GeoPark Announces Acquisition of Working Interest in Four High Quality Adjacent Blocks in World Class Vaca Muerta

Existing Production, Reserves and Cash Flow

Low-Risk Development Underway With Large Scale Upside

Well-Positioned Acreage With Available Infrastructure

Proven Unconventional Strategic Partner

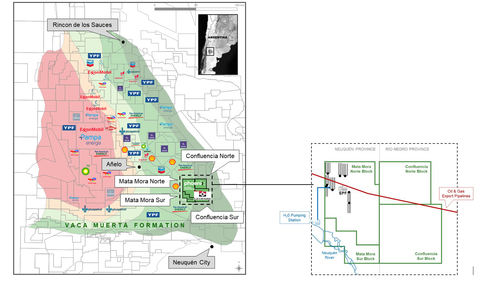

(Graphic: Business Wire)

KEY HIGHLIGHTS

Robust Strategic Fit

-

The Vaca Muerta shale formation is the best onshore hydrocarbons play in

Latin America today. It holds an estimated 16 billion bbl of oil and 300+ Tcf of unconventional gas resources with less than10% developed to date1 -

Oil production from Vaca Muerta has grown almost 4x since 2019 to 352,715 bopd2. It is currently contributing

50% of Argentina’s total oil production, and has the potential to triple again over the next six years - Vaca Muerta has been significantly de-risked since 2009, with the drilling of almost 7,000 exploration and development wells

- The blocks are located in the oil window of the Vaca Muerta formation in the Neuquen Basin, one hour from Neuquen city and close to the services hub. Immediately adjacent blocks currently produce over 28,000 gross boepd3

-

GeoPark leverages more than 20 years of operational and business presence in

Argentina -

Acquisition complements existing GeoPark portfolio assets in

Colombia ,Ecuador andBrazil

Immediate Access to Rapidly Growing Production Profile

- The new assets would increase GeoPark’s 2024 production by an estimated 5,500-6,500 net boepd, subject to when the closing date of the transaction occurs

- Average gross production of the assets was 11,220 boepd in 1Q20244 and 12,594 boepd in March 20245

- Gross exit production for 2024 is expected to be between 13,500-14,000 boepd

- Approximately 150 more gross drilling locations have been identified for the full development of the Mata Mora Norte Block

- Under the agreed indicative development program, production from the Mata Mora Norte Block is expected to reach approximately 40,000 gross boepd by 2028

Immediate Access to Rapidly Growing Reserves Profile

- The transaction represents access to 25 mmboe of 1P net reserves, 49.5 mmboe of 2P net reserves, and 102.6 mmboe of 3P net reserves, according to the Degolyer & MacNaughton (D&M) certification from December 2023

- GeoPark’s 1P Reserve Life Index (RLI) would grow to 6.7 years (from 5.4 years) and 2P Reserve Life Index (RLI) to 11.8 years (from 9.1 years) (D&M, December 2023)

Value Accretive from Day One

-

The Mata Mora Norte Block is expected to generate gross Adjusted EBITDA of

$90 -100 million68% Adjusted EBITDA margin (at$80 -90 -

At expected plateau production of 40,000 gross boepd in 2028-2030, the assets are expected to contribute

$290 -295 million$70 -

Net NPV10 of 1P Reserves is

$364 million $823 million

Significant, Low-Risk Exploration Upside

- The Mata Mora Sur, Confluencia Norte and Confluencia Sur blocks are currently in the exploration phase and represent significant potential production and reserves upside

- The three exploration blocks have 79,000 gross acres and 241 mmboe of gross 3C certified Contingent resources (118 mmboe net to GeoPark)

- Exploration acreage is estimated to add 200 gross drilling locations

- Production from the exploration assets could reach 15,000 – 20,000 gross boepd by 2028 on a P50 basis, subject to exploration success

- First exploratory well on the Confluencia Norte Block is underway

Proven Partner & Operator

-

PGR is an independent exploration and production (E&P) company focused on unconventional operations in

Argentina . PGR is a subsidiary of Mercuria, one of the world’s leading independent energy and commodity groups, with more than$174 billion $6.7 billion - PGR has grown production at Mata Mora Norte from zero to 13,000+ gross boepd in only three years, effectively de-risking 110 mmbbl of gross 2P reserves (D&M, December 2023)

