Genius Group Release Additional Details of FatBrain AI Transaction

- None.

- None.

Insights

The acquisition of FatBrain AI's assets by Genius Group represents a strategic move that has significant implications for the company's financial structure and future growth prospects. The all-share transaction structure is a noteworthy choice, as it avoids immediate cash outlays and aligns the interests of FatBrain AI's shareholders with those of Genius Group. The projected 150% increase in pro forma revenue and net profit for 2023 is a strong indicator of the potential for value creation from this deal.

However, the 40% increase in total assets juxtaposed with a 50% increase in total liabilities warrants a closer examination of the transaction's impact on the balance sheet and the company's leverage. The market's reaction to the 0.65x price/revenue multiple post-transaction will be critical, especially when considering the valuation gap with industry peers. If Genius Group can effectively integrate FatBrain AI's technology and realize the anticipated synergies, there may be potential for re-rating closer to its peers' multiples, which could be a catalyst for stock price appreciation.

The integration of FatBrain AI's assets into Genius Group's portfolio signals an aggressive push into AI-powered education, a sector witnessing substantial growth. The market capitalization comparison with edtech peers like Udemy, Coursera and Duolingo, which have much higher price/revenue multiples, suggests that Genius Group may be undervalued. This perceived undervaluation could attract investor interest, particularly if Genius Group can demonstrate a clear path to achieving its ambitious growth targets, such as impacting 100 million customers and reaching $1 billion in annual revenues within a decade.

It is essential to monitor how the market digests the transaction details and whether the investor call provides additional clarity on the execution of the growth plan. The leadership structure, with a mix of Genius Group and FatBrain AI executives, will play a pivotal role in steering the combined entity towards these goals. The strategic direction and synergy realization will be key drivers of investor confidence and stock performance in the medium to long term.

The acquisition by Genius Group is a significant event in the edtech space, reflecting the increasing importance of AI in educational technology. The move to create an AI-powered Education and Acceleration group could position Genius Group at the forefront of a transformative trend in the industry. The emphasis on building AI-driven platforms for entrepreneurs and governments aligns with the broader push towards personalized learning and the use of big data to enhance educational outcomes.

The success of this initiative hinges on the company's ability to leverage FatBrain AI's assets to deliver innovative products and services. The proposed launch of 100 Genius Cities and the goal to impact 100 million customers underscore the company's commitment to scale. However, the execution risks associated with such an expansive vision should not be underestimated. The ability to maintain a robust technological edge while scaling up operations will be critical for long-term success and achieving a valuation that reflects the company's growth trajectory and market potential.

