G2 Goldfields Significantly Increases Gold Resources at the Oko Project, Guyana

G2 Goldfields (TSX: GTWO; OTCQX: GUYGF) has announced a significant increase in gold resources at its 83,967-acre Oko Project in Guyana. The updated Mineral Resource Estimate (MRE) as of March 1, 2025, shows:

- Total Indicated gold resources increased 60% to 1.5 million ounces at 3.40 g/t Au

- Total Inferred gold resources rose 49% to 1.6 million ounces at 2.48 g/t Au

- High-grade near-surface zones at Oko Main Zone (OMZ) contain 609,000 oz at 10.25 g/t Au (Indicated) and 360,000 oz at 7.28 g/t Au (Inferred)

The resource spans a 2.5 km north-south structure, comprising the high-grade OMZ to the north and the Ghanie Gold Zone to the south. The estimate incorporates data from 587 drill holes totaling 152,817 metres. The resource remains open to depth and along strike, with ongoing exploration activities including two active diamond drill rigs targeting high-grade plunging mineralization.

G2 Goldfields (TSX: GTWO; OTCQX: GUYGF) ha annunciato un significativo aumento delle risorse aurifere nel suo progetto Oko di 83.967 acri in Guyana. La stima aggiornata delle risorse minerarie (MRE) al 1 marzo 2025 mostra:

- Le risorse aurifere indicate totali sono aumentate del 60% a 1,5 milioni di once a 3,40 g/t Au

- Le risorse aurifere inferite totali sono cresciute del 49% a 1,6 milioni di once a 2,48 g/t Au

- Le zone ad alta legge vicino alla superficie nella Zona Principale Oko (OMZ) contengono 609.000 once a 10,25 g/t Au (Indicate) e 360.000 once a 7,28 g/t Au (Inferite)

La risorsa si estende su una struttura nord-sud di 2,5 km, comprendente l'OMZ ad alta legge a nord e la Zona Aurea Ghanie a sud. La stima incorpora dati da 587 fori di perforazione per un totale di 152.817 metri. La risorsa rimane aperta in profondità e lungo la strike, con attività di esplorazione in corso che includono due impianti di perforazione al diamante attivi mirati a mineralizzazioni ad alta legge.

G2 Goldfields (TSX: GTWO; OTCQX: GUYGF) ha anunciado un aumento significativo en los recursos de oro en su proyecto Oko de 83,967 acres en Guyana. La estimación actualizada de recursos minerales (MRE) al 1 de marzo de 2025 muestra:

- Los recursos de oro indicados totales aumentaron un 60% a 1.5 millones de onzas a 3.40 g/t Au

- Los recursos de oro inferidos totales crecieron un 49% a 1.6 millones de onzas a 2.48 g/t Au

- Las zonas de alta ley cerca de la superficie en la Zona Principal Oko (OMZ) contienen 609,000 oz a 10.25 g/t Au (Indicados) y 360,000 oz a 7.28 g/t Au (Inferidos)

El recurso se extiende a lo largo de una estructura norte-sur de 2.5 km, que comprende la OMZ de alta ley al norte y la Zona de Oro Ghanie al sur. La estimación incorpora datos de 587 perforaciones que suman 152,817 metros. El recurso permanece abierto a profundidad y a lo largo de la strike, con actividades de exploración en curso que incluyen dos plataformas de perforación de diamante activas que apuntan a mineralización de alta ley.

G2 Goldfields (TSX: GTWO; OTCQX: GUYGF)는 가이아나의 83,967 에이커 오코 프로젝트에서 금 자원의 상당한 증가를 발표했습니다. 2025년 3월 1일 기준으로 업데이트된 광물 자원 추정치(MRE)는 다음과 같습니다:

- 총 지시 금 자원이 60% 증가하여 3.40 g/t Au에서 150만 온스에 이릅니다.

- 총 추정 금 자원이 49% 증가하여 2.48 g/t Au에서 160만 온스에 이릅니다.

- 오코 주요 구역(OMZ)의 고등급 근표면 구역에는 10.25 g/t Au(지시)에서 609,000 oz와 7.28 g/t Au(추정)에서 360,000 oz가 포함되어 있습니다.

