U.S. Global Investors Reports Results for the Second Quarter of 2025 Fiscal Year

U.S. Global Investors (NASDAQ: GROW) reported Q2 FY2025 results with operating revenues of $2.2 million and a net loss of $86,000 ($0.01 per share) for the quarter ended December 31, 2024. Total assets under management (AUM) decreased to $1.5 billion from $2.1 billion year-over-year. The company launched its fourth thematic ETF, the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR), its first actively managed ETF.

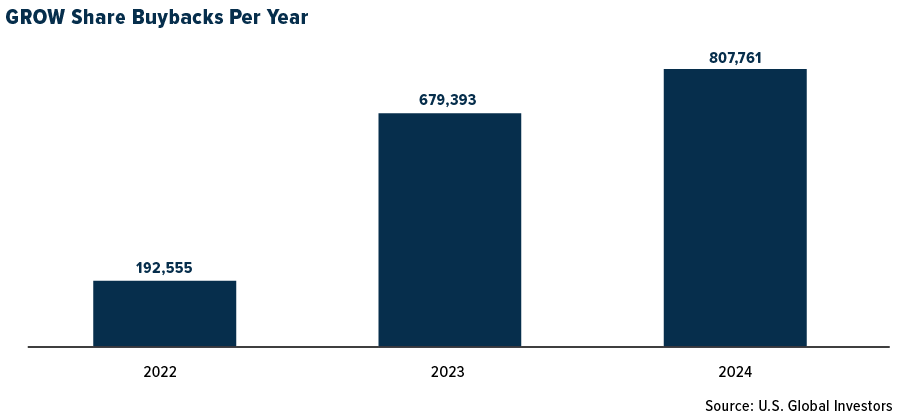

The company maintained its monthly dividend of $0.0075 per share through March 2025 and repurchased 807,761 shares at a net cost of $2.1 million in 2024, a 19% increase from the previous year. The shareholder yield was 10% as of December 31, 2024. The company reported net working capital of $38.0 million and $26.0 million in cash and cash equivalents.

U.S. Global Investors (NASDAQ: GROW) ha riportato i risultati del secondo trimestre dell'anno fiscale 2025, con ricavi operativi di 2,2 milioni di dollari e una perdita netta di 86.000 dollari (0,01 dollari per azione) per il trimestre conclusosi il 31 dicembre 2024. Il totale degli attivi gestiti (AUM) è diminuito a 1,5 miliardi di dollari rispetto ai 2,1 miliardi dell'anno precedente. L'azienda ha lanciato il suo quarto ETF tematico, il U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR), il suo primo ETF gestito attivamente.

L'azienda ha mantenuto il suo dividendo mensile di 0,0075 dollari per azione fino a marzo 2025 e ha riacquistato 807.761 azioni a un costo netto di 2,1 milioni di dollari nel 2024, con un aumento del 19% rispetto all'anno precedente. Il rendimento per gli azionisti era del 10% al 31 dicembre 2024. L'azienda ha riportato un capitale circolante netto di 38,0 milioni di dollari e 26,0 milioni di dollari in contante e equivalenti di contante.

U.S. Global Investors (NASDAQ: GROW) reportó los resultados del segundo trimestre del año fiscal 2025, con ingresos operativos de 2,2 millones de dólares y una pérdida neta de 86.000 dólares (0,01 dólares por acción) para el trimestre que terminó el 31 de diciembre de 2024. Los activos bajo gestión (AUM) disminuyeron a 1,5 mil millones de dólares desde 2,1 mil millones de dólares en comparación con el año anterior. La compañía lanzó su cuarto ETF temático, el U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR), su primer ETF gestionado activamente.

La empresa mantuvo su dividendo mensual de 0,0075 dólares por acción hasta marzo de 2025 y recompró 807.761 acciones a un costo neto de 2,1 millones de dólares en 2024, un aumento del 19% respecto al año anterior. El rendimiento para los accionistas fue del 10% al 31 de diciembre de 2024. La empresa reportó un capital de trabajo neto de 38,0 millones de dólares y 26,0 millones de dólares en efectivo y equivalentes de efectivo.

U.S. Global Investors (NASDAQ: GROW)는 2025 회계연도 2분기 실적을 보고했으며, 운영 수익은 220만 달러, 순손실은 86,000달러(주당 0.01달러)였습니다. 2024년 12월 31일에 종료된 분기에 대한 결과입니다. 전체 운용 자산(AUM)은 전년 대비 21억 달러에서 15억 달러로 감소했습니다. 이 회사는 네 번째 테마형 ETF인 U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR)를 출시했으며, 이는 첫 번째 능동적으로 관리되는 ETF입니다.

회사는 2025년 3월까지 주당 0.0075달러의 월 배당금을 유지했으며, 2024년에 210만 달러의 순비용으로 807,761주를 재매입했습니다. 이는 전년 대비 19% 증가한 수치입니다. 2024년 12월 31일 기준으로 주주 수익률은 10%였습니다. 회사는 3,800만 달러의 순 운전 자본과 2,600만 달러의 현금 및 현금성 자산을 보고했습니다.

