Hannan and JOGMEC Partner at San Martin Copper-Silver Project in Peru

Hannan Metals Limited (HANNF) has established a binding agreement with Japan Oil, Gas and Metals National Corporation (JOGMEC) for a significant Option and Joint Venture on the San Martin Project in Peru. The agreement allows JOGMEC to earn up to a 75% interest by investing up to US$35 million to deliver a feasibility study. Initial investments include US$8 million over four years, with additional funding options for prefeasibility and feasibility studies. Hannan will manage exploration until JOGMEC acquires a 51% interest, with early exploration focusing on geological data collection.

- JOGMEC can earn a 75% interest by investing up to US$35 million, increasing project potential.

- Initial commitment includes US$1 million minimum funding by JOGMEC for the first year.

- Hannan will retain management control of exploration until JOGMEC earns a 51% interest.

- None.

VANCOUVER, BC / ACCESSWIRE / November 30, 2020 / Hannan Metals Limited ("Hannan" or the "Company") (TSXV:HAN) (OTC PINK:HANNF) is pleased to announce it has signed a binding letter agreement for a significant Option and Joint Venture Agreement (the "Agreement") with Japan Oil, Gas and Metals National Corporation ("JOGMEC"). Under the Agreement, JOGMEC has the option to earn up to a

Highlights:

- The Agreement grants JOGMEC the option to earn an initial

51% ownership interest by funding US$8,000,000 in project expenditures at San Martin over a 4-year period, subject to acceleration at JOGMEC's discretion. JOGMEC's minimum commitment is to fund US$1,000,000 from 01 April 2020 to 31 March 2021 and JOGMEC has agreed to reimburse Hannan for all project related costs from 01 April 2020; - JOGMEC, at its election, can then earn:

- an additional

16% interest for a total67% ownership interest by achieving either a prefeasibility study or funding a further US$12,000,000 in project expenditures in amounts of at least US$1,000,000 per annum (for a US$20,000,000 t otal expenditure); and, - subject to owning a

67% interest, a further8% interest for a total75% ownership interest by achieving either a feasibility study or funding a further US$15,000,000 in project expenditures in amounts of at least US$1,000,000 per annum (for a US$35,000,000 t otal expenditure);

- an additional

- Should JOGMEC not proceed to a prefeasibility study or spend US

$20,000,000 in total, Hannan shall have the right to purchase from JOGMEC for the sum of US$1.00 , a two percent (2% ) Participating Interest, whereby Hannan Metals' Participating Interest will be increased to fifty-one percent (51% ) and JOGMEC's Participating Interest will be reduced to forty-nine percent (49% ); - At the completion of a feasibility study, JOGMEC has the right to either:

- Purchase up to an additional ten percent (

10% ) Participating Interest from Hannan Metals (for a total85% maximum capped Participating Interest) at fair value as determined in accordance with internationally recognized professional standards by an agreed upon independent third-party valuator; or - Receive up to an additional ten percent (

10% ) Participating Interest from Hannan (for a total85% maximum capped Participating Interest) in consideration of JOGMEC's agreement to fund development of the project, by loan carrying Hannan until the San Martin Project generates positive cash flow;

- Purchase up to an additional ten percent (

- After US

$35,000,000 has been spent by JOGMEC and before a feasibility study has been achieved, both parties will fund expenditures pro rata or dilute via a standard industry dilution formula; - If the Participating Interest in the Joint Venture of any party is diluted to less than

5% then that party's Participating Interest will be automatically converted to a2.0% net smelter royalty ("NSR"), and the other party may at any time purchase1.0% of the2.0% NSR for a cash payment of US$1,000,000 ; - Hannan will manage exploration at least until JOGMEC earns a 51 per cent interest, after which the majority participant interest holder will be entitled to act as the operator of the joint venture; and

- Initial exploration activities will focus on the collection of the geological, geophysical, and geochemical datasets in the JV project areas. The first phase of exploration is expected to conclude March 2021.