이 자원은 북남 방향으로 2.5km에 걸쳐 있으며, 북쪽에는 고등급 OMZ가, 남쪽에는 간이 금 구역이 포함되어 있습니다. 이 추정치는 총 152,817미터에 달하는 587개의 드릴 홀 데이터를 포함하고 있습니다. 자원은 깊이와 스트라이크를 따라 열려 있으며, 고등급의 침강 광물화를 목표로 하는 두 개의 활성 다이아몬드 드릴 링을 포함한 탐사 활동이 진행 중입니다.

G2 Goldfields (TSX: GTWO; OTCQX: GUYGF) a annoncé une augmentation significative des ressources en or de son projet Oko de 83 967 acres en Guyane. L'estimation mise à jour des ressources minérales (MRE) au 1er mars 2025 montre :

- Les ressources aurifères indiquées totales ont augmenté de 60 % pour atteindre 1,5 million d'onces à 3,40 g/t Au

- Les ressources aurifères inférées totales ont augmenté de 49 % pour atteindre 1,6 million d'onces à 2,48 g/t Au

- Les zones à haute teneur proches de la surface dans la zone principale Oko (OMZ) contiennent 609 000 oz à 10,25 g/t Au (indiquées) et 360 000 oz à 7,28 g/t Au (inférées)

La ressource s'étend sur une structure nord-sud de 2,5 km, comprenant l'OMZ à haute teneur au nord et la zone d'or de Ghanie au sud. L'estimation intègre des données provenant de 587 forages totalisant 152 817 mètres. La ressource reste ouverte en profondeur et le long de la strike, avec des activités d'exploration en cours, y compris deux foreuses à diamant actives ciblant une minéralisation à haute teneur.

G2 Goldfields (TSX: GTWO; OTCQX: GUYGF) hat einen signifikanten Anstieg der Goldressourcen in seinem 83.967 Acres großen Oko-Projekt in Guyana bekannt gegeben. Die aktualisierte Mineralressourcenschätzung (MRE) vom 1. März 2025 zeigt:

- Die insgesamt angegebenen Goldressourcen stiegen um 60 % auf 1,5 Millionen Unzen bei 3,40 g/t Au

- Die insgesamt vermuteten Goldressourcen erhöhten sich um 49 % auf 1,6 Millionen Unzen bei 2,48 g/t Au

- Hochgradige Zonen in der Nähe der Oberfläche in der Oko-Hauptzone (OMZ) enthalten 609.000 Unzen bei 10,25 g/t Au (angegeben) und 360.000 Unzen bei 7,28 g/t Au (vermutet)

Die Ressource erstreckt sich über eine nord-südliche Struktur von 2,5 km, die im Norden die hochgradige OMZ und im Süden die Ghanie Goldzone umfasst. Die Schätzung umfasst Daten aus 587 Bohrlöchern mit insgesamt 152.817 Metern. Die Ressource bleibt in der Tiefe und entlang der Strike offen, mit laufenden Erkundungsaktivitäten, die zwei aktive Diamantbohrgeräte umfassen, die auf hochgradige mineralisierte Zonen abzielen.

- 60% increase in Indicated gold resources to 1.5 Moz

- 49% increase in Inferred gold resources to 1.6 Moz

- High-grade near-surface zones with exceptional grades (10.25 g/t Au Indicated, 7.28 g/t Au Inferred)

- Resource remains open for expansion in multiple directions

- Located in mining-friendly jurisdiction (Guyana)

- Resources are not yet classified as reserves, requiring further economic validation

- Presence of historical underground mining voids with incomplete recent survey data

