Peter K. Scaturro, Former Partner at Goldman Sachs Global Private Client and Former CEO of Citigroup Global Private Bank, joins Star Mountain Capital as Senior Advisor

Star Mountain Capital, an investment firm with over $4.0 billion AUM focused on the lower middle-market, has announced that Peter K. Scaturro has joined as Senior Advisor. Scaturro brings 40+ years of experience in banking, wealth management, and financial services leadership. He was previously a Partner at Goldman Sachs (NYSE: GS) Global Private Client Business and CEO of Citigroup Global Private Bank. Star Mountain's Founder & CEO, Brett Hickey, expressed excitement about Scaturro's addition, citing his extensive leadership experience across multiple cycles as beneficial to all stakeholders. Scaturro highlighted the lower middle-market as a compelling opportunity for investors seeking to complement traditional portfolios.

Star Mountain Capital, una società di investimento con oltre 4,0 miliardi di dollari in gestione, focalizzata sul mercato medio-basso, ha annunciato che Peter K. Scaturro è entrato a far parte come Senior Advisor. Scaturro porta con sé oltre 40 anni di esperienza nel settore bancario, nella gestione patrimoniale e nella leadership dei servizi finanziari. In precedenza è stato Partner presso Goldman Sachs (NYSE: GS) nel settore dei Clienti Privati Globali e CEO di Citigroup Global Private Bank. Il Fondatore e CEO di Star Mountain, Brett Hickey, ha espresso entusiasmo per l'arrivo di Scaturro, sottolineando che la sua vasta esperienza di leadership attraverso diversi cicli produrrà benefici per tutti gli stakeholder. Scaturro ha messo in evidenza il mercato medio-basso come un'opportunità interessante per gli investitori in cerca di integrare i portafogli tradizionali.

Star Mountain Capital, una firma de inversión con más de 4.0 mil millones de dólares en activos bajo gestión, enfocada en el mercado medio-bajo, ha anunciado que Peter K. Scaturro se ha unido como Asesor Senior. Scaturro aporta más de 40 años de experiencia en banca, gestión de patrimonios y liderazgo en servicios financieros. Anteriormente fue Socio en Goldman Sachs (NYSE: GS) en el negocio Global de Clientes Privados y CEO de Citigroup Global Private Bank. El Fundador y CEO de Star Mountain, Brett Hickey, expresó su entusiasmo por la incorporación de Scaturro, citando su extensa experiencia en liderazgo a través de múltiples ciclos como beneficiosa para todas las partes interesadas. Scaturro destacó el mercado medio-bajo como una oportunidad atractiva para los inversores que buscan complementar sus carteras tradicionales.

스타 마운틴 캐피털(Star Mountain Capital)은 40억 달러 이상의 자산을 관리하는 중소형 시장에 중점을 둔 투자 회사로, Peter K. Scaturro가 선임 고문으로 합류했다고 발표했습니다. Scaturro는 금융 서비스 리더십, 은행 및 자산 관리 분야에서 40년 이상의 경험을 보유하고 있습니다. 그는 이전에 골드만 삭스(Goldman Sachs)의 글로벌 개인 고객 사업 부문의 파트너 및 씨티그룹 글로벌 사모은행(Citigroup Global Private Bank)의 CEO를 역임했습니다. 스타 마운틴의 창립자이자 CEO인 Brett Hickey는 Scaturro의 합류에 대해 기쁨을 표하며, 여러 사이클에 걸친 그의 광범위한 리더십 경험이 모든 이해관계자에게 이익이 될 것이라고 언급했습니다. Scaturro는 전통적인 포트폴리오를 보완하고자 하는 투자자들에게 매력적인 기회로 중소형 시장을 강조했습니다.

Star Mountain Capital, une société d'investissement avec plus de 4,0 milliards de dollars d'actifs sous gestion, axée sur le marché intermédiaire bas, a annoncé que Peter K. Scaturro a rejoint en tant que conseiller senior. Scaturro apporte plus de 40 ans d'expérience dans le secteur bancaire, la gestion de patrimoine et le leadership dans les services financiers. Auparavant, il était partenaire chez Goldman Sachs (NYSE: GS) dans le secteur des clients privés globaux et PDG de Citigroup Global Private Bank. Le fondateur et PDG de Star Mountain, Brett Hickey, a exprimé son enthousiasme à l'égard de l'ajout de Scaturro, citant sa vaste expérience en leadership à travers plusieurs cycles comme bénéfique pour toutes les parties prenantes. Scaturro a souligné que le marché intermédiaire bas représente une opportunité attrayante pour les investisseurs cherchant à compléter des portefeuilles traditionnels.