-

With robust design, Drilling & Completion (D&C) costs have fallen from

$15.9 million $14.3 million -

Lifting costs decreased from

$8.10 $5.80 $5.10 - The partnership between GeoPark and PGR represents an opportunity to jointly leverage the substantial operational, technical, financial and commercial expertise of both companies – underpinned by unique complementary entrepreneurial culture - to unlock the full potential of the acquired blocks

Summary of Terms

-

GeoPark will pay

$190 million -

In addition to the upfront consideration, GeoPark will fund

100% of exploratory commitments up to$113 million $57 million $11 million $10 million - The transaction is expected to close before the end of 3Q2024, pending customary regulatory approvals

Competitive Valuation Metrics

-

For Mata Mora Norte Block, the valuation is approximately

$9,000 -

Based on net reserves, the valuations are

$7.1 $3.5 -

Valuation per flowing barrel at closing is approximately

$28,000 -

The 2024 EV/EBITDA multiple is 1.8x (at

$80 -90 -

The plateau EV/EBITDA multiple is 0.6x (at

$70

Financing and Capital Structure

- The upfront consideration will be funded with a mix of available cash and a partial draw of an existing oil prepayment facility that offers flexible and cost-effective terms. Longer term commitments will be funded with a combination of cash generated by the assets and financing

- The pro forma net debt to Adjusted EBITDA ratio following the transaction is not expected to exceed 1.1x9

Strategic Facilities and Infrastructure

- Facilities are in place to handle 20,000 boepd of gross production, and additional facilities will be in place by 2025-2026 to handle the expected plateau production

- Two oil pipelines run directly through the block and a third is under construction, facilitating transport options for exports

-

Approximately

90% of oil sales are transported by pipeline, with70% destined for export and30% for the domestic market -

Gas production is approximately

6% of total production, with50% sold to third parties and50% used for internal consumption

Indicative Activity Plans

- The Mata Mora Norte Block currently has a dedicated drilling rig that is scheduled to drill 12-15 wells in 2024

- The full development and exploration plan for the Mata Mora Norte Block includes adding a second drilling rig in late 2025 to continue growing production to expected plateau levels, which include risked estimates of seven committed wells on two exploration blocks

Andrés Ocampo, Chief Executive Officer of GeoPark, said: “This transaction is transformational for GeoPark, adding immediate value-accretive production and reserves growth, while materially increasing and diversifying our long-term drilling inventory into one of the most prolific petroleum systems in the world. We are particularly encouraged by achieving this strategic step change alongside PGR, a proven and established operator with world class shareholders and great success in efficiently developing and de-risking the unconventional opportunities in Vaca Muerta.”

KEY METRICS

|

Mata Mora Norte |

Mata Mora Sur |

Confluencia Norte |

Confluencia Sur |

Gross Acres |

43,243 |

11,861 |

25,698 |

41,513 |

GeoPark WI |

|

|

|

|

Current Production Gross boepd |

11,207 |

- |

- |

- |

Gross 1P Reserves (D&M) |

55 mmboe |

- |

- |

- |

Gross 2P Reserves (D&M) |

110 mmboe |

- |

- |

- |

Net 2P NPV10 |

|

- |

- |

- |

Unconventional License and Permit Types |

Exploitation License |

Exploration Permit |

Exploration Permit |

Exploration Permit |

License Expiration Date |

2056 |

2026 |

2026 |

2026 |

Certified 3C Contingent Resources (mmboe) |

- |

51 |

78 |

112 |

Well Stock |

140-160 |

15-20 |

137-200 |

|

Province |

Neuquen |

Neuquen |

Rio Negro |

Rio Negro |

GLOSSARY |

|

1P |

Proven Reserves |

2P |

Proven plus Probable Reserves |

3P |

Proven plus Probable plus Possible Reserves |

Adjusted EBITDA |

Adjusted EBITDA is defined as profit for the period before net finance costs, income tax, depreciation, amortization, the effect of IFRS 16, certain non-cash items such as impairments and write-offs of unsuccessful efforts, accrual of share-based payments, unrealized results on commodity risk management contracts and other non-recurring events |

