U.S. Global Investors Reports Profitability for the First Quarter of 2025 Fiscal Year

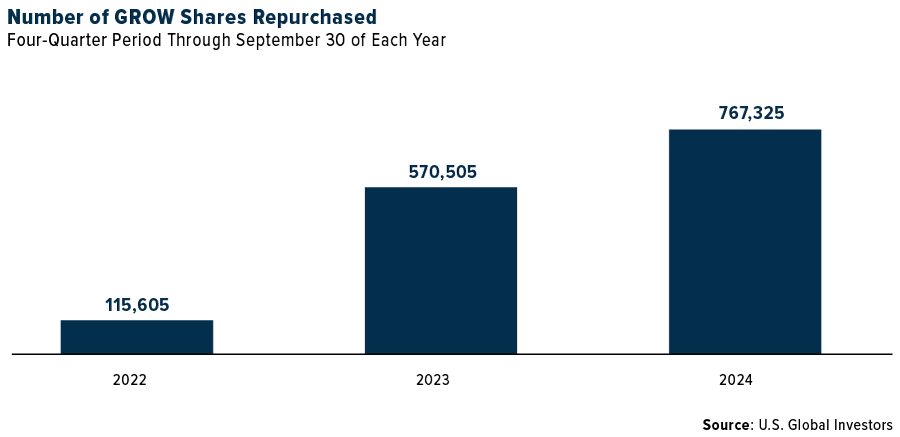

U.S. Global Investors (NASDAQ: GROW) reported net income of $315,000 ($0.02 per share) for Q1 FY2025, compared to a net loss of $176,000 in the same quarter last year. The improvement was driven by strong consolidated other income of $995,000, primarily from realized and unrealized investment gains. However, average assets under management decreased 30% to $1.5 billion from the previous year. The company maintained its monthly dividend of $0.0075 per share and enhanced its share buyback program, purchasing 197,887 class A shares for approximately $520,000 during the quarter. The Board approved plans to buy back up to 14% of outstanding shares.

U.S. Global Investors (NASDAQ: GROW) ha riportato un reddito netto di 315.000 dollari (0,02 dollari per azione) per il primo trimestre dell'anno fiscale 2025, rispetto a una perdita netta di 176.000 dollari nello stesso trimestre dell'anno precedente. Il miglioramento è stato alimentato da un forte reddito consolidato di altri 995.000 dollari, principalmente proveniente da guadagni sugli investimenti realizzati e non realizzati. Tuttavia, gli attivi medi sotto gestione sono diminuiti del 30%, raggiungendo 1,5 miliardi di dollari rispetto all'anno precedente. L'azienda ha mantenuto il suo dividendo mensile di 0,0075 dollari per azione e ha potenziato il suo programma di riacquisto di azioni, acquistando 197.887 azioni di classe A per circa 520.000 dollari durante il trimestre. Il Consiglio ha approvato piani per riacquistare fino al 14% delle azioni in circolazione.

U.S. Global Investors (NASDAQ: GROW) reportó un ingreso neto de $315,000 ($0.02 por acción) para el primer trimestre del año fiscal 2025, en comparación con una pérdida neta de $176,000 en el mismo trimestre del año pasado. La mejora fue impulsada por un fuerte ingreso consolidado adicional de $995,000, principalmente por ganancias de inversiones realizadas y no realizadas. Sin embargo, los activos promedio bajo gestión disminuyeron un 30%, alcanzando $1.5 mil millones en comparación con el año anterior. La compañía mantuvo su dividendo mensual de $0.0075 por acción y mejoró su programa de recompra de acciones, comprando 197,887 acciones clase A por aproximadamente $520,000 durante el trimestre. La Junta aprobó planes para recomprar hasta el 14% de las acciones en circulación.

U.S. Global Investors (NASDAQ: GROW)는 2025 회계연도 1분기에 $315,000 ($0.02 주당) 순이익을 보고했으며, 이는 지난해 같은 분기에 비해 176,000달러의 순손실에서 개선된 수치입니다. 이러한 개선은 주로 실현 및 비실현 투자수익으로 인한 강력한 Consolidated Other Income(비유동 자산소득)에 의해 촉진되었습니다. 그러나 관리하던 평균 자산은 전년도 대비 30% 감소하여 $1.5억이 되었습니다. 회사는 주당 0.0075달러의 월 배당금을 유지했으며, 분기 동안 약 520,000달러로 197,887주의 클래스 A 주식을 매입하여 자사주 매입 프로그램을 강화했습니다. 이사회는 발행 주식의 최대 14%를 재구매하기 위한 계획을 승인했습니다.

