Graphite One Advances its United States Graphite Supply Chain Solution Demonstrating a Pre-tax USD$1.9B NPV (8%), 26.0% IRR and 4.6 Year Payback on its Integrated Project

Graphite One Inc. has announced the results of its Pre-Feasibility Study (PFS) for the Graphite One Project, highlighting a pre-tax internal rate of return of 26.0% and a net present value of $1.93 billion. The project includes a commercial-scale battery anode facility in Washington and the Graphite Creek Mine in Alaska, expected to start production in 2025. The PFS indicates a significant increase in resources, with measured plus indicated resources up 197%. The project aims to meet rising U.S. demand for anode materials, supporting both production and local economic growth while qualifying for tax credits under the Inflation Reduction Act.

- Pre-tax internal rate of return of 26.0% with a net present value of $1.93 billion.

- Post-tax internal rate of return of 22.0% with a net present value of $1.36 billion.

- Measured plus indicated resources increased by 197% over 2019 results.

- Projected production of 75,026 tonnes per year of various graphite products, including 49,615 tonnes of anode materials.

- The project requires significant initial capital costs of $1.07 billion.

- Reliance on purchasing graphite until the mine starts production in Year 3 poses risks.

- Permitting and construction of the facility estimated to take three years may result in delays.

Insights

Analyzing...

Pre-Feasibility Study Delivers Robust Economics before Accounting for Tax Credits Enacted by the U.S. Inflation Reduction Act of 2022, Expected to Improve Post-tax Results

Projected Commercial Scale Anode Material Production for U.S. Battery Market Using Alaska Graphite

VANCOUVER, BC, Aug. 29, 2022 /PRNewswire/ - Graphite One Inc. (TSXV: GPH) (OTCQX: GPHOF) ("Graphite One" or the "Company"), is pleased to announce the results of its Pre-Feasibility Study of the Graphite One Project.

- Parallel strategy to simultaneously develop a commercial scale battery anode materials manufacturing facility in Washington State and the Graphite Creek Mine in Alaska. Manufacturing would begin with purchased materials until Alaska production is available.

- Pre-tax internal rate of return of

26.0% , using an8% discount rate, with a net present value of$1.93 billion and a payback period of 4.6 years. - Post-tax internal rate of return of

22.0% , using an8% discount rate, with net present value of$1.36 billion and a payback period of 5.1 years, before accounting for tax credits enacted by the U.S. Inflation Reduction Act of 2022, effective December 31, 2022. - Measured plus Indicated resources increased

197% over 2019 results. Inferred resources increased177% .

The Preliminary Feasibility Study ("PFS") of the Graphite One Project was prepared by JDS Energy & Mining Inc. with assistance from various independent technical consultants.

The Graphite One Project (the "Project") is planned as an integrated business operation to produce lithium ion battery anode materials and other graphite products for the U.S domestic market on a commercial scale using primarily natural graphite from Alaska. The Project combines the operation of an advanced graphite manufacturing facility to be located in Washington State (the "STP") with the supply of natural flake graphite from the Company's proposed Graphite Creek Mine in Alaska (the "Mine"). The resources associated with the Company's Alaska State mining claims were cited by the U.S. Geological Survey in January 2022 as America's largest natural graphite deposit1.

The Company anticipates that there will be a business opportunity presented by the projected strong U.S. demand for anode materials beginning in this decade and the time required to permit and construct a mine, the PFS plans the parallel design, permitting and construction of the STP and the Mine. Permitting and construction of the STP is estimated to take 3 years. The STP would operate during the first four years by processing purchased graphite. The Mine would begin production in the third year of STP operation and begin supplying graphite to the STP in its fourth year of operation. By the fifth year, it is anticipated that Alaska graphite would supply

Table 1 presents a summary of the economic results of the PFS.

