizona. Le projet devrait produire 85 000 tonnes de cuivre par an sur une durée de vie de mine de 20 ans.

L'entreprise a maintenant obtenu tous les trois permis clés de l'État : le Plan de Réhabilitation des Terres Minées, le Permis de Protection des Aquifères et le Permis de Qualité de l'Air. Le projet représente un investissement en capital de 1,7 milliard de dollars et devrait devenir le troisième plus grand producteur de cathodes aux États-Unis, avec une production destinée à des clients nationaux.

Au cours de sa durée de vie initiale de 20 ans, Copper World devrait contribuer pour plus de 850 millions de dollars en taxes aux États-Unis, dont 170 millions pour l'Arizona. Le projet créera plus de 400 emplois directs et jusqu'à 3 000 emplois indirects. Hudbay prévoit de prendre une décision de sanction du projet en 2026, après l'achèvement d'une étude de faisabilité définitive au début de 2026 et la sécurisation d'un partenaire de coentreprise minoritaire en 2025.

Hudbay Minerals (TSX, NYSE: HBM) hat die letzte wichtige Genehmigung, die Luftqualitätsgenehmigung, für sein Copper World Projekt vom Arizona Department of Environmental Quality erhalten. Das Projekt soll über eine Lebensdauer von 20 Jahren jährlich 85.000 Tonnen Kupfer produzieren.

Das Unternehmen hat nun alle drei wichtigen staatlichen Genehmigungen gesichert: den Plan zur Rekultivierung der Bergbaulandflächen, die Genehmigung zum Schutz von Aquiferen und die Luftqualitätsgenehmigung. Das Projekt repräsentiert eine Kapitalinvestition von 1,7 Milliarden Dollar und soll der drittgrößte Kathodenproduzent in den USA werden, wobei die Produktion für inländische Kunden vorgesehen ist.

Über seine anfängliche Lebensdauer von 20 Jahren wird Copper World voraussichtlich über 850 Millionen Dollar an Steuern in den USA beitragen, einschließlich 170 Millionen Dollar für Arizona. Das Projekt wird über 400 direkte Arbeitsplätze und bis zu 3.000 indirekte Arbeitsplätze schaffen. Hudbay plant, im Jahr 2026 eine Entscheidung zur Projektsanktionierung zu treffen, nachdem im frühen 2026 ein definitives Machbarkeitsstudium abgeschlossen und 2025 ein Partner für eine Minderheitsjoint-Venture gesichert wurde.

- Secured final major permit (Air Quality Permit) for Copper World project

- Expected production of 85,000 tonnes of copper annually over 20-year mine life

- Project will increase company's consolidated annual copper production by >50%

- Strong financial position with net debt to EBITDA ratio of 0.7x

- Generated $840 million in adjusted EBITDA and reduced net debt by $506 million

- Expected to contribute $850 million in U.S. taxes over project life

- Will create 400 direct jobs and 3,000 indirect jobs in Arizona

- Significant capital investment required ($1.7 billion)

- Project sanctioning not expected until 2026

- Still requires securing minority joint venture partner

Insights

This permit milestone marks a important advancement for Hudbay's Copper World project, which promises an annual output of 85,000 tonnes of copper over a 20-year mine life. The completion of all three major state permits - Mined Land Reclamation Plan, Aquifer Protection Permit and now the Air Quality Permit - positions this as one of the most shovel-ready copper projects in North America.

The project's financial metrics are compelling: a planned

The planned domestic cathode production aligns perfectly with the U.S. critical minerals strategy, potentially making Copper World the third-largest cathode producer in the country. This positioning, combined with 400 direct jobs and 3,000 indirect jobs, significantly enhances the project's strategic value in the current geopolitical context.

The project's financial structure reveals sophisticated risk management. Hudbay's

The company's requirement for a

The structured approach to project advancement, including the completion of permits before major capital commitments, significantly de-risks the development pathway. This methodical progression enhances the project's bankability and attractiveness to potential joint venture partners.