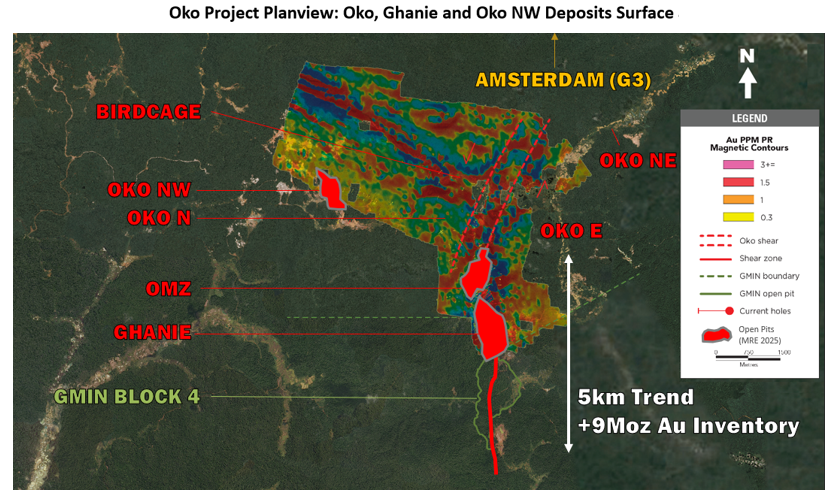

TORONTO, March 10, 2025 (GLOBE NEWSWIRE) -- G2 Goldfields Inc. (“G2” or the “Company”) (TSX: GTWO; OTCQX: GUYGF) is pleased to announce an updated Mineral Resource Estimate (“MRE” or “Resource”) within the Company’s 83,967-acre Oko Project, Guyana. The bulk of the gold mineralization lies along a prominent 2.5 km long north-south structure comprised of the high-grade Oko Main Zone (“OMZ”) to the north and a bulk mineable, disseminated resource to the south, known as the Ghanie Gold Zone (“Ghanie”). The new Resource includes all drilling data obtained up to the end of January 2025 and represents a significant increase to the previous estimate released on April 3, 2024.

Highlights

- Total Indicated gold resources increased by

60% to 1.5 million ounces (“Moz”) - Total Inferred gold resources increased by

49% to 1.6 Moz - Resource remains open to depth and to the north along strike

- OMZ established as one of highest-grade gold deposits globally

- G2 exploration team remains in growth and discovery mode

Daniel Noone, Chief Executive Officer of G2 Goldfields Inc. stated, “This MRE firmly establishes our Oko Project as both large and comparatively high grade. This, combined with Guyana’s pro-development mining policies, places Oko near the top of undeveloped gold projects. We will continue to leverage our experience, success and knowledge of this emerging district to find and develop more mines for Guyana.”