Table 1: Summary of PFS Economic Results

Economic Parameters | Project | STP | Mine | |||

Pre-tax | NPV ( | |||||

IRR | 26.0 % | |||||

Payback | 4.6 Years | |||||

Post-tax 1 | NPV ( | |||||

IRR | 22.0 % | |||||

Payback | 5.1 Years | |||||

Project Life | 26 Years | 26 Years | 23 Years | |||

Average Annual | Graphite Concentrate | 51,813 tpy | ||||

Anode Materials | 49,615 tpy | |||||

Purified Graphite | 7,354 tpy | |||||

Unpurified Graphite | 18,057 tpy | |||||

Total | 75,026 tpy | 51,813 tpy | ||||

Capital Costs | Initial Capital Costs 2 | |||||

Contingency | ||||||

Sub-Total | ||||||

Sustaining Capital Costs 2 | ||||||

Contingency | ||||||

Sub-Total | ||||||

Total Capital Costs 2 | ||||||

Operating Costs | Average annual | |||||

Average per tonne production | ||||||

Average Product Price | ||||||

1. Before any effect of | ||||||

2. Non-IFRS Financial Measure as defined below | ||||||

The U.S. tax regime for producers of critical minerals and battery components changed August 16, 2022 (see below). The Project's post-tax internal rate of return without inclusion of these changes, is

On August 16, 2022, the United States enacted the Inflation Reduction Act of 2022 (the "Act") which instituted, among other things2:

- A tax credit to producers in the U.S. of anode materials equal to 10 percent of the costs incurred with respect to the production of anode materials commencing December 31, 2022 and reducing to

75% ,50% ,25% , and0% in 2030, 2031, 2032 and thereafter, respectively. - A tax credit equal to 10 percent of the costs incurred with respect to production of graphite purified to a minimum purity of 99.9 percent graphitic carbon by mass ("Purified Graphite") – the phase out provisions in 1 specifically do not apply.

- Only production in the United States qualifies for the tax credit.

Graphite One's production is expected to qualify under the Act for tax credits in both categories as it plans to produce both anode materials and Purified Graphite in the United States, as defined in the Act. The Company will evaluate the Act's impact on the PFS economics and announce the results when available. The impact is expected to improve the post-tax results.

Based on the PFS's updated graphite resource estimate, the Mine's life for the purposes of the PFS is 23 years. The PFS assumes the STP's operational life is 26 years based on its startup with purchased graphite and continued operation with graphite from the Mine.

On average over its life, the STP would produce about 75,000 tonnes per year of products. About 49,600 tpy would be anode materials, 7,400 tpy purified graphite products, and 18,000 tpy of unpurified graphite products. The anode materials are comprised of four products:

- CPN: Coated, spherical natural graphite;

- BAN: Blended natural and artificial graphites;

- SPN: Secondary particle natural graphite; and,

- SPC: Secondary particle composite.

Based on the PFS assumptions, the average price of all products over the STP's life is

The estimated initial capital and sustaining capital costs with their respective contingencies are summarized in Table 1. Also presented are the average annual production costs for the life of the Project on both the basis of annual totals and costs per tonne of production.

The STP is designed to produce lithium ion battery anode materials on a commercial scale for the U.S. domestic market using natural graphite from Alaska as soon as it is available. At full capacity, it requires about 34.5 hectares (85 acres) of land, consists of 17 buildings, and would annually produce about 77,000 tonnes of manufactured graphite products. The products are grouped into battery anode materials, specialty purified graphite products, and traditional unpurified graphite products. The products are manufactured from natural graphite concentrate, artificial graphite precursors, coke and pitch. Key components of the manufacturing process are the purification of natural graphite and graphitization of artificial graphite precursors in high temperature, electrically heated furnaces. The STP's preferred location is in Washington State to access both its relatively lower power rates from hydro generated electricity and its skilled workforce.

Permitting and construction of the STP, once its design is finalized, is expected to take three years. The STP would be constructed in two phases, each with almost identical equipment and production capacity. An exception is that Phase 2 has three furnace lines, Phase 1 has two. Phase 1 is assumed to operate at

The STP, at full capacity (Table 2), is designed to produce 51,167 tpy of anode materials for the electric vehicle and energy storage battery markets; 7,585 tpy of purified, sized material for the speciality graphite market; and 18,622 tpy for the unpurified, traditional graphite market. Total annual production would be 77,374 tonnes based on the expected annual production capacity. The average annual production over 26 years in the PFS is 75,026 tonnes.

