U.S. Global Investors Reports Resilient Results for a Challenging March Quarter, Expands Brand in the U.K.

U.S. Global Investors, Inc. reported resilient results for the challenging March quarter, with operating revenues of $2.6 million. Despite a decrease in advisory fees, lower investment income, and AUM, the Company maintained a shareholder yield of 8.32%. Quarterly share repurchases increased 9.4% year-over-year. The merger of London-listed JETS with TRIP is expected to increase AUM fivefold, solidifying the Company's position in thematic investing. The surge in gold prices and central bank demand positively impact GOAU. The Company's healthy liquidity and capital resources position it well to meet obligations.

Operating revenues of $2.6 million in the challenging March quarter.

Maintained a shareholder yield of 8.32% and increased quarterly share repurchases by 9.4% year-over-year.

Merger of London-listed JETS with TRIP expected to increase AUM fivefold, enhancing thematic investing position.

Surge in gold prices and central bank demand benefit GOAU performance.

Company's healthy liquidity and capital resources, with $27.5 million in cash and cash equivalents.

Decrease in advisory fees, lower investment income, and AUM during the March quarter.

Operating income loss of $488, with a decrease in operating revenues compared to the previous year.

Net income loss of $35, driven by lower revenues and higher expenses.

Income before income taxes decreased to $40 in the reported quarter.

Average AUM decreased from $2.5 billion to $1.8 billion year-over-year.

Insights

The reported operating revenues and net income figures present a snapshot of U.S. Global Investors' financial health. A decrease in revenue from $3.624 million to $2.593 million alongside a significant drop in net income from $1.620 million to a loss of $35,000 reflect a challenging quarter. Given the importance of advisory fees and investment income to the business model of an investment advisory firm, the decline suggests a potential red flag for investors, as it might indicate reduced profitability in the near term. Furthermore, the decrease in assets under management from an average of $2.5 billion to $1.8 billion, with an end-of-period AUM at $1.7 billion, points to possible headwinds in client retention or asset performance.

On the positive side, the shareholder yield of 8.32% exceeds Treasury yields, which could be attractive to income-focused investors. However, the company's strategy of share repurchases warrants scrutiny. While the repurchase of 211,282 shares at a cost of $577,000 indicates confidence by management in the intrinsic value of the stock, a 9.4% increase in repurchase volume could suggest an effort to support the share price during a period of reduced earnings performance. The share buyback program does not guarantee positive returns and could be a short-term measure rather than a sign of long-term strength.

The expansion of JETS' assets under management through the merger with TRIP is a strategic move aimed at increasing its market footprint in the thematic investing space. The fivefold increase in AUM from the merger might provide greater liquidity and potentially reduce the expense ratio due to economies of scale. However, for investors, the critical question will be whether this merger can lead to improved performance of the fund and attract new investors in a competitive ETF market landscape.

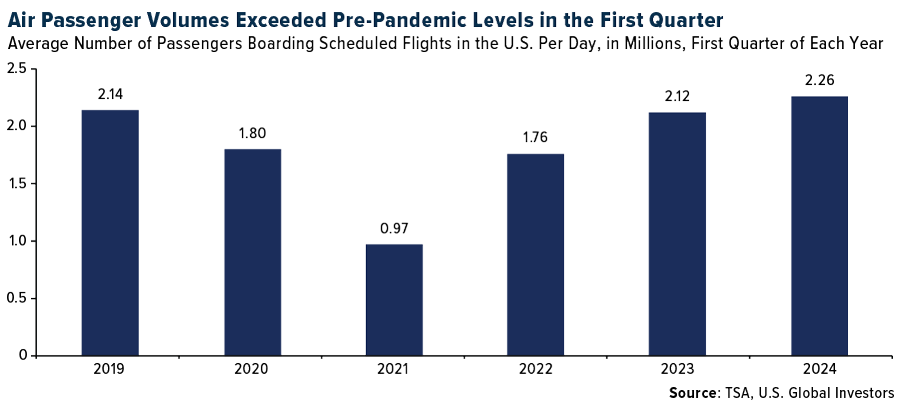

Regarding the bullish stance on the travel industry, while TSA checkpoint volumes show a promising start for 2024, investors should be aware of the cyclical nature of the airline and travel sector and potential volatility due to factors such as oil prices, geopolitical tensions and health pandemics. Investors might also consider diversification as a strategy to mitigate the risks inherent in sector-specific investments.

The performance of the GOAU ETF, which focuses on gold mining stocks, amid the backdrop of a record high in gold prices, is indicative of the ETF's potential resilience to geopolitical uncertainties and inflation. Central banks' net purchase of 290 tons of gold in the first quarter highlights the strong demand for gold as a safe haven asset. While the performance of GOAU is aligned with the recent surge in gold prices, investors should consider the volatility of the commodity markets and the fact that past performance does not guarantee future results.

Gold's behavior as a store of value in various global currencies underlines its universal appeal, which is positive for the ETF's strategy. However, investors should also be attentive to the risks associated with sector-specific funds that concentrate on precious metals and mining stocks, as they are subject to regulatory changes, environmental concerns and shifts in resource prices.