Mineral Resource Estimate

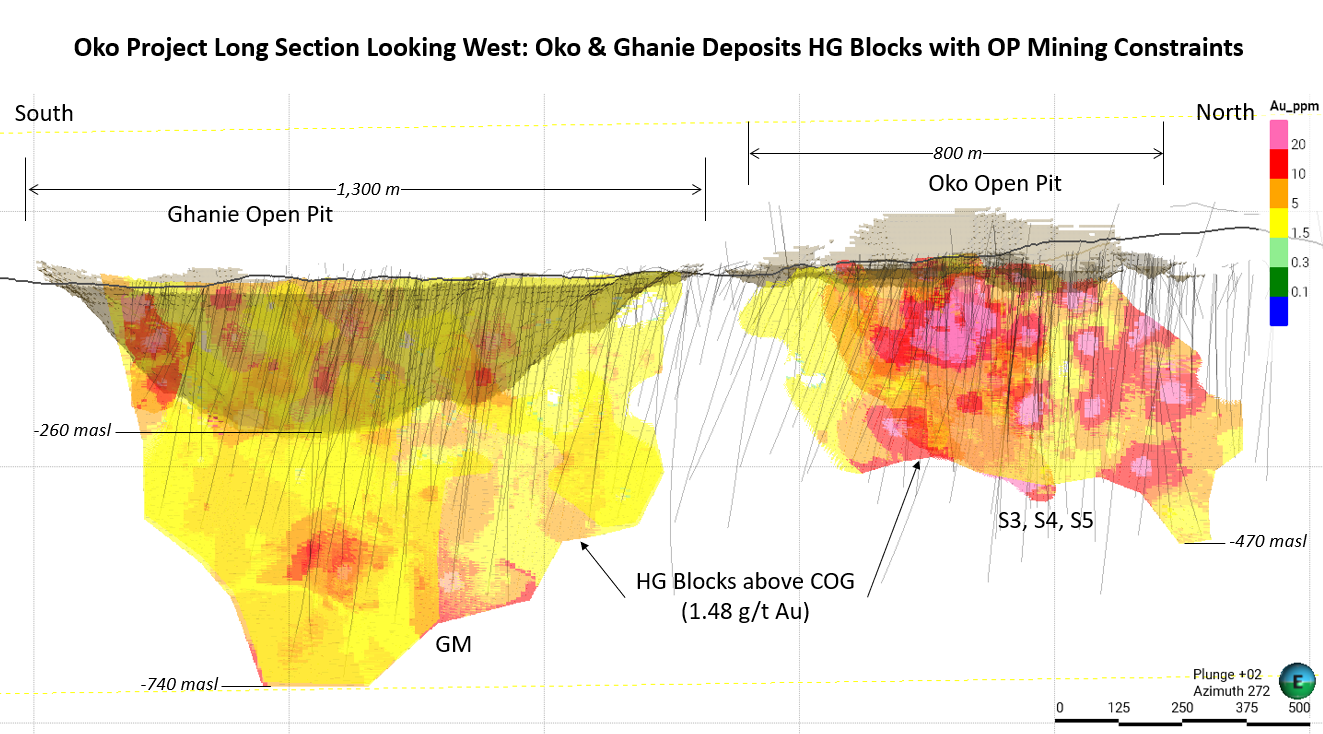

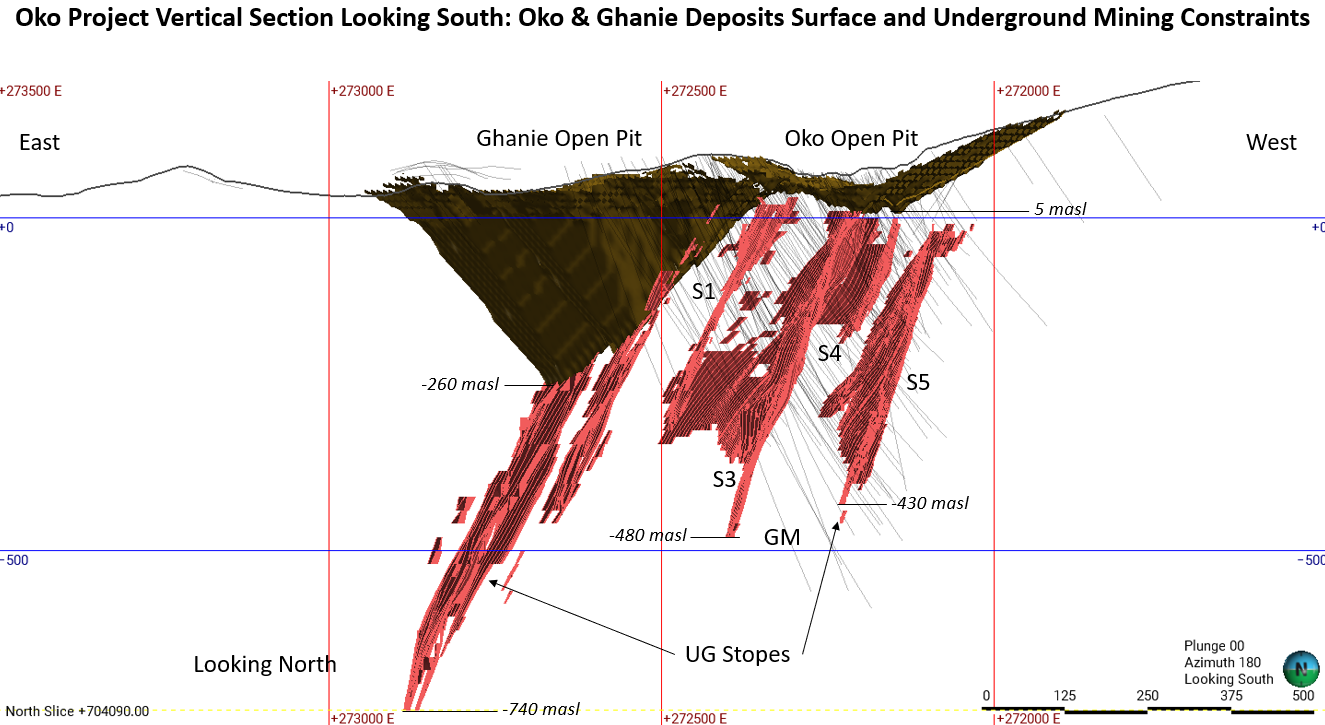

The mineral resource summary is presented in Table 1 below. Indicated resources total 1.5 Moz at a grade of 3.40 g/t Au and include high-grade, near surface zones (S3, S4, S5) at OMZ of 609,000 oz at an average grade of 10.25 g/t Au within approximately 5 to 370 m from surface, reflecting the favorable vertical zonation of the deposit. Inferred resources total 1.6 Moz @ 2.48 g/t Au and include high-grade, near surface zones at OMZ of 360,000 oz at an average grade of 7.28 g/t Au within approximately 5 to 560 m from surface.