Table 2: STP Products and Prices

No. | Category | Name | Description | Purity | Ph 1 | Total | Ph 2 | Total |

1 | Anode | CPN | Coated, spherical NG | 99.95 | 6,015 | 25,584 | 12,030 | 51,167 |

2 | BAN | Blended AG and NG | 99.95 | 11,458 | 22,915 | |||

3 | SPN | Secondary Particle NG | 99.95 | 1,829 | 3,658 | |||

4 | SPC | Secondary Particle Composite | 99.95 | 6,282 | 12,565 | |||

5 | Purified | 3299 | +32 Mesh Purified | 99+ | 59 | 3,792 | 117 |

7,585

|

6 | 599 | +50 Mesh Purified | 99+ | 527 | 1,055 | |||

7 | 899 | +80 Mesh Purified | 99+ | 586 | 1,172 | |||

8 | 199 | +100 Mesh Purified | 99+ | 977 | 1,953 | |||

9 | Battery Conductor | -320 Mesh Purified | 99.9 | 692 | 1,386 | |||

10 | Synthetic Diamond Precursor | -320 Mesh Purified | 99.99 | 951 | 1,902 | |||

11 | Unpurified | 3295 | +32 Mesh | 95+ | 95 | 9,311 | 189 |

18,622

|

12 | 595 | +50 Mesh | 95+ | 851 | 1,701 | |||

13 | 895 | +80 Mesh | 95+ | 945 | 1,890 | |||

14 | 195 | +100 Mesh | 95+ | 1,575 | 3,150 | |||

15 | Carbon Raisers Lubricants | Carbon Raisers Lubricants | 95+ | 4,640 | 9,279 | |||

16 | Coke Reject | Coke Reject | 95+ | 1,207 | 2,413 | |||

38,687 | Total | 77,374 |

The Mine would produce an average of 51,813 tonnes per year of graphite concentrate for the projected 23-year mine life. The deposit would be mined with conventional open pit mining methods including drilling, blasting, loading, and hauling. The strip ratio in the PFS plan is 2.2:1 with an ore cut-off grade of

The process facility would process an average of 2,860 tpd for 365 days per year. The flowsheet design is based on metallurgical test work conducted at SGS Canada Inc.'s facilities at Lakefield, Ontario. The flowsheet consists of a jaw crusher that feeds a semiautogenous grinding circuit. After grinding, the ore is subjected to a series of seven flotation/regrind steps. The flotation/regrind steps are designed to recover the graphite at its largest possible flake size while still maintaining a concentrate with a graphitic carbon grade of greater than

The risks and uncertainties identified for the Project are generally described in the Company's quarterly Management's Discussion and Analysis statements3. These cover the Project's financial, mining, processing, operating, market, and regulatory risks, all of which are common with similar projects.

Other identifiable risks and uncertainties specific to the Project include:

- Purchase of market graphite in advance of receiving Alaska graphite: While there is no certainty that the Company will be successful in purchasing graphite prior to receiving production from the Mine in the quantities and pricing projected in the PFS, based on industry forecasts and preliminary inquiries, the Company believes this is achievable. It is recommended that the Company begin contracting for this supply as soon as possible.

- STP's advanced processing technologies: In April 2022, the Company announced its MOU with Sunrise (Guizhou) New Energy Material Co., Ltd. ("Sunrise")4. The intent is for the parties to develop an agreement to share expertise and technology for the design, construction, and operation of the STP. There is no guarantee that the agreement will be finalized. The MOU's term was recently extended and Sunrise is in the process of preparing anode materials for sample purposes from Graphite Creek concentrate produced from graphite recovered during exploration.

- STP site selection: The STP's site has not been finalized. The Company, working with the Washington State Department of Commerce, identified several potential locations. For the purposes of the PFS, a location in Lewis County was assumed. Site selection is to be finalized as soon as possible.

- Availability of capital: For the Project presented in the PFS to be realized, the Company must acquire the required capital in a timely manner. There is no certainty that this is achievable. The Company is encouraged by the support of its investors to date and believes the recent enactment of the Inflation Reduction Act of 2022 provides investors with additional incentive to support the industry.

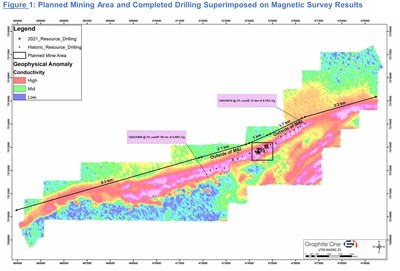

The Graphite Creek property (the "Property") is located on the Seward Peninsula, Alaska about 60 km North of Nome. The Property comprises 9,600 hectares (23,680 acres) of State of Alaska mining claims. The claim block consists of 176 claims, of which 163 are wholly owned by Graphite One (Alaska) Inc. and 13 are leased to Graphite One (Alaska). The graphitic mineral zone is exposed on the surface and strikes East/Northeast along the North face of the Kigluaik Mountains. The geophysical expression of the deposit spans more than 16 km (Figure 1).

