Ancora Sends Letter to Hasbro’s Board of Directors Regarding Opportunities to Strengthen the Company’s Long-Term Positioning and Unlock Shareholder Value

Ancora Holdings Group, a significant shareholder of Hasbro (HAS), has sent a letter urging the company’s Board of Directors to pursue a refresh of its governance, highlighting past failures in capital allocation and the underperformance of subsidiary eOne, acquired for over $4.5 billion. Ancora argues that divesting eOne could enhance Hasbro's long-term focus and financial health. Furthermore, it suggests exploring a tax-free spin-off of Wizards of the Coast, which is currently undervalued. Ancora expresses concern over the Board's lack of responsiveness and calls for stronger alignment with shareholder interests.

- Fresh leadership with new CEO Chris Cocks may lead to improved governance and strategic direction.

- Divesting eOne could provide significant financial relief and focus on core segments.

- Potential tax benefits from the sale of eOne could enhance shareholder value.

- eOne acquisition is seen as a poor capital allocation decision with negative cash flows pre-acquisition.

- Current Board's lack of engagement with shareholders raises concerns about governance and responsiveness.

- Failure to act on strategic alternatives like spinning off WOTC could continue to hinder shareholder value.

Highlights Opportunity for a Properly Refreshed Board to Pursue a Full or Partial Sale of eOne, Which Represents a

Hopes a Properly Refreshed Board Reflects on Mattel’s Flawed Acquisition of

Notes That Divesting of eOne can Improve Hasbro’s Long-Term Positioning by Enabling the Company to Deleverage and Heavily Invest in Core Segments on Growth Trajectories

Urges a Properly Refreshed Board to Reevaluate a Tax-Free Spin of Wizards of the Coast Given Hasbro’s Shares Trade at a Roughly

Views Hasbro’s Decision to Ignore Ancora’s Private Outreach Last Month as a Clear Sign of the Existing Board’s Anti-Shareholder Mentality

***

Hasbro, Inc.

Attention: The Board of Directors

Members of the Board of Directors,

Ancora believes Hasbro’s long-term results on an absolute and relative basis demonstrate that the Company’s conglomerate configuration has created value-destructive complexity. The consequences of this complexity include extremely poor capital allocation decisions, including failed acquisitions and underinvestment in crown jewel segments such as Wizards of the Coast (“WOTC”), and a perpetually large trading price discount relative to intrinsic value. Our own sum-of-the-parts analysis indicates that Hasbro’s shares are currently trading at a

|

2024E |

|

|

|

|

|

|

|

|

|

EBITDA |

|

Multiple |

|

Enterprise Value |

||||

|

|

|

|

|

|

|

|

|

|

WOTC |

|

|

16.0x |

18.0x |

20.0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer |

675 |

|

8.0x |

8.0x |

8.0x |

|

5,400 |

5,400 |

5,400 |

|

|

|

|

|

|

|

|

|

|

Entertainment |

230 |

|

8.0x |

8.0x |

8.0x |

|

1,840 |

1,840 |

1,840 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

12.1x |

13.2x |

14.2x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enterprise value |

|

|

|

|

|

|

|

|

|

Net debt |

|

|

2,998 |

2,998 |

2,998 |

|

|

|

|

Equity value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-forma diluted shares |

|

|

141.5 |

141.5 |

141.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Implied share price |

|

|

|

|

|

|

|

|

|

% to current |

|

|

|

|

|

|

|

|

|

Fortunately, we see three near-term action items for Hasbro that can yield long-term benefits for shareholders:

-

Initiate an Authentic Refresh of the Board – Well-governed companies frequently collaborate with engaged shareholders on their director refreshment efforts. While your expansion from 11 to 13 members added gaming expertise, that defensive maneuver did not cycle out long-serving directors or solve the apparent skill gap that has allowed the Company to fall behind Mattel and dramatically underperform over the long-term. We urge you to immediately commence a real refresh that replaces long-tenured incumbents with members of the Alta Fox slate. In particular, we like that the Alta Fox nominees have strong experience in capital allocation, corporate governance, finance, transactions and transformations. The Board should welcome, rather than fight, the fact that a top shareholder has identified individuals with the ability to support efforts to improve the Company’s questionable capital allocation, disclosures and overall strategic planning during a period of rapid change in the gaming and entertainment sectors.