TORONTO, Jan. 02, 2025 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. (“Hudbay” or the “Company”) (TSX, NYSE: HBM) is pleased to announce that it has received an Air Quality Permit for the Copper World project (“Copper World”) from the Arizona Department of Environmental Quality (“ADEQ”). The issuance of this permit is a significant milestone in the advancement of the project as it is the final major permit required for the development and operation of Copper World. Copper World is expected to produce 85,000 tonnes of copper per year over an initial 20-year mine life. All amounts are in U.S. dollars, unless otherwise noted.

“With the receipt of the Air Quality Permit for Copper World, we firmly believe Hudbay now has the best fully permitted copper development project in the Americas,” said Peter Kukielski, President and Chief Executive Officer. “We have completed one of the three key prerequisites in our sanctioning plan for Copper World, and we intend to advance feasibility studies and our prudent financial strategy throughout 2025 as we work toward a sanctioning decision in 2026. Copper World is expected to increase Hudbay’s consolidated annual copper production by more than

Mr. Kukielski added, “Today, Hudbay is the fourth largest copper producer listed on the NYSE and a majority of our institutional shareholders are based in the U.S. We look forward to continuing to grow our presence in the U.S. with our planned

Copper World Permitting Completed

Hudbay has now received all three key state permits required for Copper World development and operation:

- Mined Land Reclamation Plan – Completed – the Mined Land Reclamation Plan was initially approved by the Arizona State Mine Inspector in October 2021 and was subsequently amended and approved to reflect a larger private land project footprint. This approval was challenged in state court, but the challenge was dismissed in May 2023.

- Aquifer Protection Permit – Completed – the Aquifer Protection Permit was received on August 29, 2024 from the ADEQ following a robust process that included detailed analysis by the agency and Hudbay, along with a public comment period that was completed in the second quarter of 2024.

- Air Quality Permit – Completed – the Air Quality Permit was received on January 2, 2025 from the ADEQ following a similarly robust process, including a public comment period that concluded in the third quarter of 2024.

Hudbay received the two remaining permits on schedule and the company is pleased with the level of local support received at the public meetings. Hudbay looks forward to providing significant social and environmental benefits for the community and local economy in Arizona. Over the proposed initial 20-year mine life, the company expects to contribute more than