Through 2021, 66 holes have been completed in the resource area for a total of 10,112 meters of drilling. The resource data base consists of 6,412 assays. The resource remains open down dip and along strike to the East and West.

The Mineral Resource Estimate for Graphite Creek was updated with data through the 2021 Drill Program. The methodology used was similar to that described in the 2019 NI 43-101 report with a lower angle interpretation of the Kigluaik Fault and an additional estimation between interpreted graphite lodes. A lower cutoff grade of

The updated resource estimate provided in the PFS is presented in Table 3.

Table 3: PFS 2022 Resource Estimate5 | ||||

MINERAL RESOURCE | TONNAGE | GRAPHITE | CONTAINED | |

Inferred | 254.67 | 5.11 % | 13,004,017 | |

Indicated | 27.87 | 5.15 % | 1,435,135 | |

Measured | 4.67 | 5.83 % | 272,205 | |

Measured + Indicated | 32.54 | 5.25 % | 1,707,340 | |

Comparisons to the previous resource estimate from the 2019 NI 43-101 report are summarized in Table 4.

The Inferred category's tonnage increased

Table 4: Resource Estimate Comparison - 2022 PFS Update to 2019 Report6 | ||||

MINERAL | RESOURCE REPORT | TONNAGE | GRAPHITE | CONTAINED |

Inferred | 2022 PFS Results | 254.67 | 5.11 % | 13,004,017 |

Change from March 2019 | 177 % | -36 % | 77 % | |

Indicated | 2022 PFS Results | 27.87 | 5.15 % | 1,435,135 |

Change from March 2019 | 201 % | -33 % | 101 % | |

Measured | 2022 PFS Results | 4.67 | 5.83 % | 272,205 |

Change from March 2019 | 176 % | -27 % | 101 % | |

Measured + | 2022 PFS Results | 32.54 | 5.25 % | 1,707,340 |

Change from March 2019 | 197 % | -32 % | 101 % | |

Note: Cut-off Grades PFS | ||||

Table 5 provides the same comparison as Table 4 between the PFS and the 2019 report but with a

Table 5: Resource Estimate Comparison - 2022 PFS to 2019 Report at | ||||

MINERAL RESOURCE | TONNAGE | GRAPHITE | CONTAINED | |

Inferred | 36 % | -12 % | 20 % | |

Indicated | 65 % | -14 % | 43 % | |

Measured | 70 % | -9 % | 54 % | |

Measured + Indicated | 66 % | -13 % | 45 % | |

The Mine is planned as a conventional open-pit operation using drilling, blasting, loading and hauling. The Mineral Reserves, summarized in Table 6, were estimated through the process of pit optimization, pit design, mine scheduling and cut-off grade optimization. Over a 23-year life, the Mine is expected to produce 22.5 million tonnes of ore with an average grade of

Table 6: Graphite Creek Mineral Reserve Estimate | ||||||||

Class | Diluted Tonnes | Diluted | Contained | |||||

Proven | 3,812 | 6.0 | 230 | |||||

Probable | 18,678 | 5.5 | 1,028 | |||||

Total Proven & Probable | 22,490 | 5.6 | 1,258 | |||||

Notes: | ||||||||

1. Mineral Reserves follow CIM definitions and are effective as of June 1, 2022 | ||||||||

2. Mineral Reserves are estimated using a raised variable cut-off of | ||||||||

3. The final pit design contains an additional 7.6 M tonnes of Measured and Indicated resources | ||||||||

4. The final pit design contains an additional 14.0 M tonnes of Inferred resources above the | ||||||||

5. Tonnages are rounded to the nearest 1,000 t, graphite grades are rounded to one decimal | ||||||||

The PFS for the Project will be incorporated in a National Instrument 43-101 technical report that will be available under the Company's SEDAR profile at www.sedar.com, and the Company's website, within 45 days of this news release. The affiliation and areas of responsibility for each of the independent Qualified Persons (as defined under NI 43-101) involved in preparing the PFS, upon which the technical report will be based, are as follows ("QPS"):