When considering this recommendation, we hope you try to empathize with shareholders and view the situation from our perspective. It is not in shareholders’ best interests to continue giving the same directors who have overseen significant underperformance, poor capital allocation and costly acquisitions carte blanche to control the Board and, in turn, the Company. The captain responsible for steering the Titanic into an iceberg did not have the option to pick the crew for another ship. Here, however, stale directors have access to life rafts and can do what is best for long-suffering shareholders by handing their seats to individuals with the fresh perspectives and skillsets required to enhance value.

-

Pursue a Full or Partial Sale of eOne to Improve Long-Term Focus– A refreshed Board should begin assessing a full or partial sale of Hasbro’s Entertainment One (“eOne”) subsidiary, which was acquired in late 2019 for more than

$4.5 billion $167 million $400 million $4 $167 million

eOne Results Prior to Acquisition |

eOne (Hasbro) |

|||||||

Fiscal Year Ending |

FYE |

|||||||

in mil. GBP |

2015 |

2016 |

2017 |

2018 |

2019 |

2019 (PF) |

2020 |

|

Revenue |

785.8 |

802.7 |

1,082.4 |

1,029.0 |

941.2 |

1,215.8 |

956.5 |

|

Operating Profit |

60.2 |

75.0 |

67.6 |

100.7 |

70.7 |

20.0 |

(79.2) |

|

Operating Margin |

|

|

|

|

|

|

- |

|

Adjusted Operating Profit |

78.0 |

93.2 |

108.4 |

107.8 |

138.7 |

163.0 |

131.1 |

|

Adjusted Operating Margin |

|

|

|

|

|

|

|

|

|

(19.7) |

69.3 |

34.0 |

14.9 |

30.0 |

NA |

NA |

|

Cash flow before Financing |

(120.1) |

(112.5) |

22.7 |

(106.8) |

8.9 |

NA |

NA |

|

5 YR Cumulative Cash flow from Ops |

128.5 |

|||||||

5 YR Cumulative Cash flow before Financing |

(307.8) |

|||||||

5 YR Cumulative cash flow from Ops (USD) |

167.3 |

|||||||

5 YR Cumulative cash flow before Financing (USD) |

(400.8) |

|||||||

In the context of considering what is in shareholders’ best long-term interests, a refreshed Board should also contemplate the consequences of management spending its energy and time on what we deem a black hole of a segment. Most of the value Hasbro can derive from having its own entertainment arm could likely be obtained via less risky collaborations with other production entities and studios, including the many with better capabilities and track records. We assume the Board is aware that owning a production entity is not a prerequisite for brands to produce and monetize their intellectual property. Hasbro should be partnering with production and distribution partners instead of taking on the capital and execution risk of managing these processes.

To put a finer point on it, Hasbro does not need to own eOne in order to bring Dungeons & Dragons to the big screen, much like

It is equally critical for a refreshed Board to reflect on how the eOne deal has adversely impacted Hasbro’s valuation multiple due to balance sheet leverage and the perceived complexity and execution risk that was added to the corporate story. For reference, in

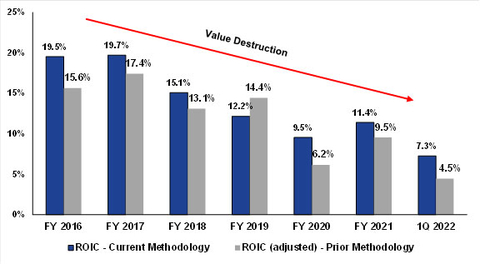

For Hasbro, the consequences of the eOne acquisition are extremely evident in the negative impact it has had on overall ROIC. This point is irrefutable. As shown below, Hasbro also revised its own ROIC calculation following the eOne deal in order to make the metric more favorable for the Company. The exhibit below details a comparison of a standard ROIC calculation versus the methodology utilized by Hasbro from 2016 to 2019. We note the first quarter 2022 metric is annualized to make the comparisons appropriate.