boe |

Barrels of oil equivalent (6,000 cf marketable gas per bbl of oil equivalent). Marketable gas is defined as the total gas produced from the reservoir after reduction for shrinkage resulting from field separation; processing, including removal of nonhydrocarbon gas to meet pipeline specifications; and flare and other losses but not from fuel usage |

boepd |

Barrels of oil equivalent per day |

bopd |

Barrels of oil per day |

Certified Reserves |

Refers to GeoPark working interest reserves before royalties paid in kind, independently evaluated by the petroleum consulting firm, DeGolyer and MacNaughton Corp. (D&M) |

mboed |

Thousands of barrels of oil equivalent per day |

mmboe |

Millions of barrels of oil equivalent |

NPV10 After Tax |

Net Present Value after tax discounted at |

PD |

Proven Developed Reserves |

PRMS |

Petroleum Resources Management System |

RLI |

Reserve Life Index |

WI |

Working Interest |

|

|

NOTICE

Additional information about GeoPark can be found in the Invest with Us section of the website at www.geo-park.com

The reserve estimates provided in this release are estimates only, and there is no guarantee that the estimated reserves will be recovered. Actual reserves may eventually prove to be greater than, or less than, the estimates provided herein. Statements relating to reserves are by their nature forward-looking statements.

Gas quantities estimated herein are reserves to be produced from the reservoirs, available to be delivered to the gas pipeline after field separation prior to compression. Gas reserves estimated herein include fuel gas.

Rounding amounts and percentages: Certain amounts and percentages included in this press release have been rounded for ease of presentation. Percentage figures included in this press release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, certain percentage amounts in this press release may vary from those obtained by performing the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this press release may not sum due to rounding.

Oil and gas production figures included in this release are stated before the effect of royalties paid in kind, consumption and losses.

All evaluations of future net revenue contained in the D&M Reports are after the deduction of cash royalties, development costs, operating expenses, production and profit taxes, fees, earn out payments, well abandonment costs, and country income taxes from the future gross revenue. It should not be assumed that the estimates of future net revenues presented in the tables represent the fair market value of the reserves. The actual production, revenues, taxes and development, and operating expenditures with respect to the reserves associated with the Company's properties may vary from the information presented herein, and such variations could be material. In addition, there is no assurance that the forecast price and cost assumptions contained in the D&M Report will be attained, and variances could be material.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this press release can be identified by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe’’, ‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding various matters including production growth, development programs, Reserve Life Index, Adjusted EBITDA, net EBITDA, lifting costs and pro forma net debt to Adjusted EBITDA. Forward-looking statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements are realized, see the Company’s filings with the

This press release contains a number of oil and gas metrics, including NPV after tax per share, reserve life index, net debt-adjusted NPV per share, etc., which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other companies and should not be used to make comparisons. Such metrics have been included herein to provide readers with additional measures to evaluate the Company's performance; however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare to the performance in previous periods.

Information about oil and gas reserves: The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proven, probable and possible reserves that meet SEC definitions for such terms. GeoPark uses certain terms in this press release, such as "PRMS Reserves" that SEC guidelines do not permit GeoPark from including in filings with the SEC. As a result, the information in the Company’s SEC filings with respect to reserves will differ significantly from the information in this press release. NPV10 after tax for PRMS 1P, 2P and 3P reserves is not a substitute for the standardized measure of discounted future net cash flows for SEC proved reserves.

1 Source: US Energy Information Administration (EIA), World Shale Gas and Shale Oil Resource Assessment, 2013.

2 Source: Sistema SESCO, Ministry of Energy,

3 Average gross boepd in January 2024.

4 Gross average production January-February, 2024, according to government data and gross average March preliminary production data from PGR, subject to variations and adjustments.

5 Gross average March preliminary production data from PGR, subject to variations and adjustments.

6 Calculated at Brent

7 Calculated at price curve in the D&M PGR report from December 2023.

8 Net acres, 19,459.

9 Considers full year 2024 of new assets.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240513403777/en/

INVESTORS:

Stacy Steimel

Shareholder Value Director

T: +562 2242 9600

ssteimel@geo-park.com

Miguel Bello

Market Access Director

T: +562 2242 9600

mbello@geo-park.com

Diego Gully

Capital Markets Director

T: +55 21 99636 9658

dgully@geo-park.com

MEDIA:

Communications Department

communications@geo-park.com

Source: GeoPark Limited