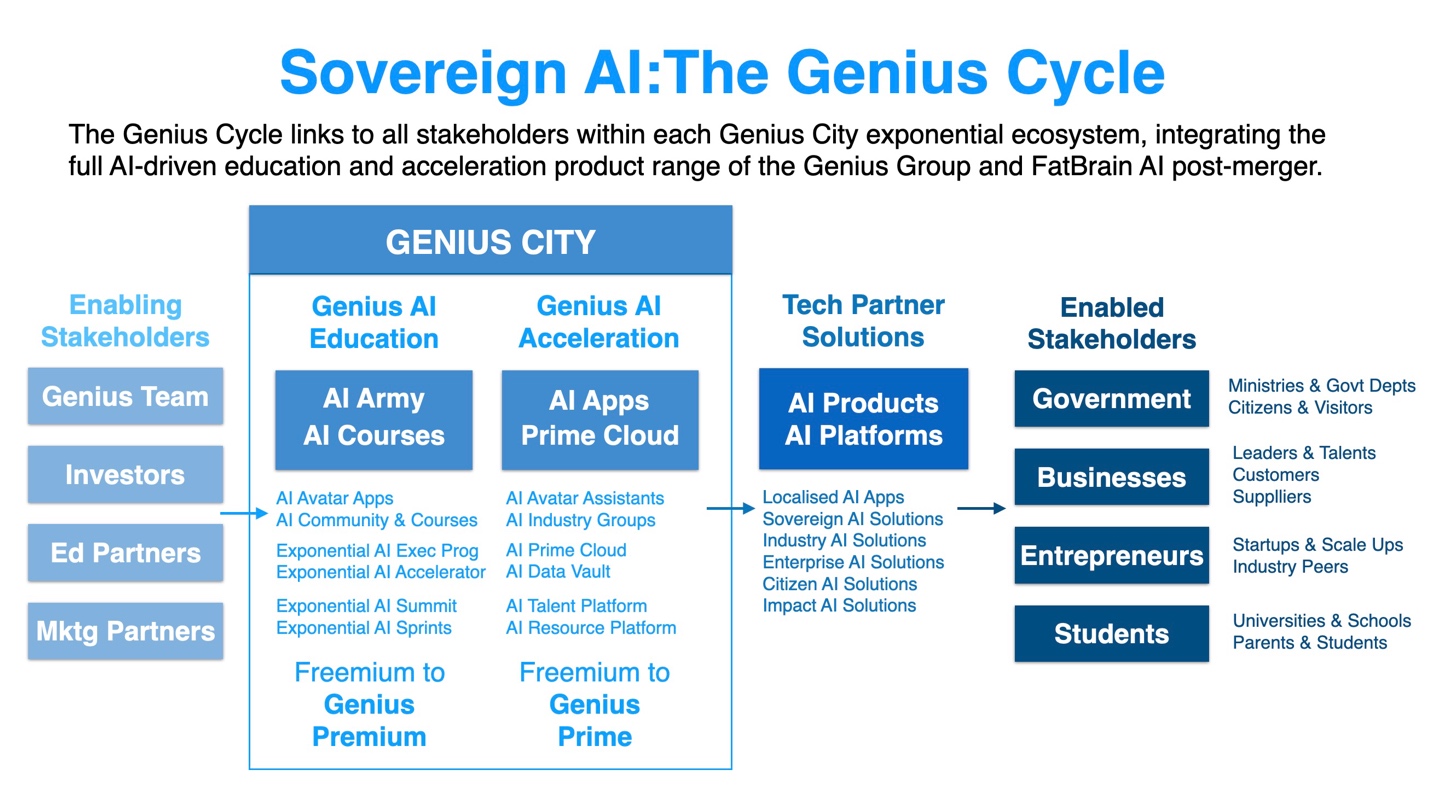

SINGAPORE, March 18, 2024 (GLOBE NEWSWIRE) -- Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading entrepreneur edtech and education group, released today additional details on their recently announced transaction to form an AI-powered Education and Acceleration group to power Sovereign AI ecosystems of tomorrow for entrepreneurs, enterprises, governments and students through AI education and enablement:

- Deal Structure: The transaction was the purchase of selected FatBrain AI assets and liabilities by Genius Group in an all-share transaction, through the purchase of the stock of a FatBrain subsidiary which is held by Genius as a wholly owned subsidiary, and no merger into Genius has taken place.

- Post-Transaction Revenue, Profit: Following the transaction, Genius Group’s 2023 pro forma revenue is expected to grow approximately

150% , with 2023 pro forma revenue guidance growing to an estimated$76 million to$80 million . Genius Group’s 2023 pro forma net profit is expected to grow approximately150% , with 2023 pro forma net profit guidance growing to an estimated$7 million to$9 million (all financials currently in the Company’s 2023 audit process). - Post-Transaction Balance Sheet: Following the transaction, Genius Group’s 2023 pro forma total assets is expected to grow approximately

40% , with 2023 pro forma total assets guidance growing to an estimated$110 million to$115 million . Genius Group’s 2023 pro forma net profit is expected to grow approximately50% , with 2023 pro forma total liabilities guidance growing to an estimated$60 million to$65 million (all financials currently in the Company’s 2023 audit process) - Post-Transaction Structure: The Post-structure leaves Genius Group Ltd as the parent company with the FatBrain assets existing in a wholly owned subsidiary of the parent company, which will continue to trade on NYSE American under the ticker NYSEAmerican:GNS as a Singapore-based company with its consolidated financials compliant with IFRS Standards.