U.S. Global Investors (NASDAQ: GROW) a annoncé les résultats du deuxième trimestre de l'exercice 2025, avec des revenus d'exploitation de 2,2 millions de dollars et une perte nette de 86 000 dollars (0,01 dollar par action) pour le trimestre se terminant le 31 décembre 2024. Les actifs sous gestion (AUM) ont diminué à 1,5 milliard de dollars contre 2,1 milliards de dollars l'année précédente. L'entreprise a lancé son quatrième ETF thématique, le U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR), son premier ETF géré activement.

L'entreprise a maintenu son dividende mensuel de 0,0075 dollar par action jusqu'en mars 2025 et a racheté 807 761 actions à un coût net de 2,1 millions de dollars en 2024, soit une augmentation de 19 % par rapport à l'année précédente. Le rendement des actionnaires était de 10 % au 31 décembre 2024. L'entreprise a rapporté un fonds de roulement net de 38,0 millions de dollars et 26,0 millions de dollars en espèces et équivalents de trésorerie.

U.S. Global Investors (NASDAQ: GROW) hat die Ergebnisse des zweiten Quartals des Geschäftsjahres 2025 veröffentlicht, mit Betriebseinnahmen von 2,2 Millionen Dollar und einem Nettoverlust von 86.000 Dollar (0,01 Dollar pro Aktie) für das am 31. Dezember 2024 endende Quartal. Die Assets under Management (AUM) sind im Jahresvergleich von 2,1 Milliarden Dollar auf 1,5 Milliarden Dollar gesunken. Das Unternehmen hat seinen vierten thematischen ETF, den U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR), seinen ersten aktiv verwalteten ETF, eingeführt.

Das Unternehmen hielt seine monatliche Dividende von 0,0075 Dollar pro Aktie bis März 2025 aufrecht und kaufte im Jahr 2024 807.761 Aktien zu einem Nettokosten von 2,1 Millionen Dollar zurück, was einem Anstieg von 19 % im Vergleich zum Vorjahr entspricht. Die Rendite für die Aktionäre betrug zum 31. Dezember 2024 10 %. Das Unternehmen berichtete über ein Nettoumlaufvermögen von 38,0 Millionen Dollar und 26,0 Millionen Dollar in Bargeld und liquiden Mitteln.

- Shareholder yield of 10%, exceeding 10-year Treasury bond yield

- Increased share repurchases by 19% YoY to 807,761 shares ($2.1M)

- Strong liquidity position with $26M cash and $38M working capital

- Launch of new actively managed ETF (WAR)

- Net loss of $86,000 vs profit of $1.2M in prior year

- Operating revenues declined to $2.2M from $2.8M YoY

- AUM decreased by $0.6B to $1.5B YoY

- Operating expenses increased to $2.77M from $2.63M YoY

Insights

The Q2 FY2025 results reveal significant headwinds for U.S. Global Investors, with operating revenues declining

The

However, the company's capital allocation strategy shows resilience and confidence in long-term prospects. The aggressive share repurchase program, which bought back 807,761 shares at

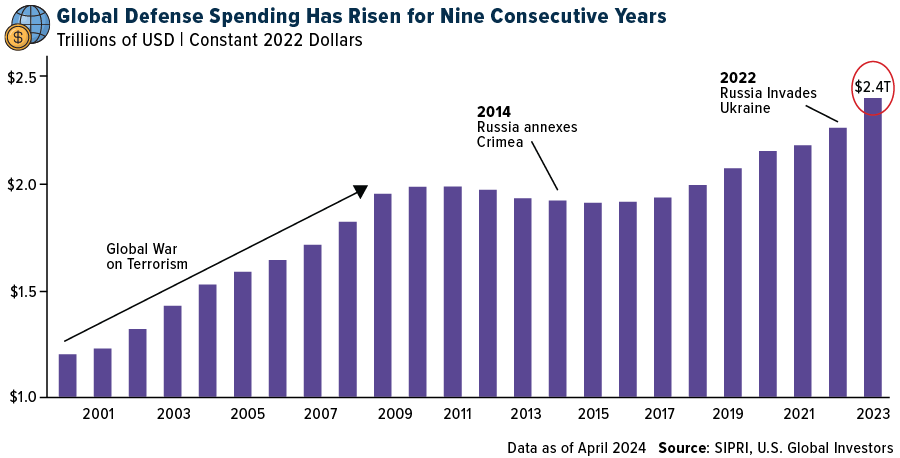

The launch of the WAR ETF is strategically timed to capitalize on growing defense spending, particularly in Europe where defense budgets reached

The company maintains a strong liquidity position with

SAN ANTONIO, Feb. 12, 2025 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm1 with longstanding experience in global markets and specialized sectors, today reported operating revenues of

Losses were reflective of market fluctuations and lower assets. At December 31, 2024, total assets under management (AUM) were approximately

The shareholder yield as of December 31, 2024, was

A Smart Beta 2.0 Approach to Investing in Global Security and Advanced Technology

At the end of 2024, the Company released its fourth thematic ETF, the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR). Launched on December 30, 2024, WAR is the Company’s first actively managed ETF, giving investors access to companies involved in not just traditional defense manufacturing but also electronic warfare, semiconductors, cybersecurity and data centers. Like the Company’s other ETFs, WAR uses a Smart Beta 2.0 strategy, meaning portfolio construction is factor- and rules-based.