The Resource includes all drilling data obtained up to the end of January 2025, including an additional 188 drill holes totalling 59,154 metres for a total inventory of 587 drill holes within 152,817 metres. The estimate was prepared by Micon International Limited (“Micon”) in accordance with National Instrument 43-101 (“NI 43-101”) with an effective date of March 1, 2025.

Table 1 – Oko-Ghanie Mineral Resource Estimate Summary

| Deposit | Mining Method | Category | Tonnage (t) | Gold Avg. Grade (g/t) | Contained Gold (oz) |

| Oko Main Zone (OMZ) | Surface (OP) | Total Indicated | 418,000 | 2.32 | 31,400 |

| Total Inferred | 535,000 | 0.88 | 15,300 | ||

| Underground (UG) | Total Indicated | 2,729,000 | 8.85 | 776,600 | |

| Total Inferred | 2,938,000 | 5.27 | 498,200 | ||

| OP + UG | Total Indicated | 3,147,000 | 7.98 | 808,000 | |

| Total Inferred | 3,473,000 | 4.60 | 513,500 | ||

| Ghanie | Surface (OP) | Total Indicated | 10,190,000 | 1.97 | 644,900 |

| Total Inferred | 6,480,000 | 1.06 | 221,700 | ||

| Underground (UG) | Total Indicated | 98,000 | 5.87 | 18,500 | |

| Total Inferred | 5,582,000 | 4.47 | 802,800 | ||

| OP + UG | Total Indicated | 10,288,000 | 2.01 | 663,400 | |

| Total Inferred | 12,062,000 | 2.64 | 1,024,500 | ||

| Oko NW | Surface (OP) | Total Inferred | 4,976,000 | 0.61 | 97,200 |

| Entire Oko Project | OP + UG | Total Indicated | 13,435,000 | 3.40 | 1,471,400 |

| Total Inferred | 20,511,000 | 2.48 | 1,635,200 | ||

Notes to Table 1:

- The effective date of this Mineral Resource Estimate is March 1, 2025.

- The MRE presented above uses economic assumptions for both, surface mining in saprolite and fresh rock and underground mining on fresh rock only.

- The MRE has been classified in the Indicated and Inferred categories following spatial continuity analysis and geological confidence.

- The calculated gold cut-off grades to report the MRE for surface mining are 0.27 g/t Au in saprolite, 0.32 g/t Au in fresh rock and for underground mining is 1.48 g/t Au in fresh rock.

- The economic parameters used are; a gold price of US

$2,281 /oz with a single metallurgical recovery of85% , a mining cost of US$2.5 /t in saprolite, US$2.75 /t in fresh rock and US$75.0 /t in underground. Processing cost of US$12 /t for saprolite and US$15 /t for fresh rock and a general and administration cost of US$2.5 /t. - For surface mining the open pits at Oko and Ghanie use slope angles of 30° in saprolite and 50° in fresh rock.

- Micon's QPs have considered that the transition between the OP mining and UG mining scenarios will result in the need for crown pillars. However, at this time, the crown pillars are considered to be recoverable, therefore Micon's QPs have considered them as part of the Mineral Resource Estimate.

- The OMZ presently has had subcontracted mid-scale miners underground mining operations on the license. G2 Goldfields has provided Micon’s QPs with digitized vertical maps of the voids, as of 2022, and the current mineral resources have been discounted based upon this information. However, there are no updated surveys, maps or production records for the underground mining operations from 2022 to present. G2 Goldfields is of the belief that there are no subcontracted mid-scale miners currently present on the Oko claims.

- The block models for Oko and Ghanie are orthogonal and use a parent block size of 10 m, along strike, 3 m across strike, and 5 m in height. The minimum child block is 2 m x 0.5 m x 1 m respectively.

- The open pit optimization uses a re-blocked size of 10 m x 9 m x 10 m and for the underground optimization uses mining shapes of 10 m long by 10 m high for Oko and 20 m long by 20 m high for Ghanie and a minimum mining width of 2 m.