Qualified Person | Company | Responsibility |

Richard Goodwin, P.Eng. | JDS Energy & Mining Inc. | Primary QP |

Tysen Hantelmann, P.Eng. | JDS Energy & Mining Inc. | OP Mining |

Mike Levy, P.E. | JDS Energy & Mining Inc. | OP Geotech |

Carly Church, P.Eng. | JDS Energy & Mining Inc. | Economic Model |

Robert Retherford, P.Geo. | Alaska Earth Sciences, Inc. | Geology and Resource Estimate |

H. M. Bolu, P.Eng. | Bomenco Minerals Engineering | Primary Processing (AK) |

Michael Herrell, P.Geo. (BC,NT) | SRK Consulting (Canada) Inc. | Geochemistry |

Tom Sharp, P.Eng. | SRK Consulting (Canada) Inc. | Water Treatment |

Les Galbraith, P.Eng. | Knight Piésold Ltd. | Water and Water Management |

The Qualified Persons for this news release are Robert Retherford, P.Geo. and Richard Goodwin, P.Eng. Mr. Retherford has reviewed this news release and verified that it accurately represents the geology and resource estimate that is stated. Mr. Goodwin has also reviewed this news release and verified that it accurately represents the findings of the PFS.

During the course of their work, the QPs have validated the data that each used in the formulation of the resource estimate and PFS findings. This includes such items as: site inspections, core sampling and assays, laboratory test work, core logs, environmental and community factors, metallurgical test work, taxation and royalties, and surveys. Both existing and new data that was collected through the course of the study were validated and used by the various QPs to inform their work. Details regarding the data used and quality assurance and quality control procedures that were employed by each QP in the preparation of the resource estimate and PFS will be included in the PFS as well as further definition on the precise roles, qualifications, and responsibilities of each QP.

The Company has included certain non-IFRS financial measures in this news release, such as Initial Capital Costs and Sustaining Capital Costs, which are not defined under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other companies. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Certain Non-IFRS financial measures used in this news release are defined below.

Initial Capital Costs: Initial capital costs include the upfront capital investment required for mine construction and related infrastructure capital costs in Alaska and the construction of the STP in Washington State.

Sustaining Capital Costs: Sustaining capital is the ongoing capital investment to sustain and maintain mining, processing and graphite production infrastructure including but not limited to mining, production of graphite products, on-site development, and closure costs.

Total Capital Costs: Total Capital Costs are the sum of Initial Capital Costs and Sustaining Capital Costs.

GRAPHITE ONE INC. (GPH: TSX–V; GPHOF: OTCQB) continues to develop its Graphite One Project (the "Project"), with the goal of becoming an American producer of high grade anode materials that is integrated with a domestic graphite resource. The Project is proposed as a vertically integrated enterprise to mine, process and manufacture high grade anode materials primarily for the lithium–ion electric vehicle battery market. As set forth in the Company's 2022 Pre-Feasibility Study, potential graphite mineralization mined from the Company's Graphite Creek Property is expected to be processed into concentrate at a graphite processing plant. The proposed processing plant would be located on the Graphite Creek Property situated on the Seward Peninsula about 60 kilometers north of Nome, Alaska. Graphite anode materials and other value–added graphite products would be manufactured from the concentrate and other materials at the Company's proposed advanced graphite materials manufacturing facility expected to be located in Washington. The Company intends to make a production decision on the Project upon the completion of a Feasibility Study.

On Behalf of the Board of Directors

"Anthony Huston" (signed)

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. Generally, forward–looking information can be identified by the use of forward–looking terminology such as "proposes", "expects", or "is expected", "scheduled", "estimates", "projects", "intends", "assumes", "believes", "indicates" or variations of such words and phrases that state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to:

(i) | the estimated amount and grade of Mineral Resources and Mineral Reserves at the Mine; |

(ii) | the results of the PFS and the PFS representing a viable development option for the Project; |

(iii) | construction of the Mine and STP and related actions; |

(iv) | the merits of the Project and the potential for the Project to become when in production one of America's largest natural graphite operations and anode material producers; |

(v) | estimates of the capital costs of constructing facilities and bringing a mine and graphite manufacturing plant into production, of sustaining capital and the duration of financing payback periods; |

(vi) | the estimated amount of future production, both produced and recovered by the Mine and produced and sold at the STP; |

(vii) | the availability and future purchase of electricity, graphite feedstock, precursors and reagents; |

(viii) | life of Mine and life of STP estimates and estimates of operating costs and total costs, net cash flow, net present value and economic returns from an operating mine and graphite manufacturing plant constructed for the Project; |