Mr Michael Hudson, CEO, states: "We are privileged to have the Japanese government-owned JOGMEC elect to partner with us on the San Martin copper-silver project. JOGMEC are the perfect partner for such a large and prospective early stage exploration project, that will need significant budget and time commitments. JOGMEC's exploration funding, of up to US

Overview of the San Martin Copper Silver Project

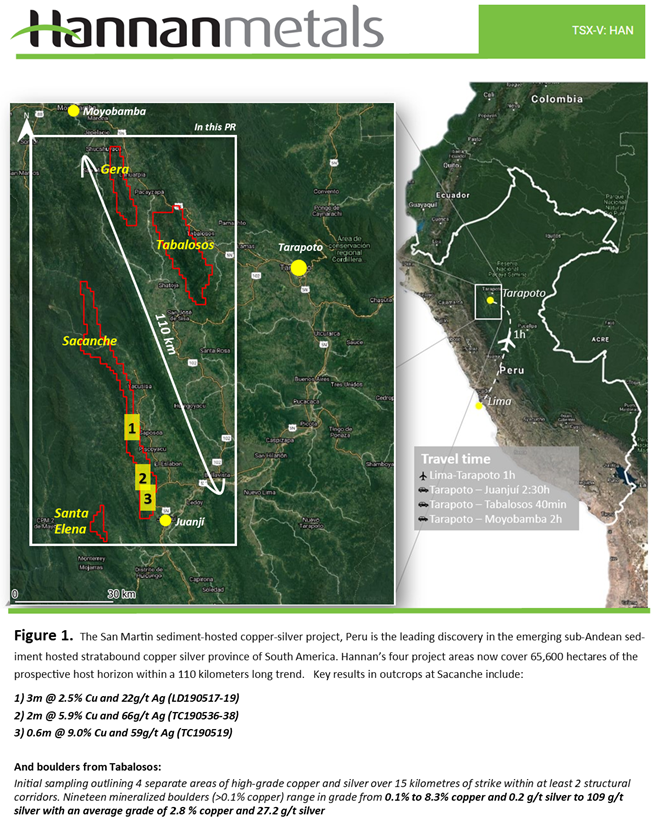

The San Martin Project is located in north-eastern Peru. Project access is excellent via a proximal paved highway, while the altitude ranges from 400 metres to 1,600 metres in a region of high rainfall and predominantly forest cover. Hannan has staked a total of 87 mineral concessions for a total of 65,600 ha (656 sq kms), covering multiple trends within a 120 km of combined strike for sedimentary-hosted copper-silver mineralization. A total of 43 granted mining concessions for 329 sq km have been granted, while the remainder remain under application.

San Martin encompass a new, basin-scale high-grade sediment-hosted copper-silver system situated along the foreland region of the eastern Andes Mountains. Geologically, analogues include the Spar Lake sediment hosted copper-silver deposit in Montana and the vast Kupferschiefer deposits in Eastern Europe where KGHM Polska Miedź (KGHM) operate the largest silver producing mine in the world, more than twice the production of any other operation, and also the sixth biggest copper miner on earth. Sediment-hosted stratiform copper-silver deposits are among the two most important copper sources in the world, the other being copper porphyries.

Hannan recognized the significant potential for large copper-silver deposits in this part of Peru and has aggressively staked a commanding position of prospective where mineralized outcrops and boulders have been discovered in context with a consistent mineralized horizon geology over 120 kilometres of combined strike. Results from outcrop channel sampling, located 20 kilometres apart, from the southern Sacanche area include 3 metres @

Initial exploration activities under the Option and Joint Venture Agreement will include geological mapping and prospecting, geochemical rock chip, soil and stream sediment sampling and trial geophysical surveys. The first phase of exploration is expected to conclude March 2021.

The Transaction remains subject to acceptance of filings with the TSX Venture Exchange

About Japan Oil, Gas and Metals National Corporation (JOGMEC)

JOGMEC is a Japanese government independent administrative agency which among other things seeks to secure stable resource supply for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. The mandated areas of responsibilities within JOGMEC relate to oil and natural gas, metals, coal and geothermal energy. JOGMEC facilitates opportunities with Japanese private companies to secure supply of natural resources for the benefit of the country's economic development.

About Hannan Metals Limited (TSXV:HAN) (OTCPK: HANNF)

Hannan Metals Limited is a natural resources and exploration company developing sustainable resources of metal needed to meet the transition to a low carbon economy. Over the last decade, the team behind Hannan has forged a long and successful record of discovering, financing, and advancing mineral projects in Europe and Peru.

Mr. Michael Hudson FAusIMM, Hannan's Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

SOURCE: Hannan Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/618649/Hannan-and-JOGMEC-Partner-at-San-Martin-Copper-Silver-Project-in-Peru

FAQ

What is the significance of Hannan's agreement with JOGMEC for the San Martin Project?

How much will JOGMEC initially invest in the San Martin Project?

What role will Hannan Metals play in the joint venture with JOGMEC?

What is the expected timeline for the initial exploration activities at the San Martin Project?