- The mineral resources described above have been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Standards and Practices.

- Messrs. Alan J. San Martin, P.Eng. and William J. Lewis, P.Geo. from Micon International Limited are the Qualified Person (QP) for this Mineral Resource Estimate (MRE).

- Numbers have been rounded to the nearest thousand tonnes and nearest hundred ounces. Differences may occur in totals due to rounding.

- Mineral resources are not mineral reserves as they have not demonstrated economic viability. The quantity and grade of reported Indicated and Inferred mineral resources in this news release are uncertain in nature and there has been insufficient exploration to define any measured resource; however, it is reasonably expected that a significant portion of Inferred Mineral Resources could be upgraded into Indicated Mineral Resources with further exploration.

- Micon's QPs have not identified any legal, political, environmental, or other factors that could materially affect the potential development of the mineral resource estimate.

Figure 1 – Oko Project Long Section Looking West

Figure 2 – Oko Project Vertical Section Looking South

Figure 3 – Oko Project Plan View

Zones Remain Open for Further Growth

The OMZ and Ghanie deposits consist of multiple plunging zones of high-grade mineralization that remain open vertically. These zones continue to be successfully targeted in an on-going drill program at Ghanie North and the OMZ Shear 3, where visible gold have been intersected in multiple recent drill holes. Two diamond drill rigs are currently active targeting high-grade plunging mineralization.

Regional Exploration

The G2 team is fully focused on near surface targets in the greater Oko area, including assets proposed to be part of the G3 Goldfields Inc. (“G3”) spin-out. The potential for the discovery of additional gold resources is considered to be excellent. G2 is currently drilling several prominent gold-in-soil anomalies north of the Oko Project which are interpreted to be part of a regional structural break. Additionally, a major soil sampling and mapping program is ongoing on the greater G2 property portfolio.

Data validation

The drilling database used to estimate the Mineral Resources reported in this press release was reviewed by Micon International Limited. A site visit was conducted by Ing. Alan J. San Martin, P.Eng., MAusIMM(CP), to inspect mineralized intervals, alteration assemblages and QA/QC protocols and to conduct field checks of trenches and to validate drill collars. Database verifications consisted of drill logs (including lithology, alteration, weathering), assay certificates, sample intervals, drill hole collars, downhole survey information and QA/QC results validations.

QA/QC

Drill core is logged and sampled in a secure core storage facility located on the OKO project site, Guyana. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to MSALABS Guyana, in Georgetown, Guyana, which is an accredited mineral analysis laboratory, for analysis. Samples from sections of core with obvious gold mineralisation are analysed for total gold using an industry-standard 500g metallic screen fire assay (MSALABS method MSC 550). All other samples are analysed for gold using standard Fire Assay-AA with atomic absorption finish (MSALABS method; FAS-121). Samples returning over 10.0 g/t gold are analysed utilizing standard fire assay gravimetric methods (MSALABS method; FAS-425). Certified gold reference standards, blanks, and field duplicates are routinely inserted into the sample stream, as part of G2 Goldfield’s quality control/quality assurance program (QAQC). No QA/QC issues were noted with the results reported herein.

Technical Report and Qualified Person

The Company intends to file a technical report to support the updated MRE on sedarplus.ca within 45 days of this news release in accordance with NI 43-101 – Standard of Disclosure of Mineral Projects.

All scientific and technical information in this news release has been reviewed and approved by Dan Noone (CEO of G2 Goldfields Inc.), a “qualified person” within the meaning of National Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of the Australian Institute of Geoscientists.

About Micon

Micon’s Qualifications and QPs

Micon International Limited is a firm of senior geological, mining, metallurgical and environmental consultants headquartered in Toronto, Canada with an office in the United Kingdom. The professionals of Micon have extensive experience in mineral resource estimation. Micon’s practice is worldwide and covers all base and precious metals. The firm’s clients include major and junior mining companies, all the major Canadian banks and investment houses and a large number of financial institutions in other parts of the world, including developmental financial institutions and export credit agencies. Micon’s technical, due diligence and valuation reports are accepted by regulatory agencies such as the US Securities and Exchange Commission, the Ontario Securities Commission, the Australian Stock Exchange, and the London Stock Exchange.