U.S. Global Investors (NASDAQ: GROW) a déclaré un revenu net de 315.000 $ (0,02 $ par action) pour le premier trimestre de l'exercice 2025, par rapport à une perte nette de 176.000 $ au cours du même trimestre l'année dernière. L'amélioration a été portée par un fort revenu consolidé autre de 995.000 $, provenant principalement de gains d'investissement réalisés et non réalisés. Cependant, les actifs moyens sous gestion ont diminué de 30 %, atteignant 1,5 milliard $ par rapport à l'année précédente. L'entreprise a maintenu son dividende mensuel de 0,0075 $ par action et a amélioré son programme de rachat d'actions, achetant 197.887 actions de classe A pour environ 520.000 $ au cours du trimestre. Le Conseil a approuvé des plans pour racheter jusqu'à 14 % des actions en circulation.

U.S. Global Investors (NASDAQ: GROW) berichtete für das erste Quartal des Geschäftsjahres 2025 einen Nettogewinn von 315.000 $ (0,02 $ pro Aktie), verglichen mit einem Nettverlust von 176.000 $ im gleichen Quartal des Vorjahres. Die Verbesserung wurde durch ein starkes konsolidiertes anderes Einkommen von 995.000 $ unterstützt, hauptsächlich aus realisierten und unrealisierbaren Investitionsgewinnen. Allerdings sank das durchschnittliche verwaltete Vermögen um 30 % auf 1,5 Milliarden $ im Vergleich zum Vorjahr. Das Unternehmen hielt seine monatliche Dividende von 0,0075 $ pro Aktie aufrecht und verbesserte sein Aktienrückkaufprogramm, indem es während des Quartals 197.887 Aktien der Klasse A für etwa 520.000 $ erwarb. Der Vorstand genehmigte Pläne zum Rückkauf von bis zu 14 % der ausstehenden Aktien.

- None.

- None.

Insights

The return to profitability with

The company's commitment to shareholder returns through a

The company faces significant headwinds from broader market conditions, including the historically long yield curve inversion and political uncertainty. The

SAN ANTONIO, Nov. 07, 2024 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm with longstanding experience in global markets and specialized sectors from gold mining to airlines, today reported net income of

Net income was bolstered by strong consolidated other income of

Inverted Yield Curve and U.S. Presidential Election Weighed on Investor Sentiment

Average assets under management (AUM) for the three-month period ended September 30, 2024, were

“The challenge to turn operating income from negative back to positive, as it was last year, is simply fund flows into our thematic, cyclical products,” says Company CEO and Chief Investment Officer Frank Holmes.

The Company believes many potential investors limited their exposure to risk due to a combination of factors, including global conflicts, uncertainty surrounding the U.S. presidential election and the inverted yield curve, which has been one of the most reliable recession indicators over the last 50 years.

“An inverted yield curve, where short-term rates are higher than long-term rates, has preceded every U.S. recession since the 1970s. This occurs because market participants, anticipating future rate cuts to combat a downturn, drive long-term rates lower,” says Mr. Holmes. “Before turning positive again in early September, the yield curve had been inverted for a staggering 783 consecutive days, the longest such period in U.S. history.1 We believe this kept a lot of investors on the sidelines. Despite these market pressures, we have remained committed to our disciplined investment approach. Post-election, we anticipate a renewed sense of investor confidence, and we’re optimistic that industry inflows will recover.

Enhanced Shareholder Value Through Continued GROW Dividends and Share Repurchases