Advancing Prudent Financing Plan with Disciplined Capital Allocation

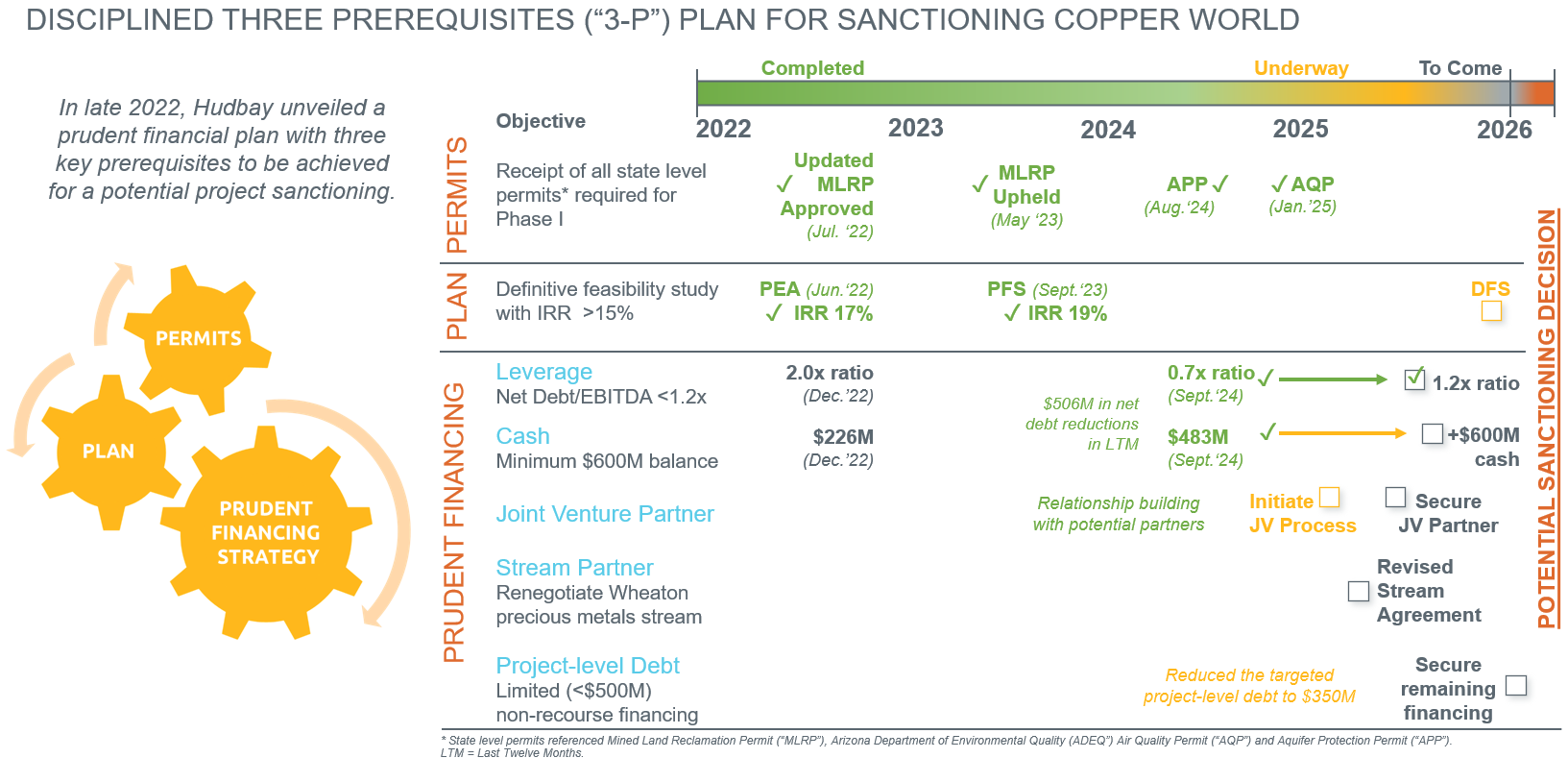

As part of Hudbay’s disciplined financial planning approach to Copper World, in October 2022, the company introduced a three prerequisites plan (“3-P”), as shown in Figure 1, including specific leverage targets and other criteria that would need to be achieved prior to making a project sanctioning decision for Copper World. The 3-P plan has the following components:

- Permits – Completed – receipt of all required state level permits.

- Plan – On Track – completion of a definitive feasibility study (“DFS”) with an internal rate of return of greater than

15% . Hudbay commenced activities related to the feasibility study for Copper World in late 2024 and expects to advance definitive feasibility study activities throughout 2025 with completion of the study in the first half of 2026. - Prudent Financing Strategy – On Track – multi-faceted financing strategy, including a committed minority joint venture partner, a renegotiated precious metals stream agreement optimized for the current project, a net debt to EBITDA ratio of less than 1.2 times, a minimum cash balance of

$600 million , and limited non-recourse project level debt.

Since the release of the 3-P plan, Hudbay has taken prudent measures to transform its balance sheet in preparation for a sanctioning decision, through strong cash flow generation, deleveraging initiatives and the completion of a successful equity offering. Hudbay has generated

Now that the major permits for Copper World have been received, Hudbay intends to commence a minority joint venture partner process early in 2025. It is anticipated that any minority joint venture partner would participate in the funding of definitive feasibility study activities in 2025 as well as in the final project design and construction for Copper World.

The opportunity to sanction Copper World is not expected until 2026 based on current estimated timelines.

About Copper World

The

In September 2023, Hudbay released its enhanced pre-feasibility study (“PFS”) for Copper World reflecting the results of further technical work on Phase I of the project. Phase I has a mine life of 20 years, which is four years longer than the Phase I mine life that was presented in the PEA, largely due to an increase in the capacity for tailings and waste deposition as a result of optimizing the site layout. Phase II is expected to involve an expansion onto federal lands with a significantly longer mine life and enhanced project economics. Phase II would be subject to the federal permitting process and was not included in the PFS results.

