Stardust Power Inc. To Go Public Through Business Combination with Nasdaq Listed Global Partner Acquisition Corporation II

- None.

- None.

- The combined entity will be named Stardust Power Inc. and is expected to be listed on Nasdaq under the ticker symbol “SDST.”

- Stardust Power aims to address a burgeoning lithium supply shortage, driven by anticipated soaring demand for electric vehicle (EV) battery capacity.

-

Domestic production of battery-grade lithium is crucial to American national security to reduce dependence on

China . -

Stardust Power plans to construct the lithium refinery located in

Greater Tulsa, Oklahoma , centrally located from a supply and offtake perspective and is designed for production of up to 50,000 metric tonnes of battery-grade lithium annually. -

Pro forma implied enterprise value of the combined company of

$490 million - Stardust Power’s management team combines decades of technical expertise and experience across global mining consulting firms, with successful capital raising experience.

-

Stardust Power’s existing owners and management will roll

100% of their interests in Stardust Power into the combined company, which reflects the Company’s support for the combination, as well as confidence in the go-forward prospects for the combined entity.

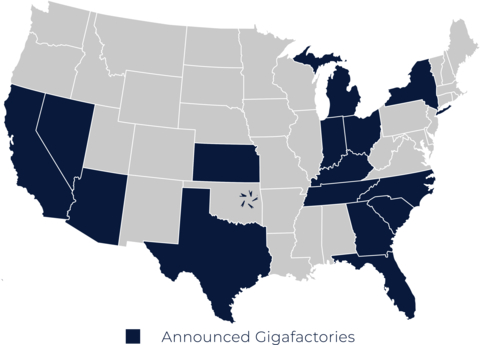

Strategic location of Stardust Power’s lithium refinery in

Electrification and Addressing

Electrification of transportation is one of the cornerstones of the energy transition. With anticipated increases in EV adoption over the next decade, demand for lithium is expected to increase by approximately 5,

Stardust Power’s strategy is to become a leading producer of battery grade lithium products in the

The

“Stardust Power aims to solve one of the largest challenges of the energy transition – reliable access to the critical minerals that will make the transition a reality,” said Roshan Pujari, CEO of Stardust Power. “Refined lithium is the key component in the lithium-ion batteries which make the proliferation of EVs, and decarbonization of transportation, possible. Domestic production of battery-grade lithium is also a crucial factor to American national security and leadership in the energy transition, which Stardust Power is working to address.”

Strategic Advantages of the Stardust Power’s Refinery Location

Stardust Power has secured 66 acres in

Securing Domestic Lithium Supply

Stardust Power’s approach to feedstock supply begins with identification and development of lithium resources across the

As lithium reserves continue to be identified and recovery is permitted, Stardust Power expects that Direct Lithium Extraction (DLE) technology will be used to recover the raw lithium. This process is both more efficient than traditional brining pond methods of production as well as more environmentally sustainable, which is anticipated to reduce land and freshwater use, while recycling brine water used during production.

Aligned Mission and Vision

GPAC II is a special purpose acquisition company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combinations, traded on Nasdaq under ticker symbols “GPAC,” “GPACW,” and “GPACU.”

GPAC II offers its merger partner long-term value creation with a proven track record and a value-added sponsor and executive team with operational and transaction expertise. GPAC II is led by executives of Antarctica Capital, an international investment firm headquartered in

GPAC II’s Chairman and Chief Executive Officer, Chandra R. Patel commented, “We are extremely pleased about GPAC II’s business combination with Stardust Power, a pioneering American lithium refiner with impressive growth potential and a massive addressable market. We believe our track record as a constructive and value-added group makes us compelling partners to enable the Stardust team to execute successfully its public listing and scale to become an industry leader. We support Stardust Power’s mission of providing increased

Transaction Overview

The implied pro forma enterprise value of Stardust Power is expected to be

Additional information about the proposed transaction, including a copy of the business combination agreement and the investor presentation, will be provided in a Current Report on Form 8-K to be filed by GPAC II with the

Advisors

Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC (“CCM”), served as an exclusive financial advisor and lead capital markets advisor to Stardust Power. Norton Rose Fulbright and Kirkland & Ellis LLP served as legal counsel to Stardust Power and GPAC II, respectively.

References:

1. Forecasts: Lithium. (2023). Benchmark Mineral Intelligence. www.benchmarkminerals.com/forecasts/lithium/

2. Lithium - World Nuclear Association. (2022). World-Nuclear.org. world-nuclear.org/information-library/current-and-future-generation/lithium.aspx

3. IEA. (2023). Trends in batteries – Global EV Outlook 2023 – Analysis. IEA. www.iea.org/reports/global-ev-outlook-2023/trends-in-batteries

4. Rhymes, J. H., Jamie D. (2023, May 22). The Smackover Formation: Unveiling the Lithium Potential. The Energy Law Blog. www.theenergylawblog.com/2023/05/articles/business/louisiana-law/the-smackover-formation-unveiling-the-lithium-potential/; Shale Reservoirs Could be “Substantial Source of Lithium.” (2022, May 17). University of

5. The implied pro forma enterprise value of the combined company is

About Stardust Power Inc.