Star Mountain Capital, eine Investmentgesellschaft mit über 4,0 Milliarden Dollar an verwaltetem Vermögen, die sich auf den unteren Mittelmarkt konzentriert, hat angekündigt, dass Peter K. Scaturro als Senior Advisor beigetreten ist. Scaturro bringt über 40 Jahre Erfahrung in den Bereichen Banking, Vermögensverwaltung und Führung im Finanzdienstleistungssektor mit. Zuvor war er Partner bei Goldman Sachs (NYSE: GS) im Global Private Client Business und CEO der Citigroup Global Private Bank. Der Gründer und CEO von Star Mountain, Brett Hickey, zeigte sich begeistert von Scaturros Hinzukommen und nannte seine umfangreiche Führungserfahrung über mehrere Zyklen hinweg als vorteilhaft für alle Beteiligten. Scaturro hob den unteren Mittelmarkt als compelling Gelegenheit für Investoren hervor, die traditionelle Portfolios ergänzen möchten.

- Addition of Peter K. Scaturro as Senior Advisor with 40+ years of financial services experience

- Star Mountain Capital's AUM exceeds $4.0 billion, indicating significant market presence

- Potential for enhanced stakeholder value through Scaturro's extensive leadership experience

- None.

Insights

Peter Scaturro's appointment as Senior Advisor to Star Mountain Capital is a strategic move for the firm. His extensive experience in wealth management and private banking could significantly enhance Star Mountain's capabilities in the lower middle-market space. Scaturro's background with

His experience across multiple economic cycles is particularly noteworthy, as it could help Star Mountain navigate market volatilities. However, investors should note that while Scaturro's expertise is in high-net-worth client management, Star Mountain's focus is on small and medium-sized businesses, which may require a different approach. The impact on Star Mountain's performance remains to be seen, but Scaturro's network and industry knowledge could potentially open new opportunities for the firm.

Star Mountain Capital's recruitment of Peter Scaturro signals a strategic enhancement of their advisory team. With over

However, it's important to note that success in high-net-worth banking doesn't automatically translate to success in private equity, especially in the lower middle-market segment. Investors should watch for any changes in Star Mountain's investment approach or performance metrics following Scaturro's addition. His involvement might attract more institutional investors, potentially increasing the firm's AUM and deal flow, but the real test will be in maintaining or improving returns in their target market.

Star Mountain Capital, a rapidly growing employee-owned specialized investment firm with over

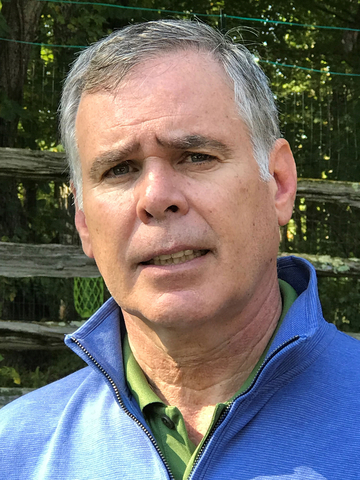

Peter Scaturro, Star Mountain Capital Senior Advisor (Photo: Business Wire)

“We are excited to welcome Peter as an aligned Senior Advisor where we believe his extensive leadership experience across multiple cycles will benefit all of our stakeholders,” said Brett Hickey, Star Mountain Capital Founder & CEO. “Peter’s extensive CEO, board, and 40+ years of financial services experience will add value to our Firm in many ways.”

“The lower middle-market provides a compelling market opportunity that I believe many investors haven’t yet benefitted from as a compelling complement to more traditional investment portfolios,” said Peter Scaturro. “Star Mountain has developed what I believe to be a distinctive platform where I also value its culture of economic alignment with team and investors.”