Based on the PFS, Phase I contemplates average annual copper production of 85,000 tonnes over a 20-year mine life, at average cash costs and sustaining cash costs of

Based on the PFS, the estimated initial capital investment for Phase I of Copper World is approximately

Copper World is one of the highest-grade open pit copper projects in the Americasiv with proven and probable mineral reserves of 385 million tonnes at

Qualified Person and NI 43-101

The technical and scientific information in this news release related to the company’s Copper World project has been approved by Olivier Tavchandjian, P. Geo, Hudbay’s Senior Vice President, Exploration and Technical Services. Mr. Tavchandjian is a qualified person pursuant to Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”).

A copy of the NI 43-101 technical report for the Copper World PFS is available on Hudbay’s SEDAR+ profile at www.sedarplus.ca and on Hudbay’s EDGAR profile at www.sec.gov.

Cautionary Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed NI 43-101.

For this reason, information contained in this news release in respect of the Copper World project may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. For further information on the differences between the disclosure requirements for mineral properties under the United States federal securities laws and NI 43-101, please refer to the company’s annual information form, a copy of which has been filed under Hudbay’s profile on SEDAR+ at www.sedarplus.ca and the company’s Form 40-F, a copy of which has been filed under Hudbay’s profile on EDGAR at www.sec.gov.

Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable Canadian and United States securities legislation. Forward-looking information includes, but is not limited to, expectations around the timing and amount of future spending at Copper World, the pursuit of a potential minority joint venture partner for the Copper World project, the anticipated workforce required for the Copper World project, intentions with respect to Hudbay’s 3-P plan for sanctioning Copper World, including the timing of any potential sanctioning decision, and expectations regarding the economics for the Copper World project. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by the company at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that Hudbay identified and were applied by the company in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to, obtaining the minor permits required for Copper World Phase I, no significant unanticipated challenges, litigation or delays to the advancement of Copper World, maintaining the company’s 3-P plan for sanctioning Copper World, including the DFS meeting the targeted IRR, no change in laws that would impact the company’s ability to advance the project, renegotiating the precious metals stream agreement for Copper World and the availability of a minority partner and financing to develop Copper World.

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), litigation, regulatory and landholding risks associated with the development and operation of Copper World, the results of the feasibility study for Copper World as well as the risks discussed under the heading “Risk Factors” in Hudbay’s most recent annual information form, a copy of which has been filed under Hudbay’s profile on SEDAR+ at www.sedarplus.ca and the company’s Form 40-F, a copy of which has been filed under Hudbay’s profile on EDGAR at www.sec.gov.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. Hudbay does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused mining company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining jurisdictions of Canada, Peru and the United States.

Hudbay’s operating portfolio includes the Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada). Copper is the primary metal produced by the company, which is complemented by meaningful gold production. Hudbay’s growth pipeline includes the Copper World project in Arizona (United States), the Mason project in Nevada (United States), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities near its existing operations.

The value Hudbay creates and the impact it has is embodied in its purpose statement: “We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities.” Hudbay’s mission is to create sustainable value and strong returns by leveraging its core strengths in community relations, focused exploration, mine development and efficient operations.

For further information, please contact:

Candace Brûlé

Vice President, Investor Relations, Financial Analysis and External Communications

(416) 814-4387

investor.relations@hudbay.com

Figure 1: Prudently Advancing Copper World with Disciplined 3-P Plan for Project Sanctioning

In late 2022, Hudbay unveiled a prudent financial plan with three key prerequisites to be achieved prior to a potential project sanctioning decision, including a Plan with robust economics from a definitive feasibility study, Permits from the Arizona state issuing agencies and a Prudent financing strategy. With the receipt of the Air Quality Permit, Hudbay has now completed one of the three prerequisites of the 3-P plan.

__________________________

i Sourced from Wood Mackenzie (Q3 2024 dataset).

ii Adjusted EBITDA, net debt, and net debt to adjusted EBITDA ratio are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and detailed reconciliation, please see the “Non-IFRS Financial Performance Measures” in the company’s management's discussion and analysis for each reporting period.

iii Cash costs and sustaining cash costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs are a useful performance indicator, please refer to the company's most recent management's discussion and analysis for each reporting period.

iv Sourced from S&P Global, August 2024.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/74f6eae6-ada4-4787-9dec-d5e94c459259