“WAR is all about defense, protection and security,” says Frank Holmes, the Company’s CEO and chief investment officer. “In today’s technologically advanced world, artificial intelligence (AI) and data centers are as crucial to protecting borders and defending against bad actors across the globe as mechanization was at the turn of the last century. Precedence Research estimates that global spending on AI in the aerospace and defense will expand from approximately

Global military expenditures reached a record

Gold Demand at New All-Time High

The Company is pleased to share that total global gold demand hit a new record high in 2024, according to a report by the World Gold Council (WGC). Demand rose

“It appears that investors are seeking a safe haven to some of the uncertainties in global markets and the economy right now—most notably the potential for a broad-based trade war. Tariffs are inflationary, and gold has historically done well when inflation fears were elevated,” says Mr. Holmes. “Against this backdrop, we’re very happy with how well our U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) performed in the fourth quarter of 2024 and in the entire calendar year. With tariff concerns persisting into the unforeseeable future, we have high hopes that GOAU will continue to spark interest from investors.”

Creating Shareholder Value Through Dividends and Share Repurchases

The Company’s Board of Directors (the “Board”) approved payment of the

In calendar year 2024, the Company repurchased 807,761 of its own shares, at a net cost of

“U.S. Global Investors is committed to creating shareholder value by maintaining a disciplined capital allocation strategy,” says Mr. Holmes. “The Board’s approval of continued monthly dividends, combined with our increased share buybacks, underscores our confidence in the Company’s long-term growth and financial strength.”

Healthy Liquidity and Capital Resources

As of December 31, 2024, the Company had net working capital of approximately

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Thursday, February 13, 2025, to discuss the Company’s key financial results for the quarter. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| Three months ended | |||||

| 12/31/2024 | 12/31/2023 | ||||

| Operating Revenues | $ | 2,231 | $ | 2,818 | |

| Operating Expenses | 2,770 | 2,626 | |||

| Operating Income (Loss) | (539 | ) | 192 | ||

| Total Other Income (Loss) | 423 | 1,473 | |||

| Income (Loss) Before Income Taxes | (116 | ) | 1,665 | ||

| Income Tax Expense (Benefit) | (30 | ) | 436 | ||

| Net Income (Loss) | $ | (86 | ) | $ | 1,229 |

| Net Income (Loss) Per Share (Basic and Diluted) | $ | (0.01 | ) | $ | 0.09 |

| Avg. Common Shares Outstanding (Basic) | 13,497,961 | 14,291,328 | |||

| Avg. Common Shares Outstanding (Diluted) | 13,498,306 | 14,291,396 | |||

| Avg. Assets Under Management (Billions) | $ | 1.5 | $ | 1.9 | |

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please carefully consider a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for WAR and GOAU by clicking here and here. Read it carefully before investing.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser. GOAU and WAR are distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU and WAR. Foreside Fund Services, LLC and Quasar Distributors, LLC are affiliated.

Investing involves risk including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Because the fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The fund is non-diversified, meaning it may concentrate more of its assets in a smaller number of issuers than a diversified fund. The fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The fund may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than

WAR is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

WAR’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS and WAR.

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

____________________

1 Registration does not imply a certain level of skill or training.

2 The Company calculates shareholder yield by adding the percentage of change in shares outstanding to the dividend yield for the 12 months ending December 31, 2024. The Company did not have debt; therefore, no debt reduction was included.

3 Precedence Research. (2024, November 13). AI in aerospace and defense market size, share and trends 2024 to 2034. Precedence Research. https://www.precedenceresearch.com/ai-in-aerospace-and-defense-market

4 Tian, N., Lopes da Silva, D., Liang, X., & Scarazzato, L. (2024, April). Trends in world military expenditure, 2023. Stockholm International Peace Research Institute (SIPRI). https://doi.org/10.55163/BQGA2180

5 European Defence Agency. (2024). Coordinated annual review on defence (CARD) report 2024. https://eda.europa.eu/docs/default-source/documents/card-report-2024.pdf

6 World Gold Council. (2025, February 5). Gold demand trends: Full year 2024. World Gold Council. https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2024

7 World Gold Council. (2025, February 10). Gold market commentary: Snakes and ladders. World Gold Council. https://www.gold.org/goldhub/research/gold-market-commentary-january-2025

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8d2495d1-836e-428d-8d53-35473fba2ac9

https://www.globenewswire.com/NewsRoom/AttachmentNg/a88a2a58-cafc-4976-a940-d8ddbd255837