SAN ANTONIO, May 09, 2024 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm with longstanding experience in global markets and specialized sectors from gold mining to airlines, today reported operating revenues of

For the three-month period ended March 31, 2024, average AUM was

The Company’s shareholder yield at the end of the period was

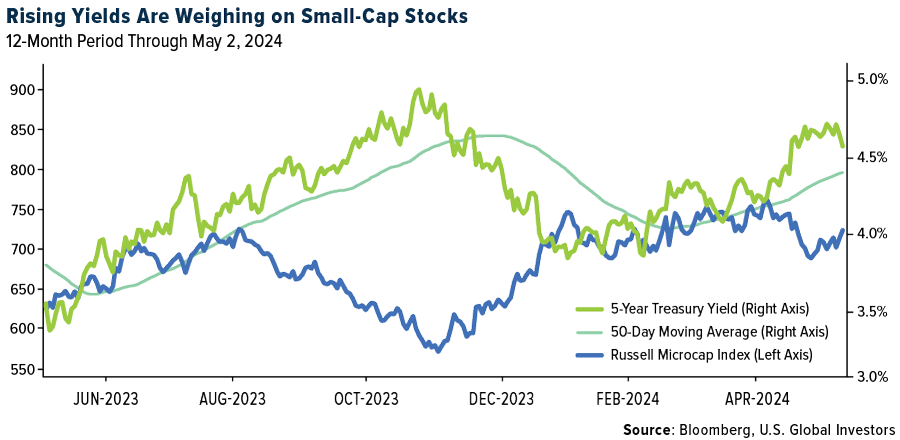

“We consider GROW a deep-value stock, especially with the Federal Reserve keeping rates higher for longer,” says Frank Holmes, the Company’s CEO and Chief Investment Officer. “Higher borrowing costs affect companies of all sizes, but they put substantial pressure on small and microcap stocks, which are generally more sensitive to economic shifts and smaller financial cushions.”

Quarterly Share Repurchases

The Company repurchased a total of 211,282 of its own shares during the quarter ended March 31, 2024, at a net cost of approximately

London-Listed JETS Merges with TRIP, Increasing AUM Fivefold

As was covered in a previous press release,2 the Company announced that its Europe-domiciled airlines ETF, the U.S. Global Jets UCITS ETF (JETS), merged into the Travel UCITS ETF (TRIP), effective April 19, 2024. This move is expected to increase JETS’ AUM fivefold, providing a larger base to grow assets and further solidifying the Company’s position as a leader in thematic investing.

“We’re pleased and extremely excited about the recent merger of our smart beta 2.0 JETS ETF, listed on the London Stock Exchange, into TRIP,” says Mr. Holmes. “TRIP presents a unique opportunity for the company to increase assets from around

The Company maintains its bullishness on the travel industry as airline executives predict that a record number of passengers will fly this summer.3 Checkpoint volumes provided by the Transportation Security Administration (TSA) are off to a record start in 2024, with carriers in the U.S. handling an average of 2.26 million passengers each day, a

GOAU Responding Well to ATH Gold Prices as Central Bank Demand Perseveres

The price of gold recently hit a record high on geopolitical uncertainty and fears that persistently sticky inflation will convince the Federal Reserve to keep rates higher for longer. The metal traded above

“Gold’s recent surge isn’t just a U.S. dollar story. The precious metal is also making historic breakouts in various currencies around the world, from the Japanese yen to the Chinese yuan and Indian rupee,” says Mr. Holmes. “This global phenomenon underscores gold’s broad appeal as a store of value and a means of preserving purchasing power. It’s also constructive for our U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU), which takes a quantitative approach to picking gold mining stocks. We’re happy to see that the smart-beta 2.0 ETF has been performing as expected with gold near all-time highs.”

Healthy Liquidity and Capital Resources

As of March 31, 2024, the Company had net working capital of approximately

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Friday, May 10, 2024, to discuss the Company’s key financial results for the quarter. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| Three months ended | |||||

| 3/31/2024 | 3/31/2023 | ||||

| Operating Revenues | $ | 2,593 | $ | 3,624 | |

| Operating Expenses | 3,081 | 2,894 | |||

| Operating Income (Loss) | (488 | ) | 730 | ||

| Total Other Income | 528 | 1,216 | |||

| Income Before Income Taxes | 40 | 1,946 | |||

| Income Tax Expense | 75 | 326 | |||

| Net Income (Loss) | $ | (35 | ) | $ | 1,620 |

| Net Income Per Share (Basic and Diluted) | $ | 0.00 | $ | 0.11 | |

| Avg. Common Shares Outstanding (Basic) | 14,077,042 | 14,747,537 | |||

| Avg. Common Shares Outstanding (Diluted) | 14,077,042 | 14,747,637 | |||

| Avg. Assets Under Management (Billions) | $ | 1.8 | $ | 2.5 | |

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here, GOAU here and for SEA here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS and GOAU.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS and GOAU.

The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than

_____________________________

1 The Company calculates shareholder yield by adding the percentage of change in shares outstanding to the dividend yield for the 12 months ending March 31, 2024. The Company did not have debt; therefore, no debt reduction was included.

2 U.S. Global Investors announces merger of Europe-Domiciled Airlines ETF into the Travel UCITS ETF (TRIP), expanding and diversifying investment opportunities in global travel industry. USGI. (2024, April 23). https://www.usfunds.com/resource/u-s-global-investors-announces-merger-of-europe-domiciled-airlines-etf-into-the-travel-ucits-etf-trip-expanding-and-diversifying-investment-opportunities-in-global-travel-industry/

3 Josephs, L. (2024, April 18). Airline executives predict a record summer and even more demand for First class. CNBC. https://www.cnbc.com/2024/04/17/airline-execs-predict-record-summer-even-more-demand-for-first-class.html

4 Gold demand trends Q1 2024. World Gold Council. (2024, April 30). https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2024

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/af421562-6bd8-45e7-8c43-08983c981e94

https://www.globenewswire.com/NewsRoom/AttachmentNg/06b1720e-a52a-4db9-987e-637fc6b1dc91