Stardust Power Inc. is a development stage manufacturer of battery-grade lithium products deigned to supply the EV industry and helping to secure America’s leadership in the energy transition. Stardust Power is developing a strategically central lithium refinery in

About Global Partner Acquisition Corporation II

Global Partner Acquisition Corporation II (“GPAC II”) is a special purpose acquisition company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar Business Combination. GPAC II offers its merger partner a unique value-added partner. GPAC II is led by executives of Antarctica Capital, an international investment firm headquartered in

Forward-Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. All statements, other than statements of present or historical fact included herein, regarding the proposed business combination, GPAC II’s and Stardust Power’s ability to consummate the transaction, the benefits of the transaction, GPAC II’s and Stardust Power’s future financial performance following the transaction, as well as GPAC II’s and Stardust Power’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

These forward-looking statements are based on GPAC II’s and Stardust Power’s management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. GPAC II and Stardust Power caution you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of GPAC II and Stardust Power. These risks include, but are not limited to, (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of GPAC II’s securities; (ii) the risk that the proposed business combination may not be completed by GPAC II’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by GPAC II; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by GPAC II’s shareholders and Stardust Power’s stockholders, the satisfaction of the minimum trust account amount following redemptions by GPAC II’s public shareholders and the receipt of certain governmental and regulatory approvals; (iv) the effect of the announcement or pendency of the proposed business combination on Stardust Power’s business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts current plans of Stardust Power and potential difficulties in Stardust Power’s employee retention as a result of the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted against GPAC II or Stardust Power related to the agreement and the proposed business combination; (vii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination (viii) the ability to maintain the listing of GPAC II’s securities on the Nasdaq; (ix) the price of GPAC II’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Stardust Power plans to operate, variations in performance across competitors, changes in laws and regulations affecting Stardust Power’s business and changes in the combined capital structure; (x) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities; (xi) the impact of the global COVID-19 pandemic and (xii) other risks and uncertainties related to the transaction set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in GPAC II’s prospectus relating to its initial Public Offering (File No. 333-351558) declared effective by the

The foregoing list of factors is not exhaustive. There may be additional risks that neither GPAC II nor Stardust Power presently know or that GPAC II or Stardust Power currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in GPAC II’s proxy statement contained in the registration statement on Form S-4 (the “Registration Statement”), including those under “Risk Factors” therein, and other documents filed by GPAC II from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and GPAC II and Stardust Power assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither GPAC II nor Stardust Power gives any assurance that either GPAC II or Stardust Power will achieve its expectations.

Important Information About the Business Combination and Where to Find It

In connection with the proposed business combination, GPAC II will file a Registration Statement with the SEC that will include a preliminary prospectus with respect to GPAC II’s securities to be issued in connection with the proposed transactions and a preliminary proxy statement with respect to the shareholder meeting of GPAC II to vote on the proposed transactions (the “proxy statement/prospectus”). GPAC II may also file other documents regarding the proposed business combination with the SEC. The proxy statement/prospectus will contain important information about the proposed business combination and the other matters to be voted upon at an extraordinary general meeting of GPAC II’s shareholders to be held to approve the proposed business combination and other matters and may contain information that an investor may consider important in making a decision regarding an investment in GPAC II’s securities. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF GPAC II AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GPAC II, STARDUST POWER AND THE PROPOSED BUSINESS COMBINATION. After the Registration Statement is declared effective, the definitive proxy statement/prospectus to be included in the Registration Statement will be mailed to shareholders of GPAC II as of a record date to be established for voting on the proposed transaction. Once available, shareholders of GPAC II will also be able to obtain free copies of the Registration Statement, including the proxy statement/prospectus, and other documents containing important information about GPAC II and Stardust Power once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov or by directing a request to Global Partner Acquisition Corp II, 7 Rye Ridge Plaza, Suite 350,

Participants in the Solicitation

GPAC II, Stardust Power and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from GPAC II’s shareholders with respect to the proposed business combination. A list of the names of those directors and executive officers of GPAC II and a description of their interests in GPAC II is set forth in GPAC II’s filings with the SEC (including GPAC II’s prospectus relating to its initial public offering (File No. 333-251558) declared effective by the SEC on January 11, 2021, GPAC II’s Annual Report on Form 10-K filed with the SEC on March 31, 2023 and subsequent filings on Form 10-Q and Form 4). Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement. The documents described in this paragraph are available free of charge at the SEC’s website at www.sec.gov, or by directing a request to Global Partner Acquisition Corp II, 7 Rye Ridge Plaza, Suite 350,

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of GPAC II, Stardust Power or the combined company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231120189778/en/

Stardust Power Contacts

For Investors:

William Tates

Stardust Power Inc.

william@stardust-power.com

For Media:

Johanna Gonzalez

investor.relations@stardust-power.com

Global Partner Acquisition Corporation II Contacts

For Media and Investors:

info@gpac2.com

Source: Stardust Power Inc.

FAQ

What is the company name and ticker symbol of the combined entity?

Where does Stardust Power plan to construct the lithium refinery?

What is the expected production capacity of the lithium refinery?

What is the pro forma implied enterprise value of the combined company?