Mr. Scaturro was most recently a Partner in the Global Private Client Business of Goldman Sachs (NYSE: GS) where he oversaw the Global Private Client Business (

Prior to Goldman Sachs, Mr. Scaturro was the Chief Executive Officer at

Before becoming Chief Executive Officer at

Earlier in his career, Mr. Scaturro was a Partner at Bankers Trust (acquired by Deutsche Bank in 1999). Mr. Scaturro began his career in 1982 at Chase Manhattan Bank in

Mr. Scaturro received a Bachelor of Applied Science in Engineering and a Master of Engineering from

Mr. Scaturro is currently a Managing Partner at Regenerative SportsCare Institute, a world-renowned regenerative-medicine destination for non-surgical, interventional orthobiologic care in

About Star Mountain

With over

Since 2010, Star Mountain has made over 275 direct investments in businesses and over 50 secondary / fund investments within its Collaborative Ecosystem®, focused on the North American lower middle-market. One of Star Mountain’s specialties is seeking current cash income for investors that is materially above the typical yields found in the public markets, often accompanied with potential long-term capital gains equity returns and low correlation to public markets through its distinctive origination, underwriting and value-added investment capabilities.

Star Mountain was recently named one of the Inc. 5000 fastest-growing private companies in America.

For the fifth straight year, Star Mountain was again named one of the Best Places to Work by Crain’s New York Business as well as once again one of the Best Places to Work by Pensions & Investments.

Star Mountain believes its focus and dedication has been productive for job creation and economic development including in underserved areas and communities. Star Mountain is dedicated to this large market of underserved businesses purpose-built to address the challenges and opportunities of these companies. As part of its commitment, Star Mountain has trademarked Investing in the Growth Engine of America®.

Star Mountain’s Charitable Foundation, a not-for-profit 501(c)3 focuses on improving lives through economic development, including job creation, health & wellness and cancer research. Notable missions include helping match veterans and women with high quality small and medium-sized business career opportunities across the country, including within Star Mountain’s portfolio.

Note: This does not constitute an offer to sell or a solicitation of an offer to purchase interests in any investment product. Awards and recognitions by unaffiliated rating services, companies and/or publications should not be construed by a client or prospective client as a guarantee that he / she / it will experience a certain level of results if Star Mountain is engaged, or continues to be engaged, to provide investment advisory services; nor should they be construed as a current or past endorsement, testimonial endorsement, recommendation or referral of Star Mountain or its representatives by any of its clients or any other third party. Rankings published by magazines and others are generally based exclusively on information prepared and / or submitted by the recognized advisor. Moreover, with regard to all performance information contained herein, directly or indirectly, if any, readers should note that past results are not indicative of future results. The description and the selection methodologies of each award and recognition are subjective and will vary.

Awards and recognitions by unaffiliated rating services, companies, and/or publications should not be construed by a client or prospective client as a guarantee that he/she/it will experience a certain level of results if Star Mountain is engaged, or continues to be engaged, to provide investment advisory services; nor should they be construed as a current or past endorsement, testimonial endorsement, recommendation or referral of Star Mountain or its representatives by any of its clients or any other third party. Rankings published by magazines and others are generally based exclusively on information prepared and/or submitted by the recognized advisor.

Crain’s two-part survey process consisted of evaluating each nominated company’s workplace policies, practices, philosophy, systems and demographics. The second part involved an employee survey to measure the employee experience. The combined scores determined the top companies and the final ranking. Star Mountain must pay a fee to Crain’s only for survey collection purposes. Detailed eligibility criteria can be found here: https://bestcompaniesgroup.com/best-companies-to-work-for-in-new-york/eligibility/

To be named to P&I‘s Best Places list, all firms met Best Companies’ high threshold for inclusion and were evaluated against others of similar size. Individual firm profiles, which were compiled based on survey results, reflect

Companies on the 2023 Inc. 5000 are ranked according to percentage revenue growth from 2019 to 2022. To qualify, companies must have been founded and generating revenue by March 31, 2019. They must be

View source version on businesswire.com: https://www.businesswire.com/news/home/20240903047473/en/

John Polis – Media@StarMountainCapital.com

Source: Star Mountain Capital, LLC