(ix) | investigation of opportunities to improve the economics of the Mine and STP and the success of any such opportunities; |

* | the completion of additional optimization studies on the Project in advance of, or in connection with, a Feasibility Study; and |

(xi) | timing for the filing of a technical report for the PFS on SEDAR. |

All forward-looking statements are based on the Company's or its consultants' current beliefs as well as various assumptions made by them and information currently available to them. The most significant assumptions are set forth above, but generally these assumptions include:

(i) | the presence of and continuity of minerals at the Mine at estimated grades; |

(ii) | the geotechnical, hydrological, hydrogeological, and metallurgical characteristics conforming to sampled results; |

(iii) | the capacities and durability of various pieces of machinery and equipment; |

(iv) | the availability of electricity, STP feedstock, personnel, machinery and equipment at estimated prices and within the estimated delivery times; |

(v) | currency exchange rates; |

(vi) | the graphite and anode materials sales prices and exchange rates assumed; |

(vii) | appropriate discount rates applied to the cash flows in the economic analysis; |

(viii) | tax rates and royalty rates applicable to the Project; |

(ix) | the availability of acceptable financing under assumed structure and costs; |

* | the anticipated performance of mined graphite in concentrating processes and STP feedstock in the graphite product manufacturing processes; |

(xi) | reasonable contingency requirements; |

(xii) | success in realizing proposed operations; |

(xiii) | receipt of permits and other regulatory approvals on acceptable terms; and |

(xiv) | the fulfillment of environmental assessment commitments and arrangements with local communities. |

Although the Company's management considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. Many forward-looking statements are made assuming the correctness of other forward-looking statements, such as statements of net present value and internal rates of return, which are based on most of the other forward-looking statements and assumptions herein. The cost information is also prepared using current values, but the time for incurring the costs will be in the future and it is assumed costs will remain stable over the relevant period.

Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions.

Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date it is expressed in this news release, and the Company undertakes no obligation to update publicly or revise any forward-looking information, except as required by applicable securities laws. For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum 2014 Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term "resource" does not equate to the term "reserves". Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC's disclosure standards normally do not permit the inclusion of information concerning "measured mineral resources", "indicated mineral resources" or "inferred mineral resources" or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves" by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that "inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimated "inferred mineral resources" may not form the basis of feasibility or other economic studies. Investors are cautioned not to assume that all or any part of an "inferred mineral resource" exists, is economically or legally mineable, or will ever be upgraded to a higher resource category. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of "reserves" are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as "reserves" under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

___________________________ | |

2 Section 13502. Advanced Manufacturing Production Credit of Inflation Reduction Act of 2022; - https://www.congress.gov/117/bills/hr5376/BILLS-117hr5376enr.xml | |

3 https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00025247 | |

5 Footnotes: | |

a) | Mineral Resource Statement is effective, June 1, 2022 |

b) | Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves have not demonstrated economic viability. There is no certainty that any part of a Mineral Resource will ever be converted into Reserves. |

c) | Inferred Mineral Resources represent material that is considered too speculative to be included in economic evaluations. Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Indicated or Measured Mineral Resources. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. |

6 Footnotes: | |

a) | Mineral Resource Statement is effective June 1, 2022. |

b) | Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves have not demonstrated economic viability. There is no certainty that any part of a Mineral Resource will ever be converted into Reserves. |

c) | Inferred Mineral Resources represent material that is considered too speculative to be included in economic evaluations. Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Indicated or Measured Mineral Resources. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. |

7 Footnotes: | |

a) | Mineral Resource Statement is effective June1, 2022. |

b) | Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves have not demonstrated economic viability. There is no certainty that any part of a Mineral Resource will ever be converted into Reserves. |

c) | Inferred Mineral Resources represent material that is considered too speculative to be included in economic evaluations. Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Indicated or Measured Mineral Resources. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/graphite-one-advances-its-united-states-graphite-supply-chain-solution-demonstrating-a-pre-tax-usd1-9b-npv-8-26-0-irr-and-4-6-year-payback-on-its-integrated-project-301613608.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/graphite-one-advances-its-united-states-graphite-supply-chain-solution-demonstrating-a-pre-tax-usd1-9b-npv-8-26-0-irr-and-4-6-year-payback-on-its-integrated-project-301613608.html

SOURCE Graphite One Inc.