The Board of Directors (the "Board") authorized a monthly dividend of

The Board also approved plans to buy back up to approximately

“Similar to United Airlines, which just announced a

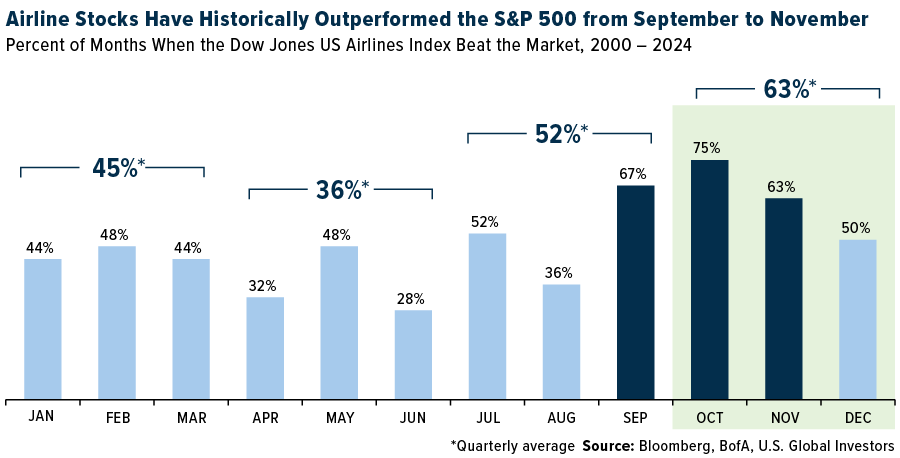

Historically Strong Seasonality for Airline Stocks

Despite an exceptionally robust summer travel season that posted a record number of people—approximately 3 million3—board commercial planes in the U.S. on a single day in July, the U.S. Global Jets ETF (NYSE: JETS) saw increased bets against the airline industry by short sellers.4 However, the Company believes inflows will return on seasonality as we head further into the fall and winter months.

“Historically, airline stocks have tended to outperform in the fall,” Mr. Holmes continues. “According to Bank of America’s analysis of the Dow Jones U.S. Airlines Index since 2000, the second half of the year has typically been the stronger half for airlines. The industry has outperformed the S&P 500 in three of the last six months of the year—namely September, October and November.”5

U.S. Global Investors Marketing Team Recognized by IMEA

The Company is pleased to announce that its marketing team received a STAR Award from the Investment Management Education Alliance (IMEA) at its annual awards ceremony in October. The recognition, in the category of Investor Content for a Product, was awarded to the Company for its content on the U.S. Global Jets ETF.

“We continue to leverage our strong branding strategy to raise awareness of our investment products. In October, for instance, we hosted a JETS webcast for registered investment advisors (RIAs) that was well-attended,” says Mr. Holmes.

Healthy Liquidity and Capital Resources

As of September 30, 2024, the Company had net working capital of approximately

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Friday, November 8, 2024, to discuss the Company’s key financial results for the quarter. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| Three months ended | ||||||

| 9/30/2024 | 9/30/2023 | |||||

| Operating Revenues | $ | 2,157 | $ | 3,133 | ||

| Operating Expenses | 2,716 | 2,918 | ||||

| Operating Income (Loss) | (559 | ) | 215 | |||

| Total Other Income (Loss) | 995 | (456 | ) | |||

| Income (Loss) Before Income Taxes | 436 | (241 | ) | |||

| Income Tax Expense (Benefit) | 121 | (65 | ) | |||

| Net Income (Loss) | $ | 315 | $ | (176 | ) | |

| Net Income (Loss) Per Share (Basic and Diluted) | $ | 0.02 | $ | (0.01 | ) | |

| Avg. Common Shares Outstanding (Basic) | 13,714,517 | 14,465,510 | ||||

| Avg. Common Shares Outstanding (Diluted) | 13,714,517 | 14,465,701 | ||||

| Avg. Assets Under Management (Billions) | $ | 1.5 | $ | 2.1 | ||

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com. Read it carefully before investing. U.S. Global mutual funds are distributed by Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser. JETS is distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS. Foreside Fund Services, LLC and Quasar Distributors, LLC are affiliated.

Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Companies in the consumer discretionary sector are subject to risks associated with fluctuations in the performance of domestic and international economies, interest rate changes, increased competition and consumer confidence.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

The Dow Jones US Total Market Airlines Index is constructed and weighted using free-float market capitalization and the index is quoted in USD.

Please carefully consider a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.

It is not possible to invest in an index.

1 Bilello, C. (2024, September 4). The longest inversion in history is over – Chart of the day. https://bilello.blog/2024/the-longest-inversion-in-history-is-over-chart-of-the-day-9-4-24

2 Singh, R. K. (2024, October 15). United Airlines sees stronger profit, unveils

3 Shepardson, D. (2024, July 8). US agency screens record 3 million airline passengers in single day. Reuters. https://www.reuters.com/world/us/us-agency-screens-record-3-million-airline-passengers-single-day-2024-07-08

4 Forte, P. (2024, July 11). Wall Street bets against airlines despite summer travel boom. Bloomberg. https://www.bloomberg.com/news/articles/2024-07-11/bets-against-airline-stocks-hit-post-pandemic-high-amid-summer-travel-boom?sref=1pPyLRr7

5 Didora, A. G., & Clough, S. (2024, September 9). Time to consider airlines: Pricing improves as fuel moves lower. Bank of America.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/09a53b26-c713-4383-b9d9-3e6dd29d937b

https://www.globenewswire.com/NewsRoom/AttachmentNg/ac940fe0-bb28-47b9-ba97-3545bebc28f3