Qualified Persons for the Technical Report

Mineral Resources are estimated by Ing. Alan J. San Martin, P.Eng., MAusIMM(CP), and William J. Lewis, P.Geo., from Micon with more than 20 years’ experience in mineral exploration, resource estimation and mining, including in South America and Canada. Both are considered “Qualified Persons” for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and have reviewed and approved the scientific and technical disclosure contained in this news release. The Qualified Persons have verified the data underlying the MRE contained in this news release. There were no limitations imposed on the Qualified Persons for verification of the data.

About G2 Goldfields Inc.

The G2 Goldfields team is comprised of professionals who have been directly responsible for the discovery of millions of ounces of gold in Guyana as well as the financing and development of the Aurora Gold Mine, Guyana’s largest gold mine [RPA, 43-101, Technical Report on the Aurora Gold Mine, March 31, 2020].

In March 2025, G2 announced an Updated Mineral Resource Estimate (“MRE”) for the Oko property in Guyana [see press release dated March 10, 2025]. Highlights of the Updated MRE include:

Total combined open pit and underground Resource for the Oko Main Zone (OMZ):

- 513,500 oz. Au – Inferred contained within 3,473,000 tonnes @ 4.60 g/t Au

- 808,000 oz. Au – Indicated contained within 3,147,000 tonnes @ 7.98 g/t Au

Total combined open pit and underground Resource for the Ghanie Zone:

- 1,024,500 oz. Au – Inferred contained within 12,062,000 tonnes @ 2.64 g/t Au

- 663,400 oz. Au – Indicated contained within 10,288,000 tonnes @ 2.01 g/t Au

Total combined open pit and underground Resource for the Oko NW Zone:

- 97,200 oz. Au – Inferred contained within 4,976,000 tonnes @ 0.61 g/t Au

The MRE was prepared by Micon International Limited with an effective date of March 1, 2025. Significantly, the updated mineral resources lie within an average depth of 370 metres of surface. The Oko district has been a prolific alluvial goldfield since its initial discovery in the 1870s, and modern exploration techniques continue to reveal the considerable potential of the district.

AngloGold Ashanti (NYSE:AU) currently holds 35,948,965 shares representing

All scientific and technical information in this news release has been reviewed and approved by Dan Noone (CEO of G2 Goldfields Inc.), a “qualified person” within the meaning of National Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of the Australian Institute of Geoscientists.

Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company's website (www.g2goldfields.com).

On behalf of the Board of G2 Goldfields Inc.

“Daniel Noone”

CEO & Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: +1.416.628.5904

Email: j.wagenaar@g2goldfields.com

Forward-Looking Statements

This news release contains certain forward-looking statements, including, but not limited to, statements about the Resource remaining open to depth and to the north along strike, the Company will continue to leverage our experience, success and knowledge of this emerging district to find and develop more mines for Guyana, on-going drill program at Ghanie North and the OMZ Shear 3, where visible gold have been intersected in multiple recent drill holes, Two diamond drill rigs are currently active targeting high-grade plunging mineralization, the G2 team is fully focused on near surface targets in the greater Oko area, including assets proposed to be part of the G3 Goldfields Inc. (“G3”) spin-out, the potential for the discovery of additional gold resources is considered to be excellent, G2 is currently drilling several prominent gold-in-soil anomalies north of the Oko Project which are interpreted to be part of a regional structural break, and a major soil sampling and mapping program is ongoing on the greater G2 property portfolio. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “schedule”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements, including the risk factors set out in the management information circular of the Company dated December 20, 2024. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. The Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Cautionary Note on Mineral Resources

This press release contains the terms “Inferred” and “Indicated” Mineral Resources. Investors are cautioned not to assume that any part or all of the Inferred and Indicated Mineral Resources reported in this press release are or will be economically or legally mineable. Investors are also cautioned not to assume that all or any part of mineral deposits in the Inferred and Indicated Resource categories will ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility studies. The Mineral Resources set out in this news release are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the Indicated level of recovery will be realized.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy and / or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6ec946c4-0fcc-4583-bf85-7769de03e309

https://www.globenewswire.com/NewsRoom/AttachmentNg/e789f282-5bc0-4ae1-a6d9-4bfc5758220a

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca6fef8f-79c4-4a17-a098-c026098033f2