FY |

FY |

FY |

FY |

FY |

FY |

Q1 |

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Adjusted EBITDA (Non-GAAP) |

977.2 |

1,036.3 |

796.5 |

911.1 |

1,015.2 |

1,214.0 |

174.0 |

NOPAT Adjustments: |

|||||||

Less Depreciation |

119.7 |

143.0 |

139.3 |

133.5 |

120.2 |

163.3 |

25.1 |

Rent Expense |

52.6 |

63.6 |

65.2 |

68.9 |

90.6 |

88.2 |

22.3 |

Lease-Related Interest |

4.5 |

5.4 |

5.5 |

5.8 |

8.3 |

7.1 |

1.7 |

Adjusted EBITA |

905.6 |

951.5 |

716.8 |

840.7 |

977.3 |

1,131.8 |

169.5 |

Cash Taxes |

199.2 |

209.3 |

157.7 |

185.0 |

215.0 |

249.0 |

37.3 |

NOPAT |

706.4 |

742.2 |

559.1 |

655.7 |

762.3 |

882.8 |

132.2 |

ROIC |

|

|

|

|

|

|

|

ROIC (prior methodology): |

|

|

|

|

|

|

|

Net Earnings - as adjusted |

566.1 |

693.1 |

488.8 |

524.7 |

514.6 |

723.4 |

79.4 |

Total Debt |

1,721.0 |

1,848.6 |

1,704.8 |

1,697.1 |

5,099.2 |

4,201.4 |

3,997.8 |

Total Equity |

1,900.1 |

2,126.5 |

2,022.8 |

1,938.6 |

3,253.2 |

3,381.7 |

3,122.4 |

|

3,621.1 |

3,975.0 |

3,727.7 |

3,635.7 |

8,352.4 |

7,583.1 |

7,120.2 |

ROIC (adjusted) - Prior Methodology |

|

|

|

|

|

|

|

While the Board may be reluctant to cut its losses soon on a highly dilutive and debt-funded acquisition that saw Hasbro issue 10 million new shares, shareholders should not have to continually suffer the consequences of what is obviously a flawed deal. The Board needs to consider Mattel’s acquisition of

We suspect Hasbro could recoup up to

3. Reevaluate Alternatives for WOTC as Conditions Permit – A refreshed Board should continually assess strategic alternatives, including a tax-free spin, for the WOTC segment. We consider WOTC to be an exceptional business that deserves strong focus and investment. But the fact is the market has not been giving Hasbro nearly enough credit for WOTC, as evidenced by the Company’s lagging share price over the long-term. It gives us great concern that you apparently rejected this reality when recently concluding that it is best for shareholders to keep WOTC within Hasbro’s corporate structure. Our analysis indicates a spin of WOTC could unlock more than

WOTC is a fantastic segment, coupling great growth potential with high EBITDA margins and returns on capital. Businesses with these characteristics will warrant premium multiples as standalone entities, which is something that is unlikely to happen in Hasbro’s confusing conglomerate configuration and for as long as the "Brand Blueprint" remains the north star.

Though our initial outreach apparently fell on deaf ears, we still welcome the opportunity to meet with you to share more detailed analysis and provide specific recommendations for repositioning Hasbro as a leader. There is no reason to continue doubling down on the governance missteps that have eroded the Company’s foundation and resulted in sustained underperformance. If the Board takes the right steps today, as

Sincerely,

|

|

|||||||

Chief Executive Officer and Executive Chairman |

President |

|||||||

|

|

***

About Ancora

Founded in 2003,

1 Ancora’s base case sum of the parts valuation for Hasbro assumes an 18x multiple for WOTC, resulting in a

View source version on businesswire.com: https://www.businesswire.com/news/home/20220503005460/en/

rjerpbak@ancora.net

Source:

FAQ

What did Ancora Holdings Group suggest regarding Hasbro's Board of Directors?

Why does Ancora believe Hasbro should divest eOne?

What are the financial implications of selling eOne for Hasbro?

What potential benefits does Ancora see in spinning off Wizards of the Coast?