- Post-Transaction Leadership: Genius Group has an exeuctive executive team and Board of Directors as follows. Peter Ritz, FatBrain’s AI’s CEO, will join the Genius Group Board as Executive Director and Michael Moe, FatBrain AI’s Chairman, will join the Genius Group Board as Non-Executive Chairman. The Current Genius Group of Roger James Hamilton (CEO), Suraj Naik (Executive Director) and Richard Berman, Eric Pulier and Salim Ismail (Non-Executive Directors) remain on the Board. The split of the Board is: 2 members (

29% ) FatBrain AI representation. 5 members (71% ) Genius Group representation. - Post-Transaction Ownership: All of FatBrain AI’s former shareholders, which includes investors in the US and accomplished technology and education entrepreneurs and investors, including Michael Moe and Peter Ritz, will receive one (1) Genius Group share for every three (3) FatBrain AI shares. The ownership split immediately subsequent will be approximately

57% owned by Genius Group’s shareholders and43% owned by FatBrain AI’s shareholders. - Approvals: All necessary approvals for the transaction from shareholders, the board and regulators were received prior to the closing. The transaction is not a change of control transaction, and thus the Company believes does not qualify as a significant transaction or merger which would trigger any valuation provisions under any Company agreements.

- Market Capitalization of FatBrain Ai and Genius Group: Based on our 2023 guidance revenue and post-deal ownership splits of FatBrain AI and Genius Group, together with Genius Group/’s

$0.29 per ordinary share closing day price on Wed 13 Mar, 2024 – the closing date of the transaction, this delivers a price / revenue multiple for FatBrain AI’s once their shares are converted to Genius Group’s of approximately a 0.4x price / trailing revenue multiple. Genius Group’s price / trailing revenue multiple by comparison delivers approximately a 0.85x price / revenue multiple. - Market Capitalization of Post-Transaction Group vs Industry Peers: The market capitalization based on shares issued post-transactions, delivers a ratio of approximately a 0.65x price / revenue multiple based on the

$0.29 closing date price. This compares to the price / revenue multiples of publicly listed Edtech peers: As of their current share prices, Udemy’s price / revenue multiple is 2.73x; Coursera’s ratio is 3.58x; and Duolingo ratio is 17.5x. This gives our publicly traded Edtech peers a range of price / revenue multiples between four times and twenty-seven times Genius Group. We believe this represents a significant, potential upside in our share price as we grow and get closer to a fair value in comparison to our public-listed peers in Edtech. - Growth Plan: The plan provides an integrated roadmap and product range to strive to reach the following: launch 100 Genius Cities, impact 100 million customers and students and achieve

$1 billion in annual revenues within the next decade, with a shared mission: To build an AI-driven entrepreneur education and acceleration platform, empowering our exponential future.”

The Growth Plan will be presented by Roger James Hamilton and Peter Ritz to investors on Genius Group’s Investor Call on Thursday March 21, 2024.

About Genius Group

Genius Group is a leading entrepreneur Edtech and education group, with a mission to disrupt the current education model with a student-centered, life-long learning curriculum that prepares students with the leadership, entrepreneurial and life skills to succeed. Through its learning platform, GeniusU, the Genius Group has a member base of 5.4 million users in 200 countries, ranging from early age to 100.

For more information, please visit https://www.geniusgroup.net/

About FatBrain AI

FatBrain AI provides powerful and easy-to-use AI solutions to empower the enterprise stars of tomorrow to grow, innovate, and drive the majority of the global economy. FatBrain's AI 2.0 technologies and advanced data services transform continuous learning, narrative reasoning, large language models, cloud and blockchain technologies into auditable, explainable and easy to integrate AI solutions. FatBrain's subscriptions allow all companies to deploy its advanced AI solutions quickly, easily, and securely behind their firewalls or via cloud. FatBrain's global delivery includes 600+ team across design, development centers in the US, UK, India and Kazakh Republic.

For more information, please visit https://Fatbrain AI/

Investor Notice

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward-looking statements described in our most recent Annual Report on Form 20-F, as amended for the fiscal year ended December 31, 2022, filed with the SEC on June 6, 2023 and August 3, 2023. If any of these risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. See "Forward-Looking Statements" below.

Forward-Looking Statements

Statements made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,” “will” “plan,” “should,” “expect,” “anticipate,” “estimate,” “continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Risk Factors” in the Company's Annual Reports on Form 20-F, as may be supplemented or amended by the Company's Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise.

Contacts

Investors:

Solomon Bamidele, Investor Relations

Email: investor@geniusgroup.net

US Investors:

Dave Gentry

RedChip Companies Inc

1-800-RED-CHIP

GNS@redchip.com